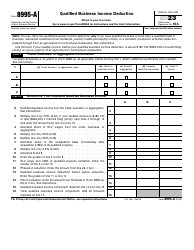

This version of the form is not currently in use and is provided for reference only. Download this version of

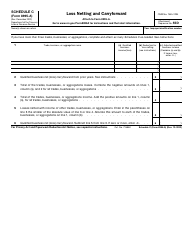

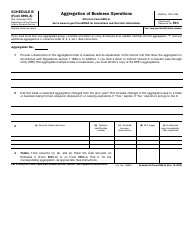

Instructions for IRS Form 8995-A

for the current year.

Instructions for IRS Form 8995-A Deduction for Qualified Business Income

This document contains official instructions for IRS Form 8995-A , Deduction for Qualified Business Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8995-A is available for download through this link.

FAQ

Q: What is IRS Form 8995-A?

A: IRS Form 8995-A is a form used to claim the Deduction for Qualified Business Income.

Q: What is the Deduction for Qualified Business Income?

A: The Deduction for Qualified Business Income is a tax deduction available to individuals who have income from qualified businesses.

Q: Who is eligible for the Deduction for Qualified Business Income?

A: Individuals who have income from qualified businesses, such as sole proprietorships, partnerships, and S corporations, may be eligible for the deduction.

Q: What businesses qualify for the Deduction for Qualified Business Income?

A: Most businesses can qualify for the deduction, as long as they are not a specified service trade or business (SSTB) or engaged in certain specified activities.

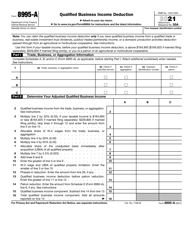

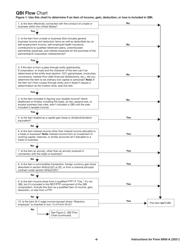

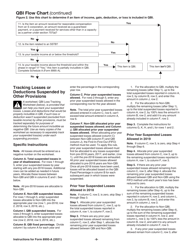

Q: How do I calculate the Deduction for Qualified Business Income?

A: The deduction is generally calculated as 20% of the qualified business income from the eligible business.

Q: Do I need to file IRS Form 8995-A?

A: You only need to file IRS Form 8995-A if you meet certain criteria, such as having qualified business income and being eligible for the deduction.

Q: When is the deadline to file IRS Form 8995-A?

A: The deadline to file IRS Form 8995-A is typically the same as the deadline to file your individual income tax return, which is April 15th.

Q: Can I e-file IRS Form 8995-A?

A: Yes, you can e-file IRS Form 8995-A, either on your own using tax software or through a tax professional.

Q: What documentation do I need to support my deduction for qualified business income?

A: You should keep records and documentation that support your qualified business income, such as income statements, receipts, and expense records.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.