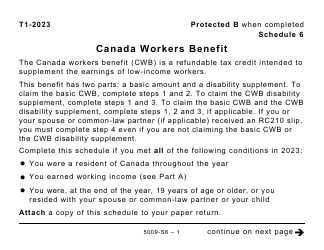

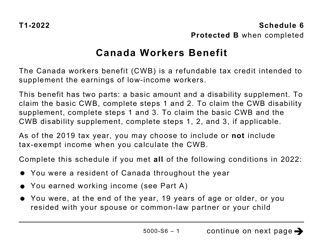

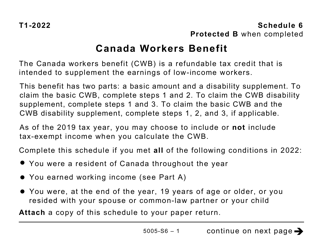

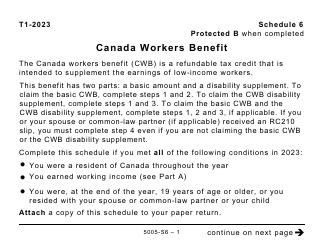

This version of the form is not currently in use and is provided for reference only. Download this version of

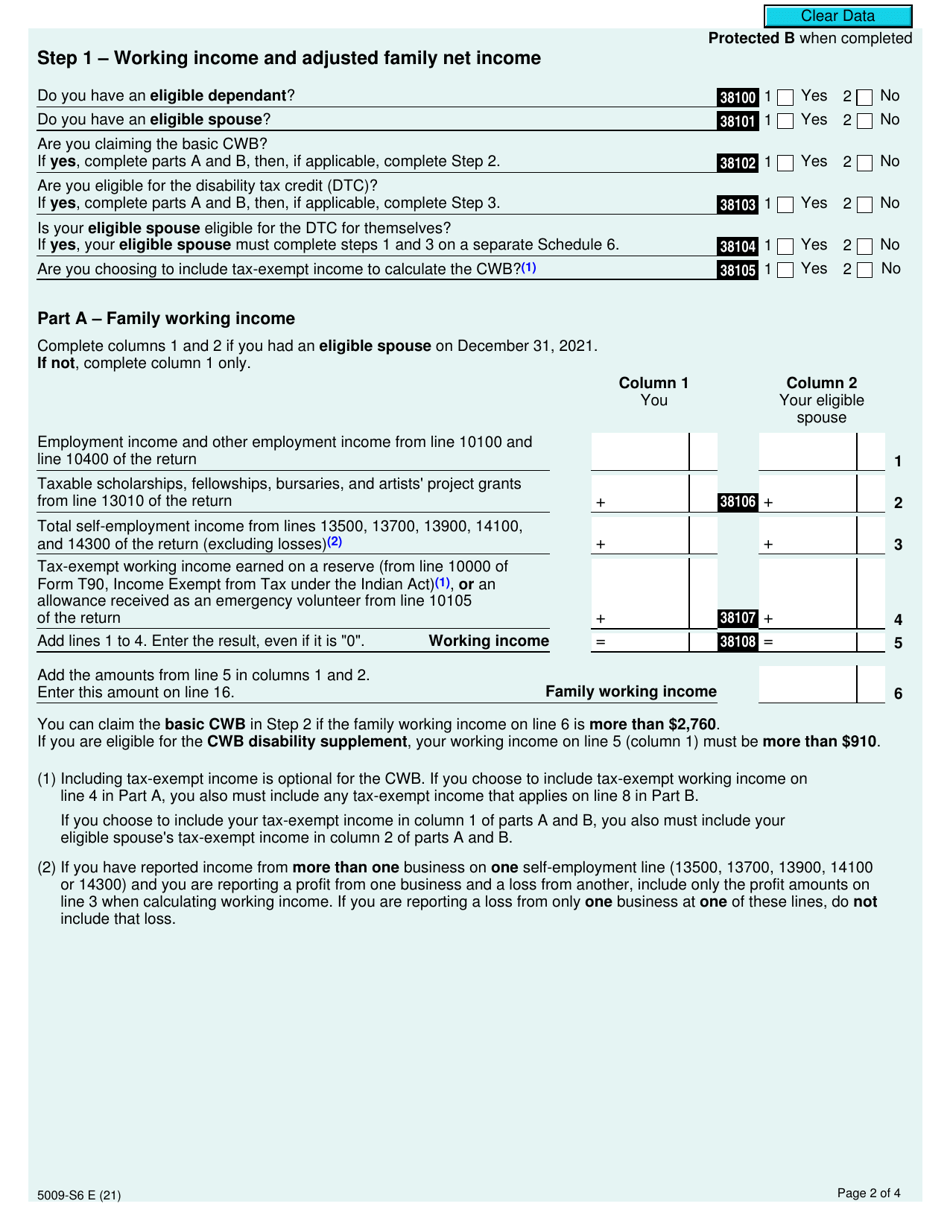

Form 5009-S6 Schedule 6

for the current year.

