This version of the form is not currently in use and is provided for reference only. Download this version of

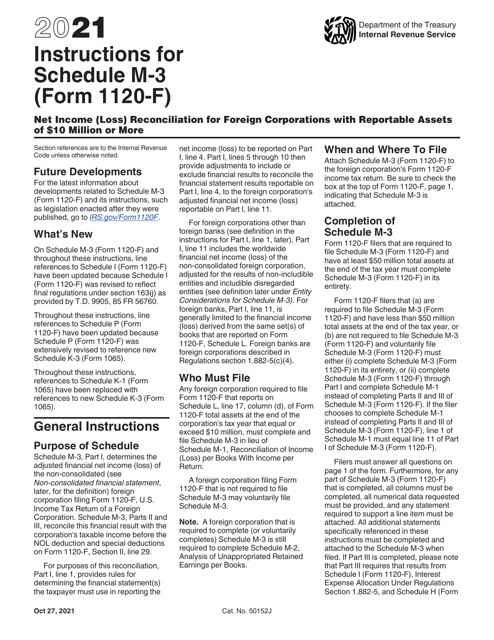

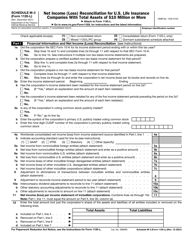

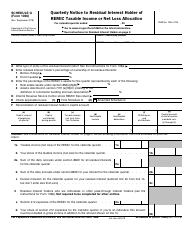

Instructions for IRS Form 1120-F Schedule M-3

for the current year.

Instructions for IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More

This document contains official instructions for IRS Form 1120-F Schedule M-3, Reportable Assets of $10 Million or More - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1120-F Schedule M-3?

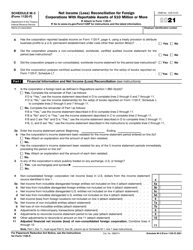

A: IRS Form 1120-F Schedule M-3 is a form used by foreign corporations with reportable assets of $10 million or more to reconcile their net income (loss).

Q: Who is required to file IRS Form 1120-F Schedule M-3?

A: Foreign corporations with reportable assets of $10 million or more are required to file IRS Form 1120-F Schedule M-3.

Q: What is the purpose of IRS Form 1120-F Schedule M-3?

A: The purpose of IRS Form 1120-F Schedule M-3 is to provide a detailed reconciliation of the foreign corporation's net income (loss) as reported on its income statement to its taxable income (loss) as reported on its tax return.

Q: What information is required on IRS Form 1120-F Schedule M-3?

A: IRS Form 1120-F Schedule M-3 requires information such as net income (loss) from the foreign corporation's income statement, adjustments for book-to-tax differences, and the reconciliation of taxable income (loss) to pre-tax book income (loss).

Q: Are there any penalties for not filing IRS Form 1120-F Schedule M-3?

A: Yes, there may be penalties for not filing IRS Form 1120-F Schedule M-3 or for filing an incomplete or inaccurate form. It is important to comply with the filing requirements to avoid penalties.

Q: Is IRS Form 1120-F Schedule M-3 the only form that foreign corporations with reportable assets of $10 million or more need to file?

A: No, foreign corporations with reportable assets of $10 million or more are also required to file IRS Form 1120-F and possibly other related forms or schedules.

Q: Can I hire a tax professional to help me complete IRS Form 1120-F Schedule M-3?

A: Yes, hiring a tax professional who is knowledgeable about international tax laws and regulations can be helpful in completing IRS Form 1120-F Schedule M-3 accurately and efficiently.

Q: Is there a deadline for filing IRS Form 1120-F Schedule M-3?

A: Yes, the deadline for filing IRS Form 1120-F Schedule M-3 is typically the same as the deadline for filing the foreign corporation's tax return, which is usually the 15th day of the third month after the end of the corporation's tax year.

Q: What should I do if I have questions or need assistance with IRS Form 1120-F Schedule M-3?

A: If you have questions or need assistance with IRS Form 1120-F Schedule M-3, you can contact the IRS or seek help from a tax professional who specializes in international tax matters.

Instruction Details:

- This 27-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.