This version of the form is not currently in use and is provided for reference only. Download this version of

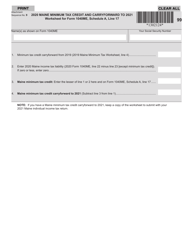

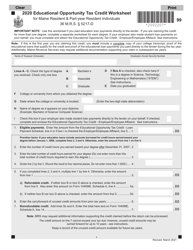

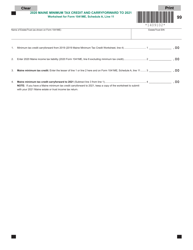

Form 1040ME Schedule A

for the current year.

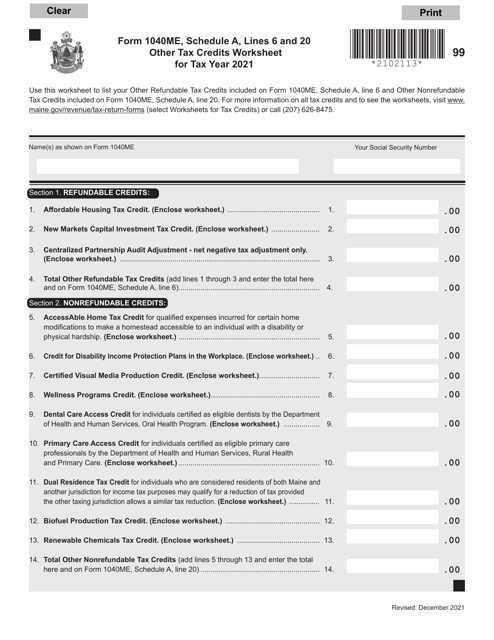

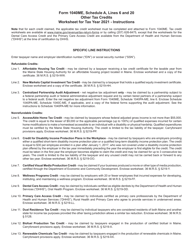

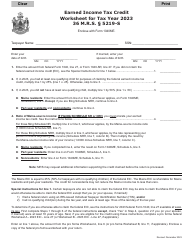

Form 1040ME Schedule A Other Tax Credits Worksheet - Maine

What Is Form 1040ME Schedule A?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule A?

A: Form 1040ME Schedule A is a tax form used in the state of Maine to itemize deductions.

Q: What is the purpose of the Other Tax Credits Worksheet on Form 1040ME Schedule A?

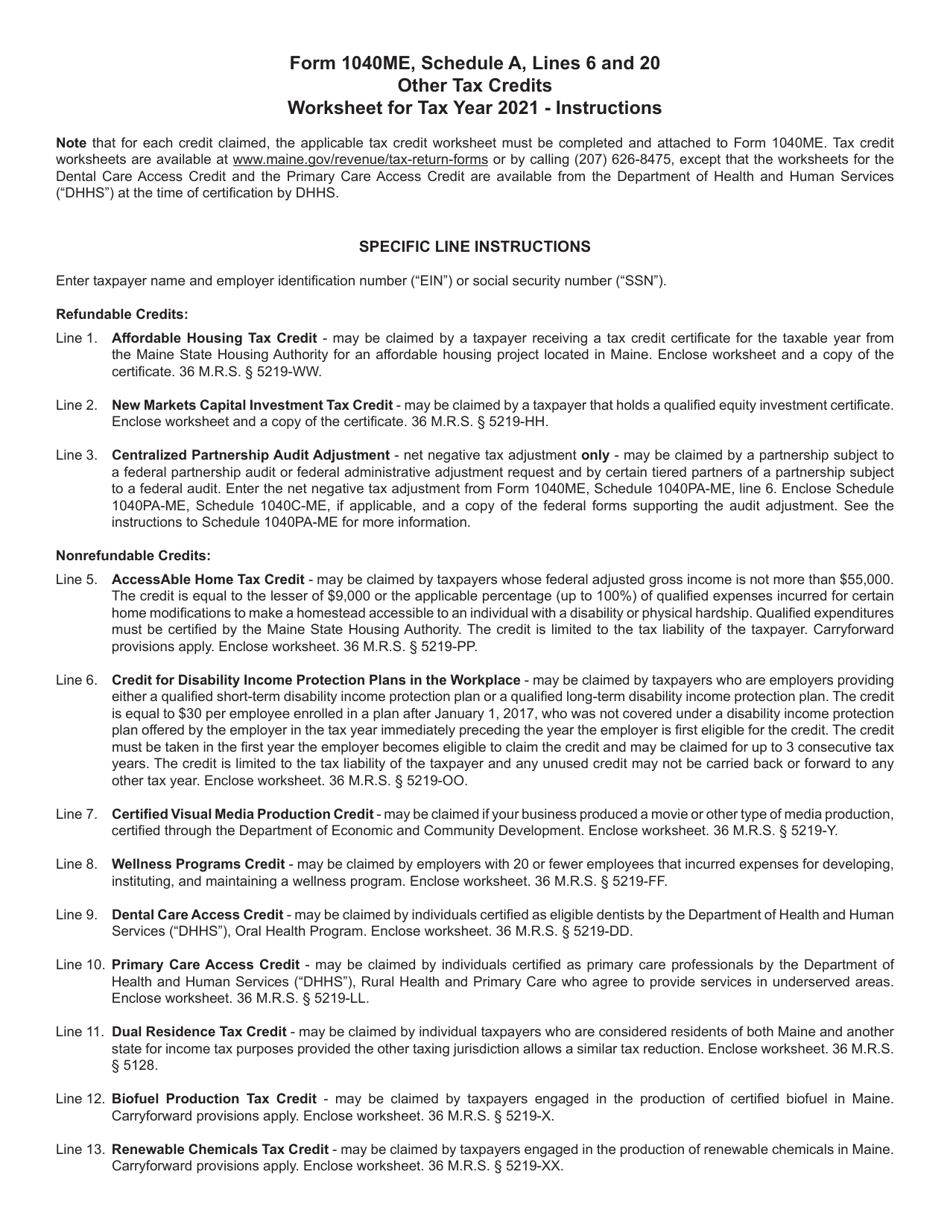

A: The Other Tax Credits Worksheet helps taxpayers calculate certain tax credits that can be claimed on their Maine state income tax return.

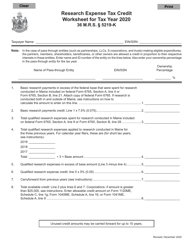

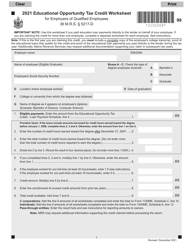

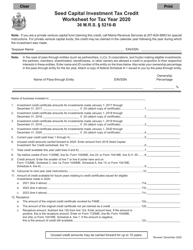

Q: What types of tax credits are included on the Other Tax Credits Worksheet?

A: The Other Tax Credits Worksheet includes tax credits such as the Child and Dependent Care Credit, Education Opportunity Credit, and the Elderly Property Tax Refund Credit.

Q: How do I use the Other Tax Credits Worksheet on Form 1040ME Schedule A?

A: Follow the instructions on the worksheet to calculate the amount of each tax credit you are eligible for. Then, transfer the total credits to the appropriate lines on your Maine state income tax return.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Schedule A by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.