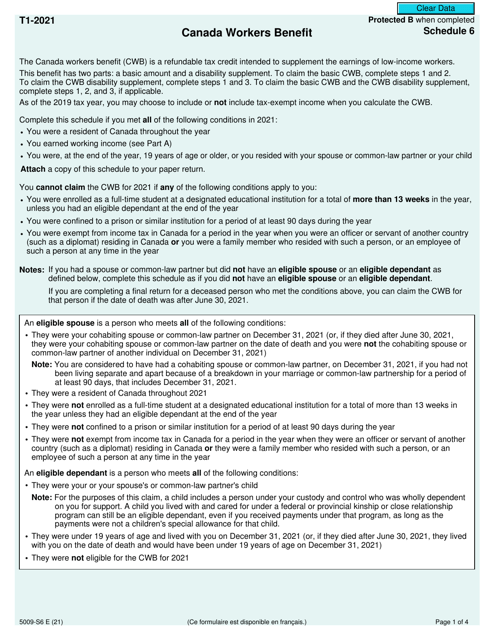

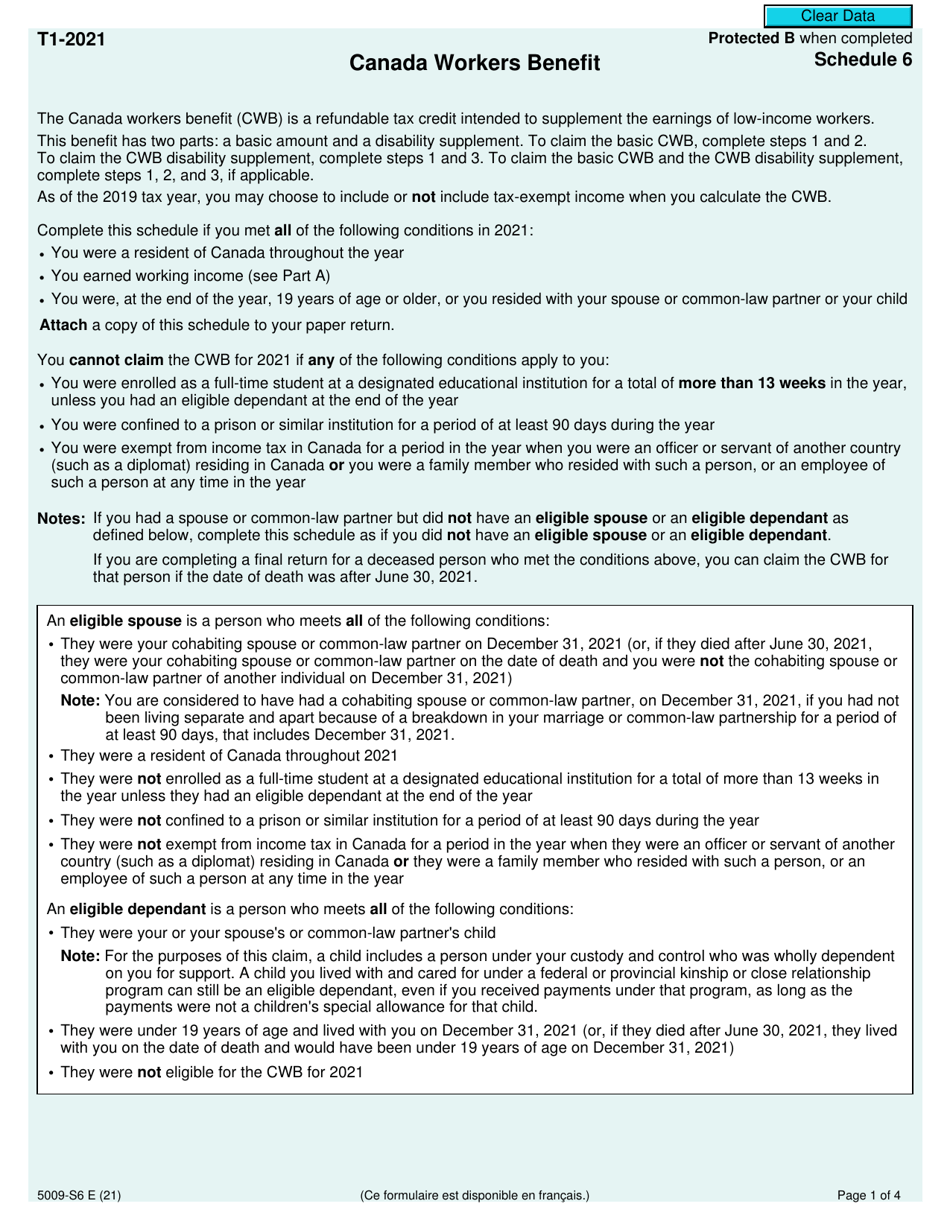

Form 5009-S6 Schedule 6 Canada Workers Benefit - Canada

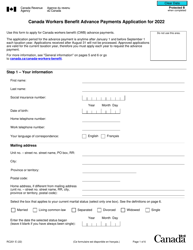

Form 5009-S6 Schedule 6 is used in Canada to report information related to the Canada Workers Benefit program. This program provides tax relief and support to low-income individuals and families who are working and earning employment income. It helps eligible individuals and families by supplementing their income through refundable tax credits.

Individuals who are eligible for the Canada Workers Benefit (CWB) and want to claim this benefit can file the Form 5009-S6 Schedule 6.

FAQ

Q: What is Form 5009-S6?

A: Form 5009-S6 is a schedule used in Canada to claim the Canada Workers Benefit (CWB).

Q: What is the Canada Workers Benefit (CWB)?

A: The Canada Workers Benefit (CWB) is a tax credit designed to benefit low-income working individuals and families in Canada.

Q: Who can claim the Canada Workers Benefit?

A: Individuals who are working and have a low income may be eligible to claim the Canada Workers Benefit.

