This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 943-X

for the current year.

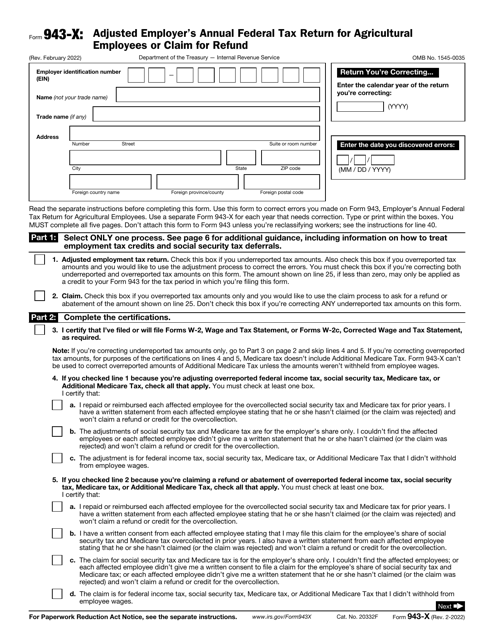

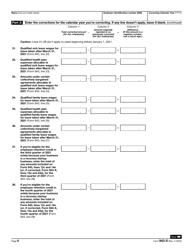

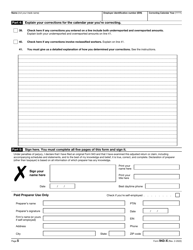

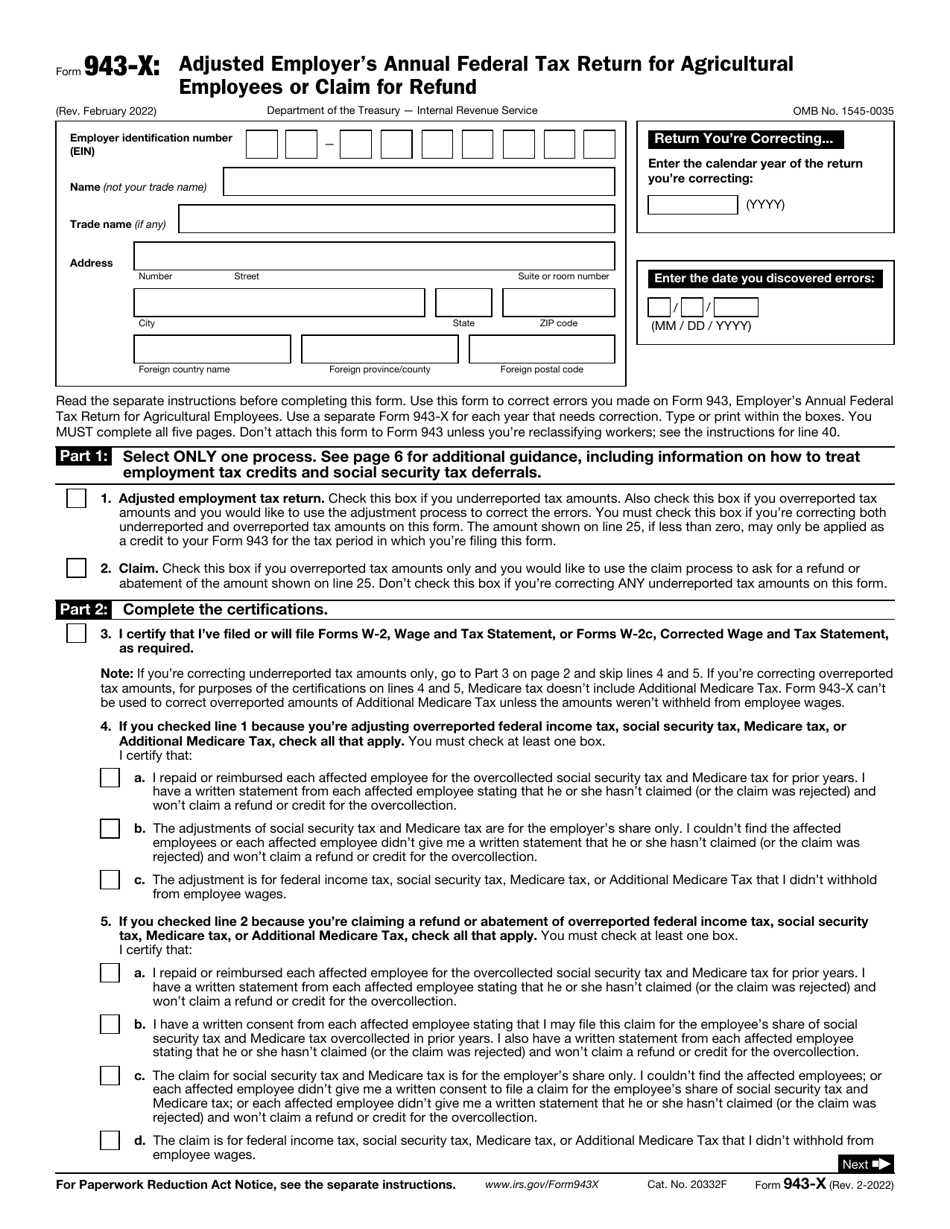

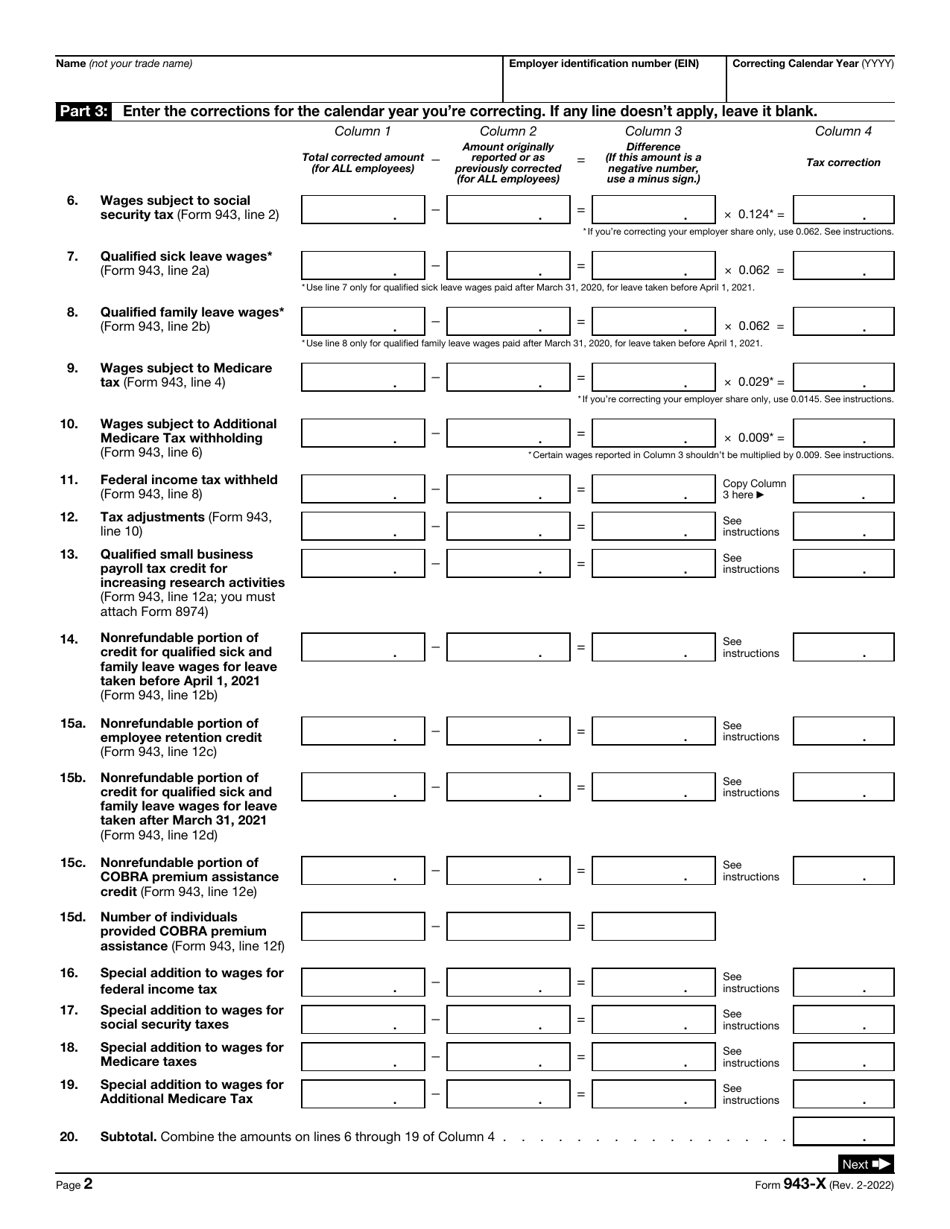

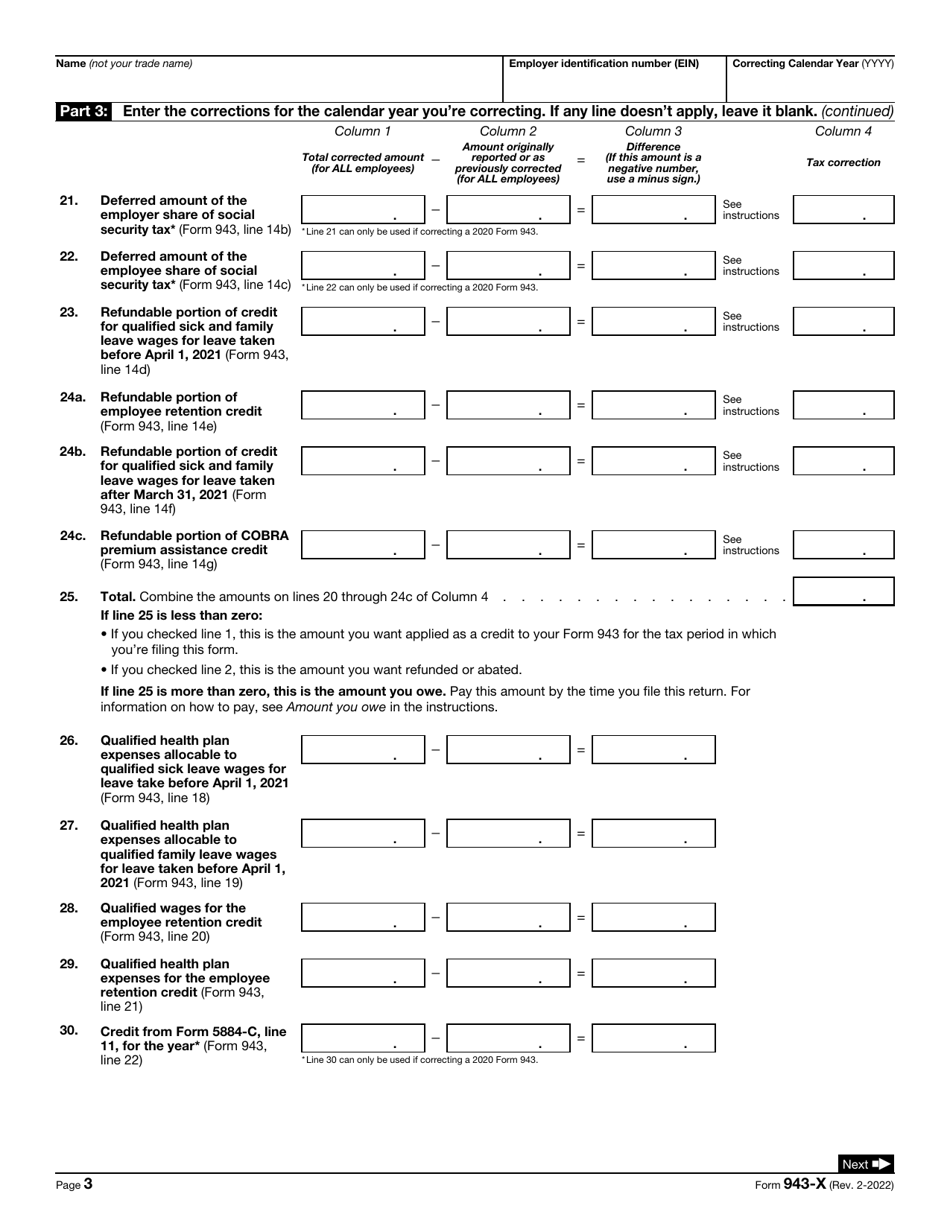

