This version of the form is not currently in use and is provided for reference only. Download this version of

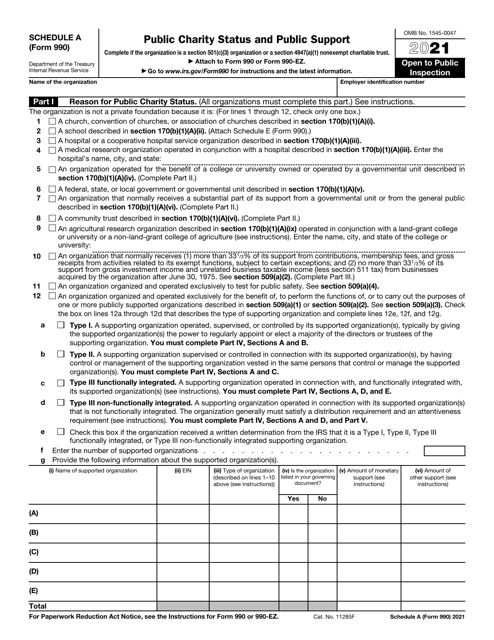

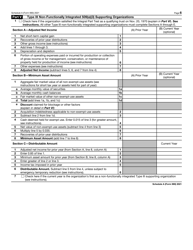

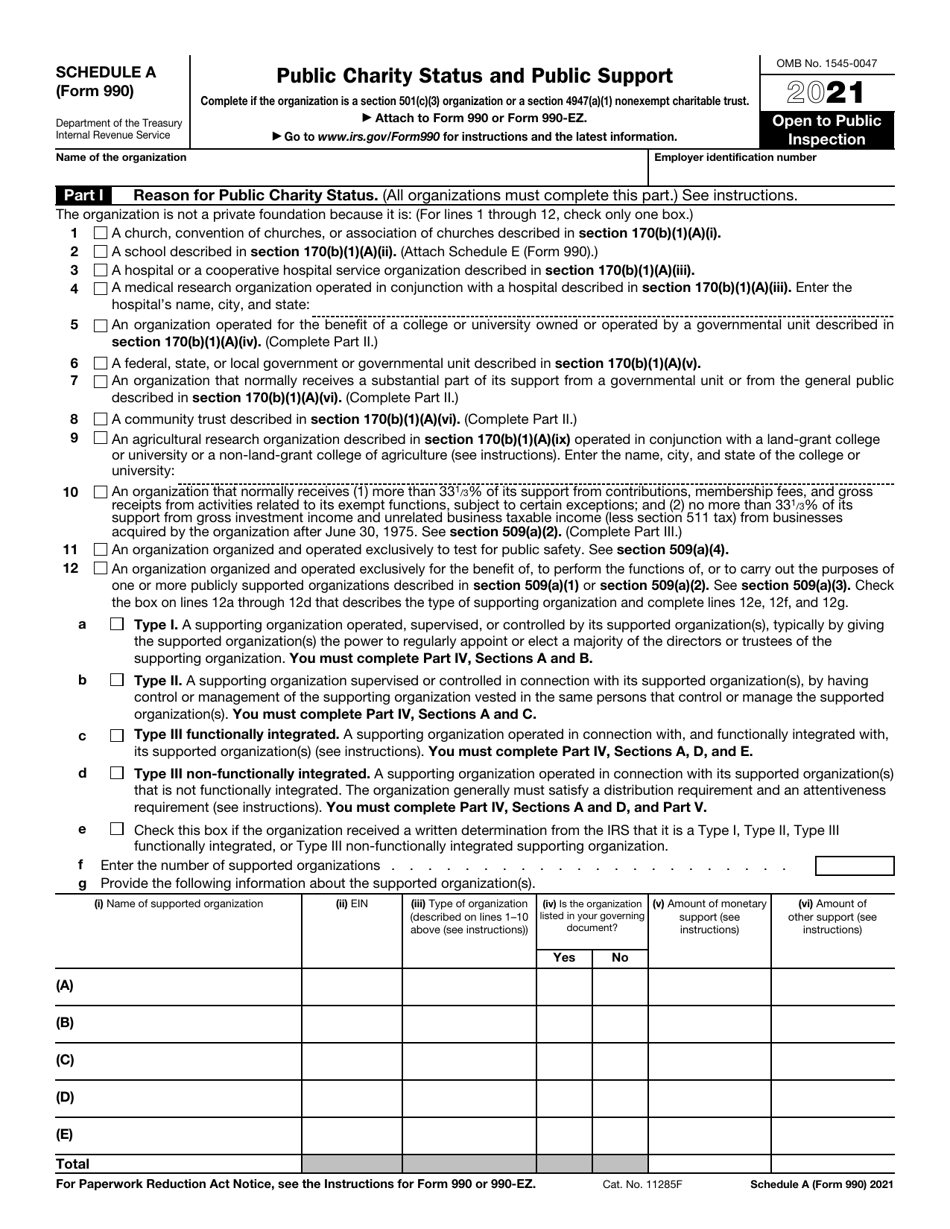