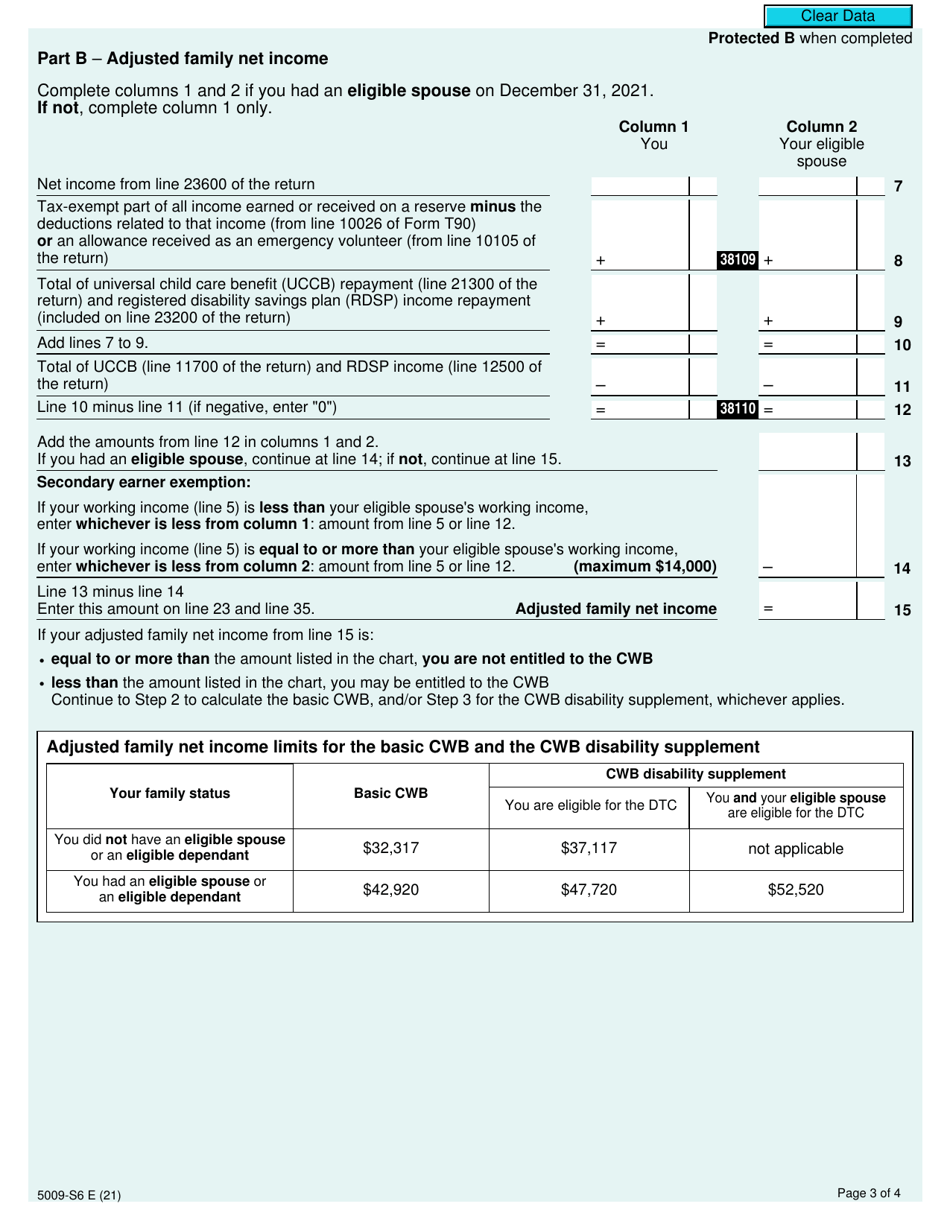

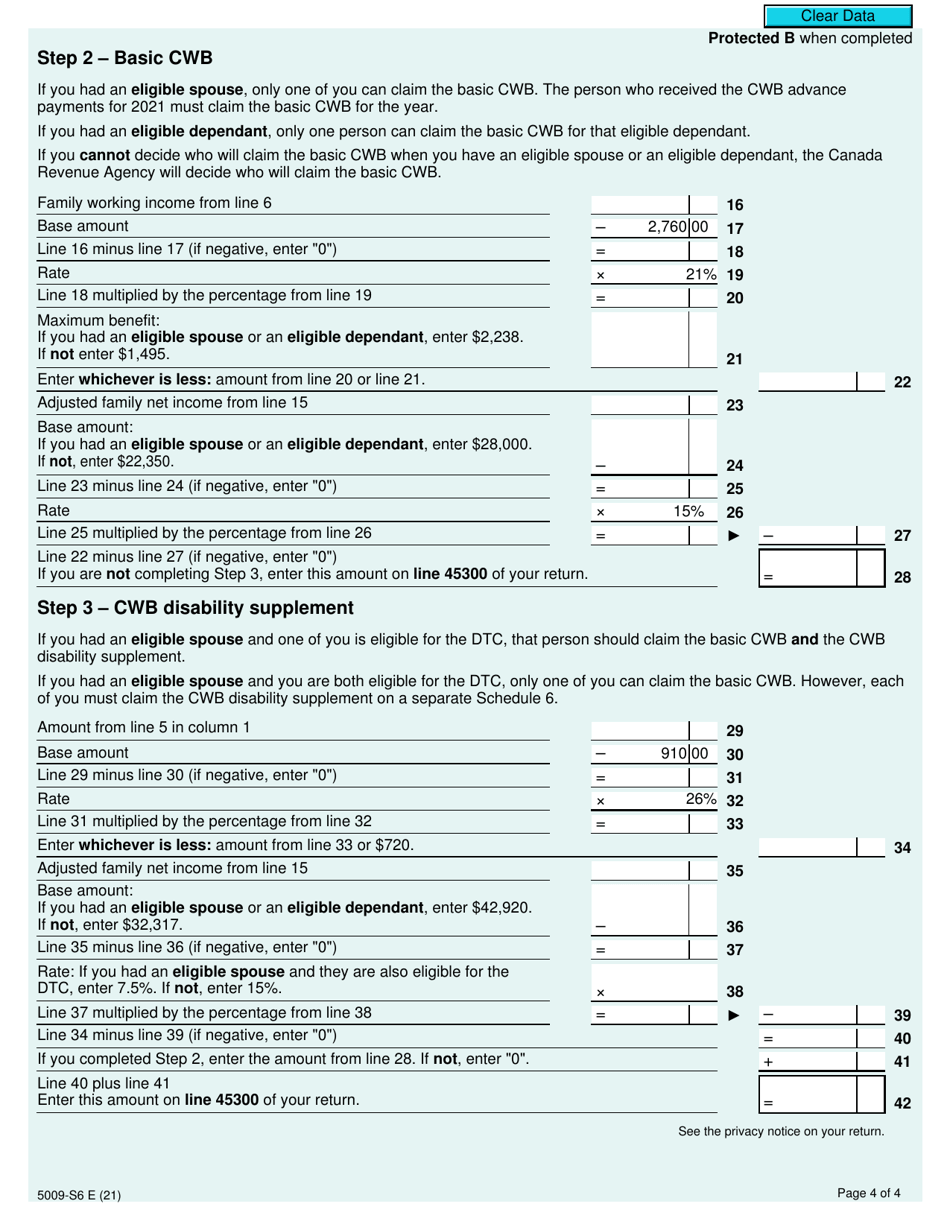

Q: What information is required on Schedule 6?

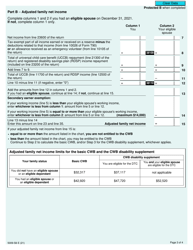

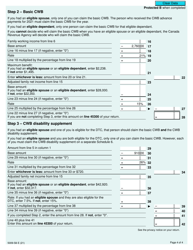

A: Schedule 6 requires information such as employment income, work-related expenses, and other details related to the calculation of the Canada Workers Benefit.

Q: How do I submit Form 5009-S6?

A: Form 5009-S6 should be completed and submitted along with your personal income tax return.

Q: When is the deadline to submit Form 5009-S6?

A: The deadline to submit Form 5009-S6 is typically the same as the deadline for filing your personal income tax return in Canada.

Q: How much can I receive from the Canada Workers Benefit?

A: The amount you can receive from the Canada Workers Benefit depends on various factors, such as your income, family size, and other eligibility criteria.

Q: Is the Canada Workers Benefit taxable?

A: No, the Canada Workers Benefit is not taxable.

Q: Can I claim the Canada Workers Benefit if I receive other government benefits?

A: Yes, you can still claim the Canada Workers Benefit even if you receive other government benefits. However, the amount you receive may be adjusted based on those benefits.