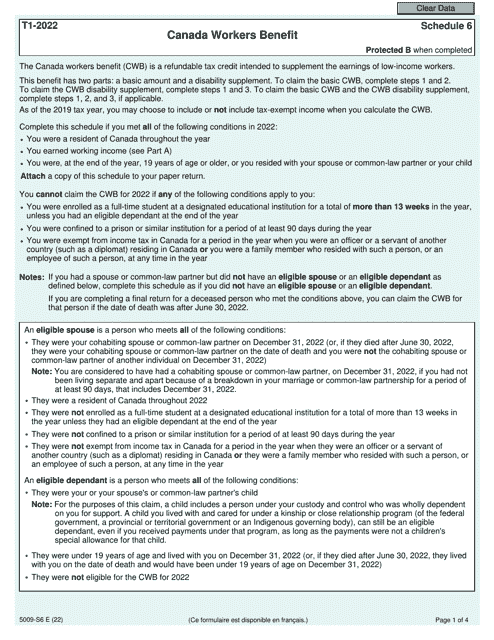

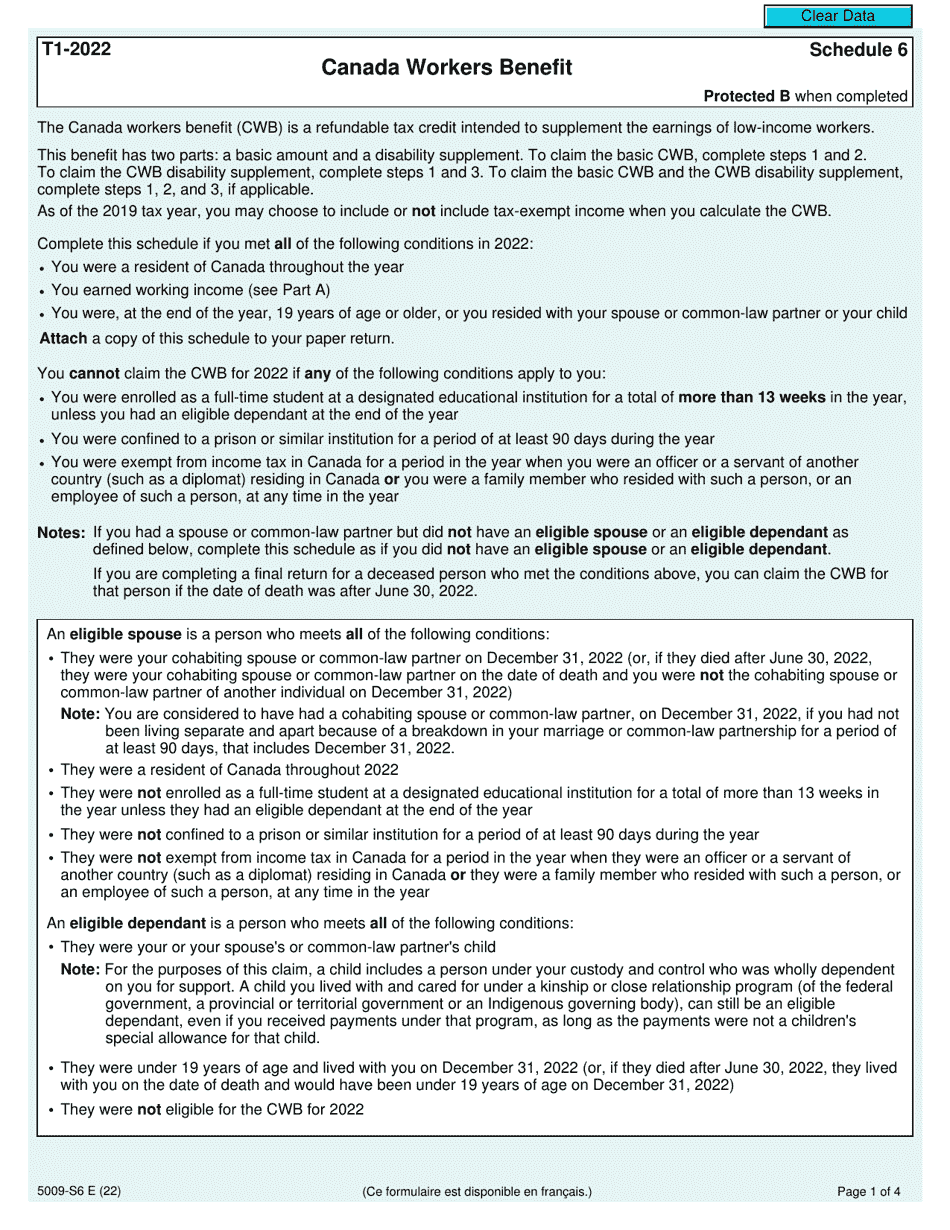

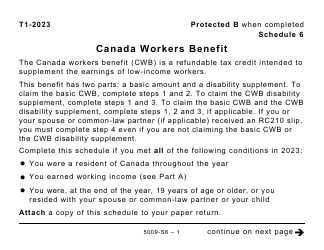

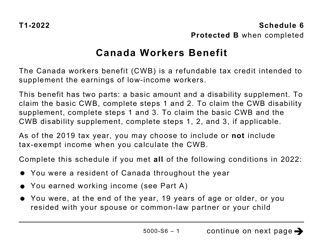

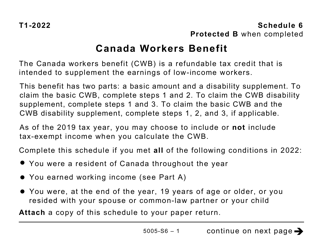

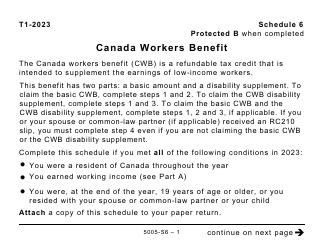

Form 5009-S6 Schedule 6 Canada Workers Benefit - Canada

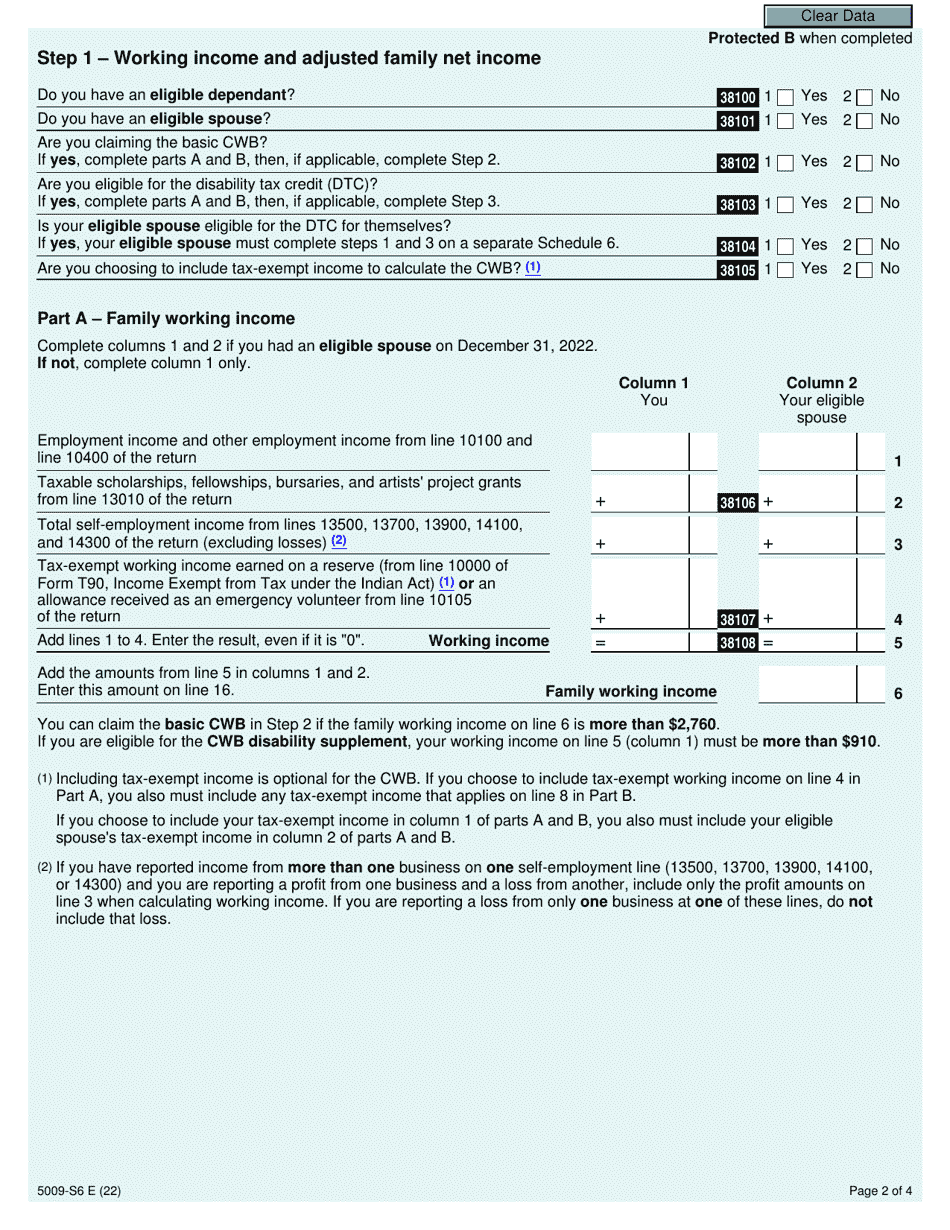

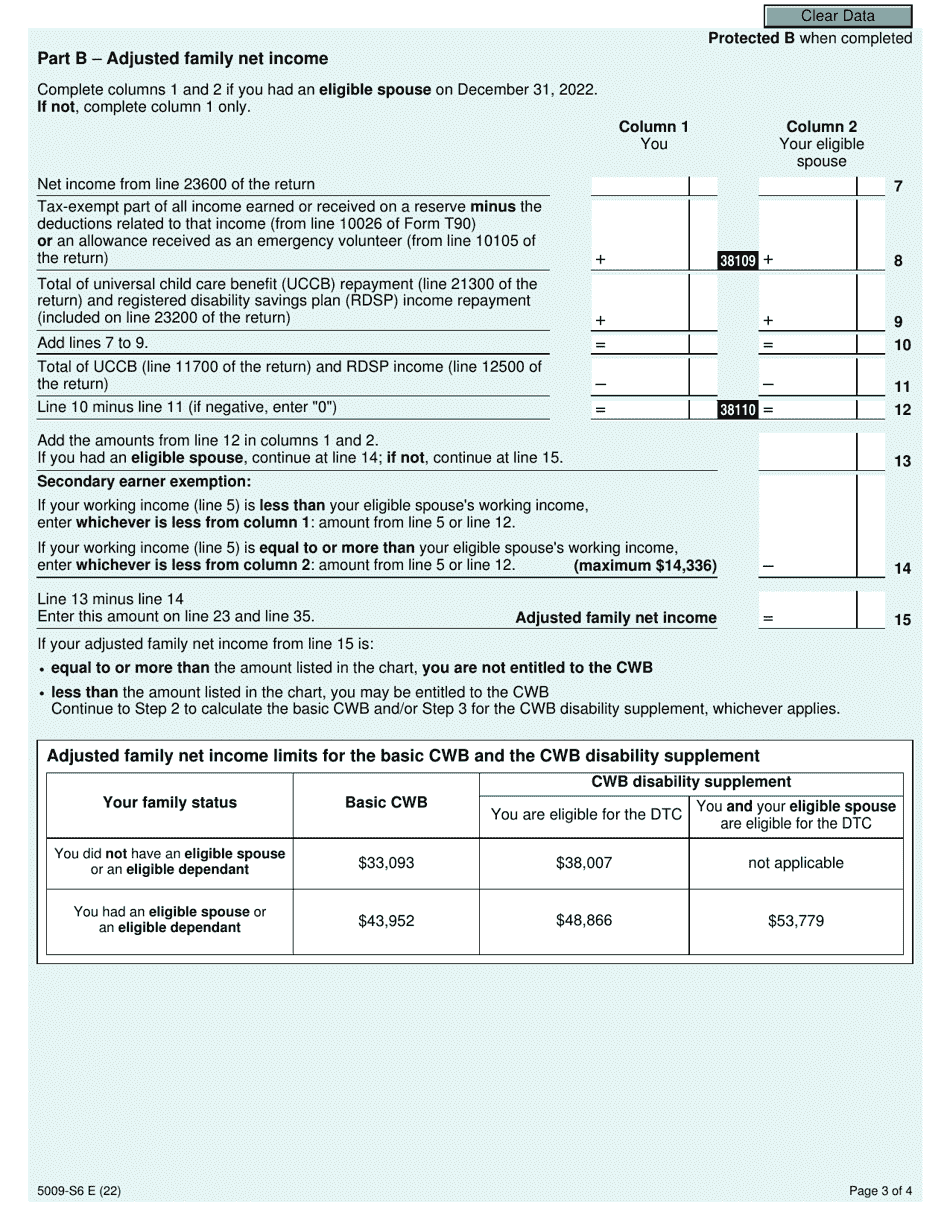

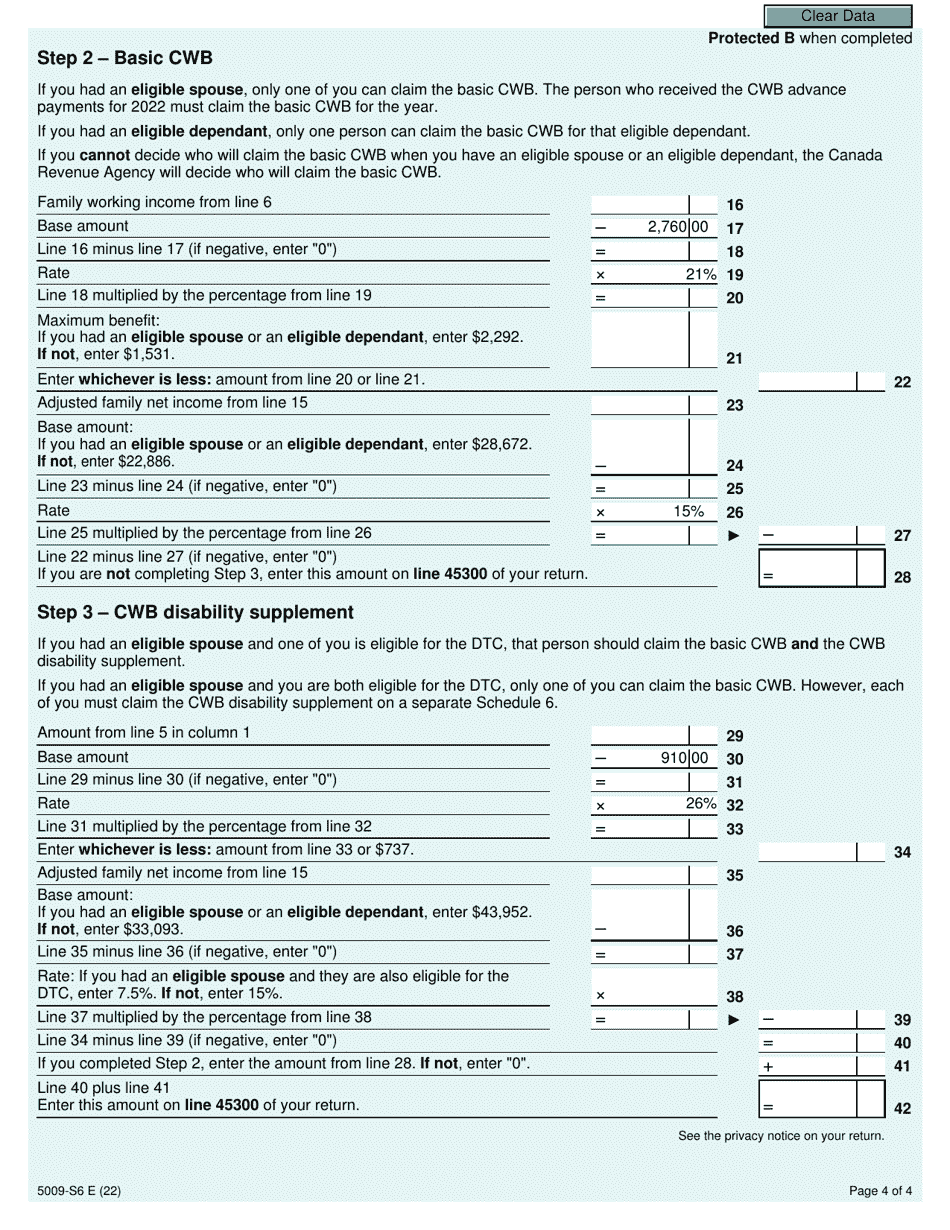

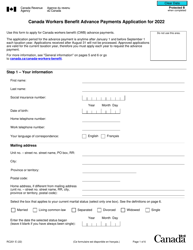

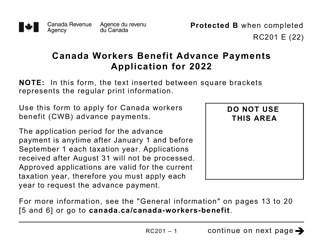