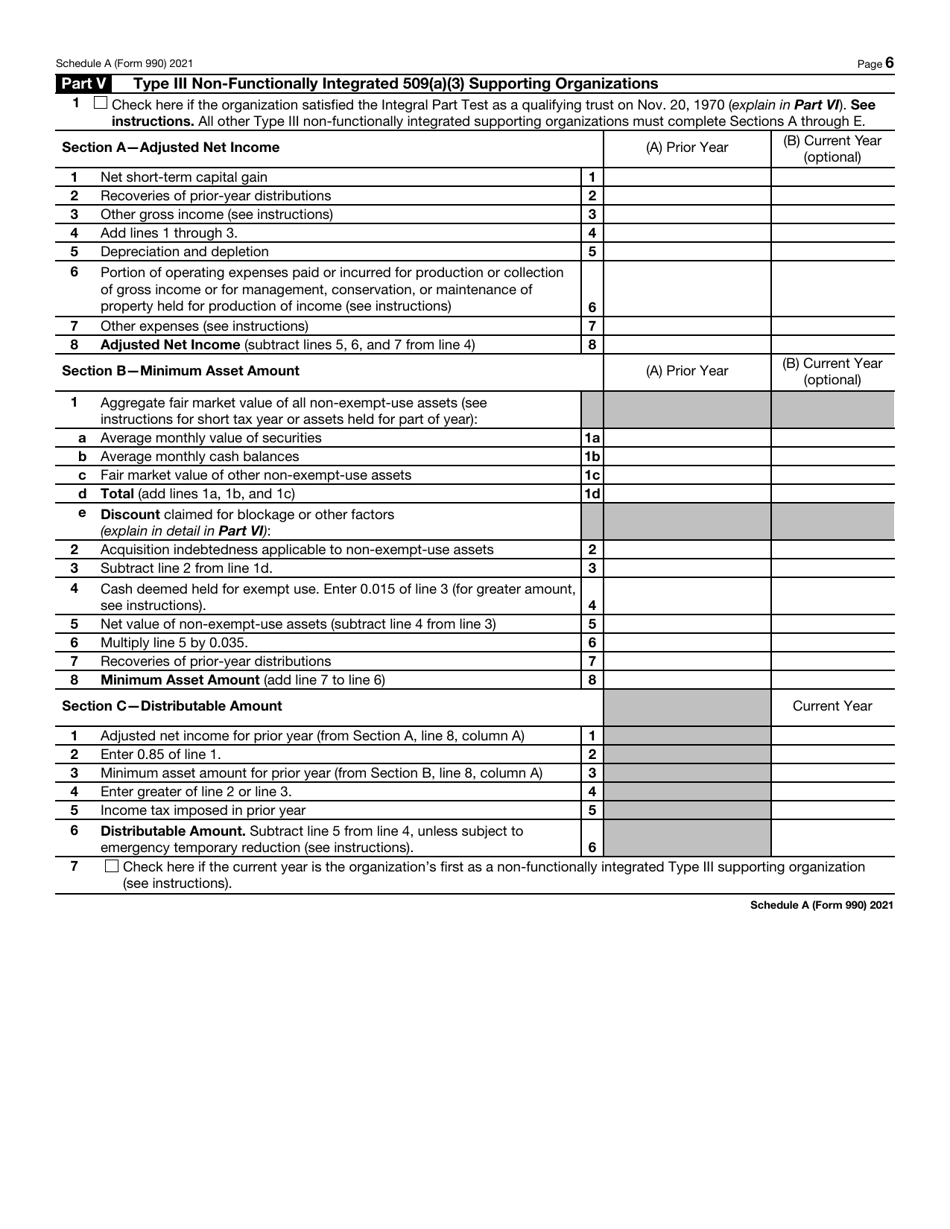

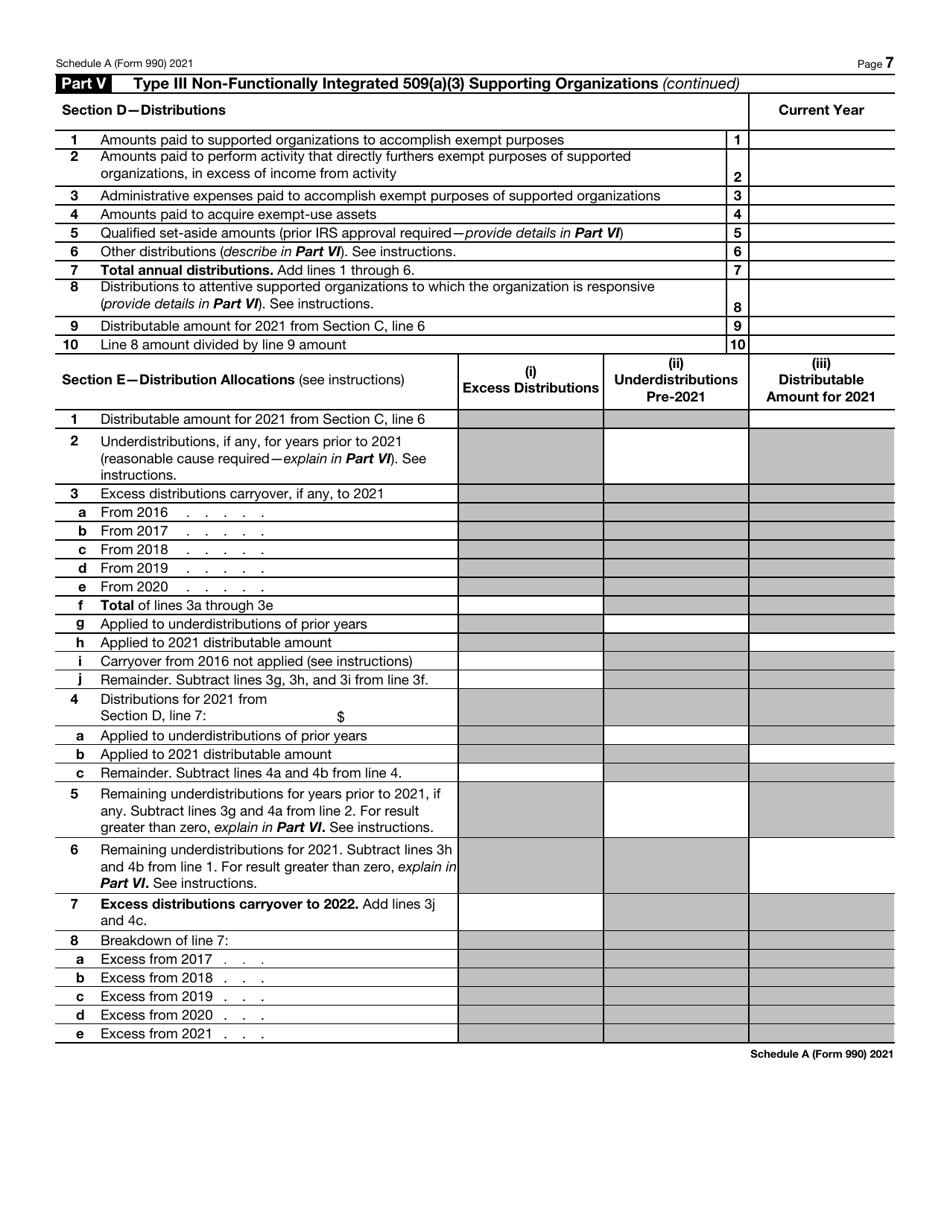

