This version of the form is not currently in use and is provided for reference only. Download this version of

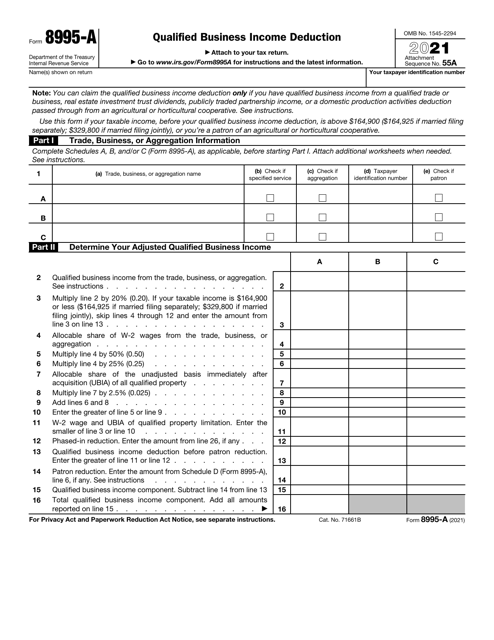

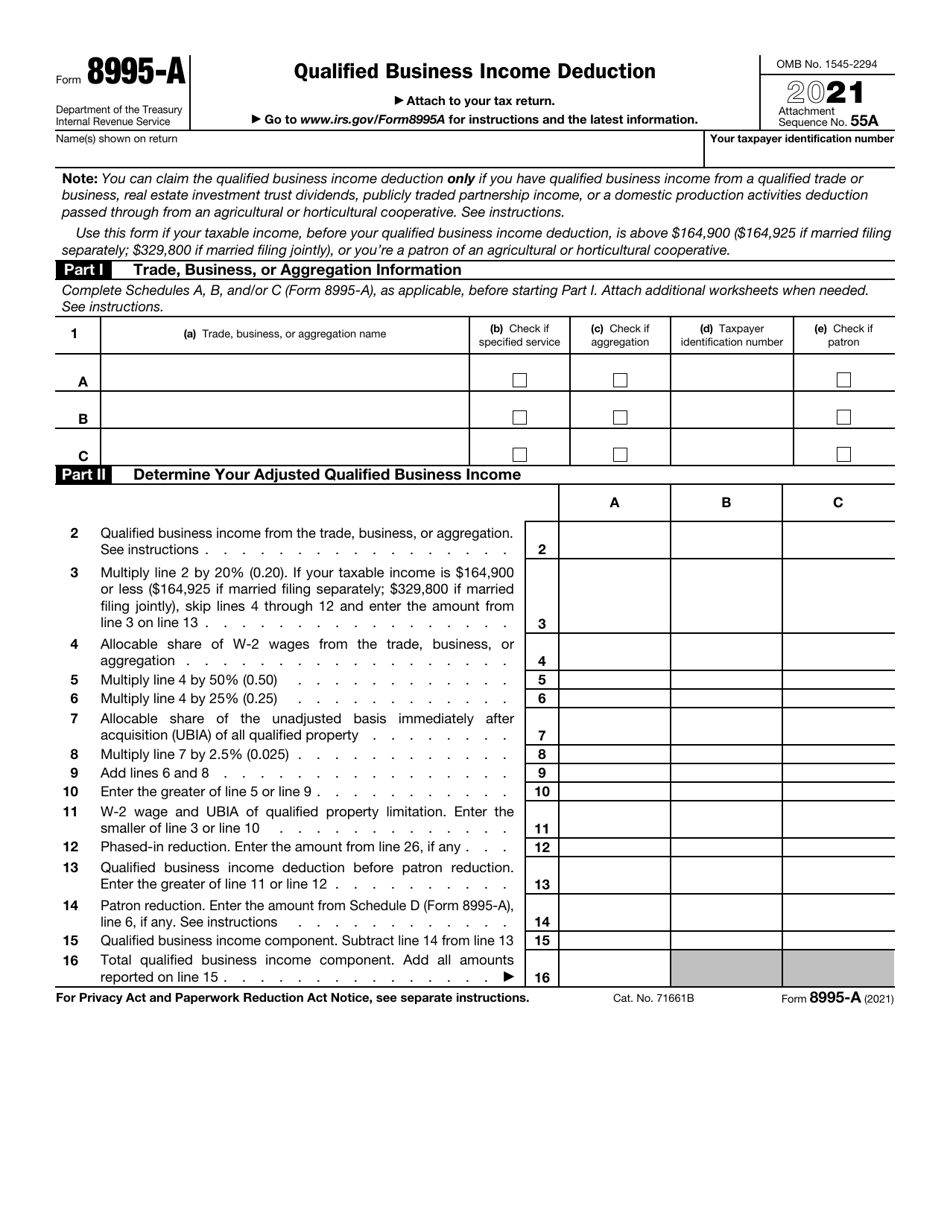

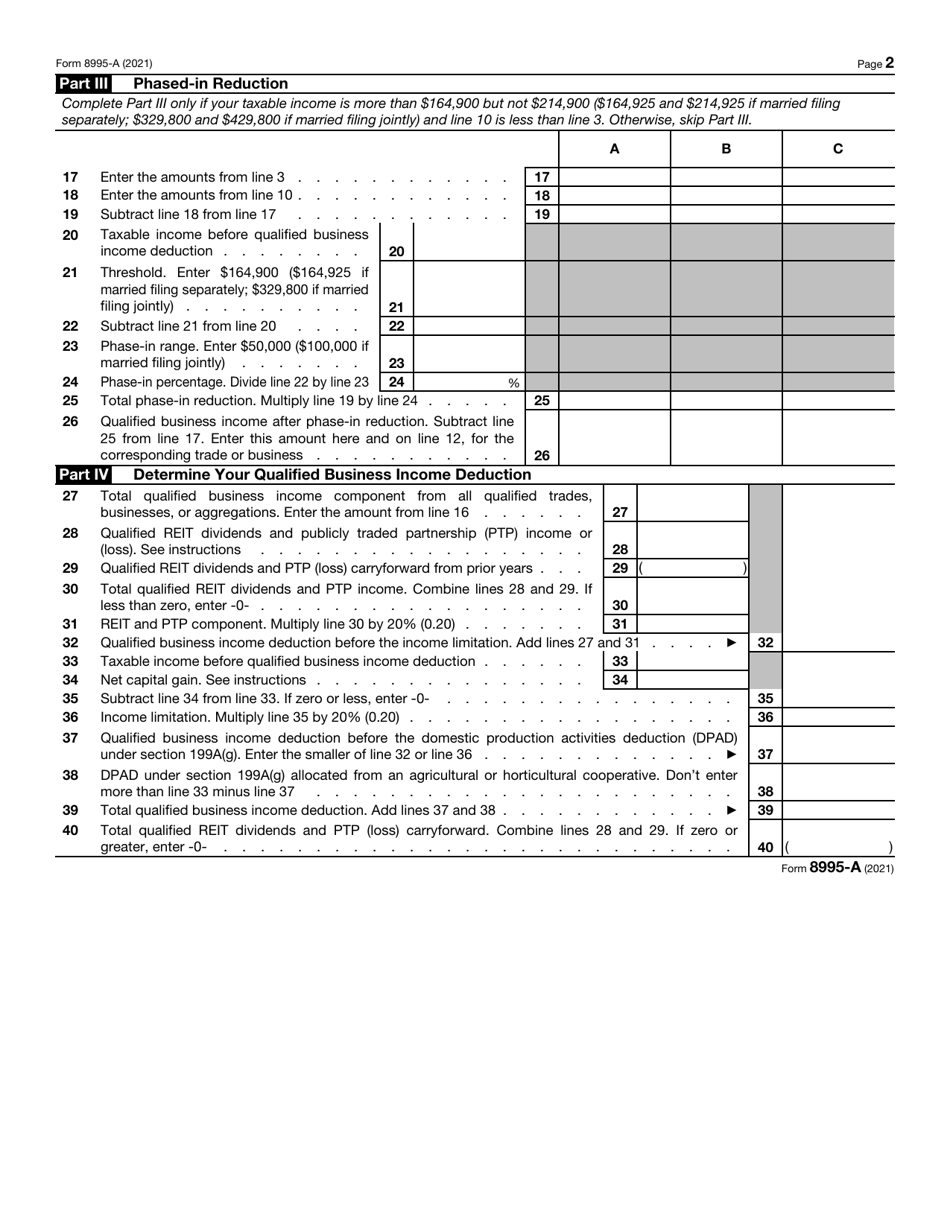

IRS Form 8995-A

for the current year.

IRS Form 8995-A Qualified Business Income Deduction

What Is IRS Form 8995-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is used to calculate the Qualified Business Income Deduction.

Q: What is the Qualified Business Income Deduction?

A: The Qualified Business Income Deduction is a tax break for certain small business owners.

Q: Who is eligible for the Qualified Business Income Deduction?

A: Eligibility for the deduction depends on factors such as the type of business and the taxpayer's income.

Q: How do I fill out IRS Form 8995-A?

A: You will need to provide information about your business and income during the tax year.

Q: Is the Qualified Business Income Deduction available in both the US and Canada?

A: No, the Qualified Business Income Deduction is only available in the United States.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8995-A through the link below or browse more documents in our library of IRS Forms.