This version of the form is not currently in use and is provided for reference only. Download this version of

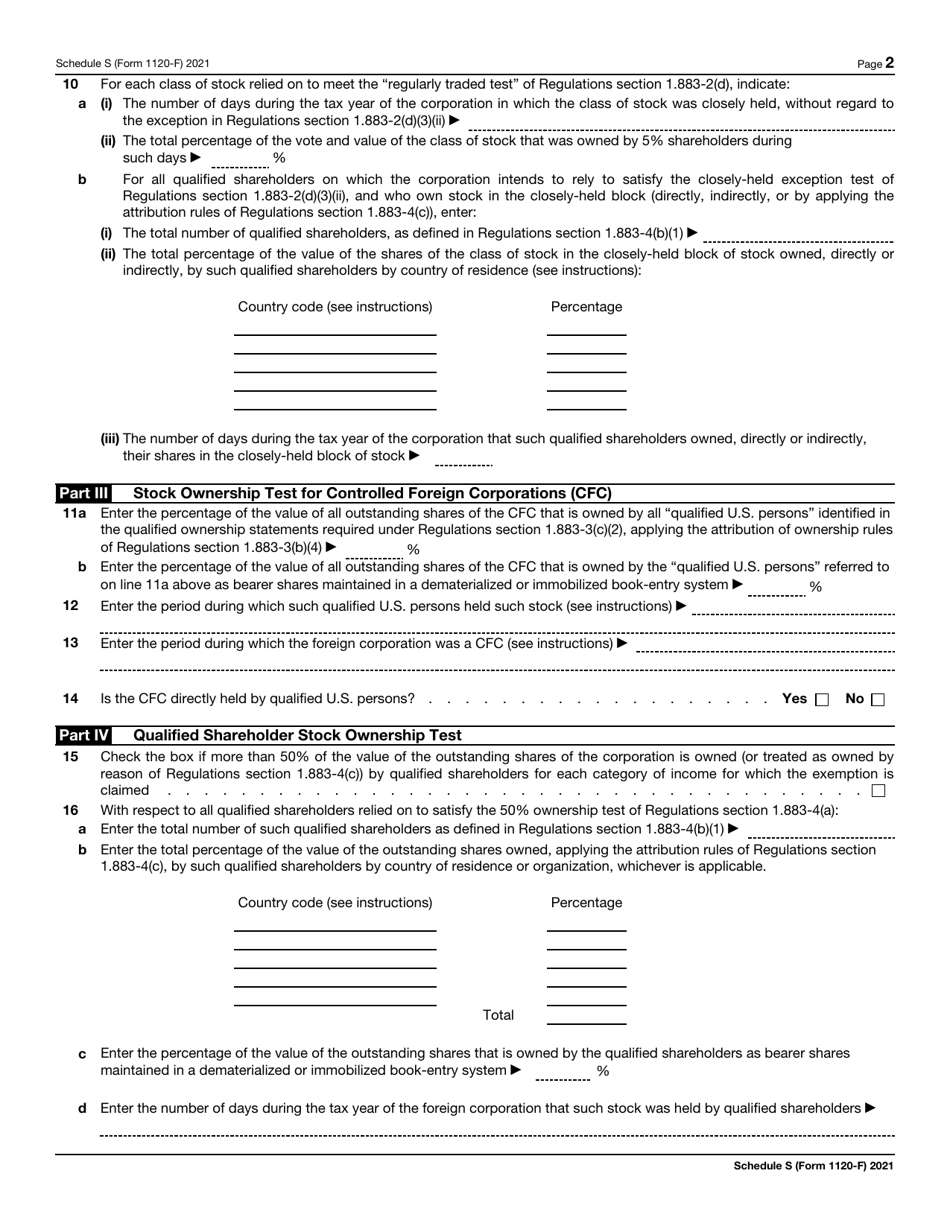

IRS Form 1120-F Schedule S

for the current year.

