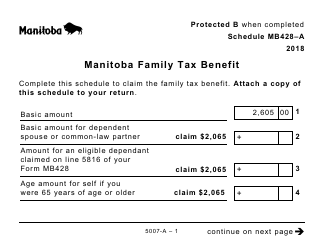

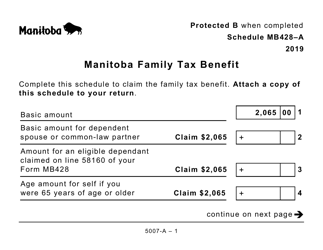

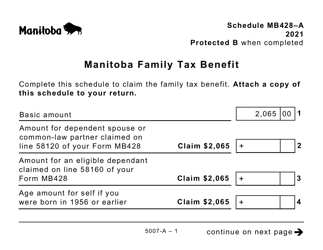

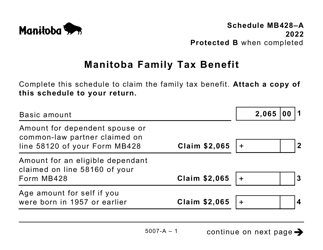

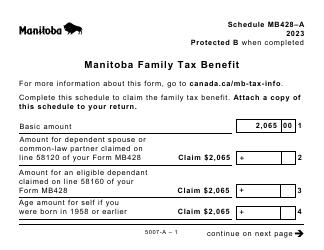

This version of the form is not currently in use and is provided for reference only. Download this version of

