This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8955-SSA

for the current year.

Instructions for IRS Form 8955-SSA Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

This document contains official instructions for IRS Form 8955-SSA , Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8955-SSA is available for download through this link.

FAQ

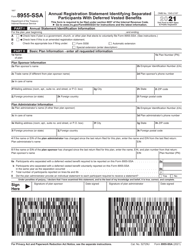

Q: What is IRS Form 8955-SSA?

A: IRS Form 8955-SSA is an annual registration statement used to identify separated participants with deferred vested benefits.

Q: Who needs to file IRS Form 8955-SSA?

A: Plan administrators of qualified retirement plans, such as pension plans and profit-sharing plans, need to file IRS Form 8955-SSA.

Q: What are deferred vested benefits?

A: Deferred vested benefits are retirement benefits that have been earned by participants but are not yet payable.

Q: When is IRS Form 8955-SSA due?

A: IRS Form 8955-SSA is generally due by the last day of the seventh month following the end of the plan year.

Q: What happens if IRS Form 8955-SSA is not filed on time?

A: Failure to file IRS Form 8955-SSA may result in penalties imposed by the IRS.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.