This version of the form is not currently in use and is provided for reference only. Download this version of

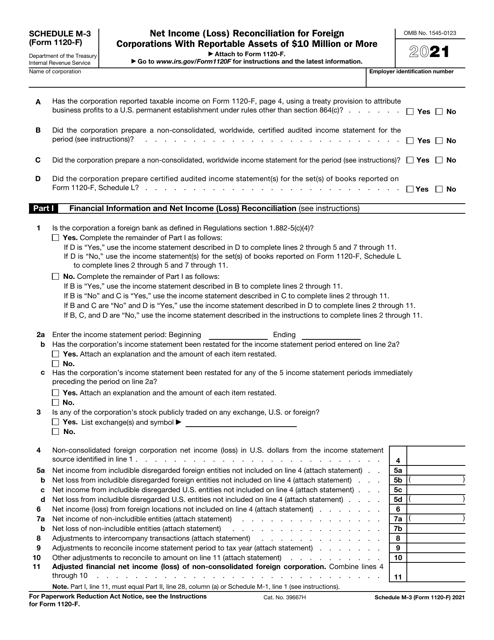

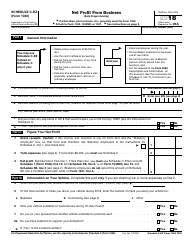

IRS Form 1120-F Schedule M-3

for the current year.

