This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-F Schedule S

for the current year.

Instructions for IRS Form 1120-F Schedule S Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883

This document contains official instructions for IRS Form 1120-F Schedule S, Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883 - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule S is available for download through this link.

FAQ

Q: What is IRS Form 1120-F?

A: IRS Form 1120-F is a tax form used by foreign corporations to report income from a U.S. trade or business.

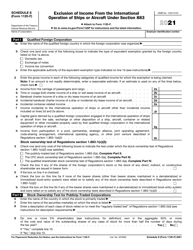

Q: What is Schedule S on IRS Form 1120-F?

A: Schedule S is used to claim the exclusion of income from the international operation of ships or aircraft under Section 883.

Q: Who can use Schedule S?

A: Foreign corporations engaged in the international operation of ships or aircraft can use Schedule S.

Q: What is the purpose of the exclusion under Section 883?

A: The exclusion is meant to prevent double taxation of income earned by foreign corporations operating ships or aircraft.

Q: How do I qualify for the exclusion?

A: To qualify, your foreign corporation must meet specific ownership and operational requirements outlined in Section 883.

Q: What information is needed to complete Schedule S?

A: You will need to provide details about your foreign corporation's income, expenses, and activities related to the international operation of ships or aircraft.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.