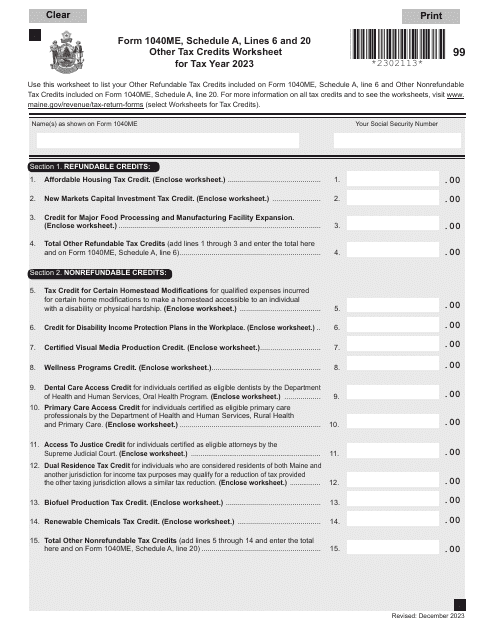

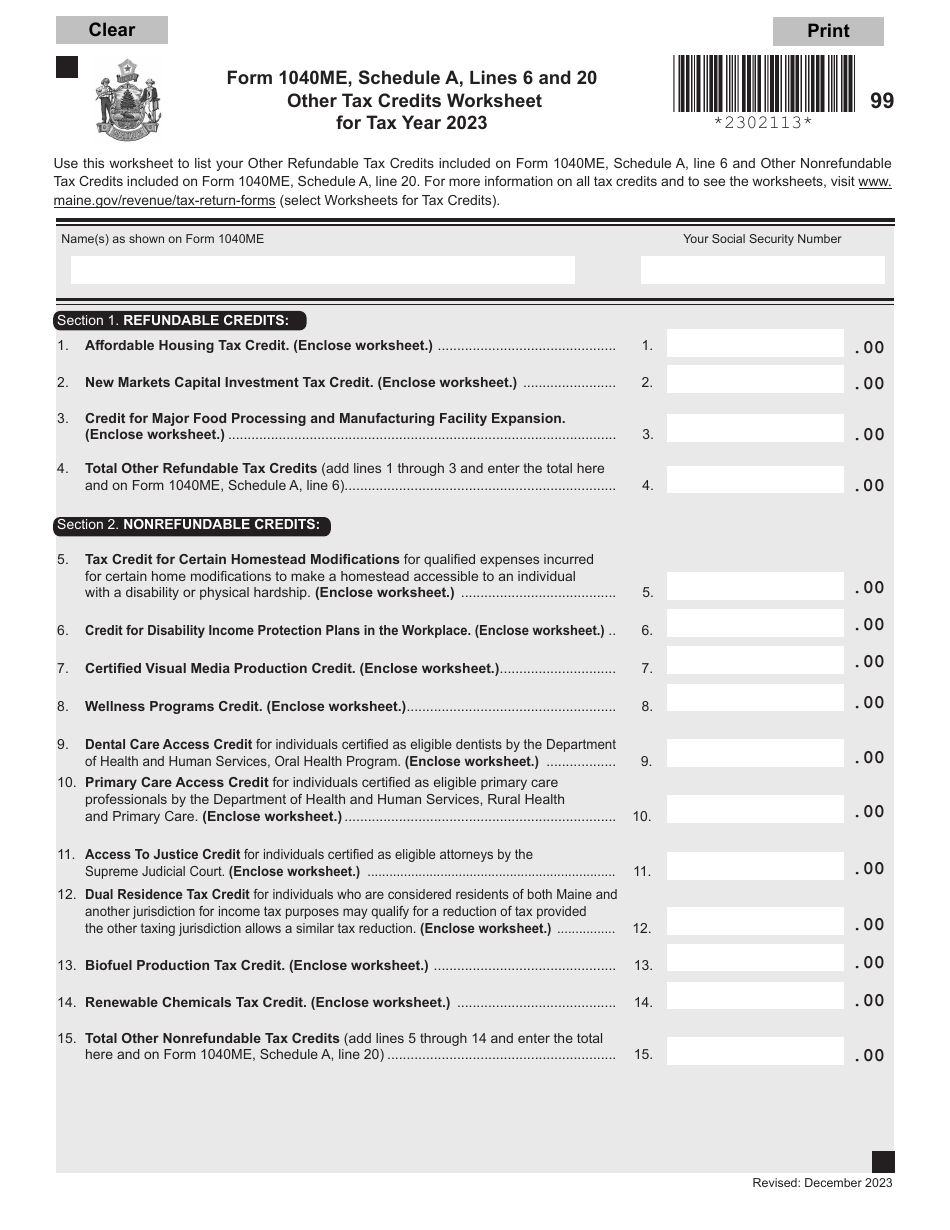

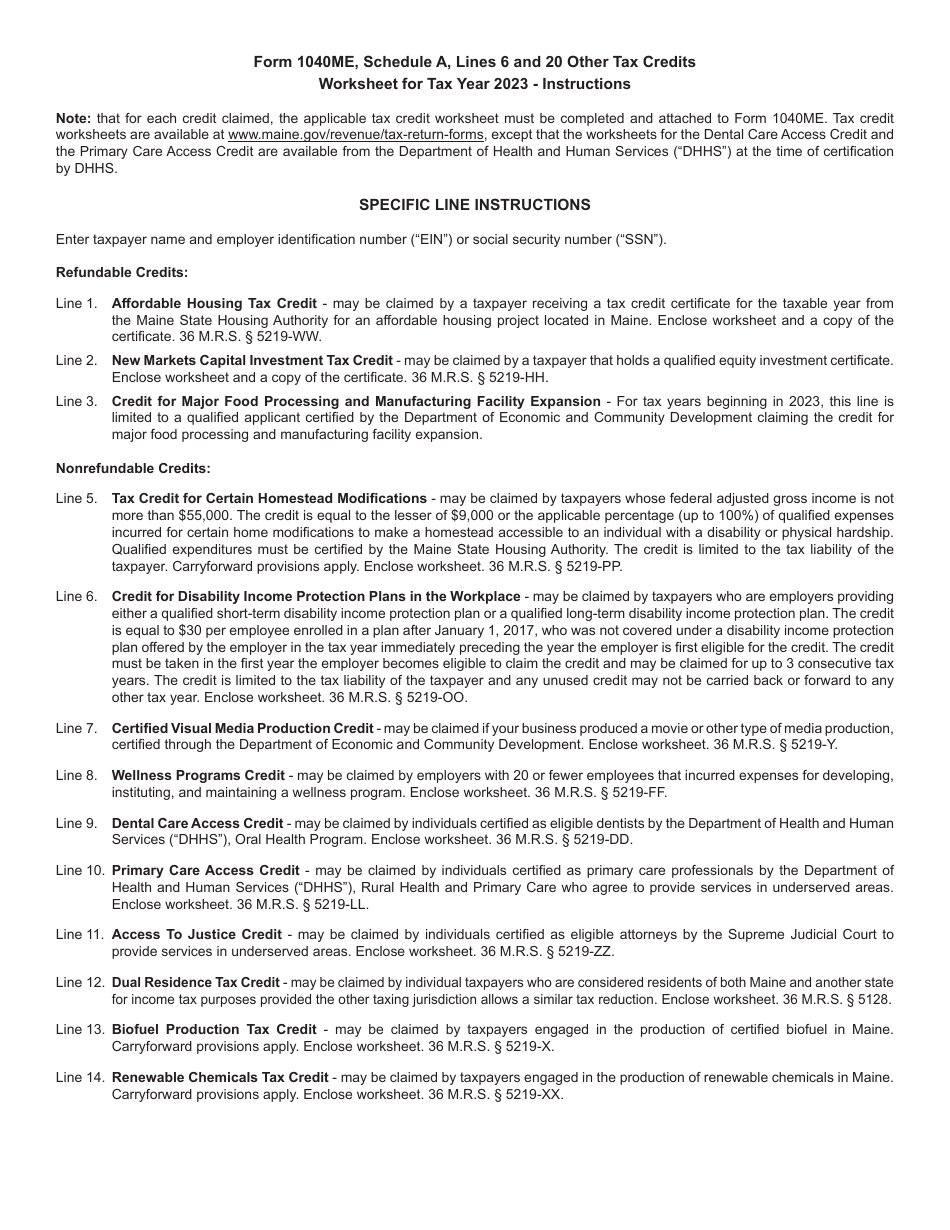

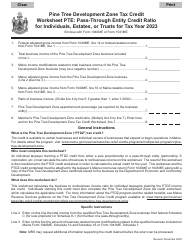

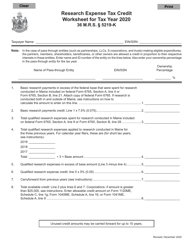

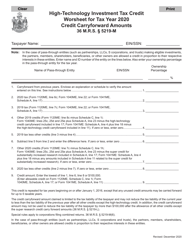

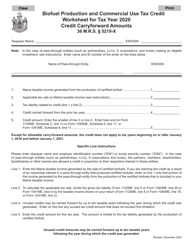

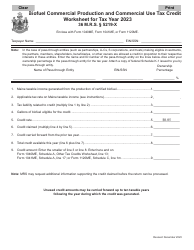

Form 1040ME Schedule A Other Tax Credits Worksheet - Maine

What Is Form 1040ME Schedule A?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule A?A: Form 1040ME Schedule A is a tax form used in the state of Maine to report itemized deductions.

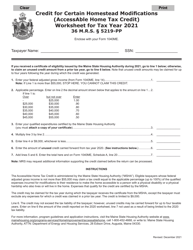

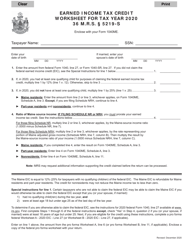

