This version of the form is not currently in use and is provided for reference only. Download this version of

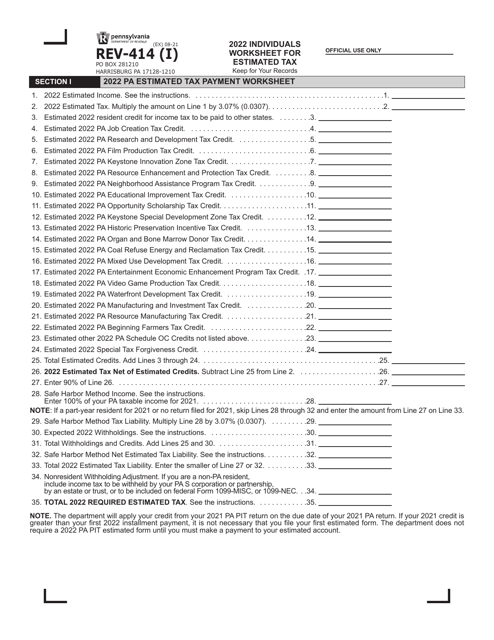

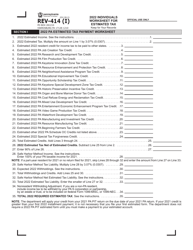

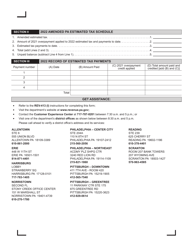

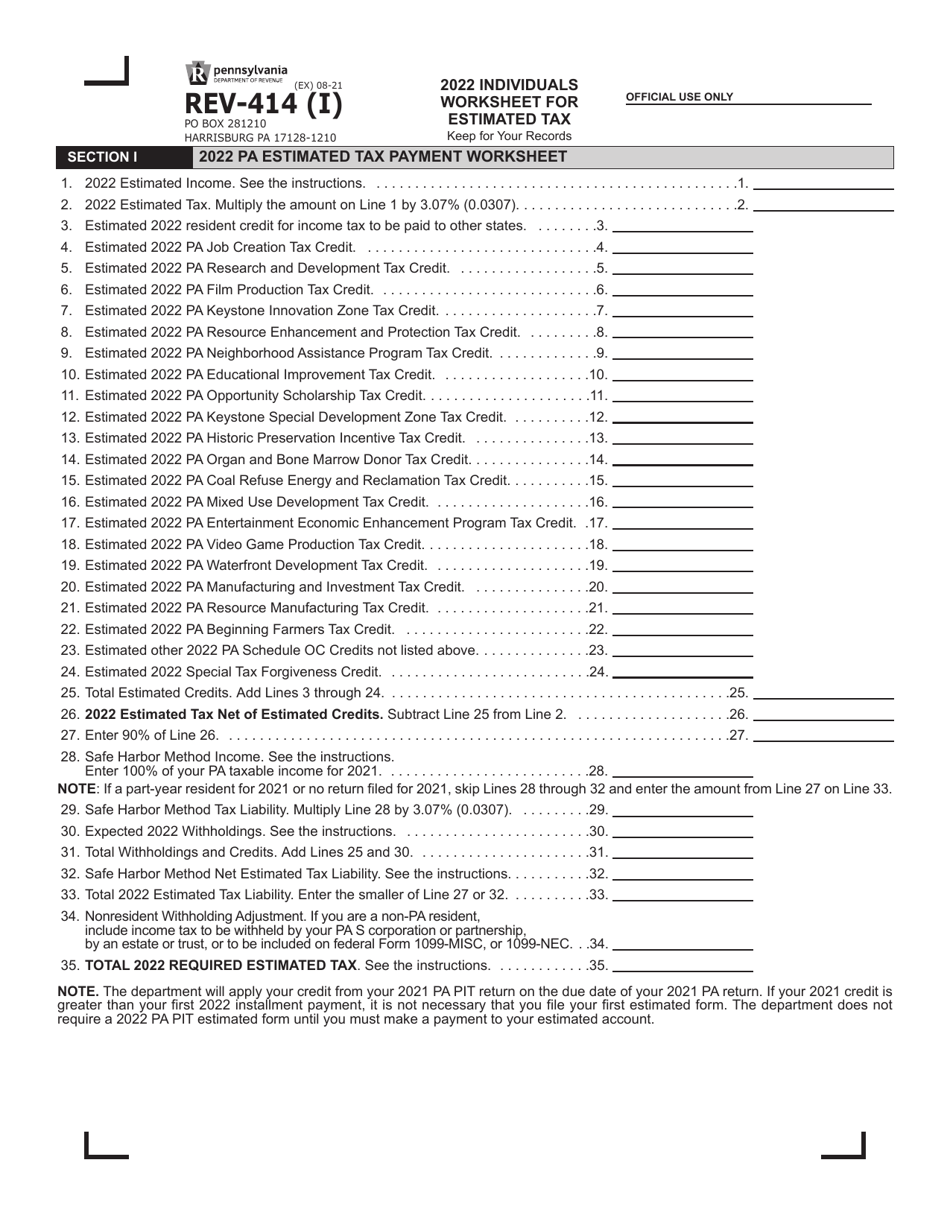

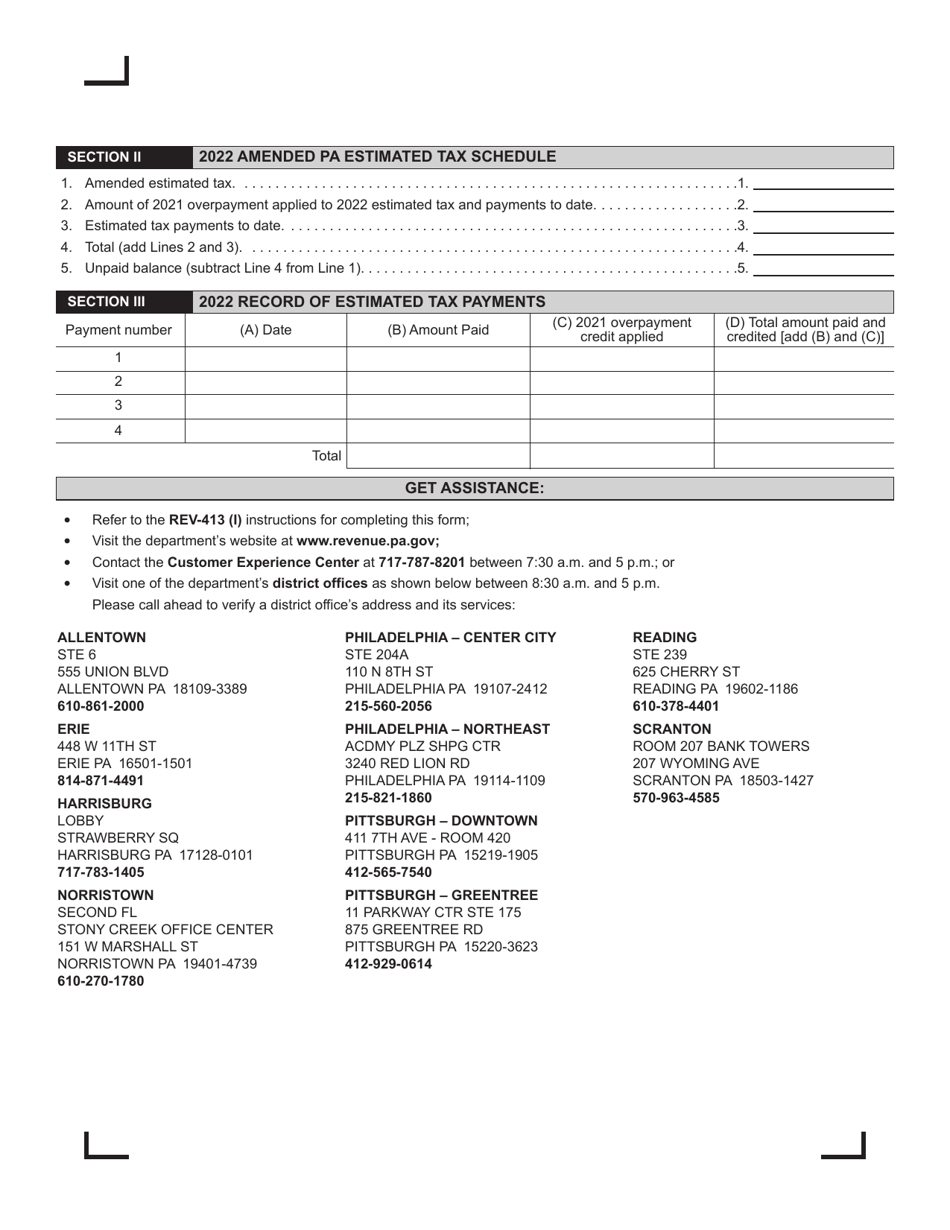

Form REV-414 (I)

for the current year.

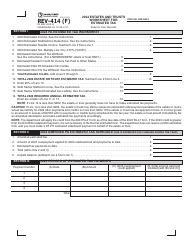

Form REV-414 (I) Individuals Worksheet for Estimated Tax - Pennsylvania

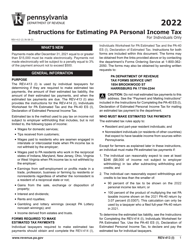

What Is Form REV-414 (I)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-414 (I)?

A: Form REV-414 (I) is the Individuals Worksheet for Estimated Tax in Pennsylvania.

Q: What is the purpose of Form REV-414 (I)?

A: The purpose of Form REV-414 (I) is to calculate and report estimated tax payments for individuals in Pennsylvania.

Q: Who needs to file Form REV-414 (I)?

A: Individuals who are required to make estimated tax payments in Pennsylvania need to file Form REV-414 (I).

Q: What information is required on Form REV-414 (I)?

A: Form REV-414 (I) requires information such as the individual's name, address, and Social Security number, as well as details of estimated income and deductions.

Q: When is Form REV-414 (I) due?

A: Form REV-414 (I) is due on April 15th of the tax year, or the 15th day of the fourth month following the close of the taxpayer's fiscal year.

Q: Can Form REV-414 (I) be filed electronically?

A: Yes, Form REV-414 (I) can be filed electronically through the Pennsylvania Department of Revenue's e-Services platform.

Q: What happens if I don't file Form REV-414 (I)?

A: If you are required to file Form REV-414 (I) and fail to do so, you may be subject to penalties and interest on any underpaid estimated tax amounts.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-414 (I) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.