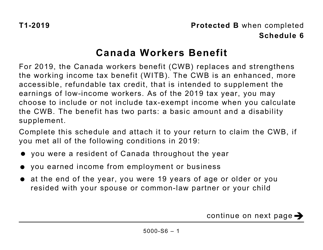

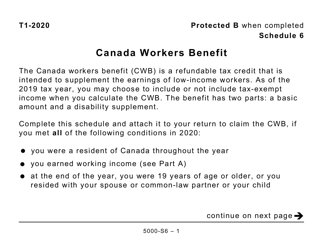

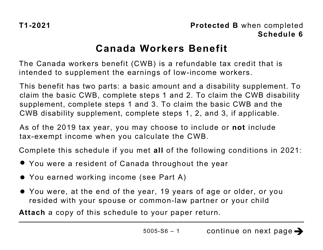

Form 5009-S6 Schedule 6 Canada Workers Benefit is used to claim the Canada Workers Benefit, which is a tax credit designed to provide financial assistance to low-income individuals and families in Canada who are working.

The Form 5009-S6 Schedule 6 Canada Workers Benefit is filed by individuals in Canada who qualify for the Canada Workers Benefit program.

FAQ

Q: What is Form 5009-S6?A: Form 5009-S6 is the Schedule 6 for the Canada Workers Benefit.

