This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 1040ME

for the current year.

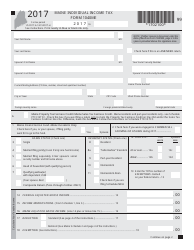

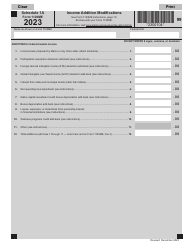

Instructions for Form 1040ME Maine Individual Income Tax - Maine

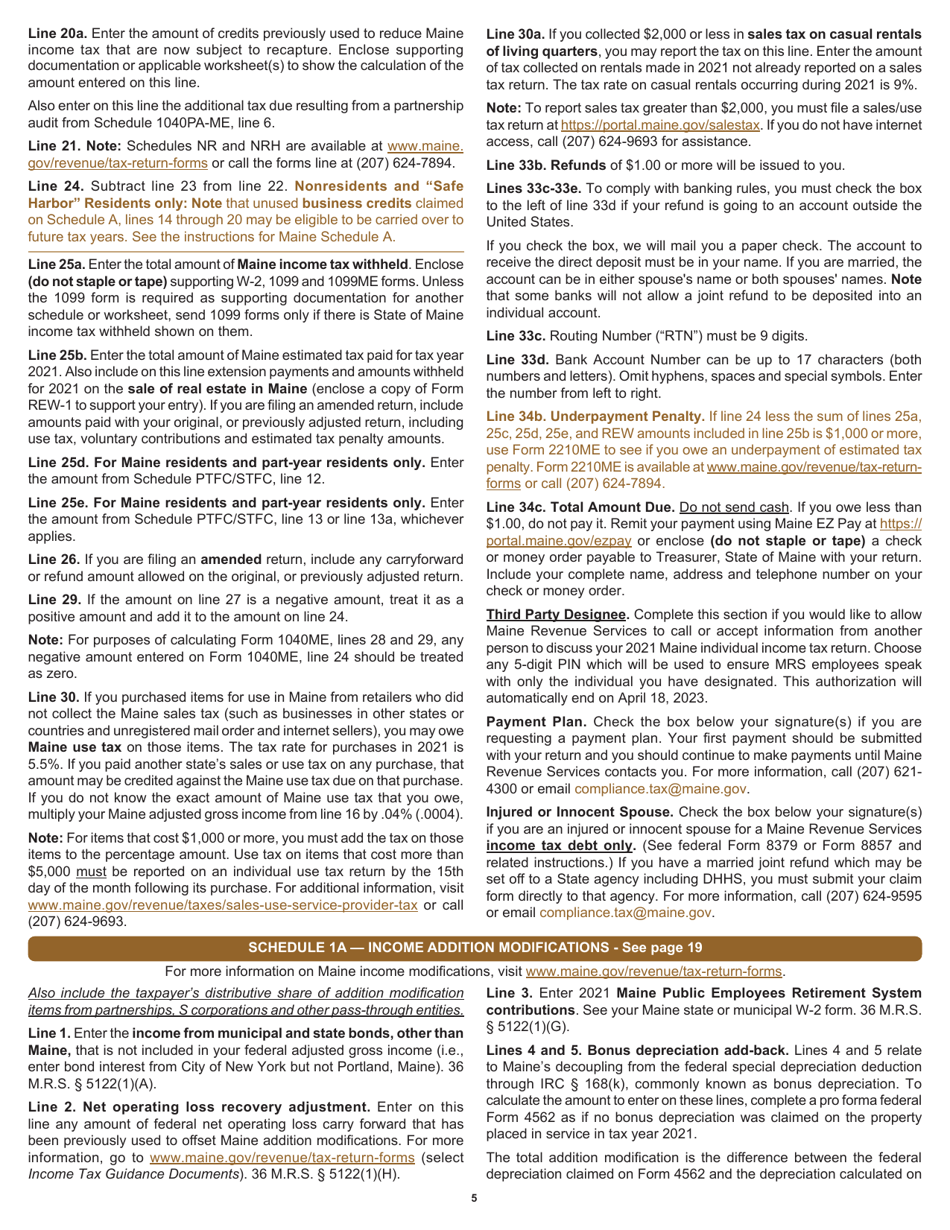

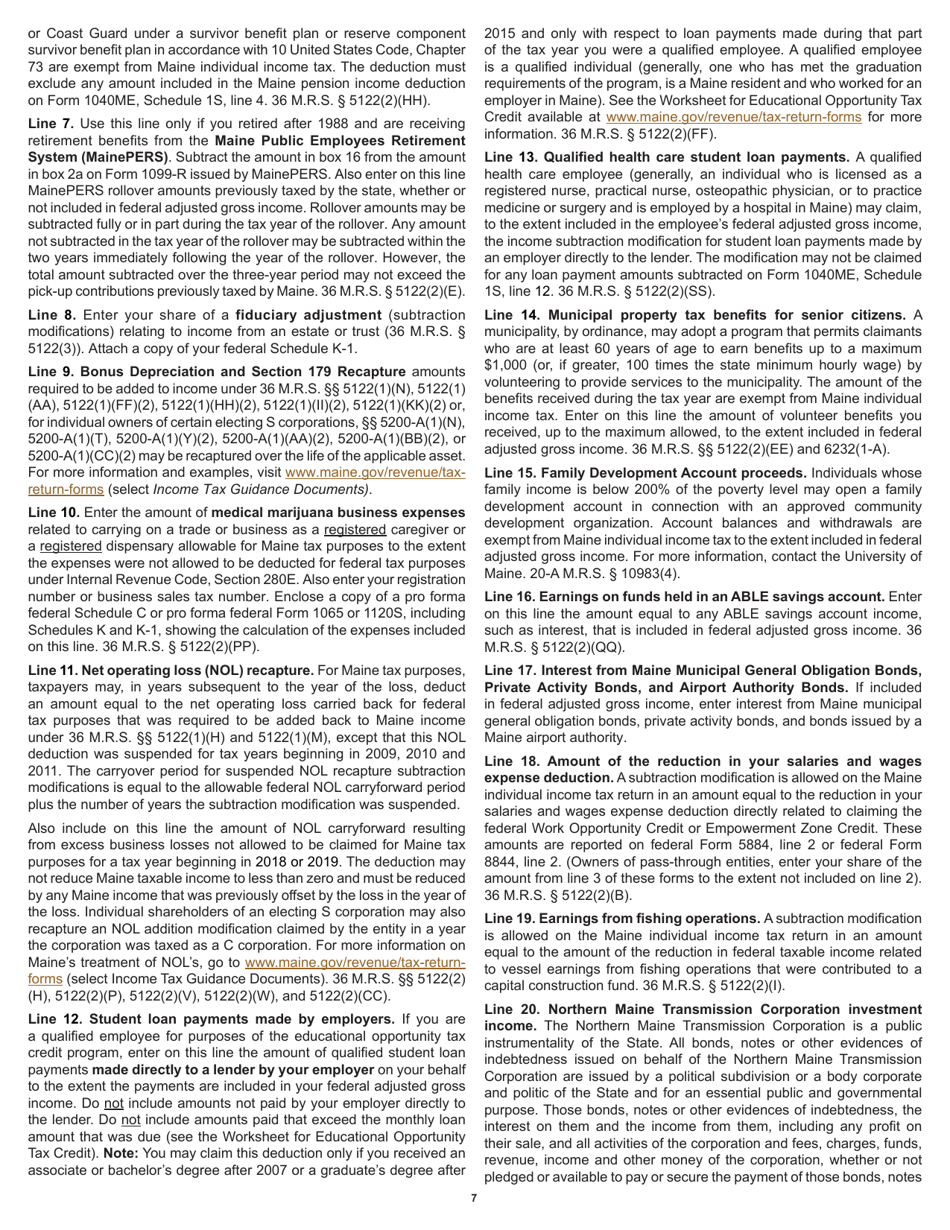

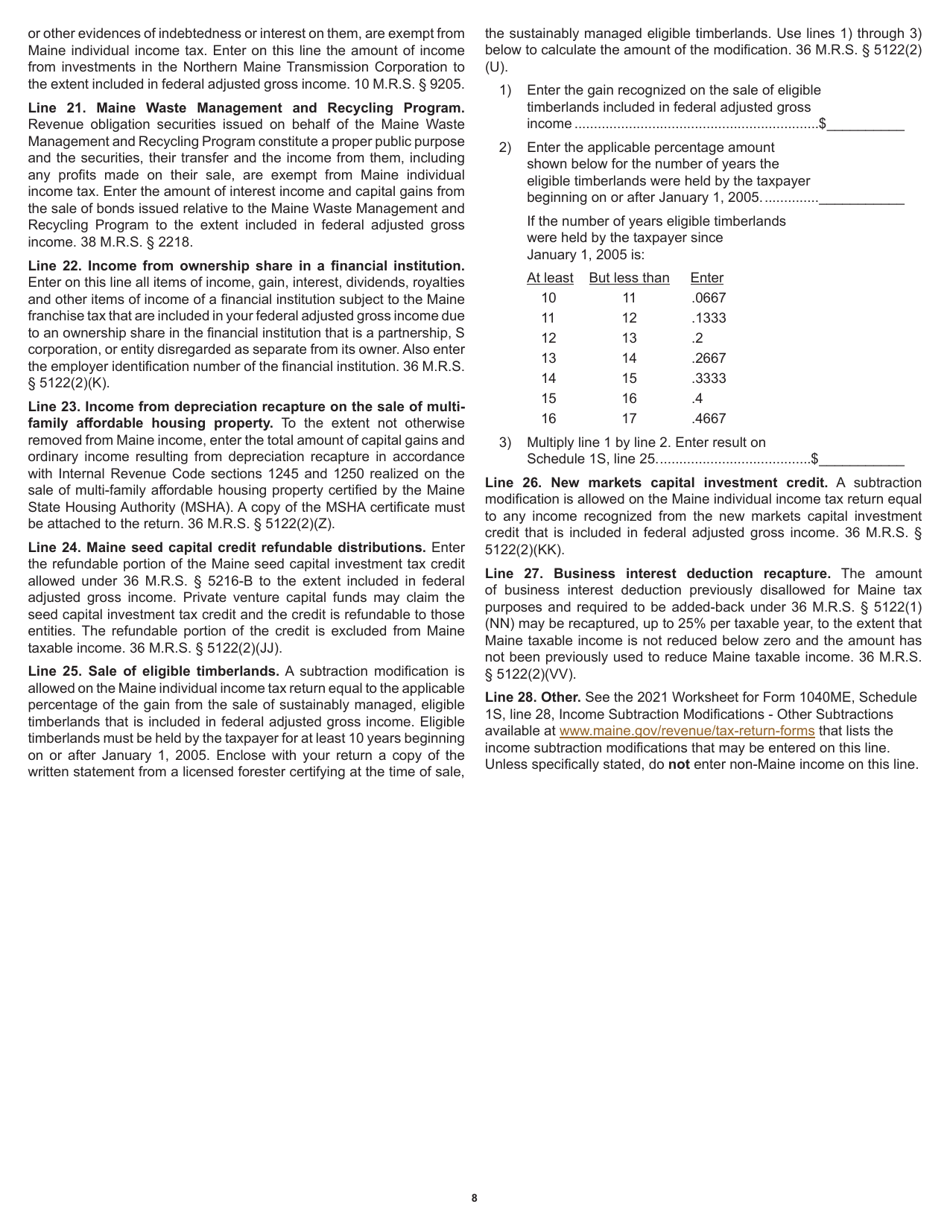

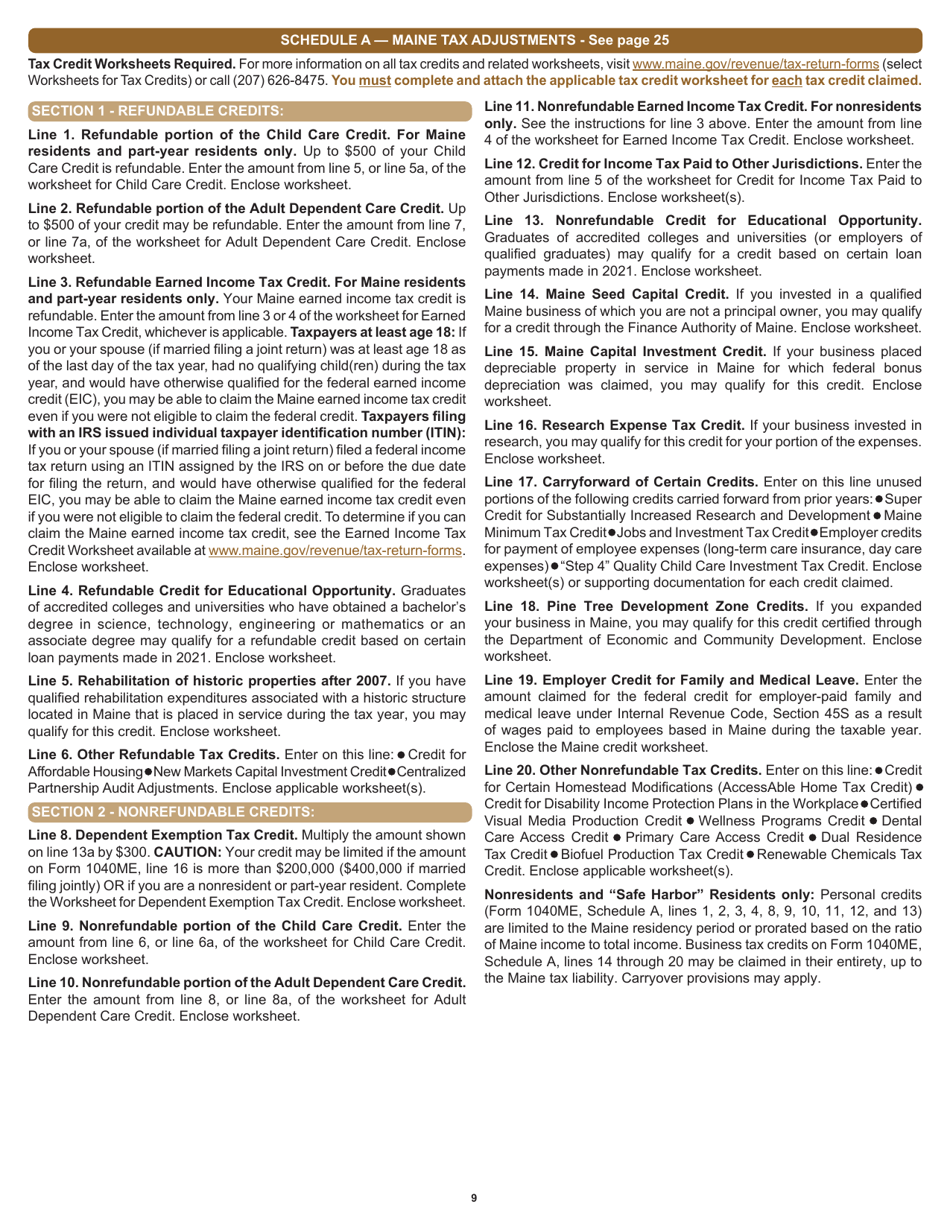