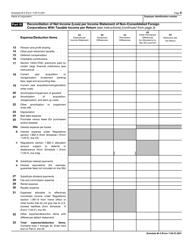

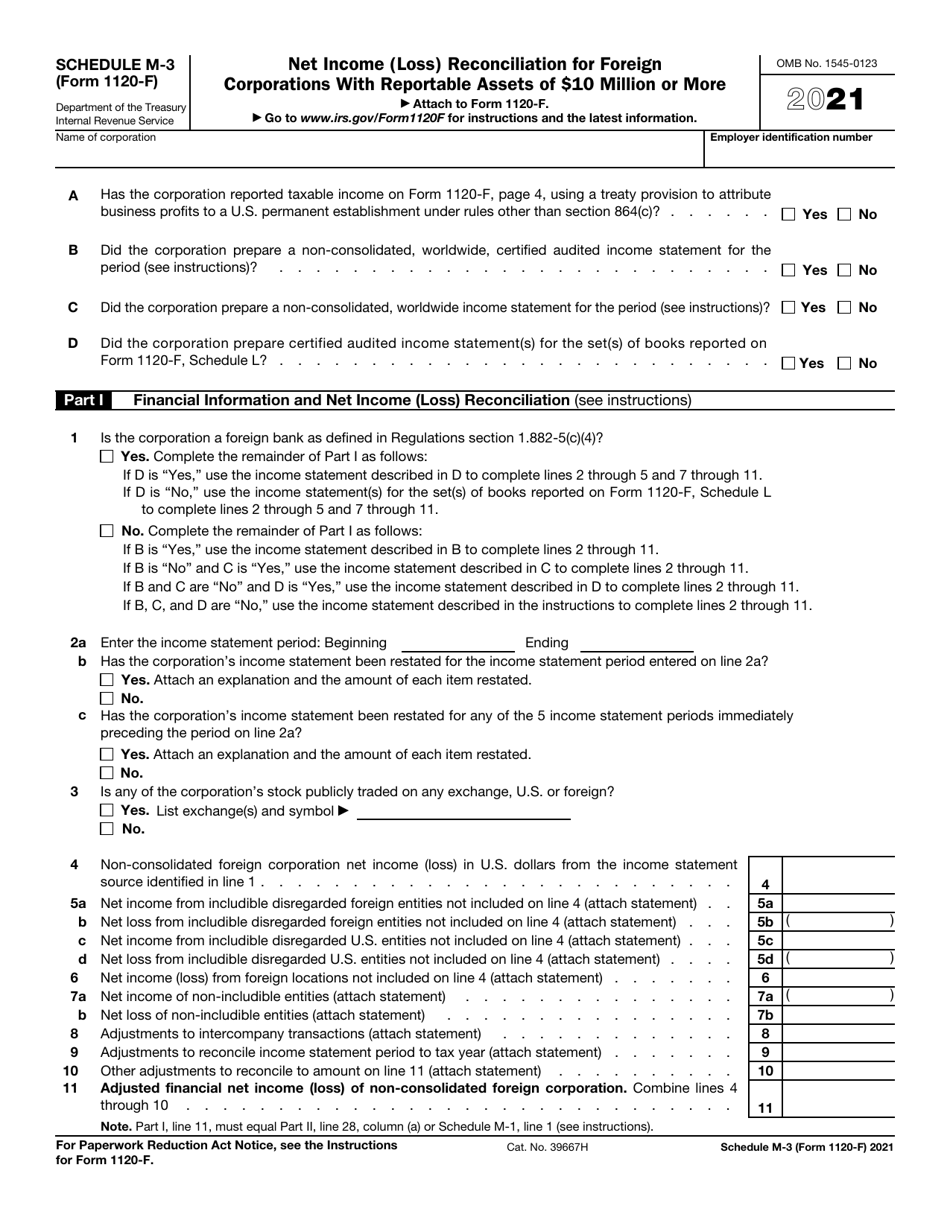

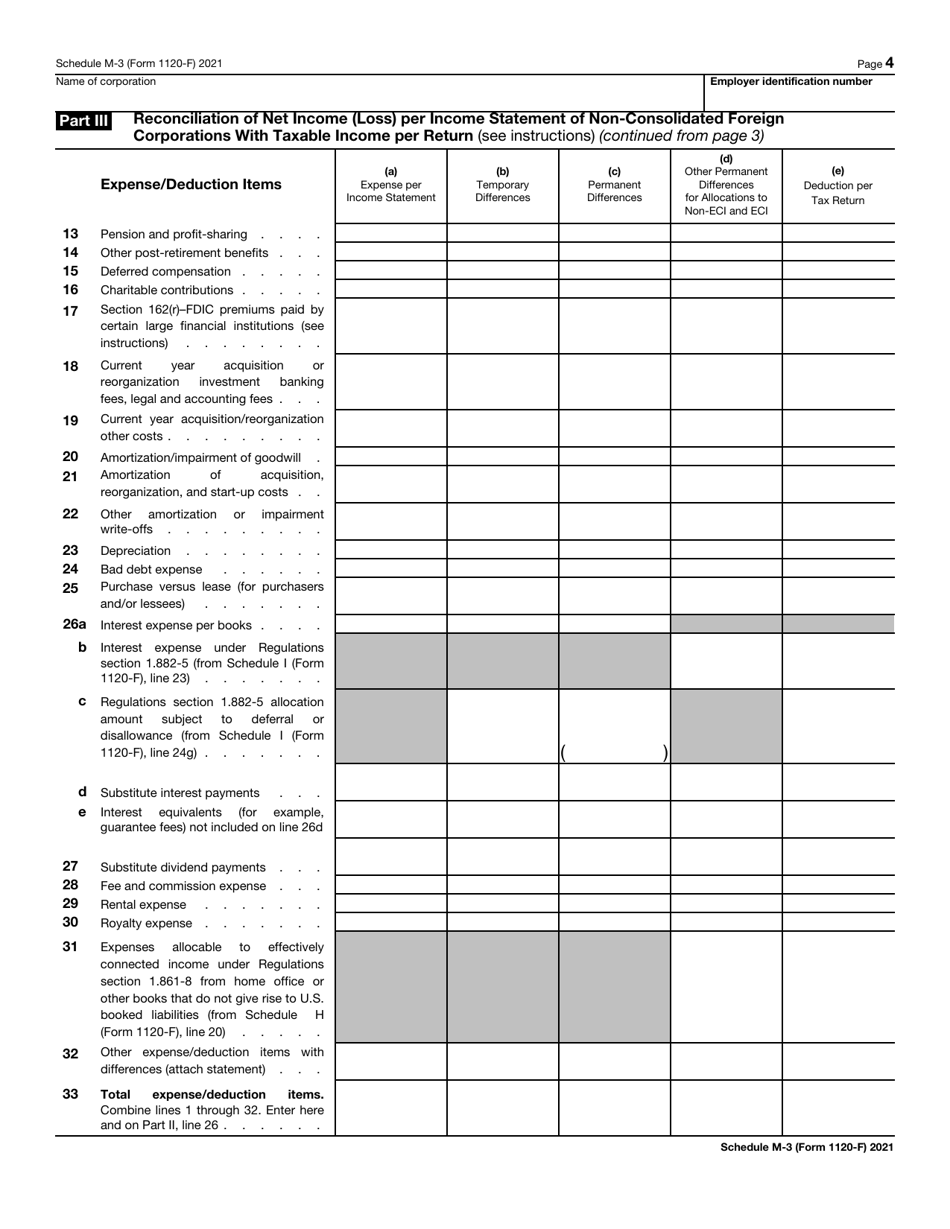

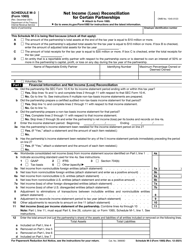

IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More

What Is IRS Form 1120-F Schedule M-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F?

A: IRS Form 1120-F is a tax form for foreign corporations engaged in trade or business within the United States.

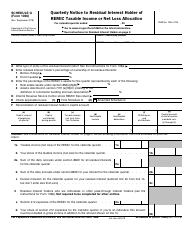

Q: What is Schedule M-3?

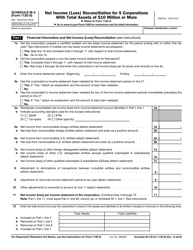

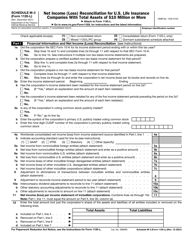

A: Schedule M-3 is a supplemental schedule to Form 1120-F that reconciles a foreign corporation's net income (loss) for financial accounting purposes with its taxable income (loss) for tax purposes.

Q: Who needs to file Form 1120-F?

A: Foreign corporations engaged in trade or business within the United States need to file Form 1120-F.

Q: What are reportable assets?

A: Reportable assets are assets that meet or exceed a threshold of $10 million for a foreign corporation.

Q: Why is Schedule M-3 required?

A: Schedule M-3 is required to provide additional information and reconciliation between the foreign corporation's financial accounting and tax accounting.

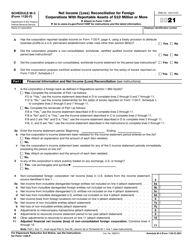

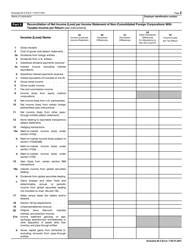

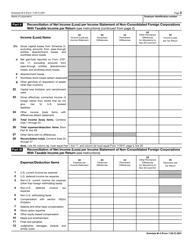

Q: What information is included in Schedule M-3?

A: Schedule M-3 includes details about the foreign corporation's net income (loss), permanent and temporary differences between financial accounting and tax accounting, and other reconciling items.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule M-3 through the link below or browse more documents in our library of IRS Forms.