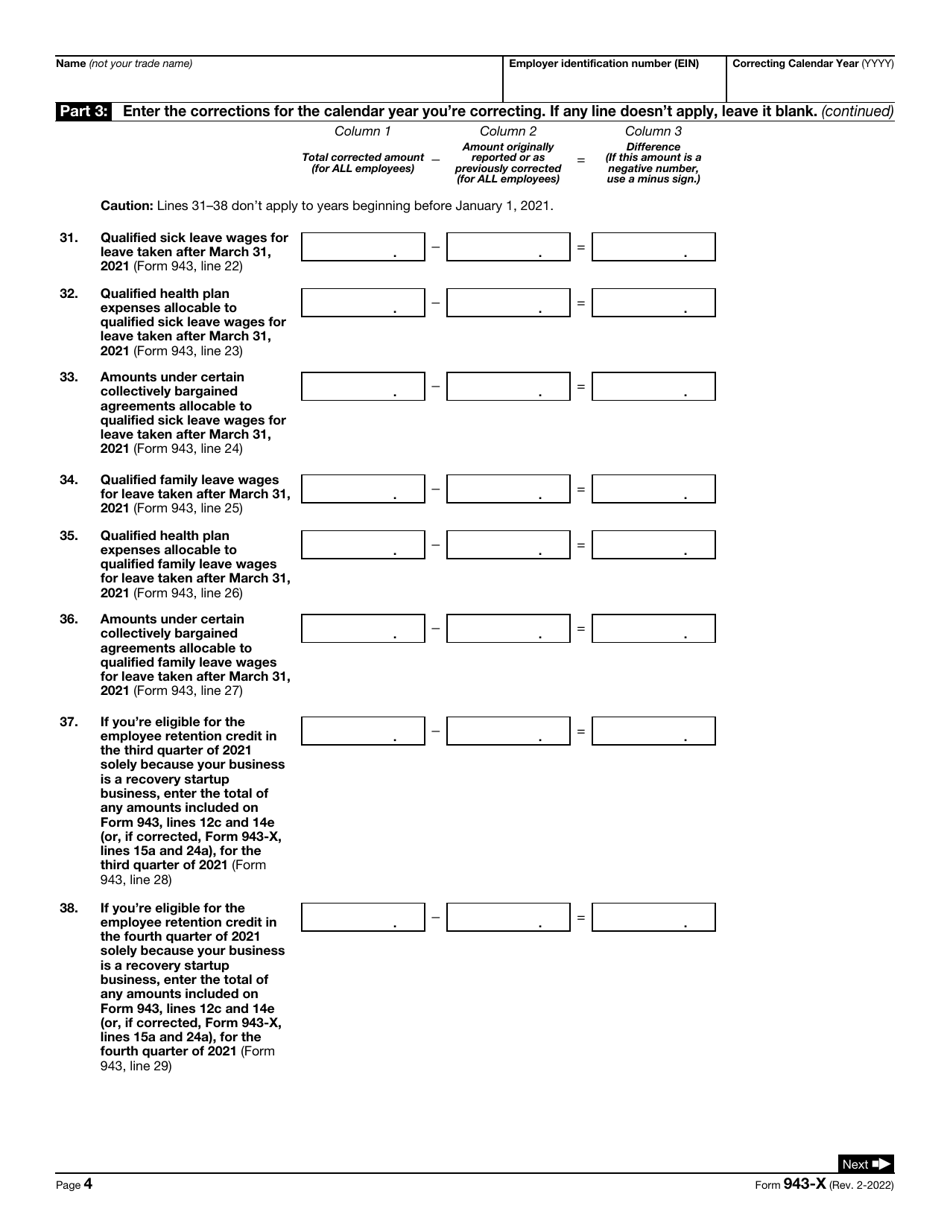

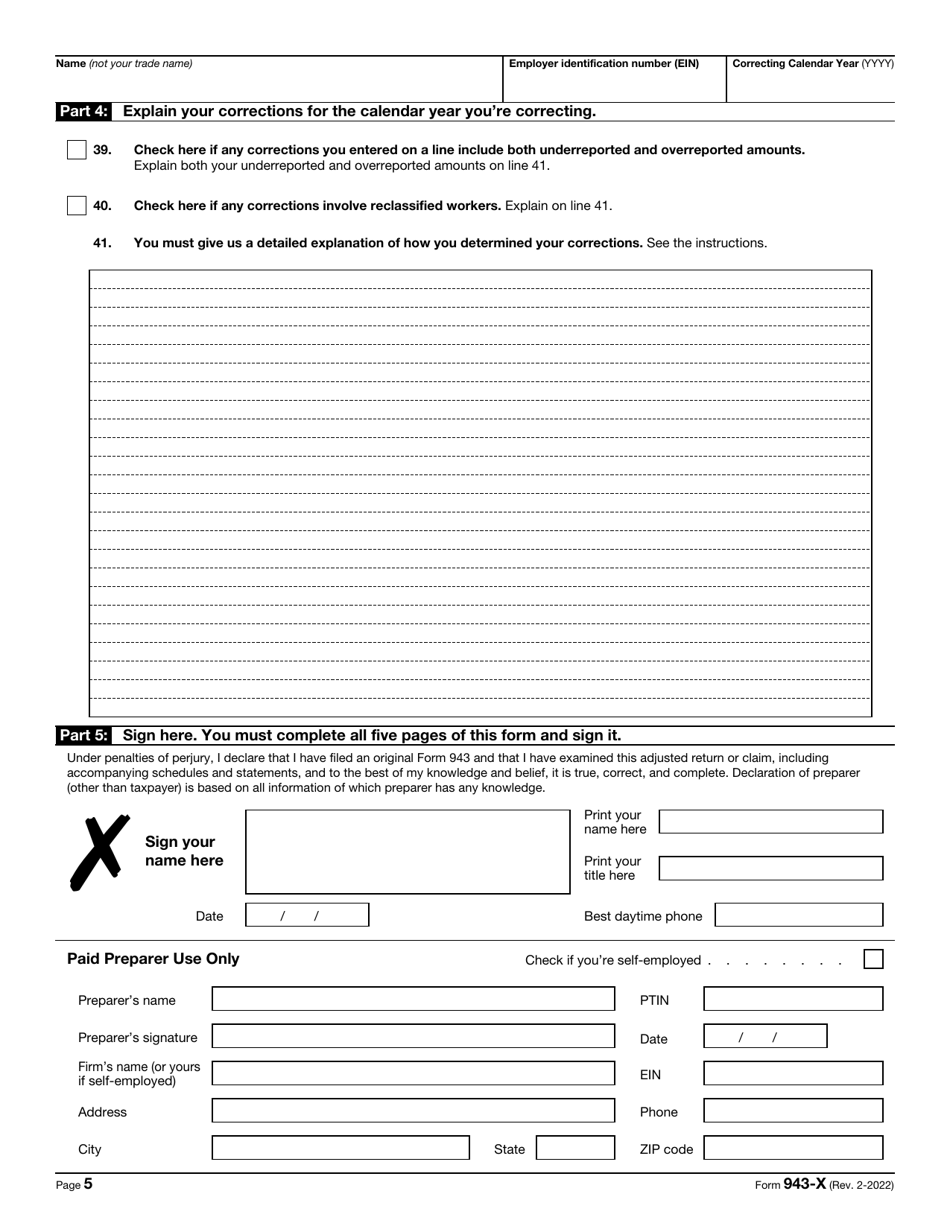

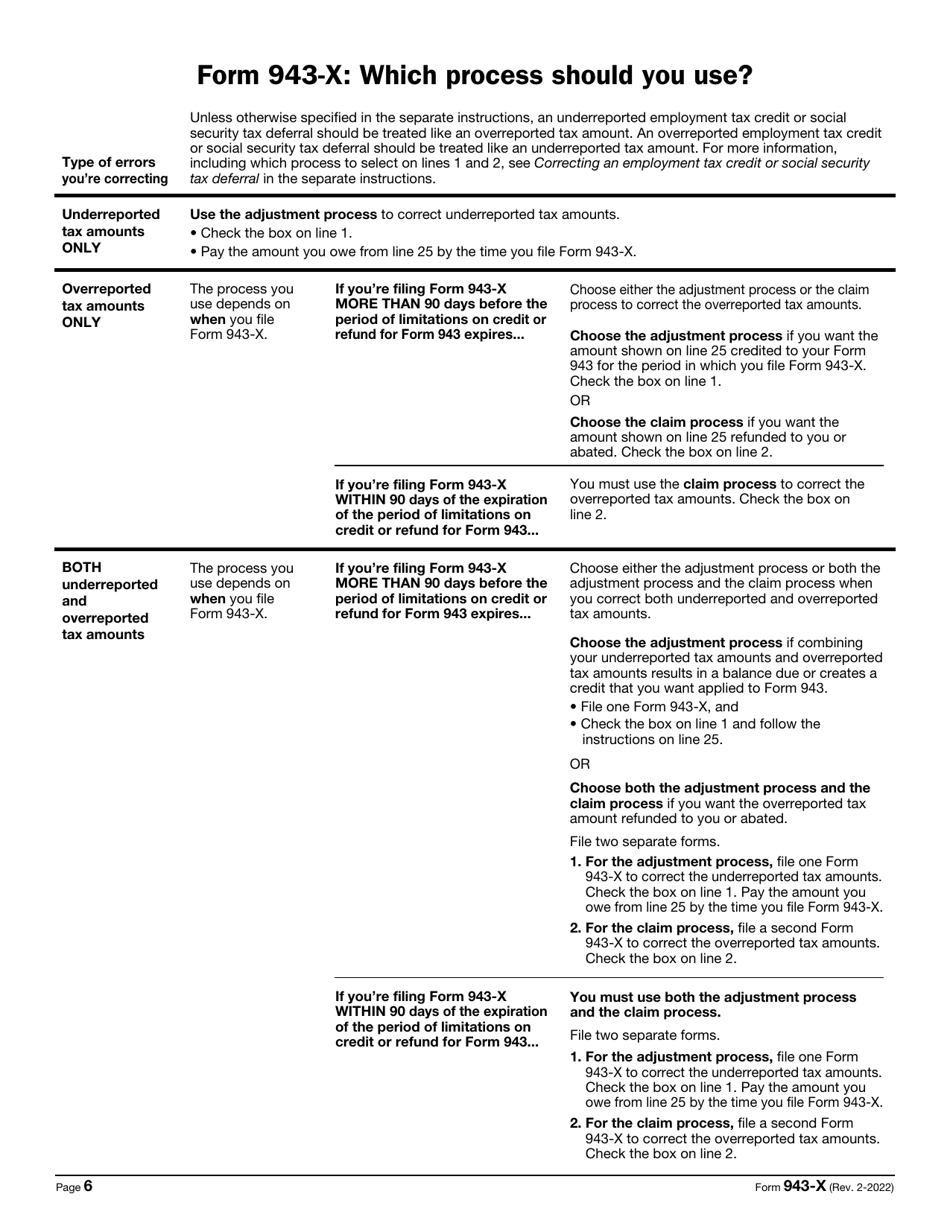

IRS Form 943-X Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

What Is IRS Form 943-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 943-X?