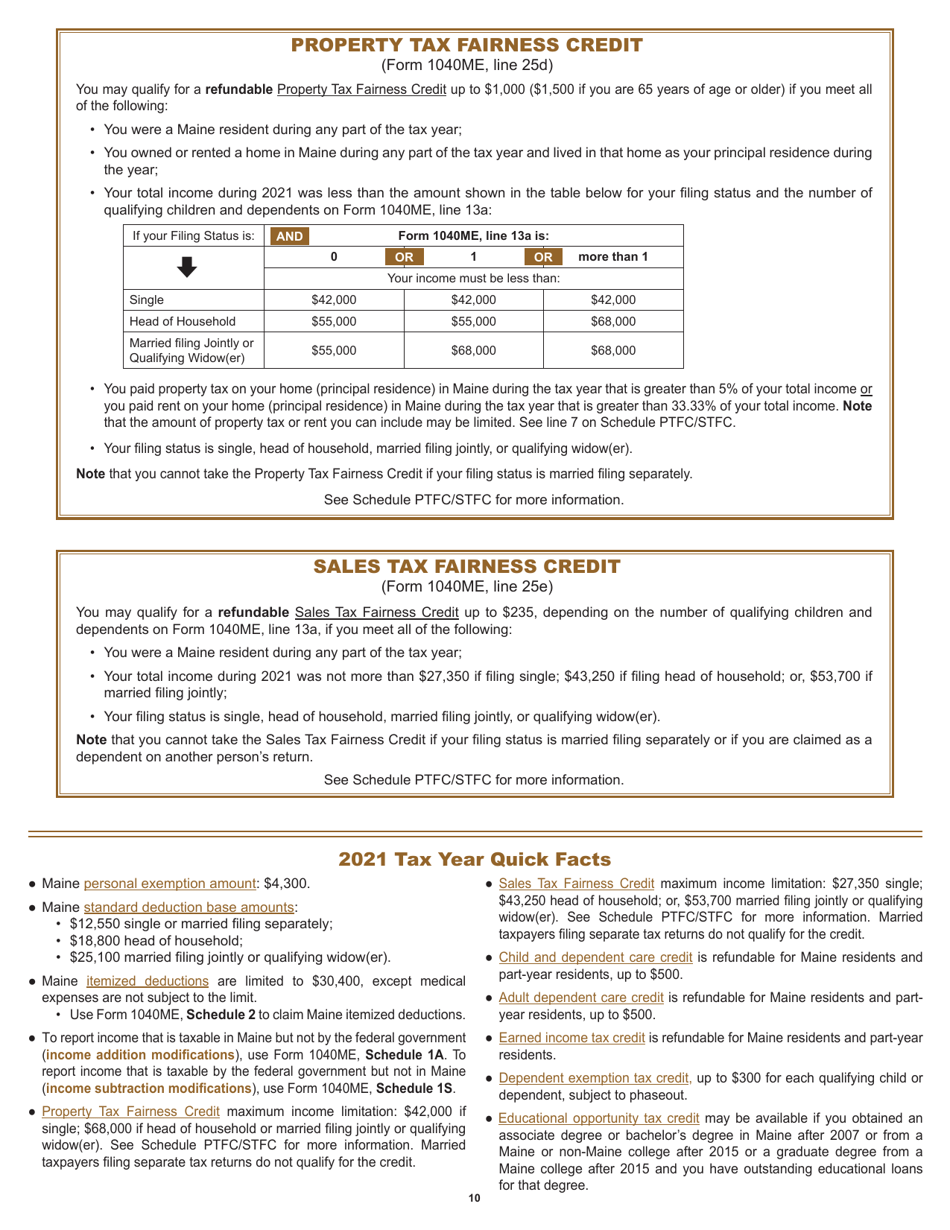

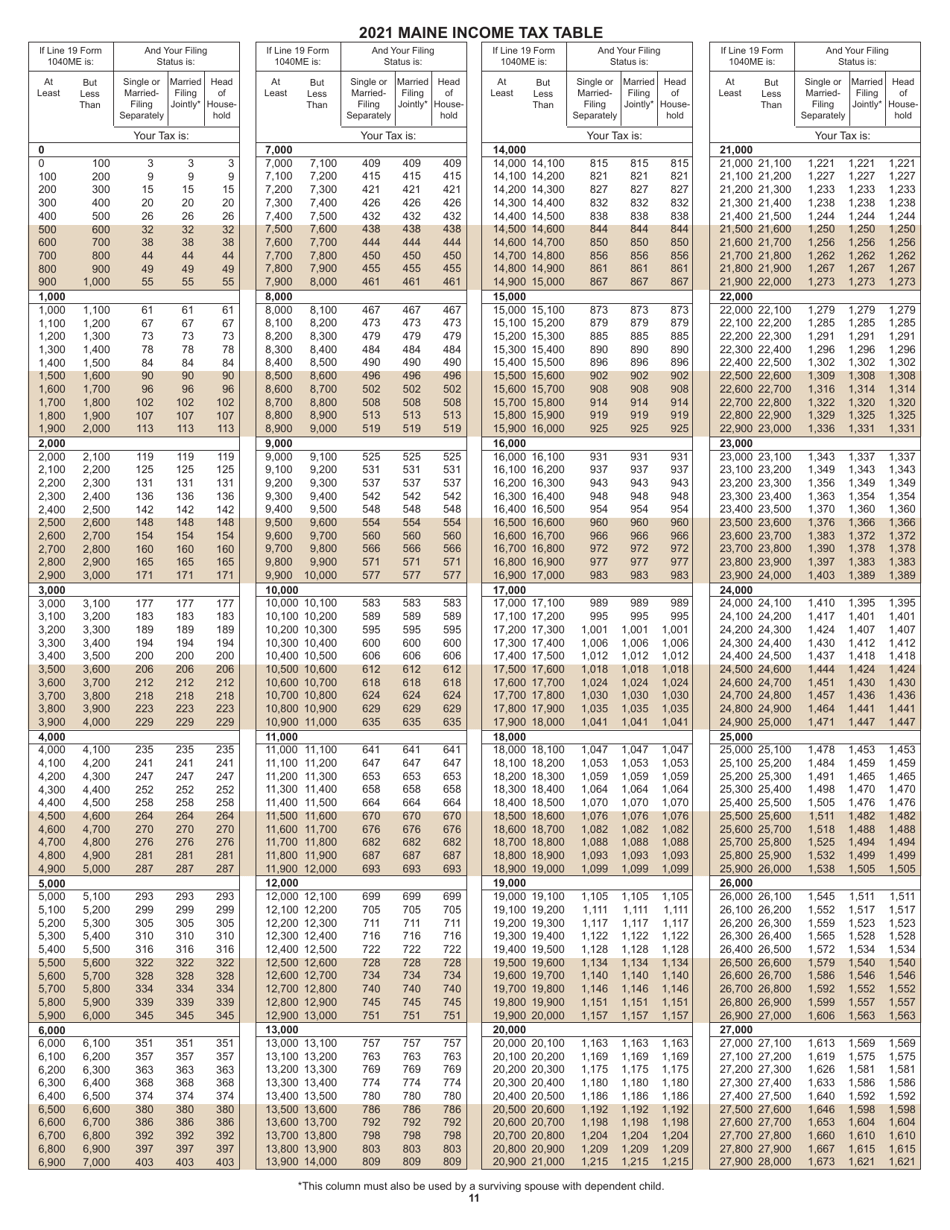

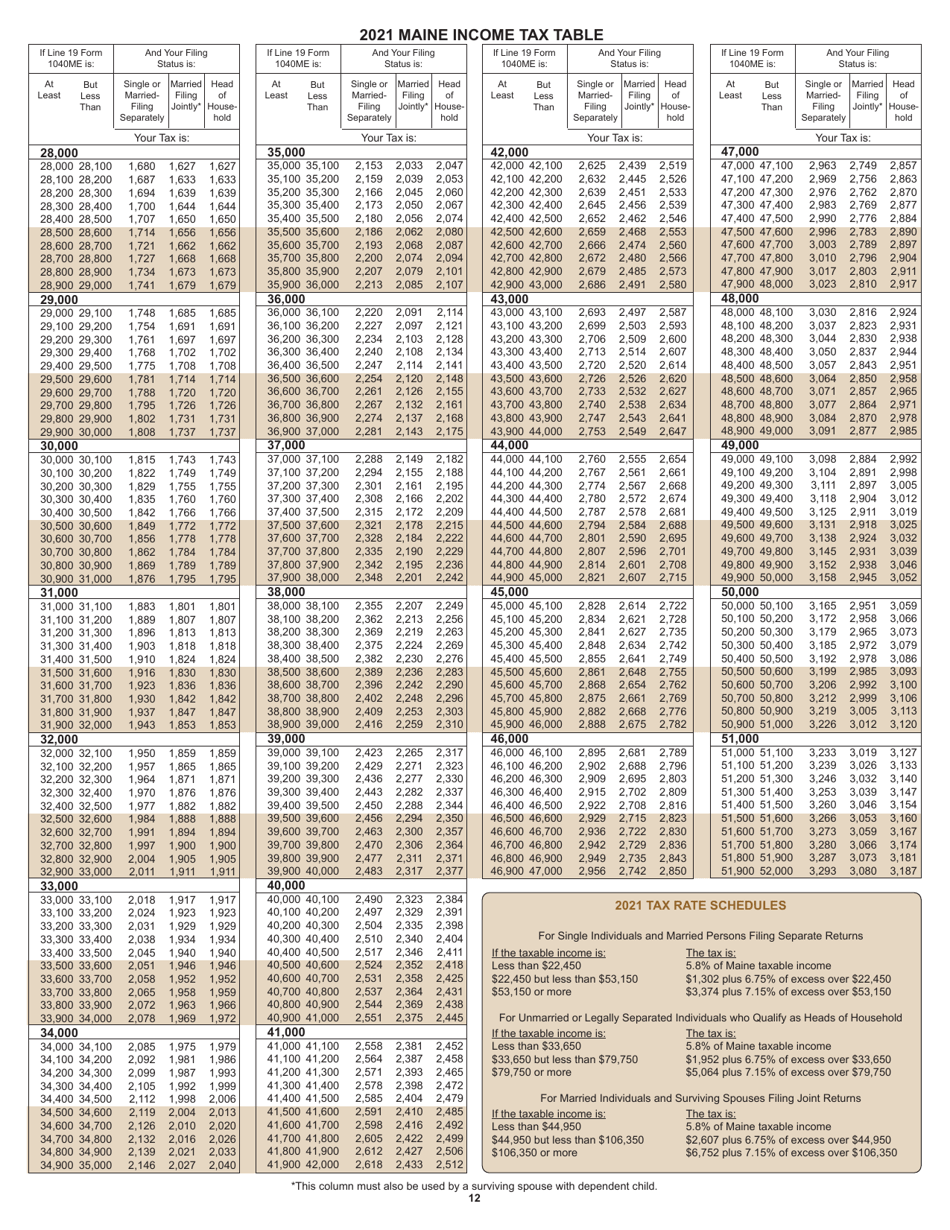

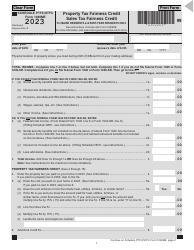

