This version of the form is not currently in use and is provided for reference only. Download this version of

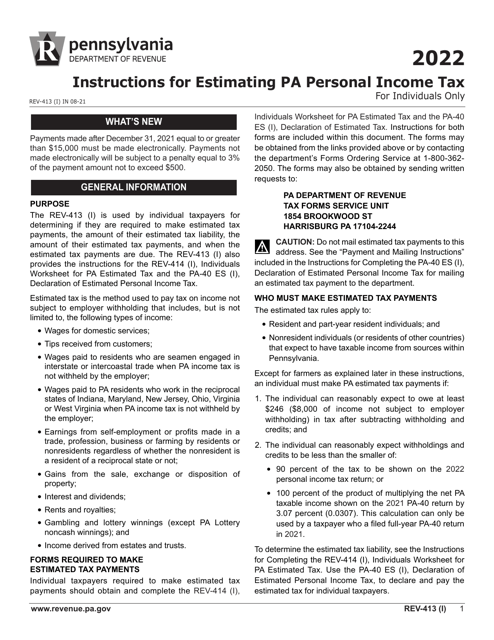

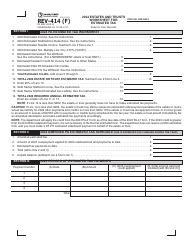

Instructions for Form REV-414 (I), PA-40 ES (I)

for the current year.