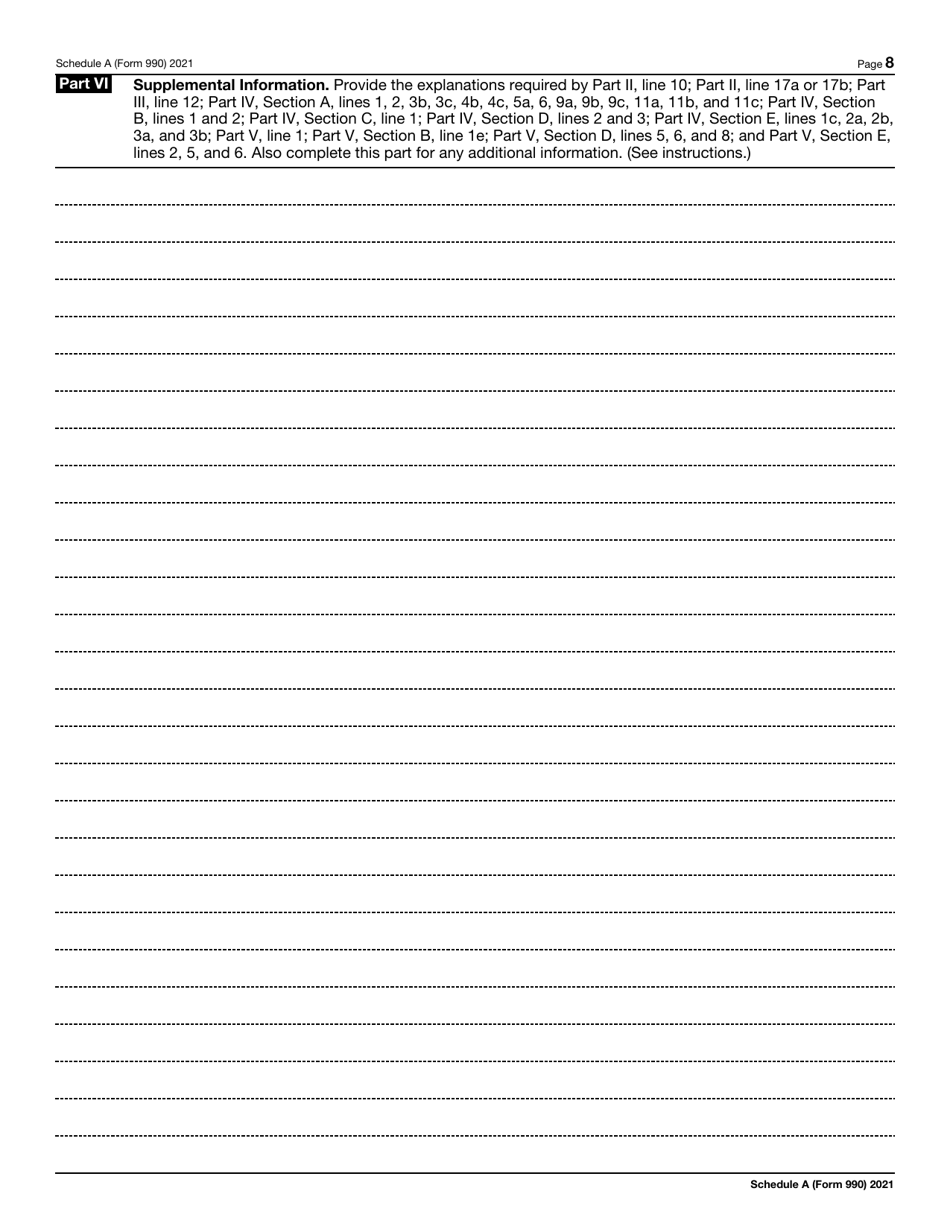

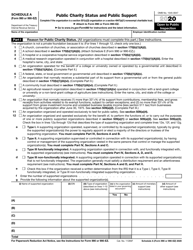

IRS Form 990 Schedule A

for the current year.