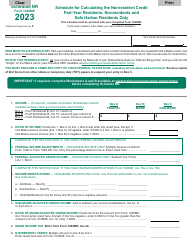

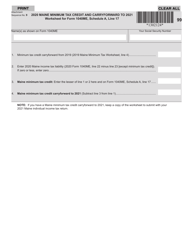

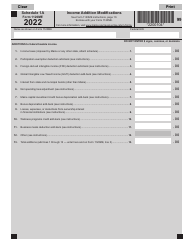

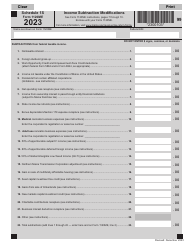

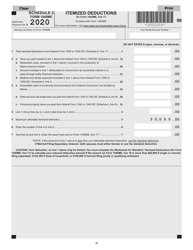

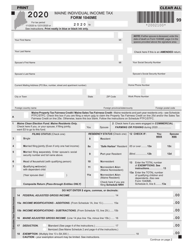

This document contains official instructions for Form 1040ME , Maine Individual Income Tax - a form released and collected by the Maine Revenue Services. An up-to-date fillable Form 1040ME Schedule A is available for download through this link.

FAQ

Q: What is Form 1040ME?

A: Form 1040ME is the Maine Individual Income Tax form.

