This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5010-S11 Schedule BC(S11)

for the current year.

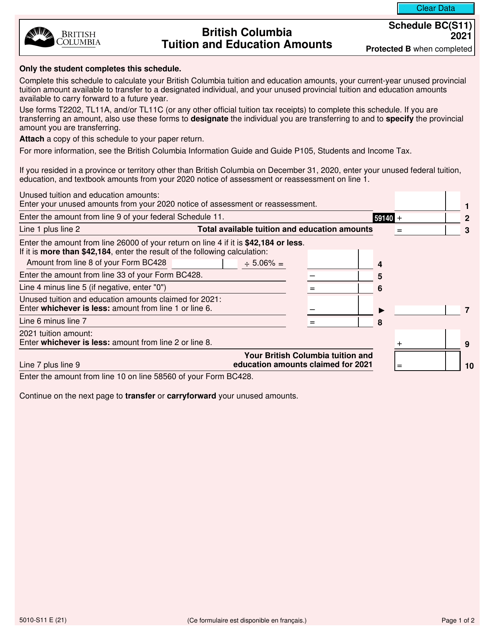

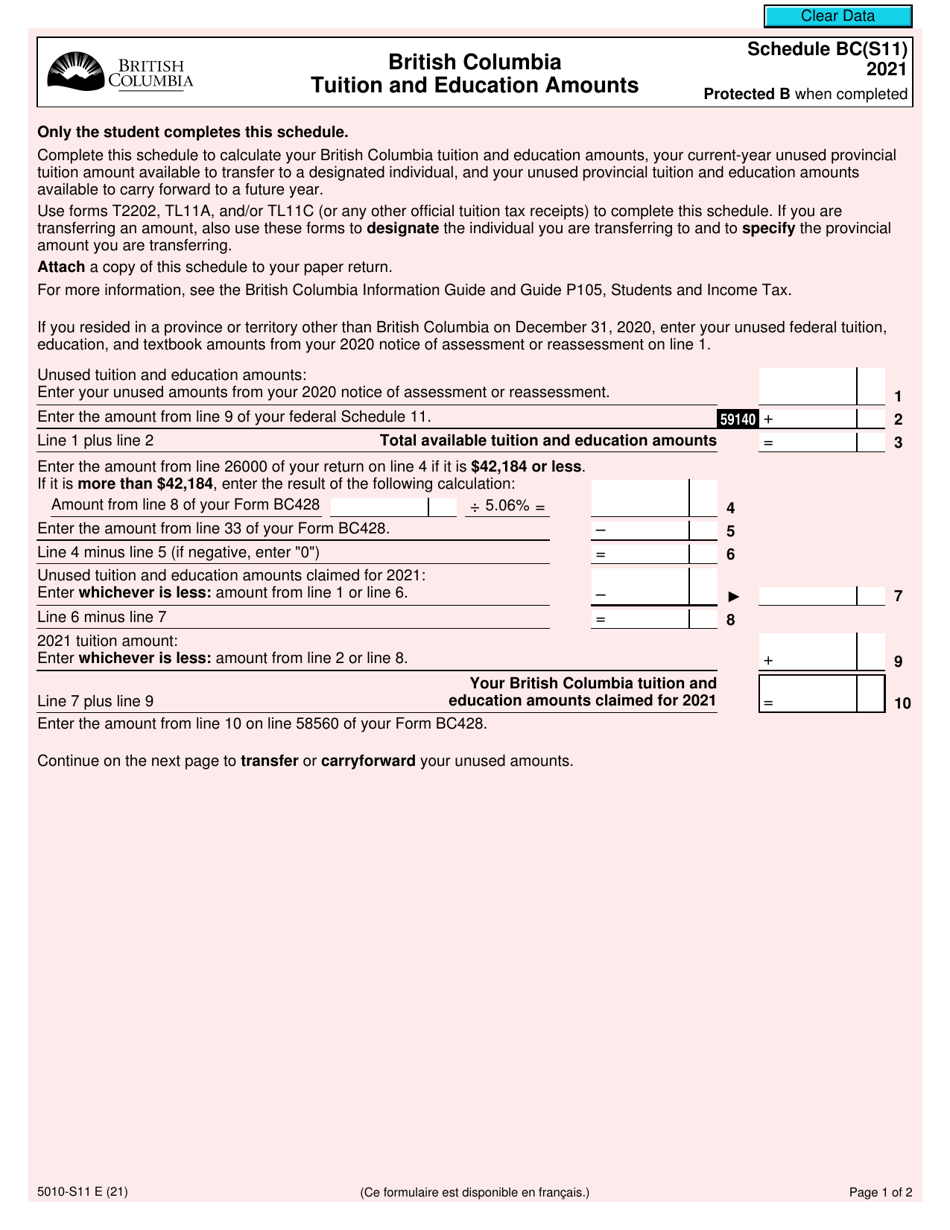

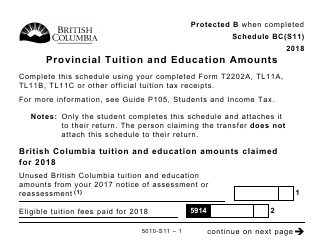

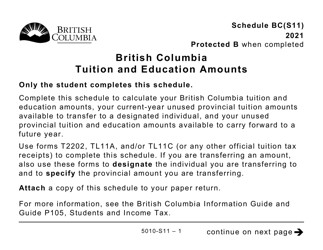

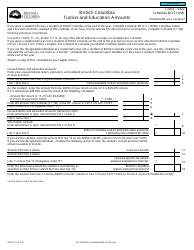

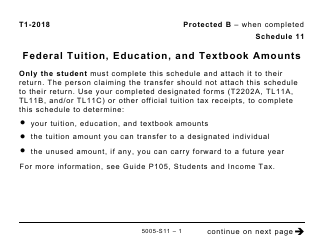

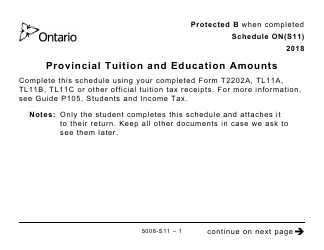

Form 5010-S11 Schedule BC(S11) British Columbia Tuition and Education Amounts - Canada

Form 5010-S11 Schedule BC(S11) is used in Canada for reporting tuition and education amounts specifically for the province of British Columbia.

The Form 5010-S11 Schedule BC(S11) is typically filed by individuals who reside in British Columbia, Canada and wish to claim tuition and education amounts for tax purposes.

FAQ

Q: What is Form 5010-S11 Schedule BC(S11)?

A: Form 5010-S11 Schedule BC(S11) is a tax form related to claiming tuition and education amounts in British Columbia, Canada.

Q: What are tuition and education amounts?

A: Tuition and education amounts are deductions that can be claimed to reduce your taxable income for certain educational expenses.

Q: Who can claim tuition and education amounts in British Columbia?

A: Residents of British Columbia who are enrolled in eligible educational programs can claim these amounts.

Q: What is the purpose of Schedule BC(S11)?

A: Schedule BC(S11) is used by residents of British Columbia to calculate and claim their tuition and education amounts.

Q: Can I claim tuition and education amounts for programs outside of British Columbia?

A: No, Schedule BC(S11) is specifically for residents of British Columbia and can only be used to claim amounts related to educational programs in British Columbia.

Q: Are there any eligibility criteria for claiming tuition and education amounts?

A: Yes, there are specific eligibility criteria and restrictions outlined by the CRA. It is important to review these criteria before claiming these amounts.

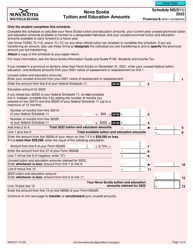

Q: What documents do I need to complete Schedule BC(S11)?

A: You will typically need your T2202A form, which is provided by your educational institution, to complete Schedule BC(S11). Additionally, you may need other supporting documents such as receipts or invoices for eligible expenses.