A: IRS Form 943-X is the Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund.

Q: Who can use IRS Form 943-X?

A: This form is used by employers who have previously filed IRS Form 943 and need to make adjustments or claim a refund for agricultural employees.

Q: When should I file IRS Form 943-X?

A: You should file Form 943-X when you become aware of an error or need to make changes to a previously filed Form 943.

Q: Can I file IRS Form 943-X electronically?

A: No, you cannot file Form 943-X electronically. It must be filed by mail.

Q: Is there a deadline for filing IRS Form 943-X?

A: Yes, Form 943-X must be filed within the time period allowed for claiming a refund or making an adjustment.

Q: How long does it take to process IRS Form 943-X?

A: Processing times can vary, but it generally takes several weeks to process a Form 943-X.

Q: Do I need to keep a copy of IRS Form 943-X for my records?

A: Yes, it is recommended to keep a copy of Form 943-X and any supporting documentation for your records.

Form Details:

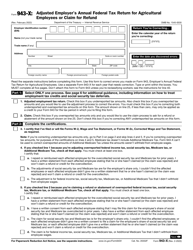

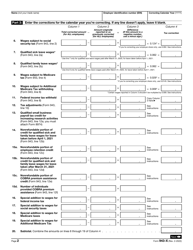

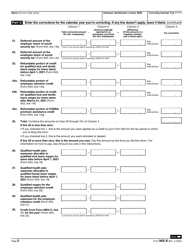

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 943-X through the link below or browse more documents in our library of IRS Forms.