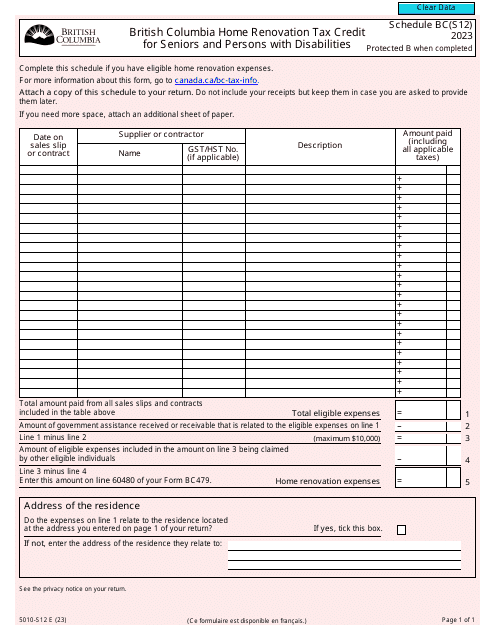

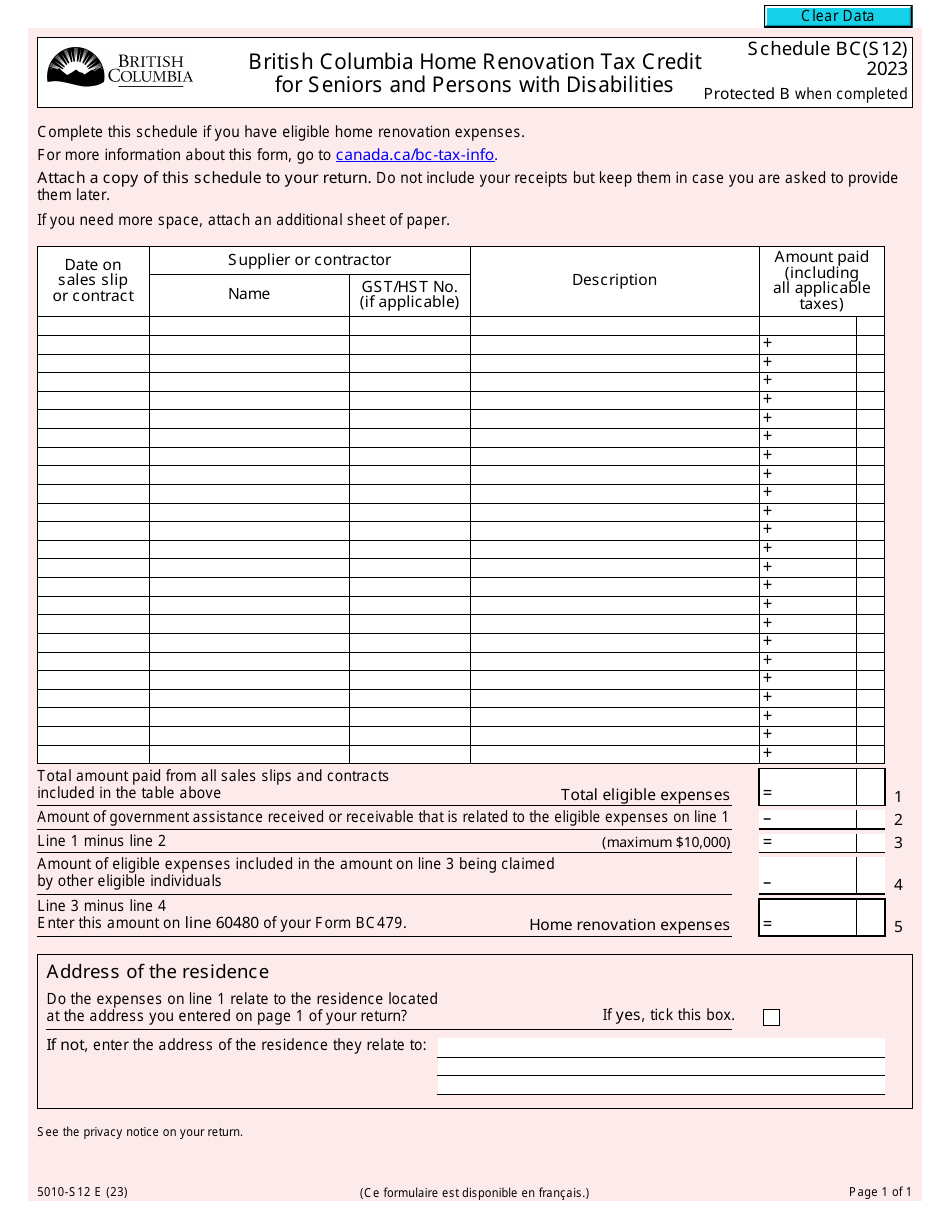

Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities - Canada

Form 5010-S12 Schedule BC(S12) is used in Canada for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons with Disabilities. This tax credit is meant to support eligible individuals in British Columbia who have incurred expenses for home renovations or adaptations to improve accessibility.

The Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities in Canada is typically filed by the eligible senior or person with disabilities who wishes to claim the tax credit.

Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5010-S12?

A: Form 5010-S12 is the Schedule BC(S12) used for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities in Canada.

Q: What is the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities?

A: The British Columbia Home Renovation Tax Credit is a tax credit available to seniors and persons with disabilities in British Columbia, Canada, for eligible home renovation expenses.

Q: Who is eligible for the British Columbia Home Renovation Tax Credit?

A: Seniors and persons with disabilities who meet certain criteria are eligible for the British Columbia Home Renovation Tax Credit.

Q: What are eligible home renovation expenses?

A: Eligible home renovation expenses include renovations or alterations that improve accessibility, safety, or functionality of a principal residence.

Q: How do I claim the British Columbia Home Renovation Tax Credit?

A: You can claim the British Columbia Home Renovation Tax Credit by filling out Form 5010-S12 and including it with your income tax return.

Q: Is there a deadline for claiming the British Columbia Home Renovation Tax Credit?

A: Yes, the deadline for claiming the British Columbia Home Renovation Tax Credit is the same as the deadline for filing your income tax return.

Q: Can I claim the British Columbia Home Renovation Tax Credit for expenses incurred in previous years?

A: No, the British Columbia Home Renovation Tax Credit can only be claimed for eligible expenses incurred in the current tax year.

Q: Are the home renovation expenses deductible?

A: No, the home renovation expenses are not deductible for income tax purposes. They can only be used to claim the British Columbia Home Renovation Tax Credit.

Q: What documentation do I need to support my claim for the British Columbia Home Renovation Tax Credit?

A: You should keep all receipts and invoices related to the eligible home renovation expenses as supporting documentation for your claim.