Instructions for Form REV-414 (I), PA-40 ES (I) - Pennsylvania

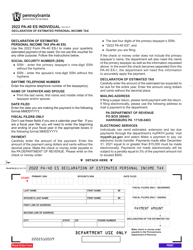

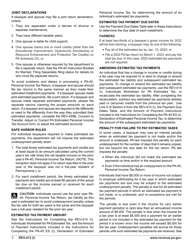

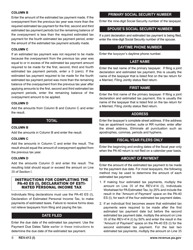

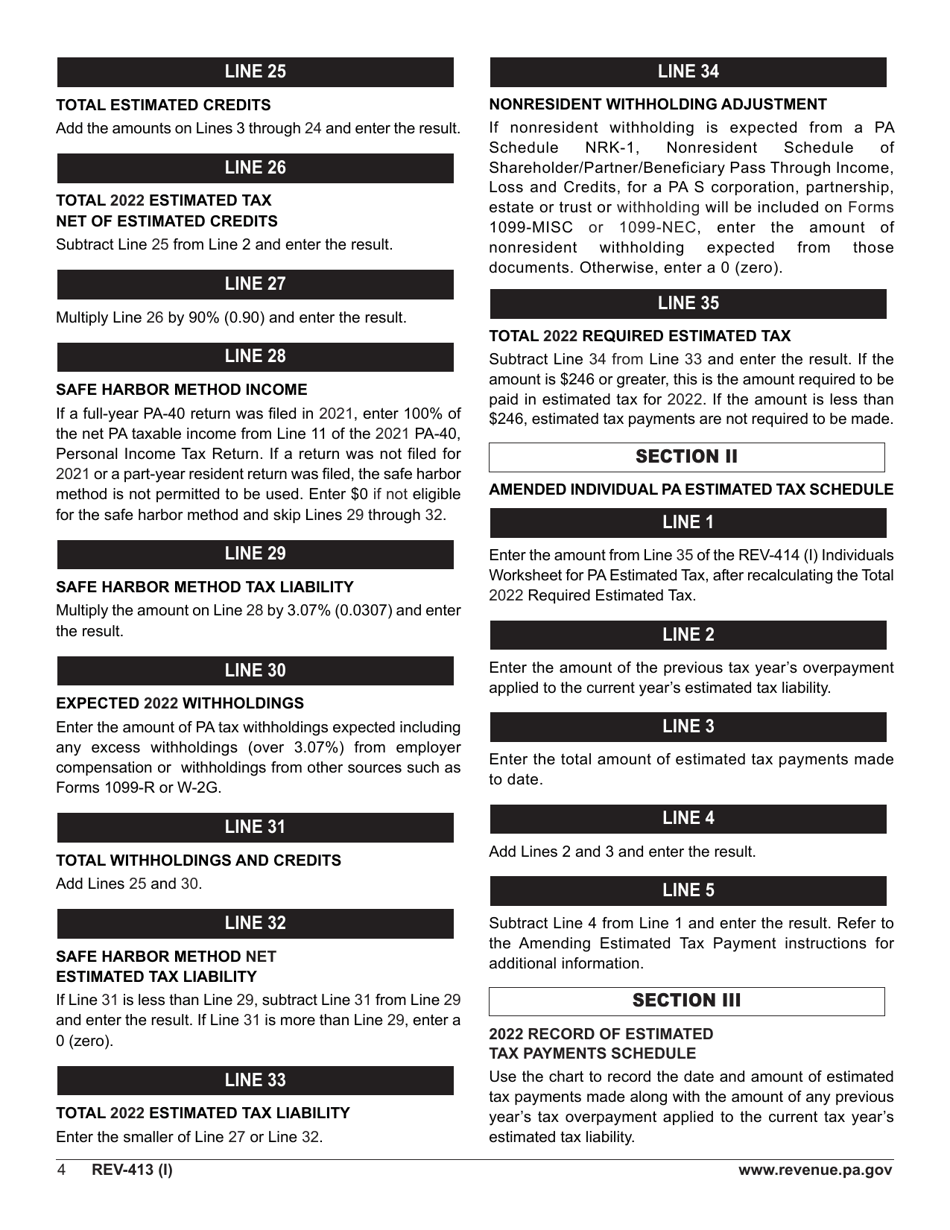

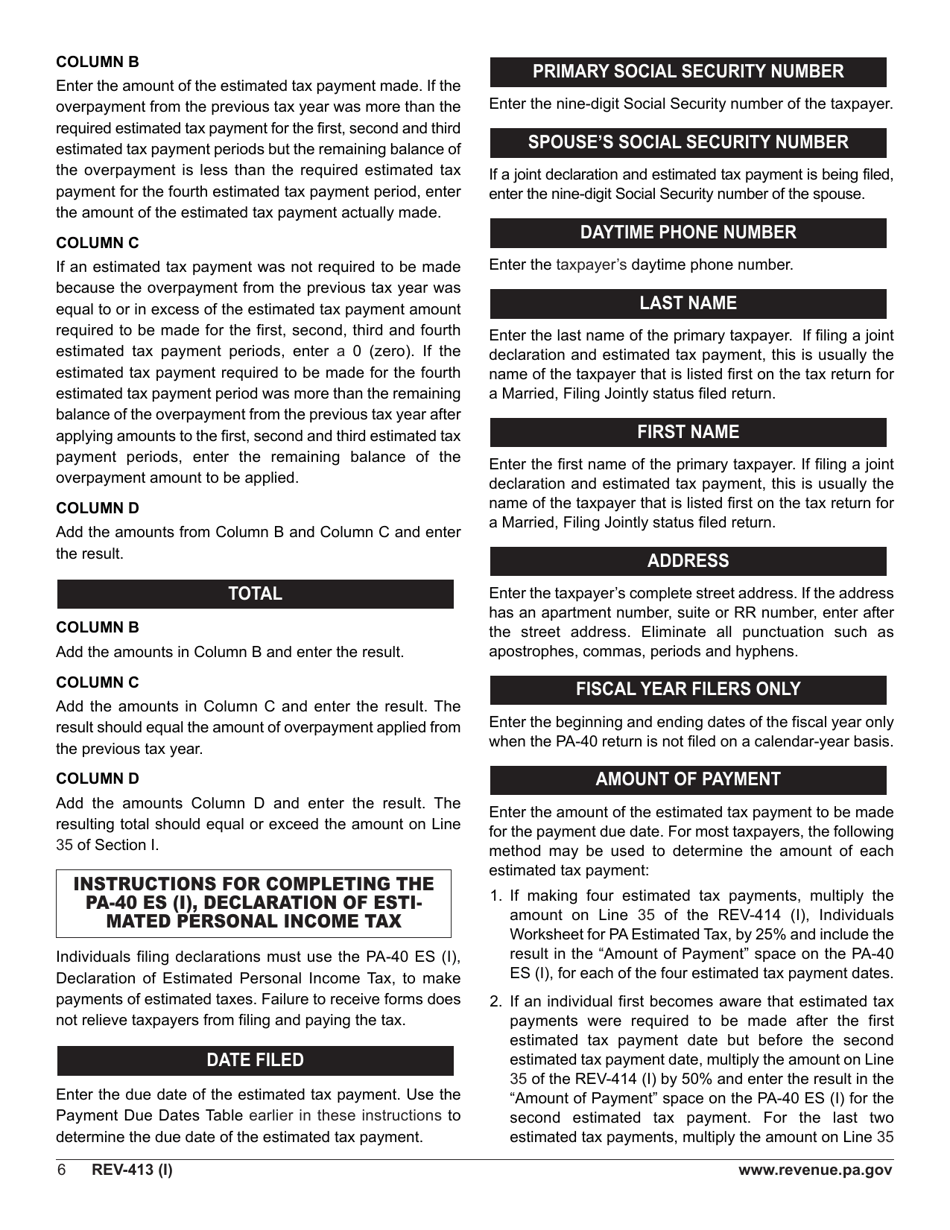

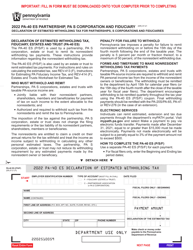

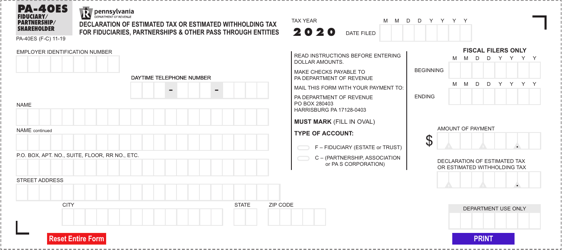

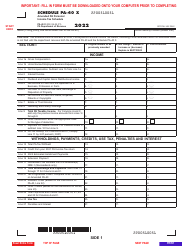

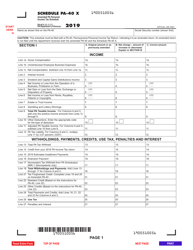

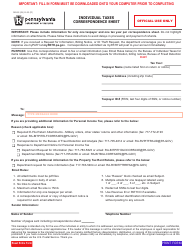

This document contains official instructions for Form REV-414 (I) , and Form PA-40 ES (I) . Both forms are released and collected by the Pennsylvania Department of Revenue. An up-to-date fillable Form REV-414 (I) is available for download through this link. The latest available Form PA-40 ES (I) can be downloaded through this link.

FAQ

Q: What is Form REV-414 (I), PA-40 ES (I)?

A: Form REV-414 (I), PA-40 ES (I) is a tax form used in Pennsylvania to make estimated income tax payments.

Q: Who needs to fill out Form REV-414 (I), PA-40 ES (I)?

A: Individuals who expect to owe at least $8,000 in Pennsylvania income tax for the year and do not have their taxes withheld by their employer or other sources.

