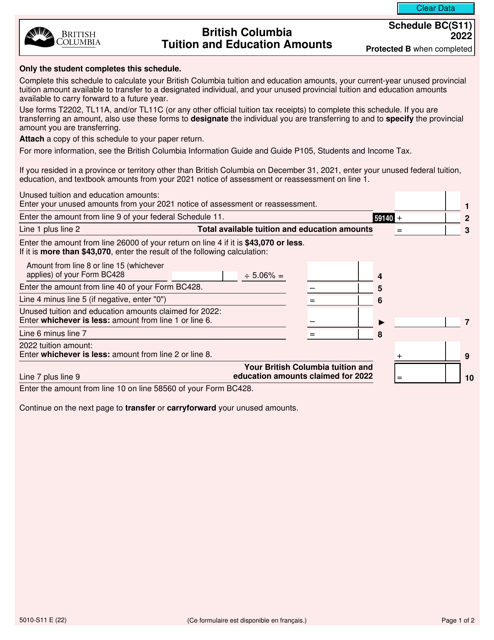

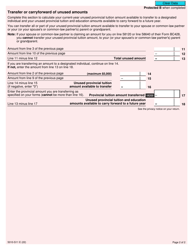

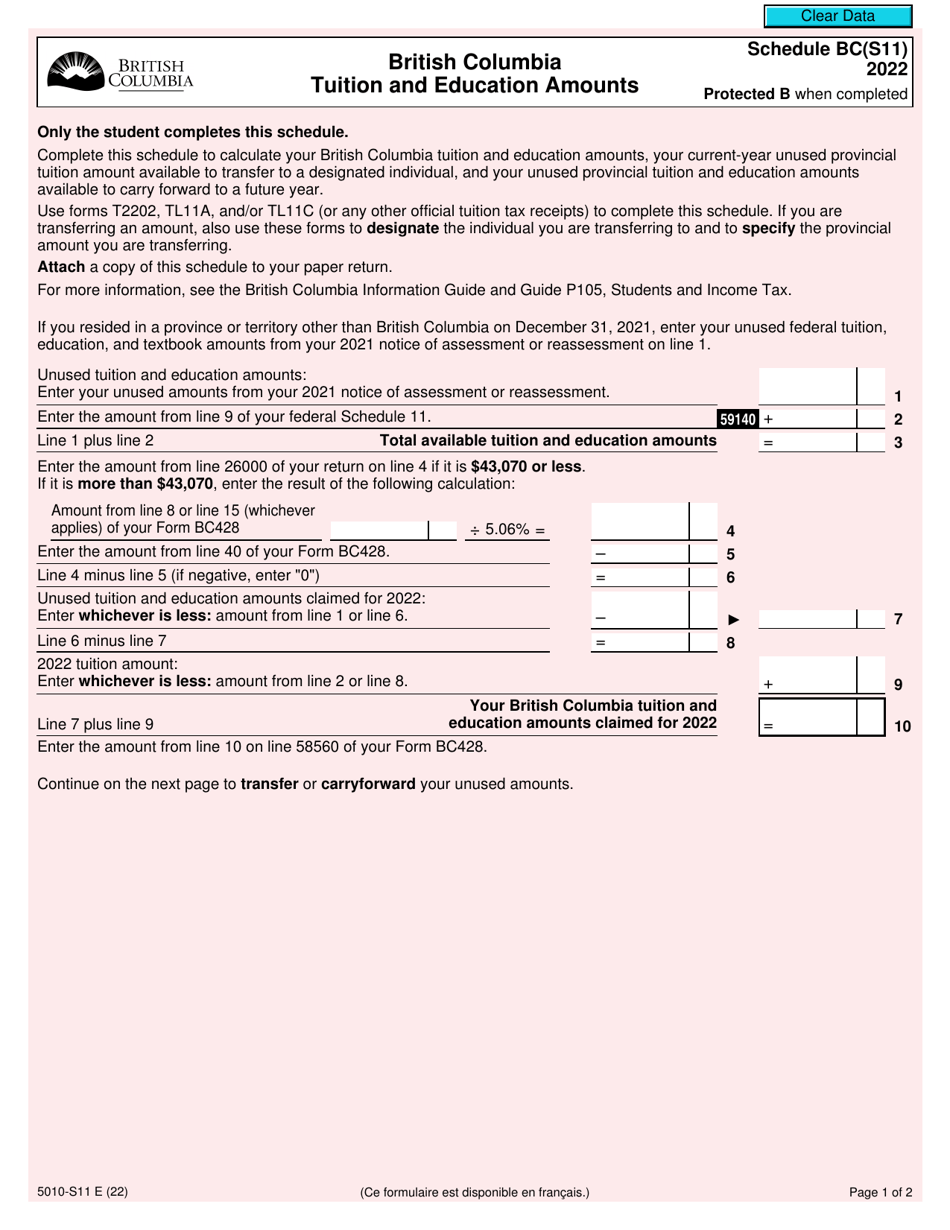

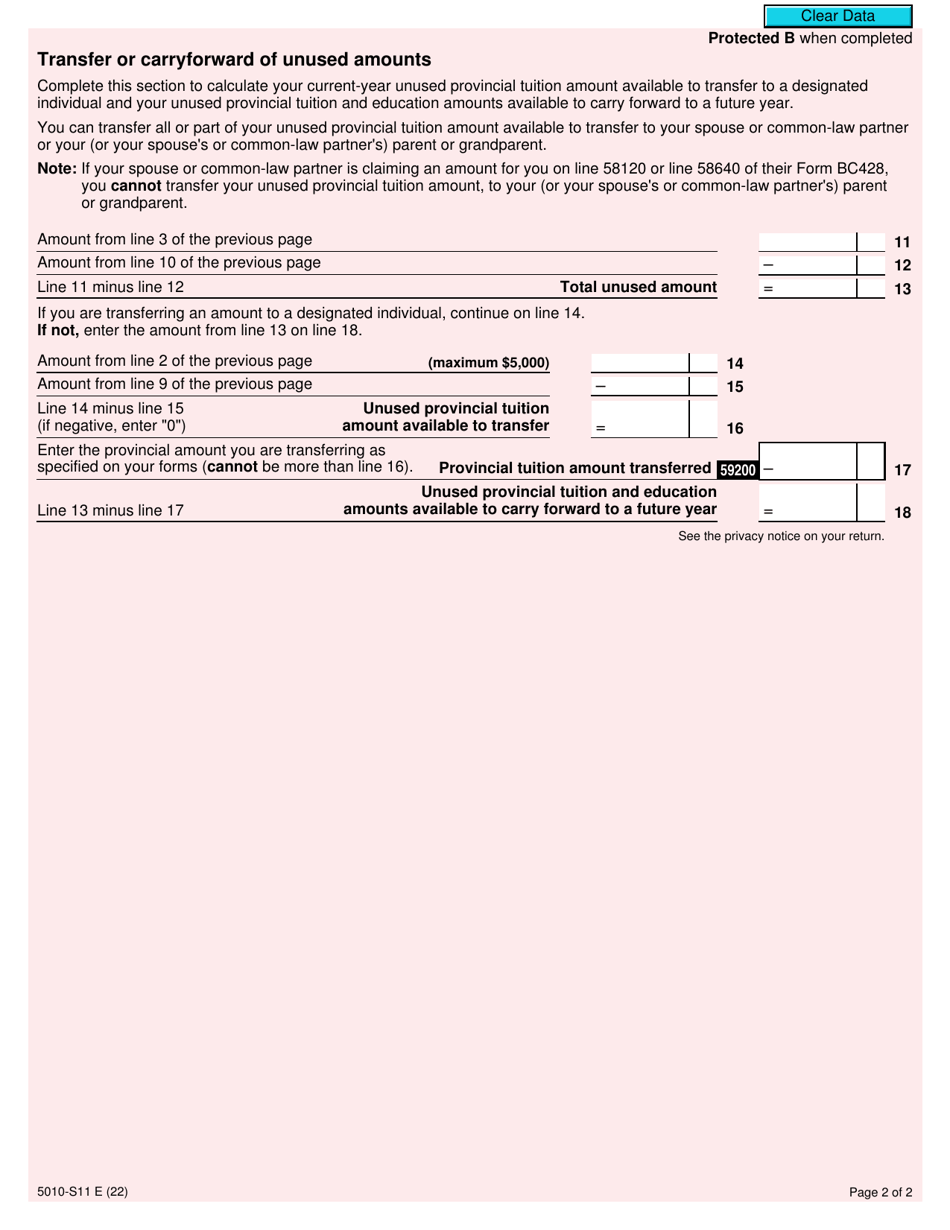

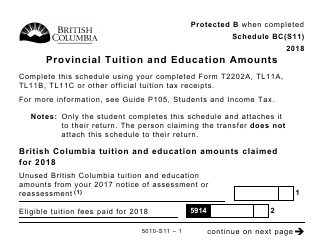

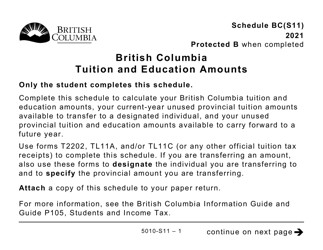

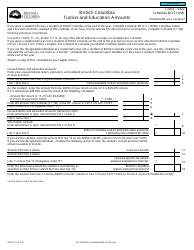

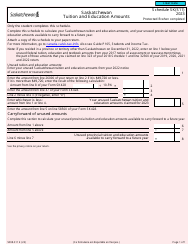

Form 5010-S11 Schedule BC(S11) British Columbia Tuition and Education Amounts - Canada

Form 5010-S11 Schedule BC(S11) is used in Canada for claiming tuition and education amounts specifically in the province of British Columbia. It helps individuals to calculate the deductions they are eligible for related to education expenses.

The individual taxpayer who is a resident of British Columbia, Canada, files the Form 5010-S11 Schedule BC(S11) for claiming tuition and education amounts.