Q: What is the Canada Workers Benefit?A: The Canada Workers Benefit is a federal tax credit designed to help low-income workers in Canada.

Q: Who is eligible for the Canada Workers Benefit?A: Individuals who are employed in Canada and have a working income within the eligible range may be eligible for the Canada Workers Benefit.

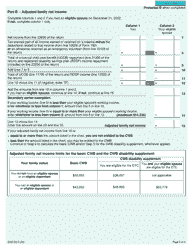

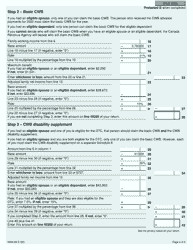

Q: What is the purpose of Schedule 6?A: Schedule 6 is used to calculate the amount of the Canada Workers Benefit that you may be entitled to.

Q: How do I fill out Form 5009-S6?A: You can fill out Form 5009-S6 by following the instructions provided on the form. Make sure to accurately enter information about your income, deductions, and credits.

Q: When is the deadline for submitting Form 5009-S6?A: The deadline for submitting Form 5009-S6 depends on your personal tax situation. It is typically due with your annual tax return.

Q: Can I claim the Canada Workers Benefit if I am self-employed?A: Yes, self-employed individuals may be eligible to claim the Canada Workers Benefit. The criteria for eligibility are the same as for employees.

Q: Is the Canada Workers Benefit taxable income?A: No, the Canada Workers Benefit is not considered taxable income. It is a non-taxable federal tax credit.

Q: What happens if I make a mistake on Form 5009-S6?A: If you make a mistake on Form 5009-S6, you may need to correct it by filing an adjustment request or an amended tax return. Contact the CRA for guidance on how to correct the error.