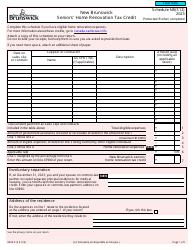

This version of the form is not currently in use and is provided for reference only. Download this version of

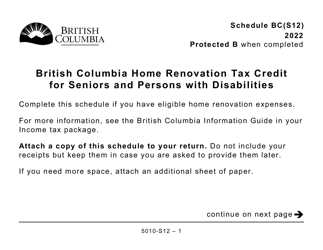

Form 5010-S12 Schedule BC(S12)

for the current year.

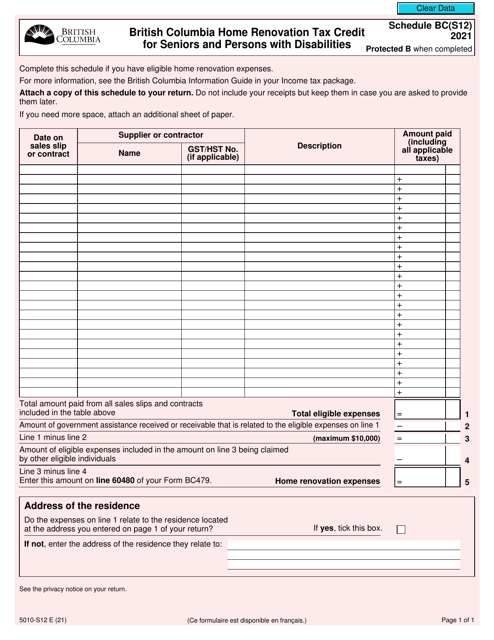

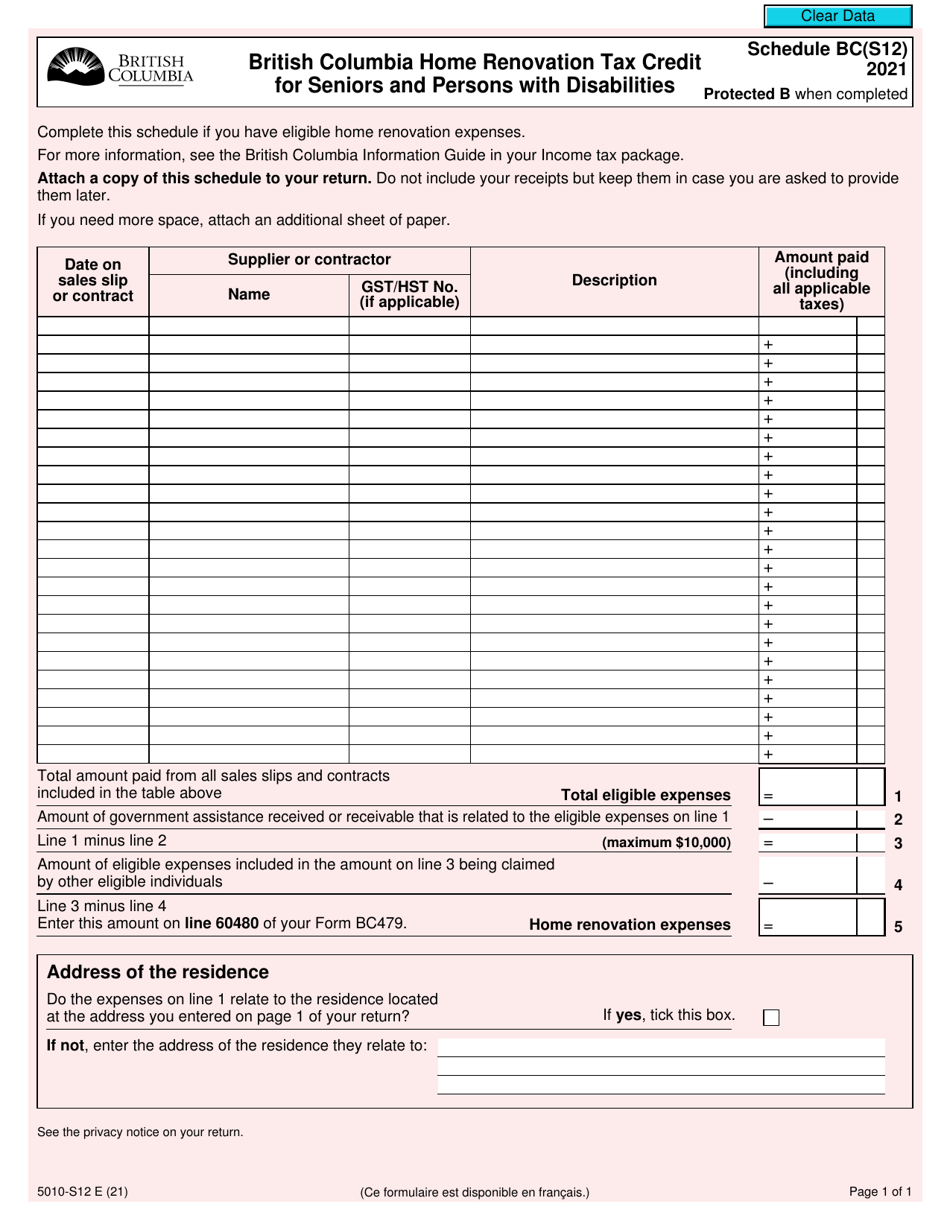

Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities - Canada

Form 5010-S12 Schedule BC(S12) is used in Canada for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities. This tax credit is specifically for eligible seniors and persons with disabilities who have made qualifying home renovations in British Columbia.

The form 5010-S12 Schedule BC(S12) for the British Columbia Home Renovation Tax Credit for Seniors and Persons with Disabilities in Canada is typically filed by the individuals who meet the eligibility criteria for this tax credit.

FAQ

Q: What is Form 5010-S12 Schedule BC(S12)?

A: Form 5010-S12 Schedule BC(S12) is a tax form related to the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities.

Q: What is the British Columbia Home Renovation Tax Credit?

A: The British Columbia Home Renovation Tax Credit is a tax credit available to eligible seniors and persons with disabilities in British Columbia, Canada.

Q: Who is eligible for the British Columbia Home Renovation Tax Credit?

A: Seniors and persons with disabilities who own or rent a home in British Columbia and have incurred eligible renovation expenses are eligible for the tax credit.

Q: What are eligible renovation expenses?

A: Eligible renovation expenses include expenses incurred for renovations that make a home more accessible, safer, or more functional for eligible seniors and persons with disabilities.

Q: Are there any maximum limits for the tax credit?

A: Yes, there are maximum limits for the tax credit. The maximum credit per household is $10,000, and the maximum credit per tax year is $2,500.

Q: How can I claim the British Columbia Home Renovation Tax Credit?

A: To claim the tax credit, you need to complete Form 5010-S12 Schedule BC(S12) and include it with your tax return for the applicable tax year.

Q: Is the British Columbia Home Renovation Tax Credit refundable?

A: No, the British Columbia Home Renovation Tax Credit is not refundable. It can only be used to reduce or eliminate your tax payable for the year.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, there are deadlines for claiming the tax credit. The credit can be claimed for eligible expenses incurred between October 1, 2020, and December 31, 2022.