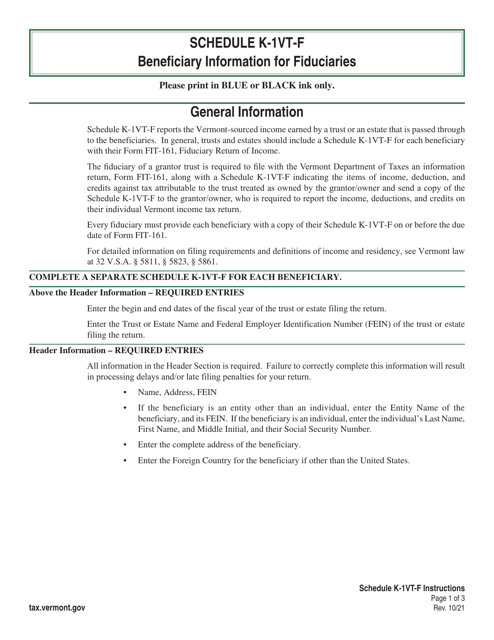

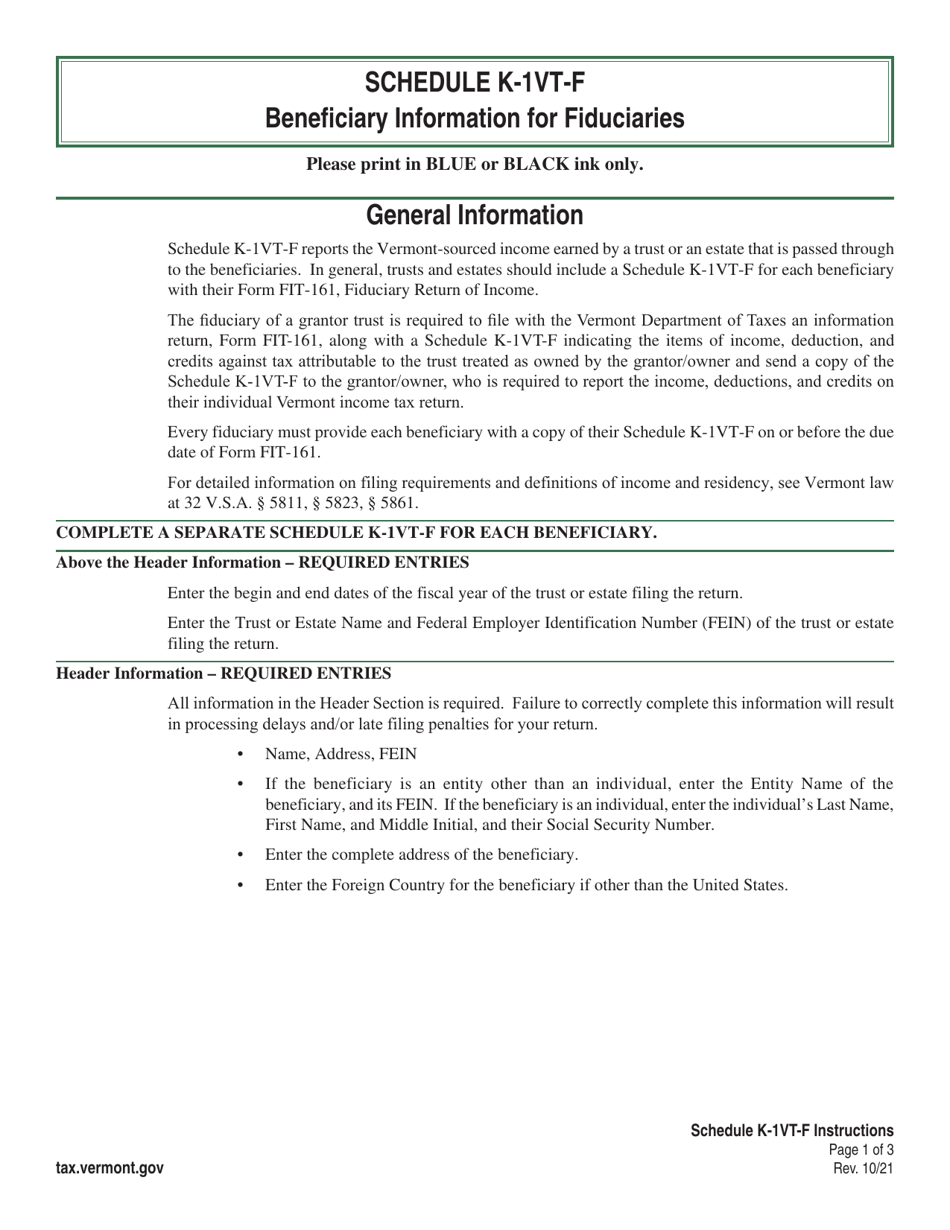

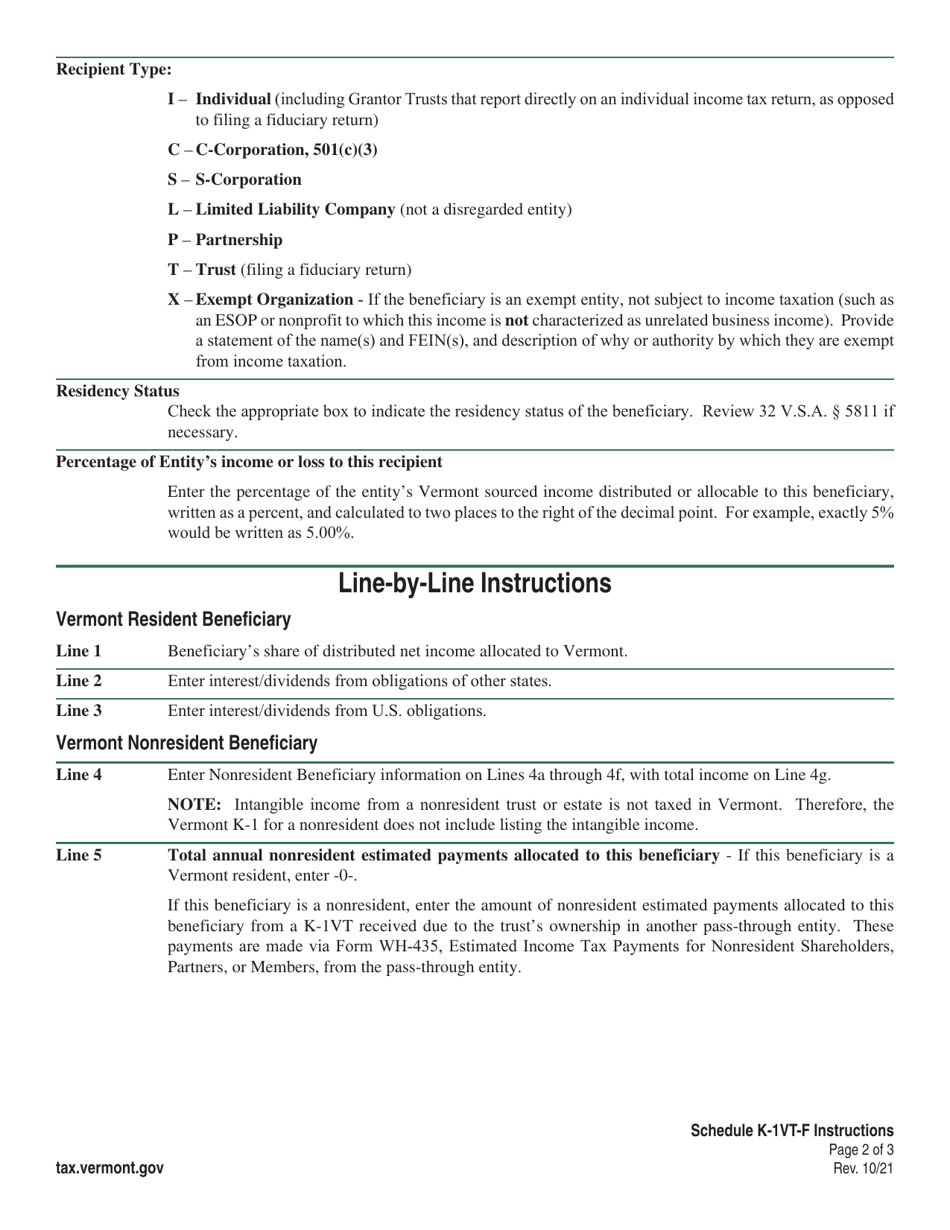

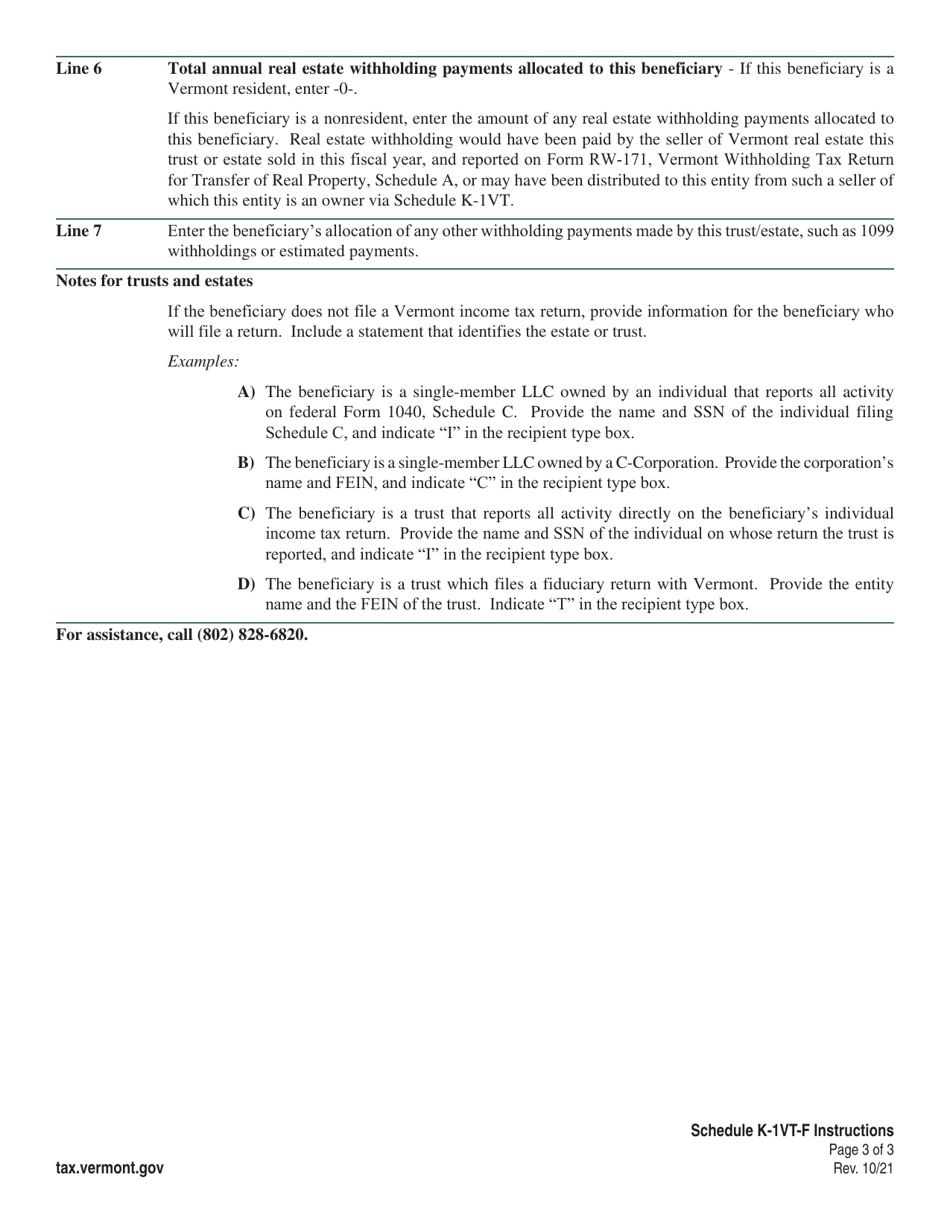

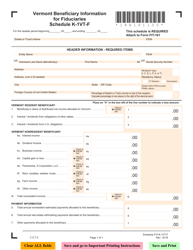

Instructions for Schedule FIT-K-1VTF Beneficiary Information for Fiduciaries - Vermont

This document contains official instructions for Schedule FIT-K-1VTF , Beneficiary Information for Fiduciaries - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule FIT-K-1VTF?

A: Schedule FIT-K-1VTF is a form used to provide beneficiary information for fiduciaries in the state of Vermont.

Q: Who needs to file Schedule FIT-K-1VTF?

A: Fiduciaries who have beneficiaries in Vermont need to file Schedule FIT-K-1VTF.

Q: What information is required on Schedule FIT-K-1VTF?

A: Schedule FIT-K-1VTF requires information about the beneficiaries, including their names, addresses, and share of income or loss.

Q: When is the deadline to file Schedule FIT-K-1VTF?

A: The deadline to file Schedule FIT-K-1VTF is usually the same as the deadline for filing the Vermont fiduciary income tax return.

Q: Are there any penalties for not filing Schedule FIT-K-1VTF?

A: Yes, failure to file Schedule FIT-K-1VTF may result in penalties and interest.

Q: Can I file Schedule FIT-K-1VTF electronically?

A: Yes, Schedule FIT-K-1VTF can be filed electronically through the Vermont Taxpayer Service Center.

Q: Is Schedule FIT-K-1VTF only for individuals or can businesses also file it?

A: Schedule FIT-K-1VTF is specifically for fiduciaries, which can include individuals and businesses acting as trustees or executors of an estate.

Q: Do I need to attach any documents to Schedule FIT-K-1VTF?

A: You may need to attach supporting documents, such as copies of beneficiary statements, to Schedule FIT-K-1VTF.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.