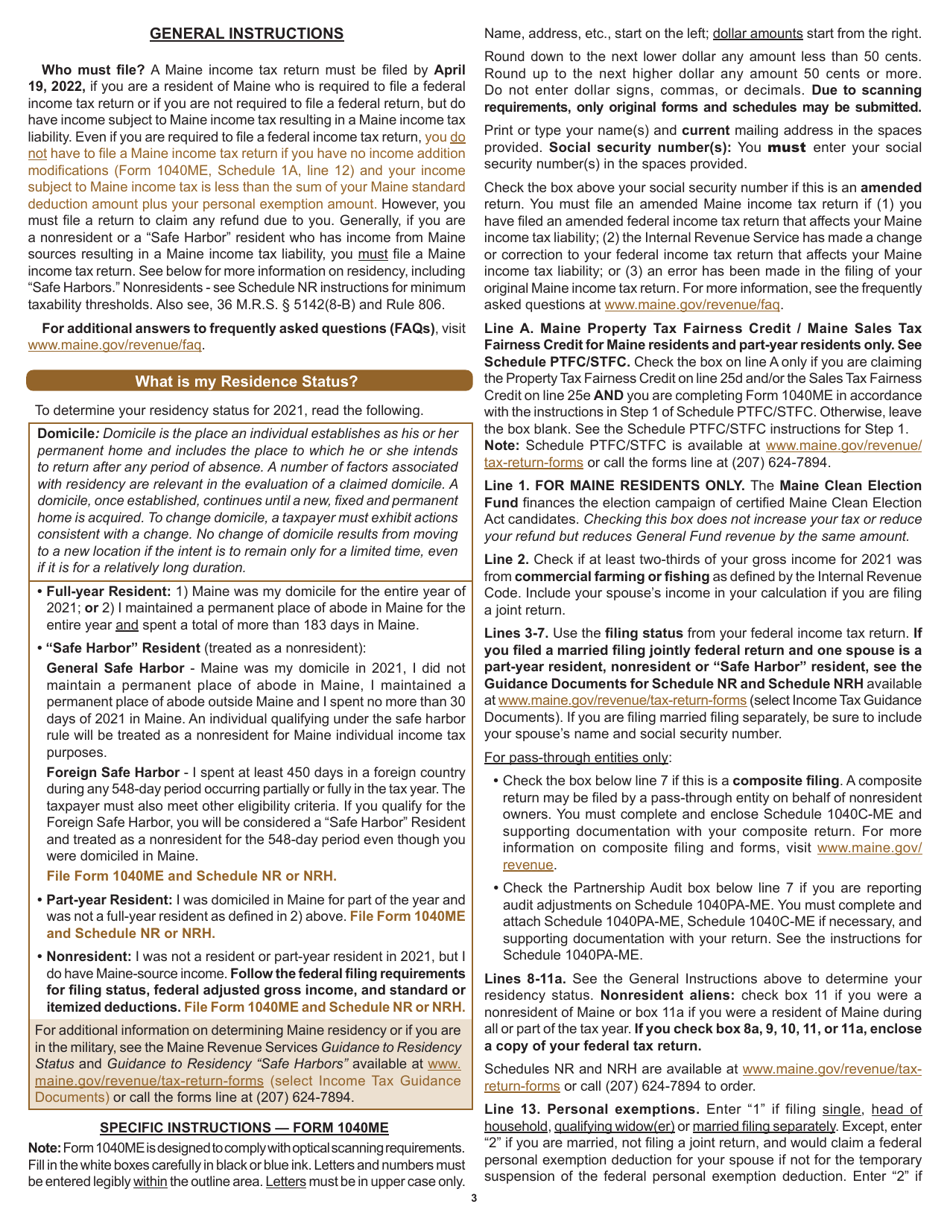

Q: Who needs to file Form 1040ME?

A: Residents of Maine who earned income during the tax year need to file Form 1040ME.

Q: When is the due date for Form 1040ME?

A: The due date for Form 1040ME is usually April 15th, but it may vary depending on weekends and holidays.

Q: What information is needed to complete Form 1040ME?