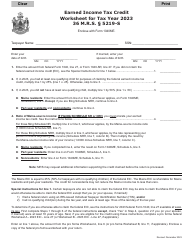

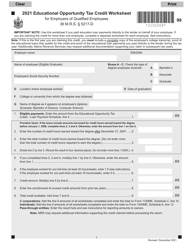

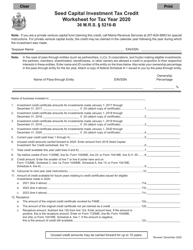

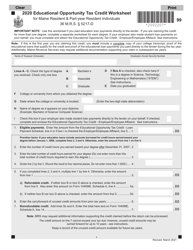

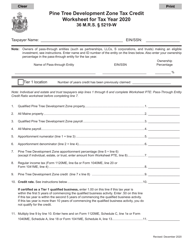

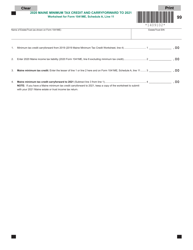

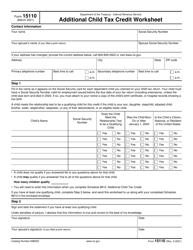

Q: What is the purpose of the Other Tax Credits Worksheet?A: The Other Tax Credits Worksheet on Form 1040ME Schedule A is used to calculate various tax credits that a taxpayer may be eligible for.

Q: What types of tax credits can be claimed on the Other Tax Credits Worksheet?A: The Other Tax Credits Worksheet allows taxpayers to claim credits such as the Maine Resident Homestead Property Tax Credit and the Maine Child and Dependent Care Credit.

Q: How do I complete the Other Tax Credits Worksheet?A: To complete the Other Tax Credits Worksheet, you will need to follow the instructions provided on the form and provide the necessary information and calculations.

Q: Can I claim tax credits on Form 1040ME Schedule A?A: Yes, you can claim various tax credits on Form 1040ME Schedule A if you meet the eligibility requirements for each credit.

Q: Do I need to file Form 1040ME Schedule A?A: You only need to file Form 1040ME Schedule A if you choose to itemize deductions on your Maine state tax return, rather than taking the standard deduction.