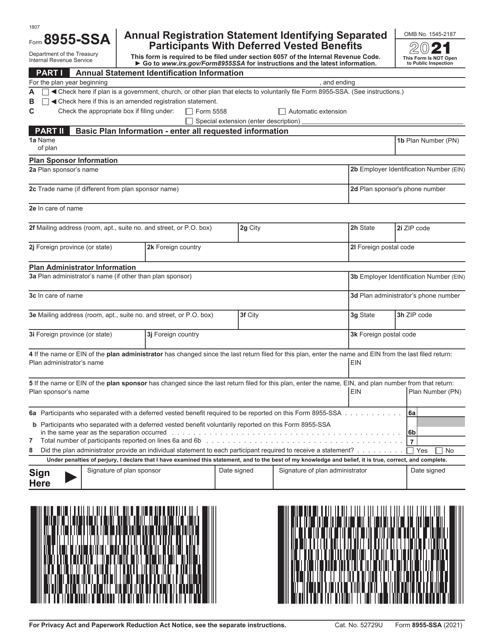

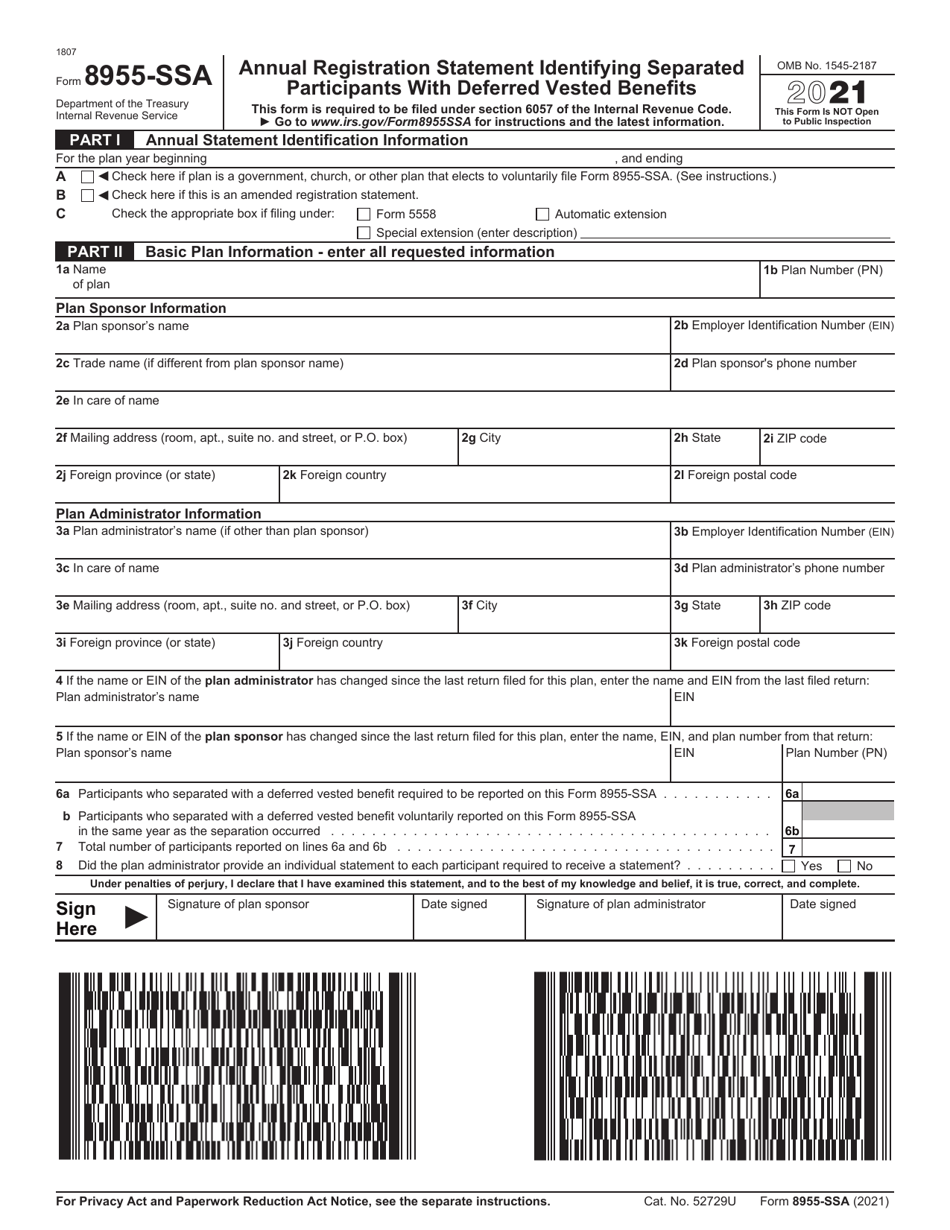

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8955-SSA

for the current year.

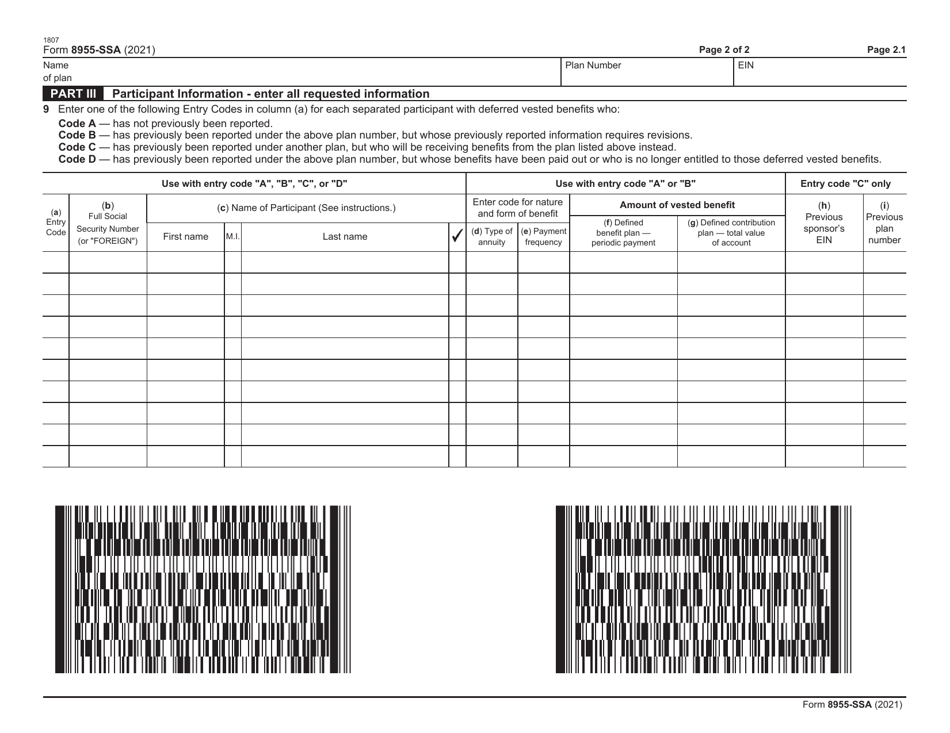

IRS Form 8955-SSA Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

What Is IRS Form 8955-SSA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8955-SSA?

A: IRS Form 8955-SSA is an Annual Registration Statement that identifies separated participants with deferred vested benefits.

Q: Who needs to file IRS Form 8955-SSA?

A: Plan administrators of retirement plans that have separated participants with deferred vested benefits need to file IRS Form 8955-SSA.

Q: What is the purpose of filing IRS Form 8955-SSA?

A: The purpose of filing IRS Form 8955-SSA is to allow the IRS to track separated participants with deferred vested benefits and ensure their proper reporting and taxation.

Q: When is the deadline for filing IRS Form 8955-SSA?

A: The deadline for filing IRS Form 8955-SSA is the last day of the seventh month following the plan year-end.

Q: Is IRS Form 8955-SSA required for all retirement plans?

A: No, IRS Form 8955-SSA is only required for retirement plans that have separated participants with deferred vested benefits.

Form Details:

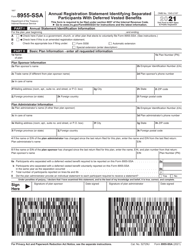

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8955-SSA through the link below or browse more documents in our library of IRS Forms.