This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990-T

for the current year.

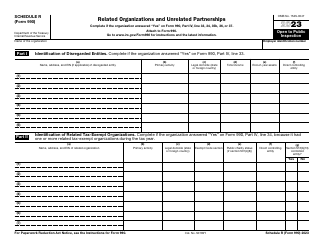

Instructions for IRS Form 990-T Exempt Organization Business Income Tax Return (And Proxy Tax Under Section 6033(E))

This document contains official instructions for IRS Form 990-T , Exempt Organization Proxy Tax Under Section 6033(E)) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-T is available for download through this link.

FAQ

Q: What is Form 990-T?

A: Form 990-T is the Exempt Organization Business Income Tax Return.

Q: Who needs to file Form 990-T?

A: Exempt organizations with unrelated business income of $1,000 or more in a tax year must file Form 990-T.

Q: What is unrelated business income?

A: Unrelated business income includes income from a trade or business regularly conducted by an exempt organization.

Q: What is the purpose of Form 990-T?

A: Form 990-T is used to report and calculate the tax on unrelated business income of exempt organizations.

Q: Are all exempt organizations required to file Form 990-T?

A: No, only exempt organizations with unrelated business income of $1,000 or more need to file Form 990-T.

Q: Are there any exceptions to filing Form 990-T?

A: Yes, certain types of exempt organizations are exempt from filing Form 990-T, such as religious organizations.

Q: Are there any penalties for not filing Form 990-T?

A: Yes, there are penalties for not filing or filing an incomplete or inaccurate Form 990-T. It is important to comply with the filing requirements.

Q: When is the deadline for filing Form 990-T?

A: The deadline for filing Form 990-T is the 15th day of the 5th month after the end of the organization's tax year.

Q: Do I need to pay tax on all unrelated business income?

A: No, there are certain deductions and exemptions that may apply to reduce the taxable amount of unrelated business income.

Instruction Details:

- This 36-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.