This version of the form is not currently in use and is provided for reference only. Download this version of

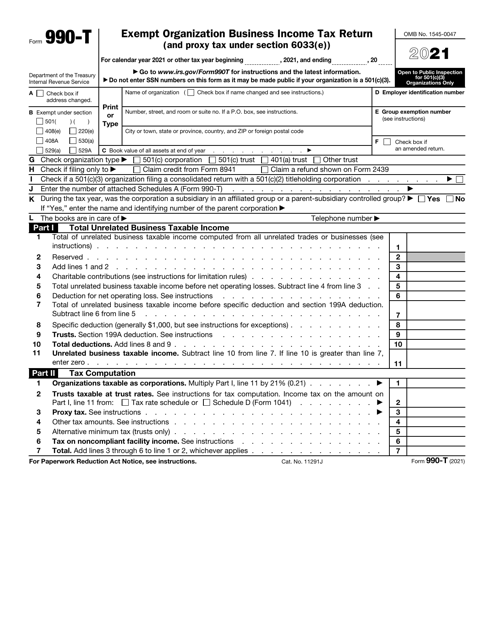

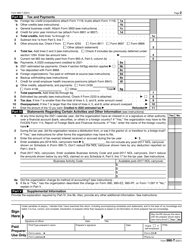

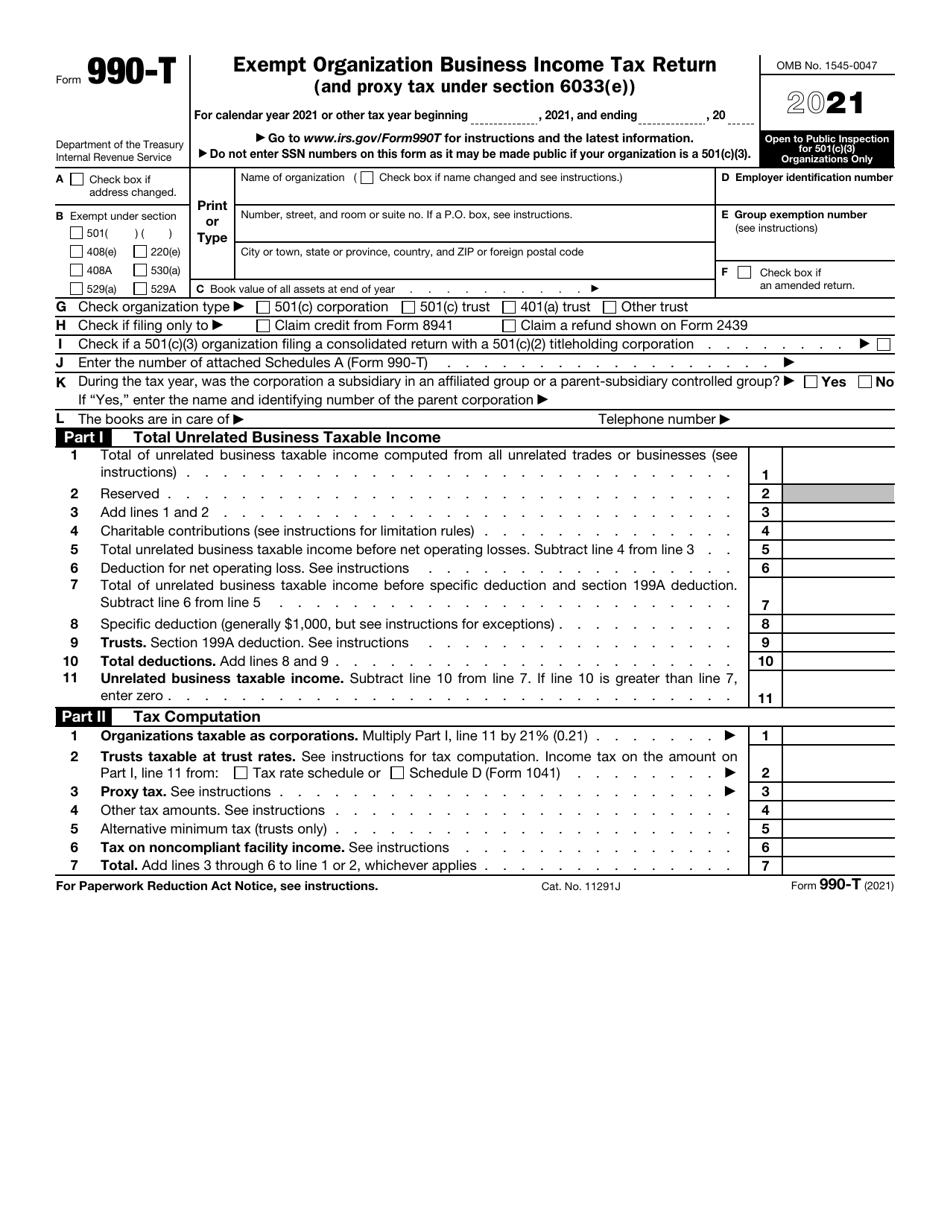

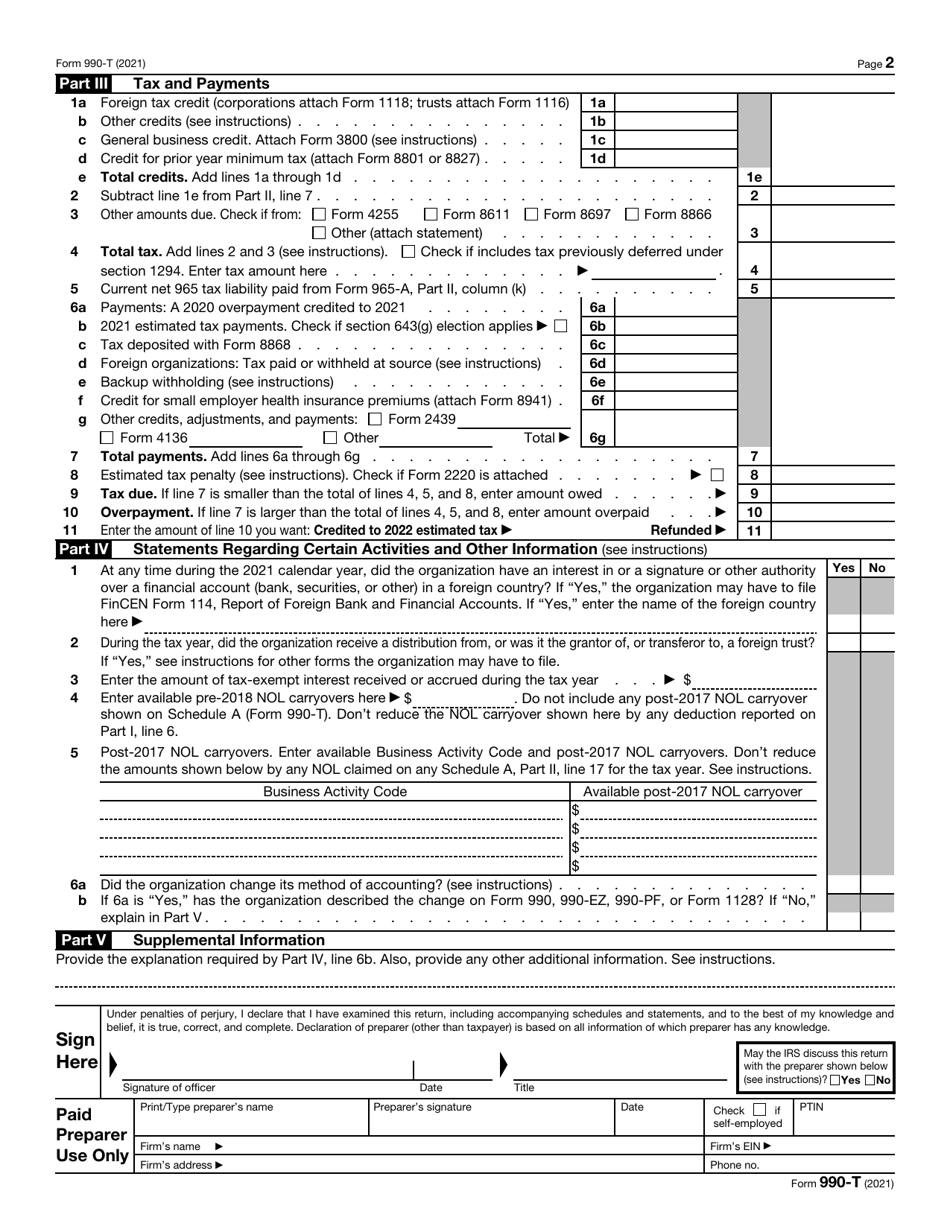

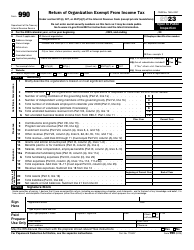

IRS Form 990-T

for the current year.

IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

What Is IRS Form 990-T?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990-T?

A: IRS Form 990-T is the Exempt Organization Business Income Tax Return.

Q: Who files IRS Form 990-T?

A: Exempt organizations that have unrelated business income file IRS Form 990-T.

Q: What is unrelated business income?

A: Unrelated business income is income generated by an exempt organization from a trade or business that is not substantially related to its exempt purpose.

Q: What is a proxy tax under Section 6033(e)?

A: A proxy tax under Section 6033(e) is a tax imposed on certain exempt organizations that engage in lobbying or political campaign activities.

Q: When is IRS Form 990-T due?

A: IRS Form 990-T is generally due on the 15th day of the 5th month after the end of the organization's tax year.

Q: Are all exempt organizations required to file IRS Form 990-T?

A: No, only exempt organizations that have unrelated business income or engage in certain lobbying or political campaign activities are required to file IRS Form 990-T.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-T through the link below or browse more documents in our library of IRS Forms.