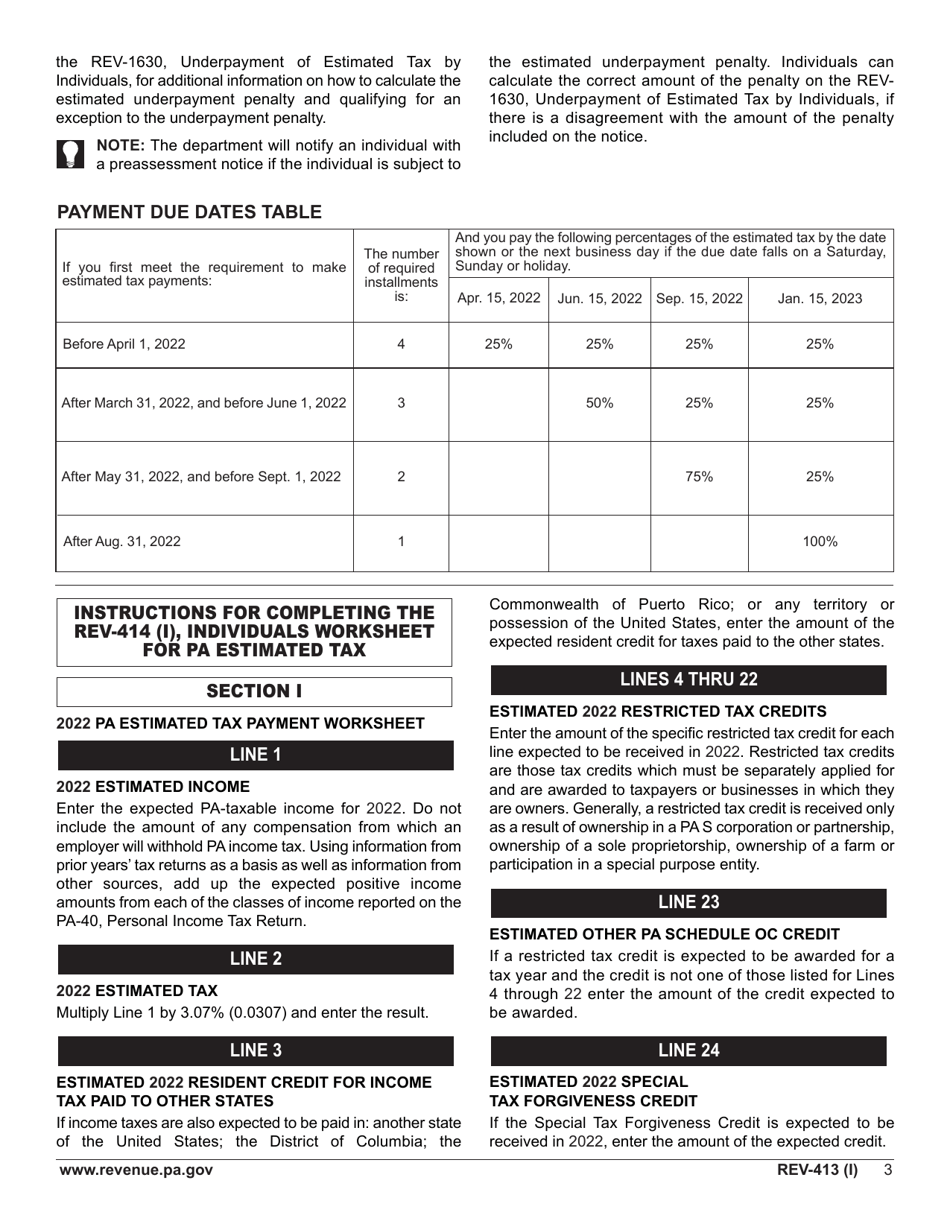

Q: When is Form REV-414 (I), PA-40 ES (I) due?