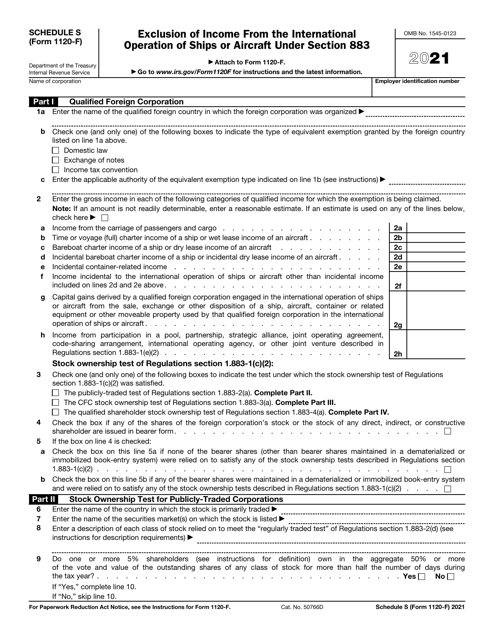

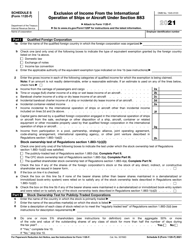

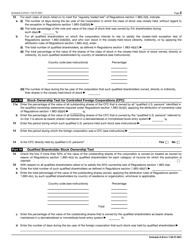

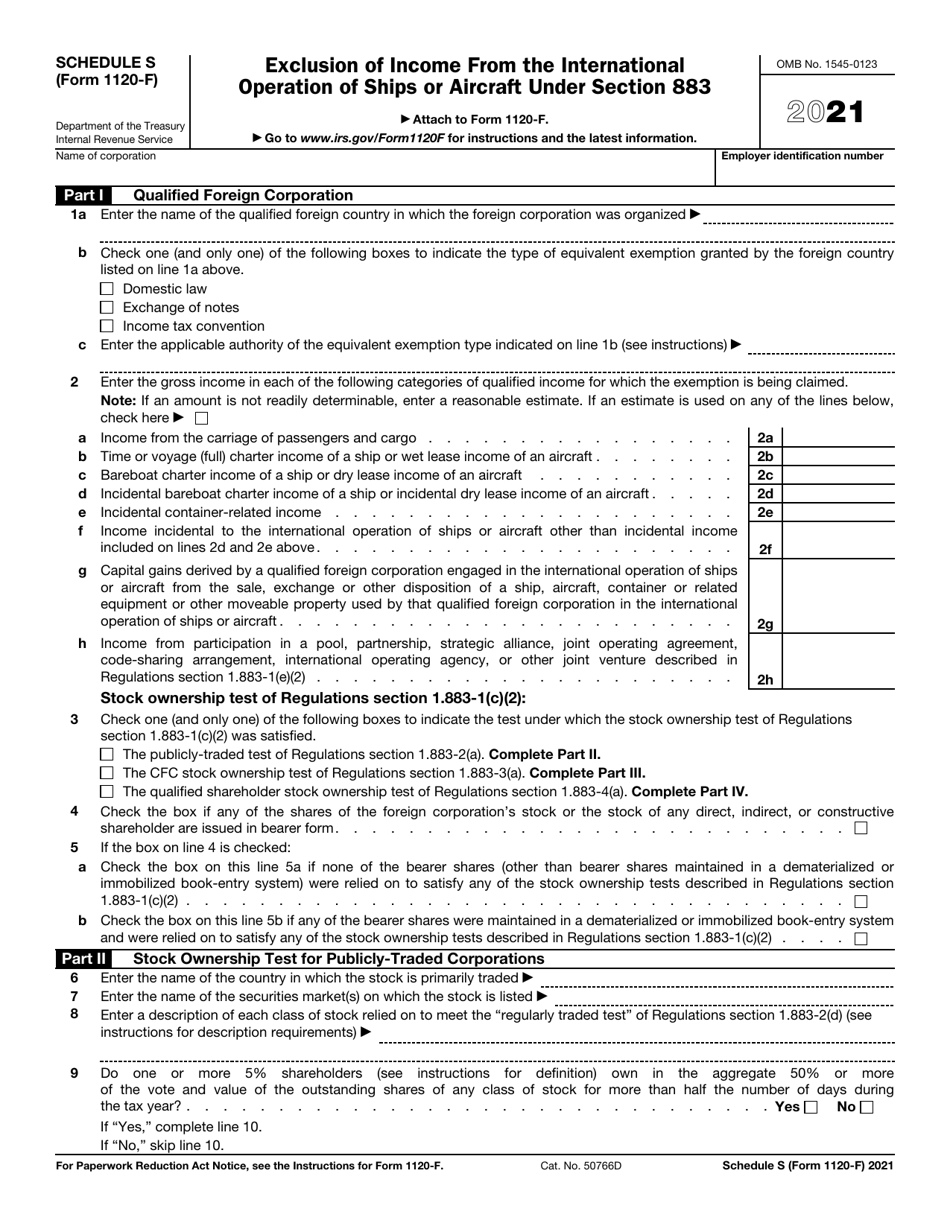

IRS Form 1120-F Schedule S Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883

What Is IRS Form 1120-F Schedule S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F Schedule S?

A: IRS Form 1120-F Schedule S is a form used to report the exclusion of income from the international operation of ships or aircraft under Section 883 of the tax code.

Q: What does Section 883 of the tax code refer to?

A: Section 883 of the tax code refers to the provision that allows certain income derived from the international operation of ships or aircraft to be excluded from U.S. taxation.

Q: Who is required to file IRS Form 1120-F Schedule S?

A: Taxpayers who are engaged in the international operation of ships or aircraft and wish to exclude income under Section 883 are required to file IRS Form 1120-F Schedule S.

Q: What is the purpose of excluding income under Section 883?

A: The purpose of excluding income under Section 883 is to avoid double taxation on income derived from the international operation of ships or aircraft.

Q: Are there any specific requirements to be eligible for the exclusion of income under Section 883?

A: Yes, there are specific requirements to be eligible for the exclusion of income under Section 883, such as the taxpayer must be engaged in the international operation of ships or aircraft, among others.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule S through the link below or browse more documents in our library of IRS Forms.