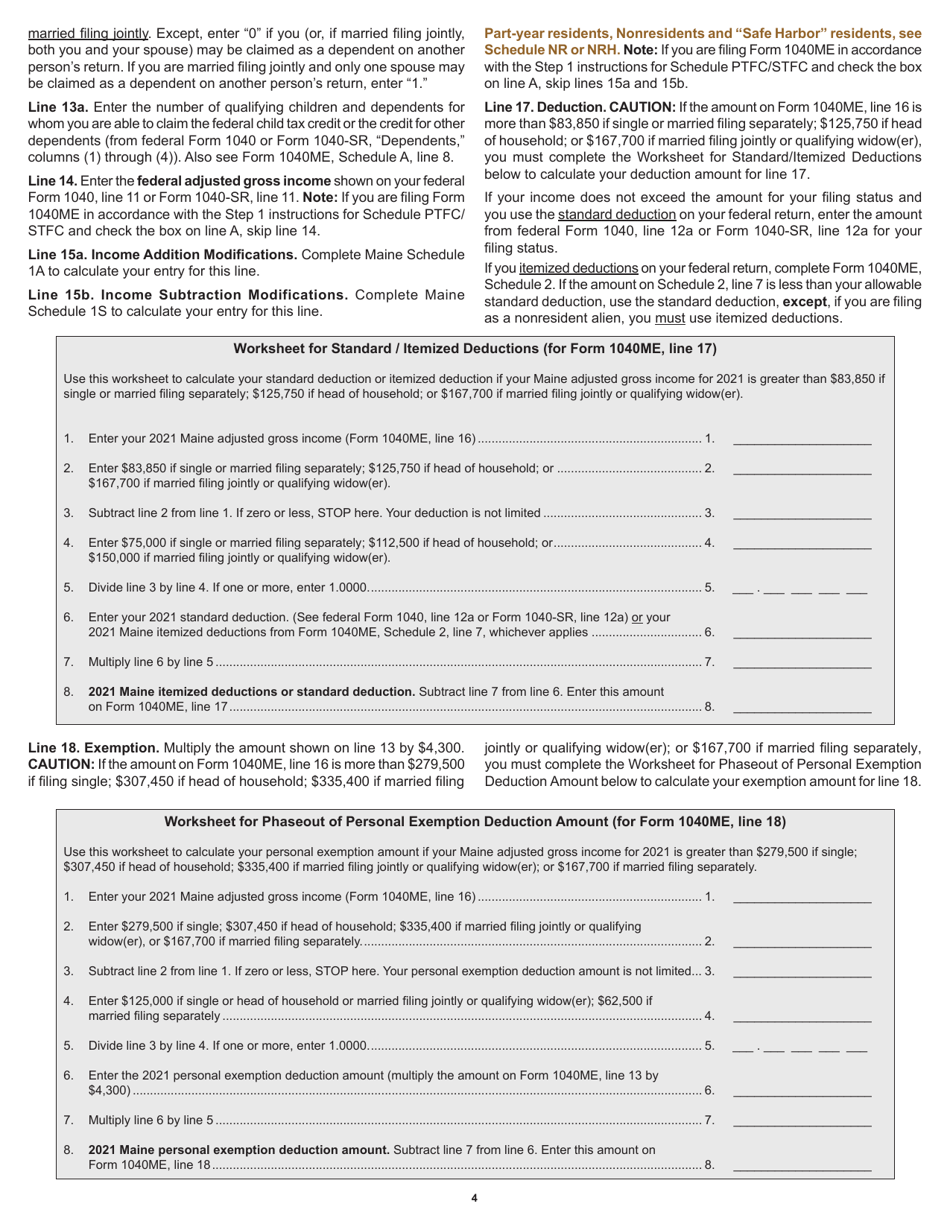

A: You will need to provide information about your income, deductions, and credits.

Q: Can I e-file Form 1040ME?

A: Yes, you can e-file Form 1040ME using approved software or through a tax professional.

Q: Are there any additional forms or schedules that need to be filed with Form 1040ME?

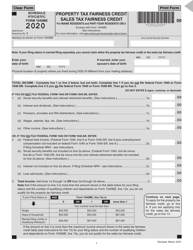

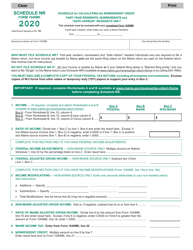

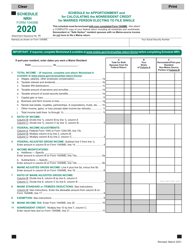

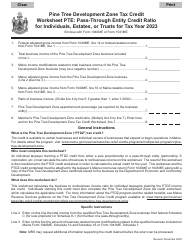

A: Depending on your specific situation, you may need to attach additional forms or schedules, such as Schedule PTFC or Schedule NR.

Q: What if I can't pay the full amount of tax owed on Form 1040ME?

A: If you can't pay the full amount, you should still file your return and pay as much as you can to avoid penalties and interest.

Q: Can I request an extension to file Form 1040ME?

A: Yes, you can request an extension, but you must pay any tax owed by the original due date to avoid penalties and interest.

Q: What if I made a mistake on my Form 1040ME?

A: If you made a mistake on your return, you can file an amended return using Form 1040X.

Instruction Details:

- This 12-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Revenue Services.