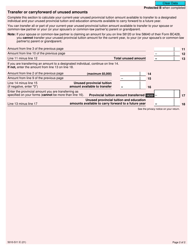

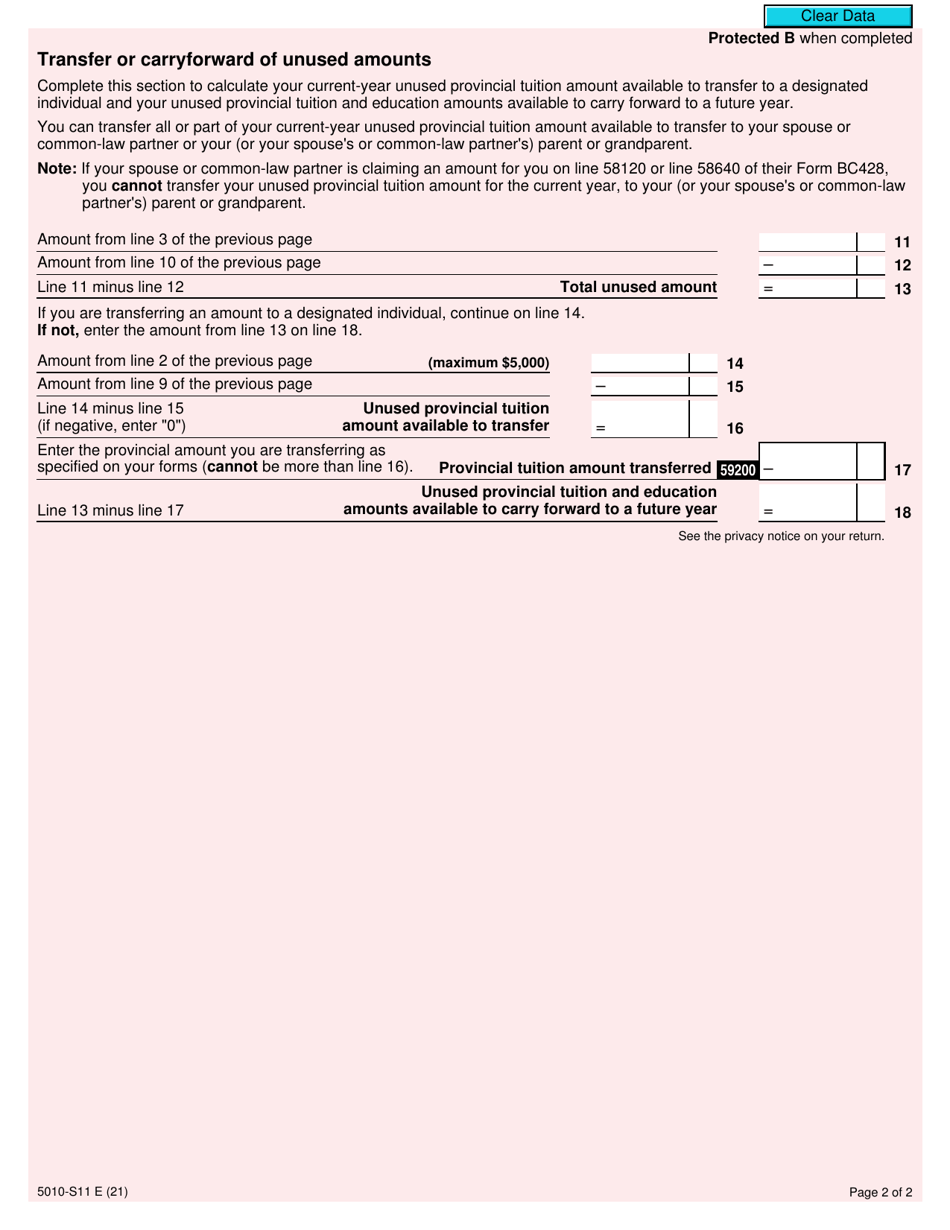

Q: Can I carry forward unused tuition and education amounts?

A: Yes, if you are unable to use all of your tuition and education amounts in the current year, you may be able to carry them forward and claim them in a future year.

Q: Can I transfer my tuition and education amounts to someone else?

A: In certain cases, you may be able to transfer a portion of your tuition and education amounts to a parent, grandparent, or spouse. However, there are specific eligibility criteria for transferring these amounts.