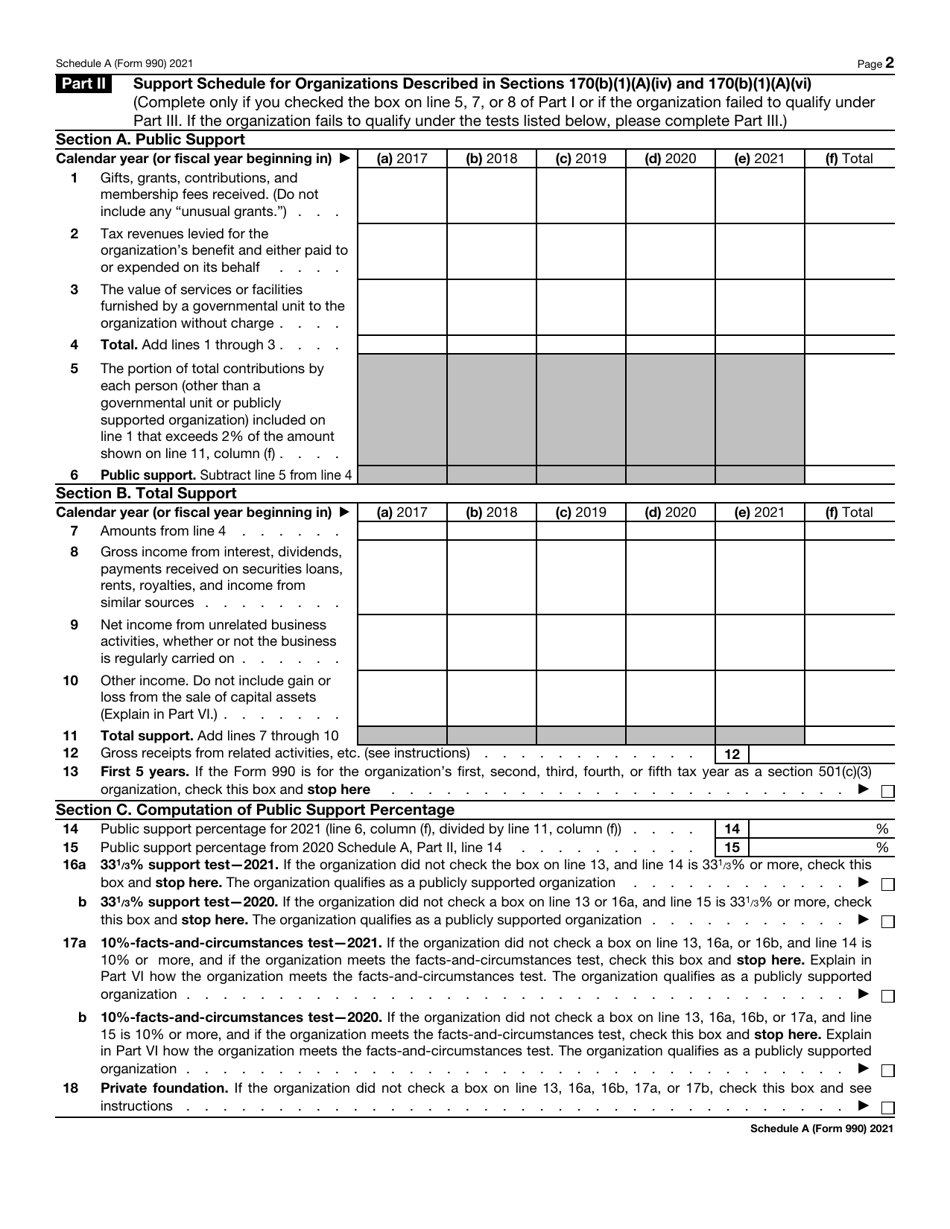

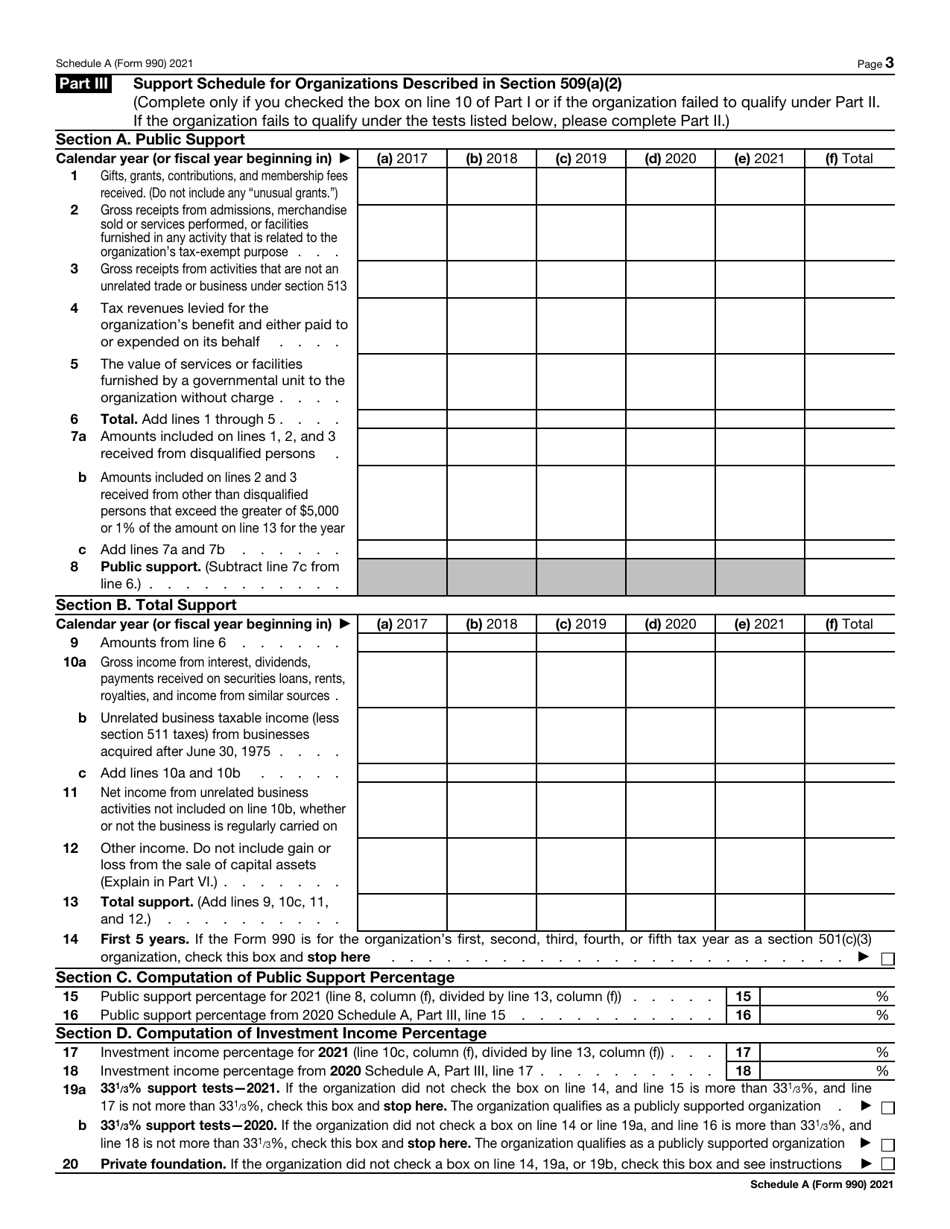

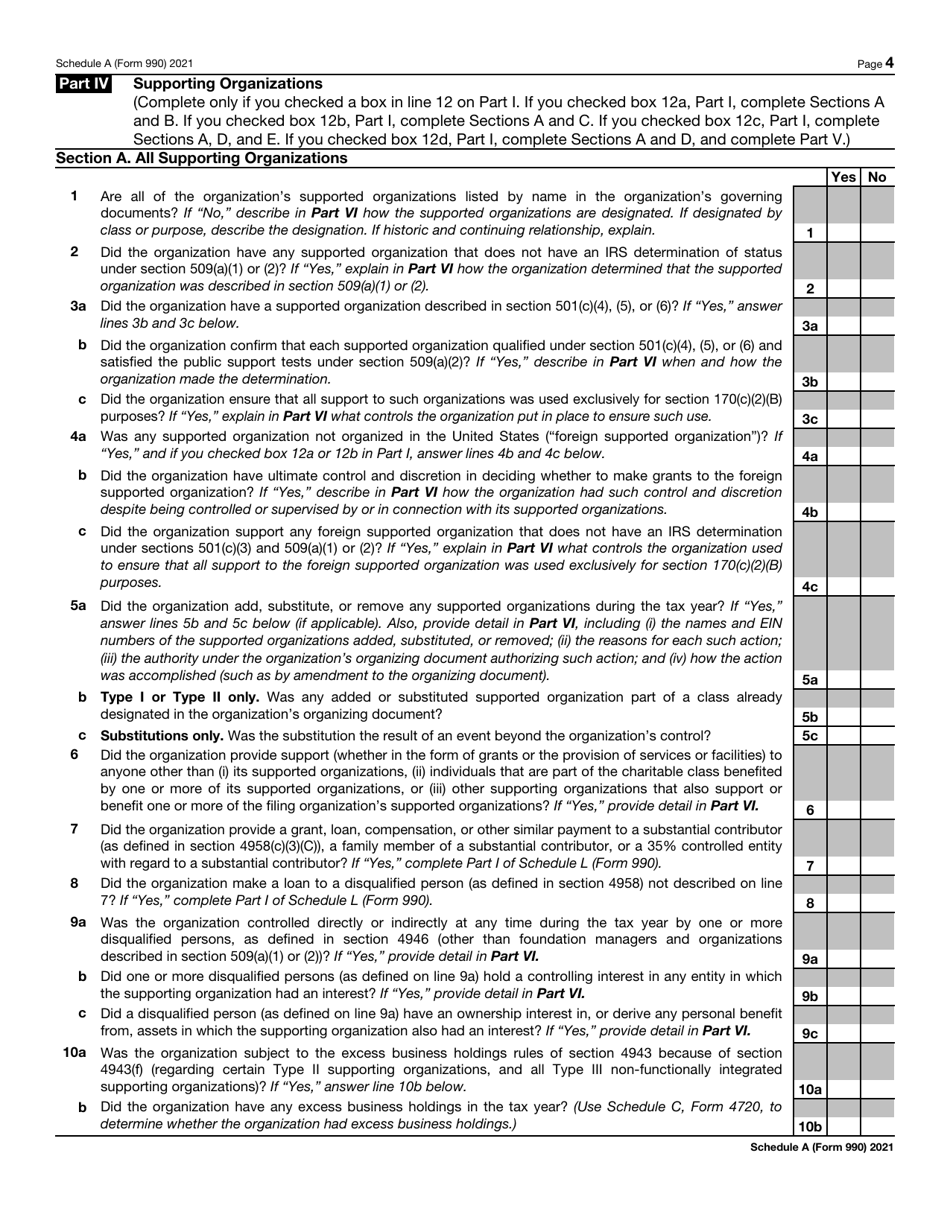

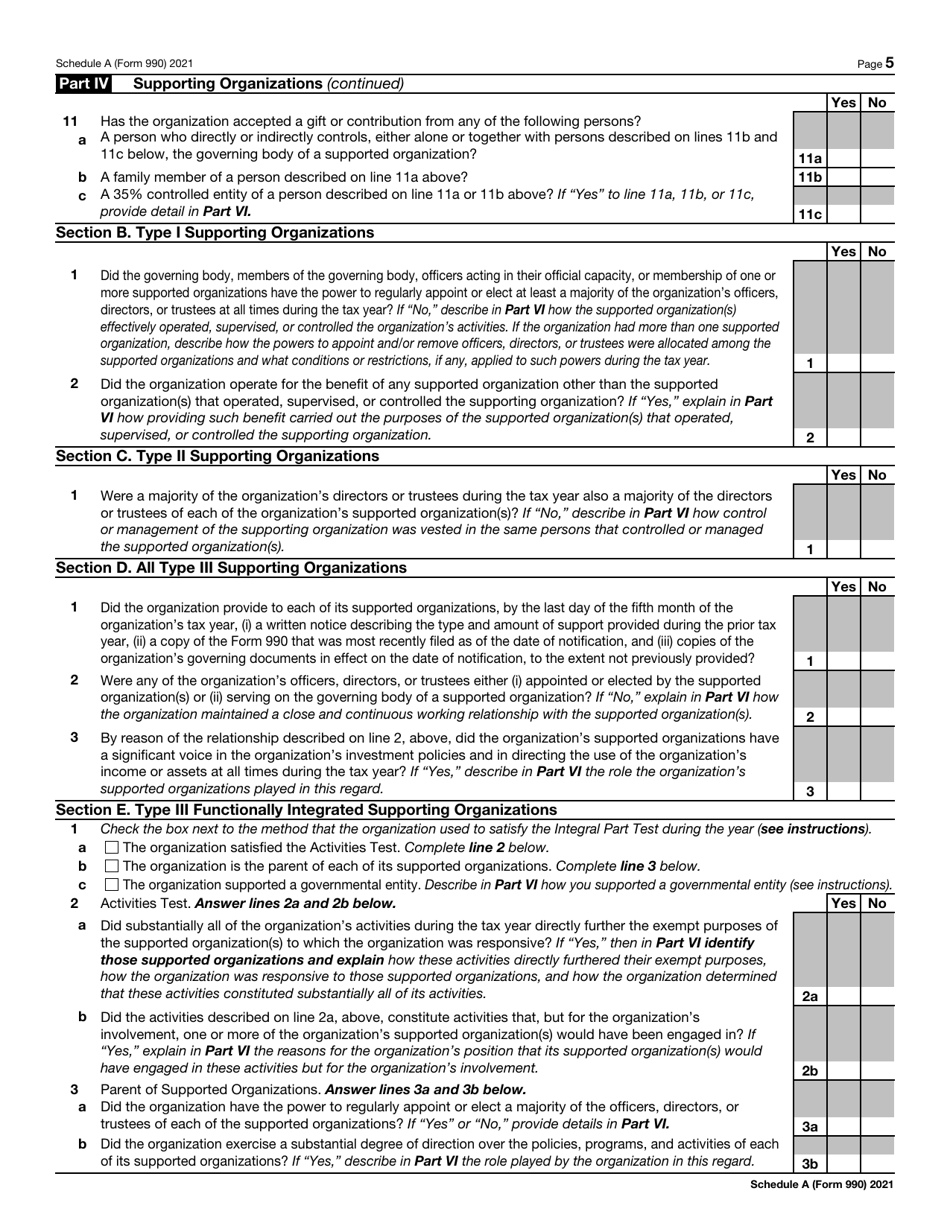

IRS Form 990 Schedule A Public Charity Status and Public Support

What Is IRS Form 990 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule A?

A: IRS Form 990 Schedule A is a form used by tax-exempt organizations to provide information about their public charity status and public support.

Q: Who needs to file IRS Form 990 Schedule A?

A: Tax-exempt organizations, specifically those classified as public charities, may need to file IRS Form 990 Schedule A.

Q: What information is required on IRS Form 990 Schedule A?

A: IRS Form 990 Schedule A requires information about the organization's public charity status, its sources of public support, and other related financial details.

Q: Why is IRS Form 990 Schedule A important?

A: IRS Form 990 Schedule A helps the IRS and the public assess a tax-exempt organization's eligibility for public charity status and the level of support it receives.

Q: When is the deadline to file IRS Form 990 Schedule A?

A: The deadline to file IRS Form 990 Schedule A depends on the organization's fiscal year-end. It is usually due by the 15th day of the 5th month after the end of the fiscal year.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule A through the link below or browse more documents in our library of IRS Forms.