Instructions for IRS Form 990 Schedule A Public Charity Status and Public Support

This document contains official instructions for IRS Form 990 Schedule A, Public Charity Status and Public Support - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule A?

A: IRS Form 990 Schedule A is a form used by public charities to report their public charity status and public support.

Q: Who needs to file IRS Form 990 Schedule A?

A: Public charities that meet certain requirements outlined by the IRS need to file Form 990 Schedule A.

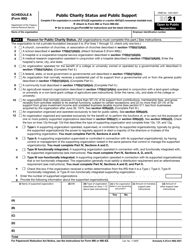

Q: What information does IRS Form 990 Schedule A require?

A: IRS Form 990 Schedule A requires information about the organization's public charity status, sources of public support, and activities conducted during the tax year.

Q: When is IRS Form 990 Schedule A due?

A: The due date for IRS Form 990 Schedule A is usually the same as the due date for the organization's annual Form 990 filing, which is the 15th day of the 5th month after the end of the organization's fiscal year.

Instruction Details:

- This 20-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.