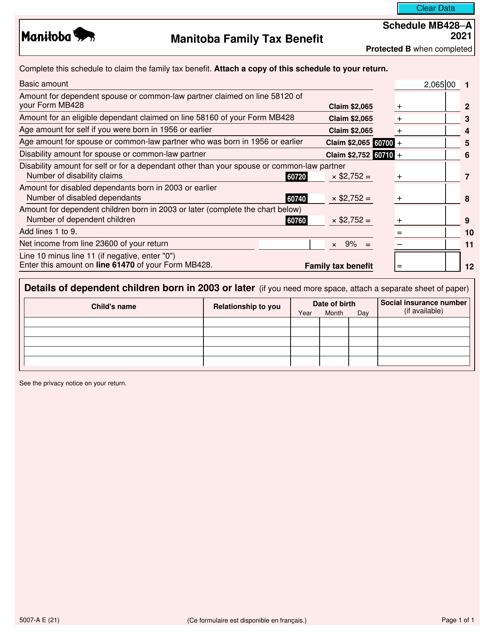

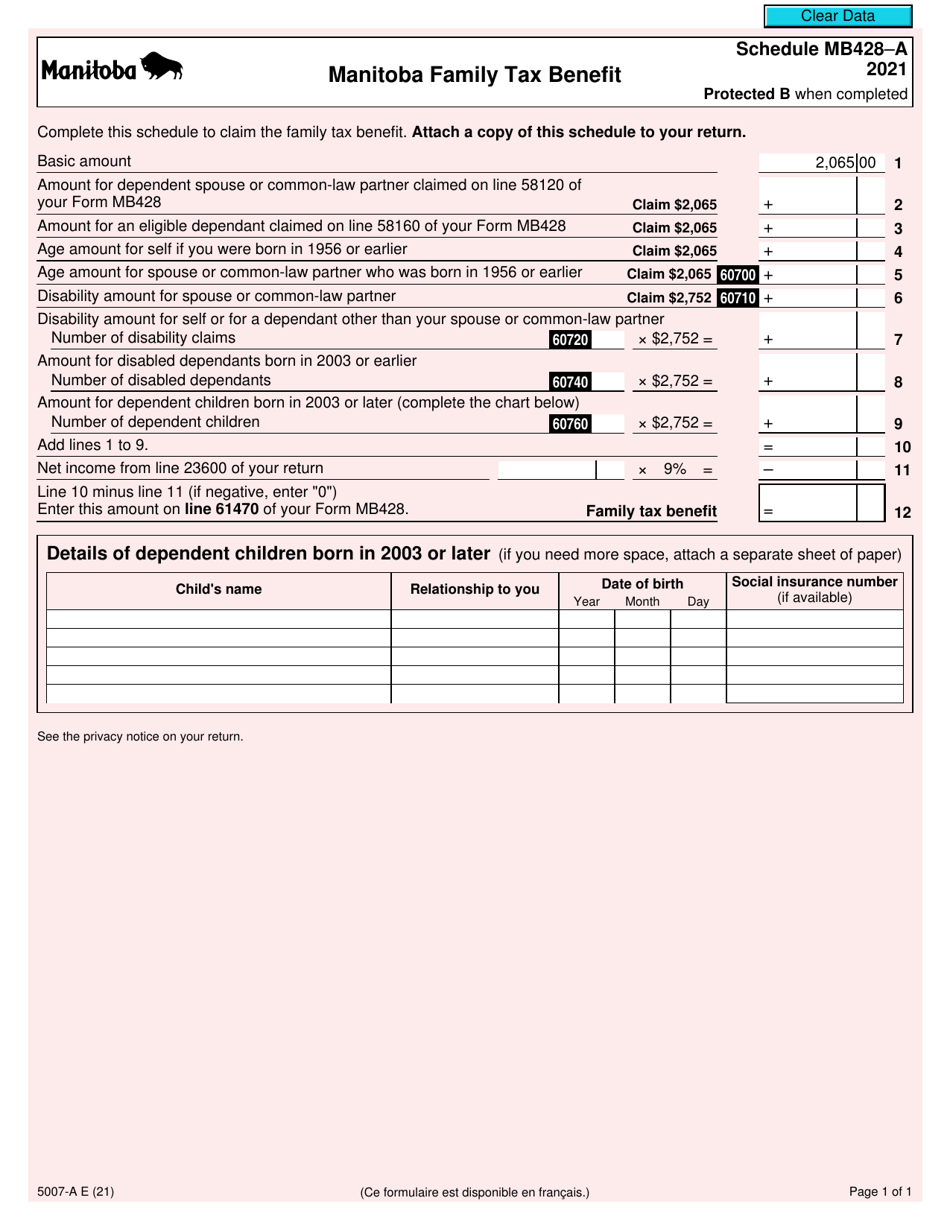

Form 5007-A Schedule MB428-A

for the current year.

Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit - Canada

Form 5007-A Schedule MB428-A is used to claim the Manitoba Family Tax Benefit in Canada. It allows eligible individuals or families to apply for financial assistance to help with the costs of raising children.

The Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit in Canada is typically filed by eligible Manitoba residents who wish to claim the Manitoba Family Tax Benefit.

FAQ

Q: What is Form 5007-A Schedule MB428-A?

A: Form 5007-A Schedule MB428-A is a tax form used in Canada for claiming the Manitoba Family Tax Benefit.

Q: Who can use Form 5007-A Schedule MB428-A?

A: Residents of Manitoba, Canada who meet the eligibility criteria can use Form 5007-A Schedule MB428-A.

Q: What is the Manitoba Family Tax Benefit?

A: The Manitoba Family Tax Benefit is a program in Manitoba, Canada that provides financial assistance to low-income families.

Q: What information is required on Form 5007-A Schedule MB428-A?

A: Form 5007-A Schedule MB428-A requires information about the taxpayer's income, family members, and other eligibility criteria.

Q: When is the deadline for submitting Form 5007-A Schedule MB428-A?

A: The deadline for submitting Form 5007-A Schedule MB428-A depends on the tax year. Please check with the Canada Revenue Agency for the specific deadline.

Q: Can I claim the Manitoba Family Tax Benefit if I live outside of Manitoba?

A: No, the Manitoba Family Tax Benefit is only available to residents of Manitoba.

Q: What happens after I submit Form 5007-A Schedule MB428-A?

A: After you submit Form 5007-A Schedule MB428-A, the Canada Revenue Agency will review your application and determine your eligibility for the Manitoba Family Tax Benefit.

Q: Is the Manitoba Family Tax Benefit taxable income?

A: No, the Manitoba Family Tax Benefit is not considered taxable income.