This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040-C

for the current year.

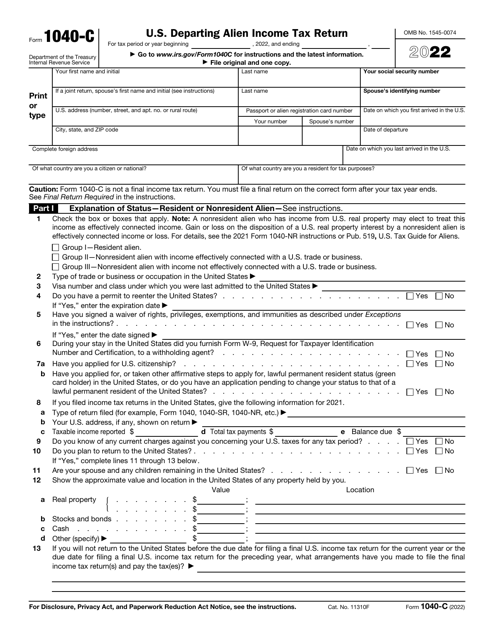

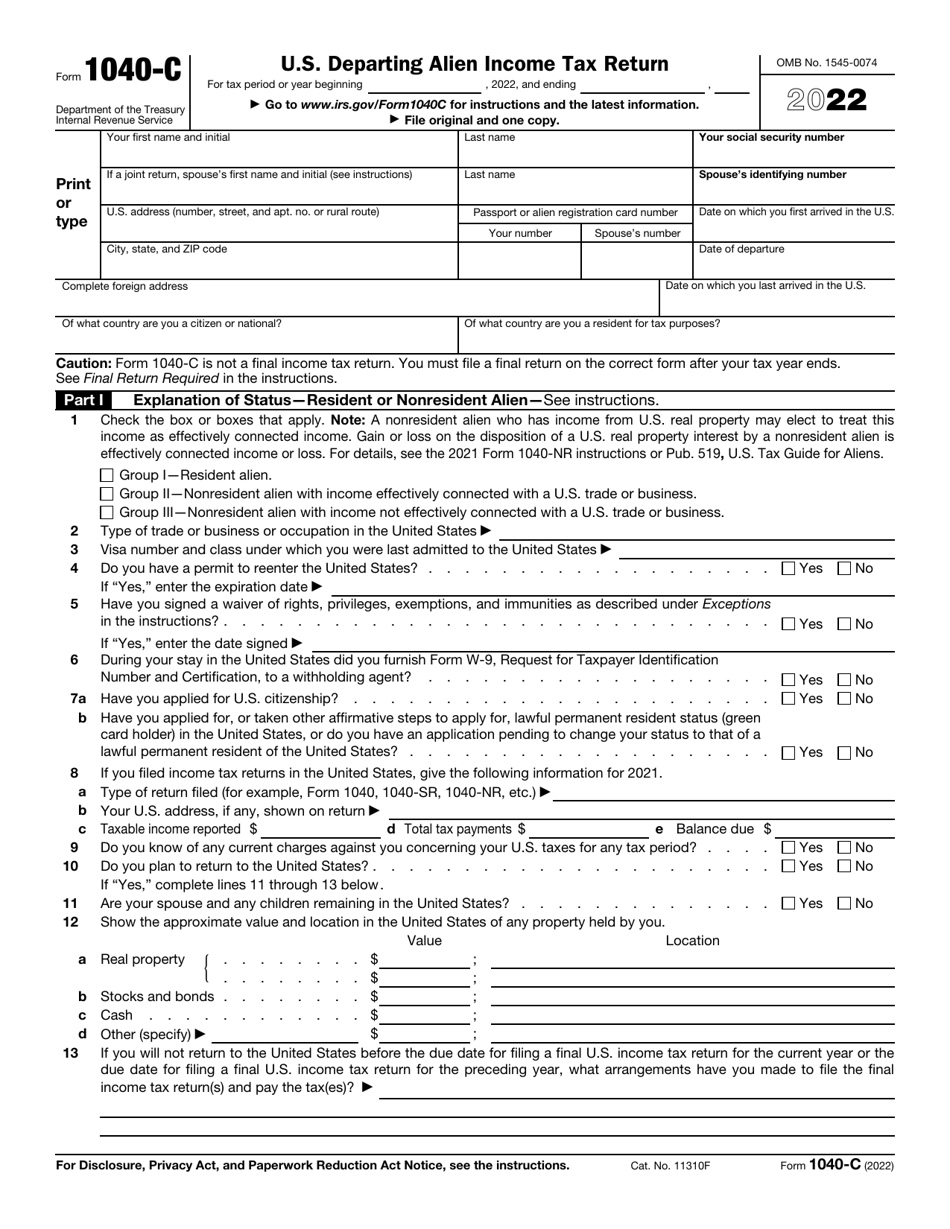

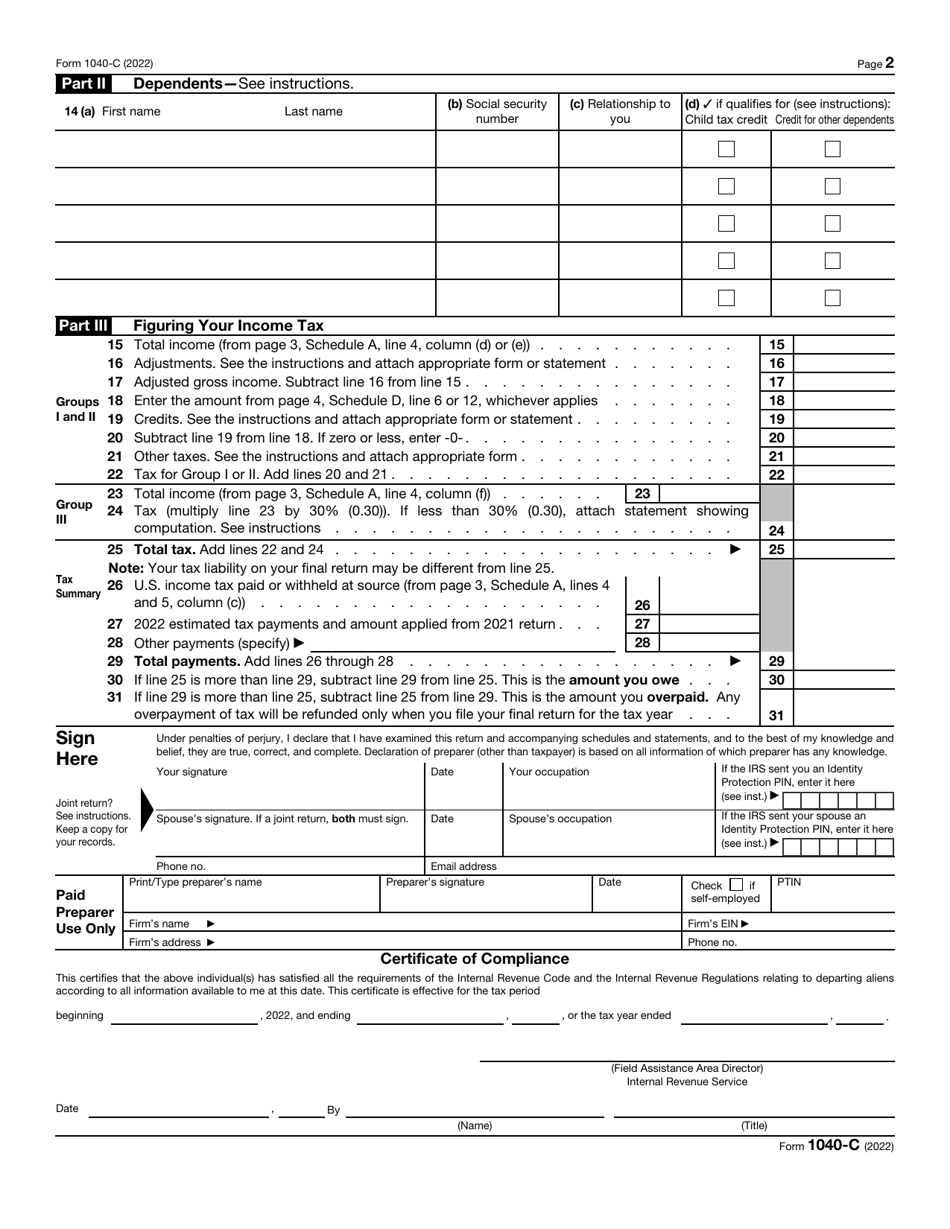

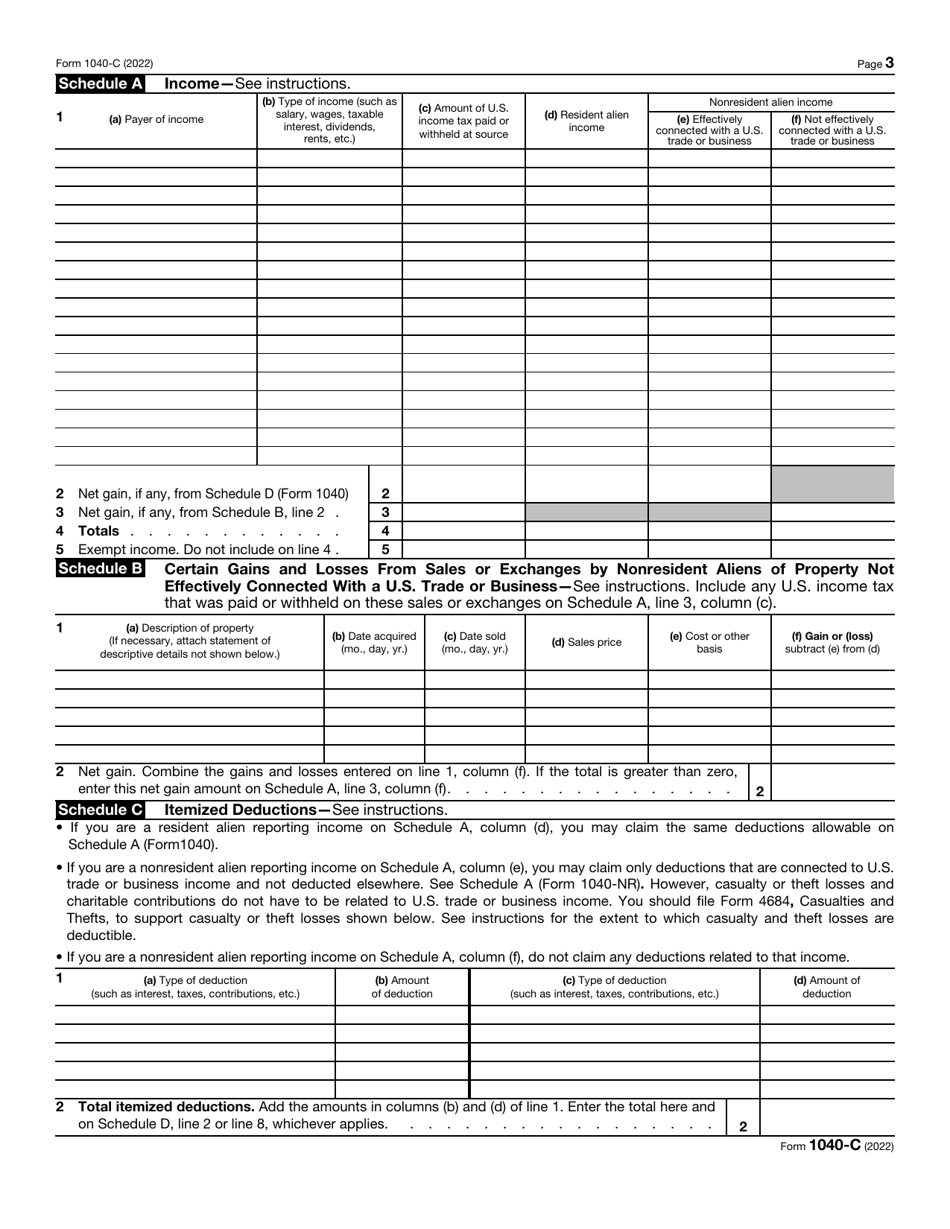

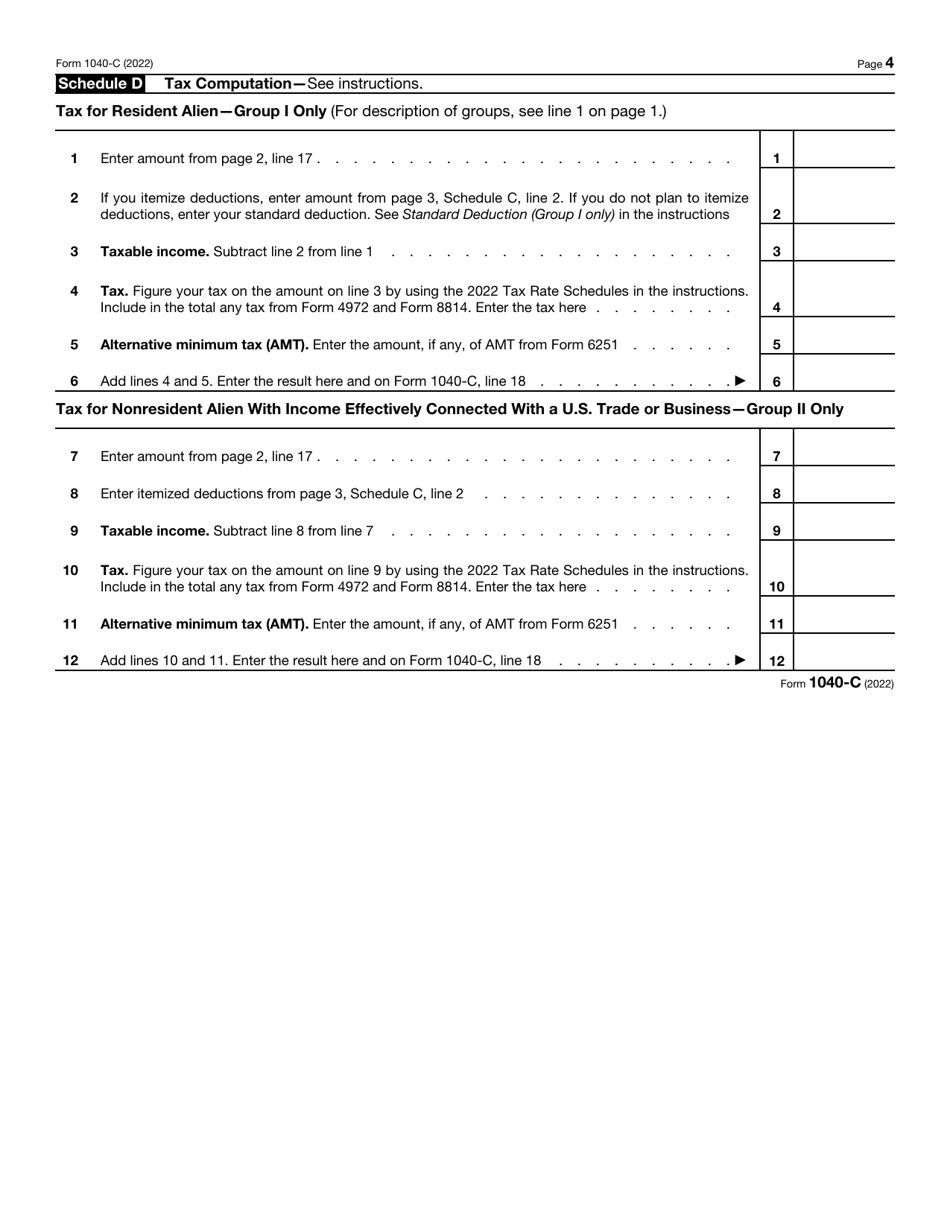

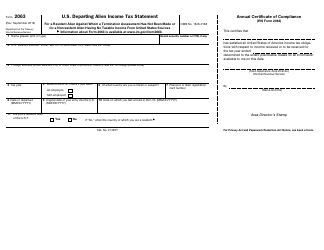

IRS Form 1040-C U.S. Departing Alien Income Tax Return

What Is IRS Form 1040-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040-C?

A: IRS Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who uses IRS Form 1040-C?

A: IRS Form 1040-C is used by nonresident aliens who are leaving the United States and need to report their income for the portion of the year they were in the country.

Q: What does IRS Form 1040-C cover?

A: IRS Form 1040-C covers income earned by nonresident aliens from U.S. sources, such as wages, salaries, tips, and other forms of income.

Q: When should IRS Form 1040-C be filed?

A: IRS Form 1040-C should be filed by nonresident aliens before they leave the United States.

Q: Are there any special requirements for filing IRS Form 1040-C?

A: Yes, nonresident aliens must attach a certificate of foreign status (such as Form 8833) to IRS Form 1040-C when filing.

Q: What should I do if I have questions about IRS Form 1040-C?

A: If you have questions about IRS Form 1040-C, you can consult the instructions provided by the IRS or seek assistance from a tax professional.

Q: Is there a deadline for filing IRS Form 1040-C?

A: Yes, IRS Form 1040-C must be filed before a nonresident alien leaves the United States.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-C through the link below or browse more documents in our library of IRS Forms.