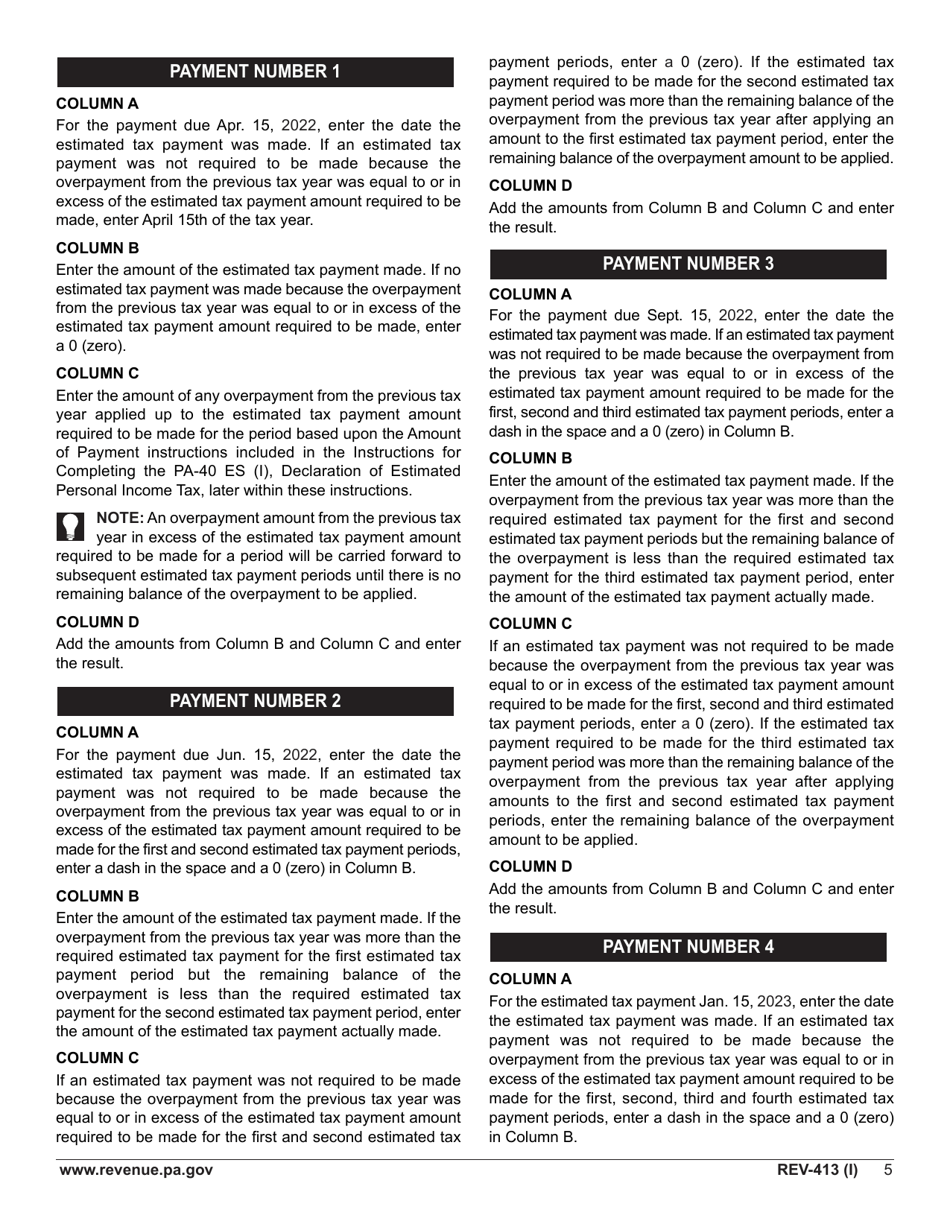

A: The form is due on April 15, June 15, September 15, and January 15 of the following year, corresponding to each estimated tax payment period.

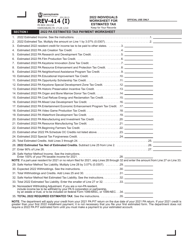

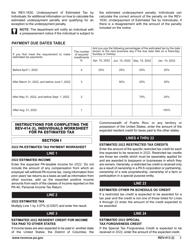

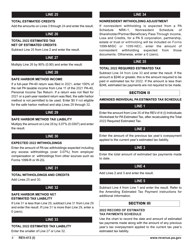

Q: How do I calculate my estimated tax payment?