Form 5010-S11 Schedule BC(S11) British Columbia Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5010-S11 Schedule BC(S11)?

A: Form 5010-S11 Schedule BC(S11) is a specific tax form used in Canada.

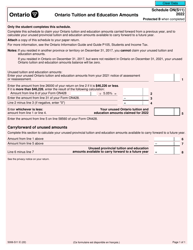

Q: What is the purpose of Form 5010-S11 Schedule BC(S11)?

A: The purpose of Form 5010-S11 Schedule BC(S11) is to claim tuition and education amounts for residents of British Columbia.

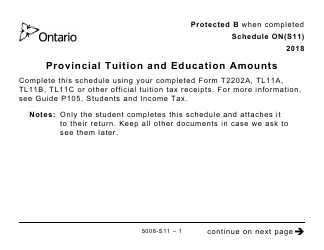

Q: Who can use Form 5010-S11 Schedule BC(S11)?

A: Residents of British Columbia, Canada can use Form 5010-S11 Schedule BC(S11).

Q: What can be claimed using Form 5010-S11 Schedule BC(S11)?

A: Form 5010-S11 Schedule BC(S11) allows you to claim tuition and education amounts.

Q: Is Form 5010-S11 Schedule BC(S11) only for students?

A: No, Form 5010-S11 Schedule BC(S11) can be used by both students and their supporting individuals.