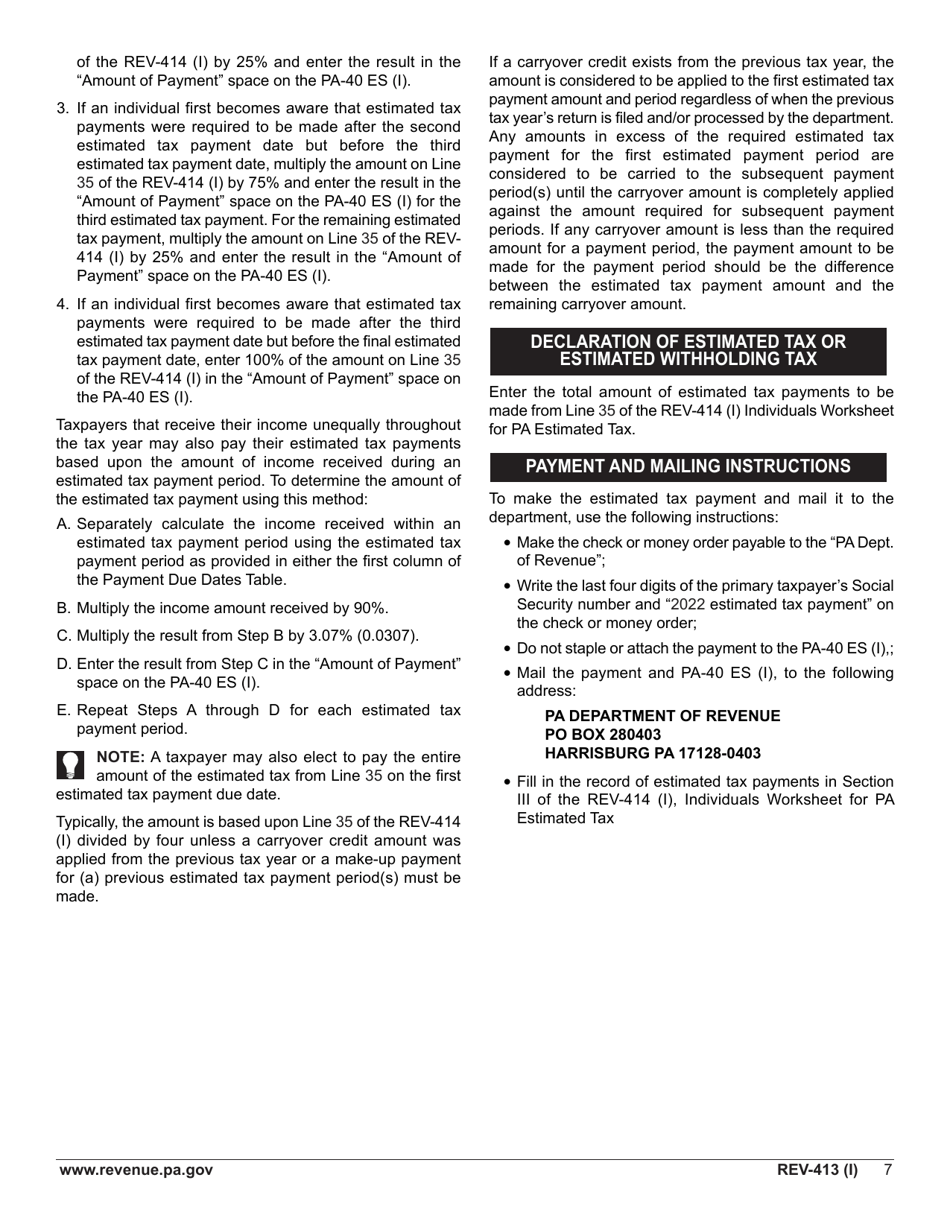

A: To calculate your estimated tax payment, you can use Form REV-414 (I) or the worksheet provided in the form instructions. It involves estimating your annual income, deductions, and credits.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Pennsylvania Department of Revenue.