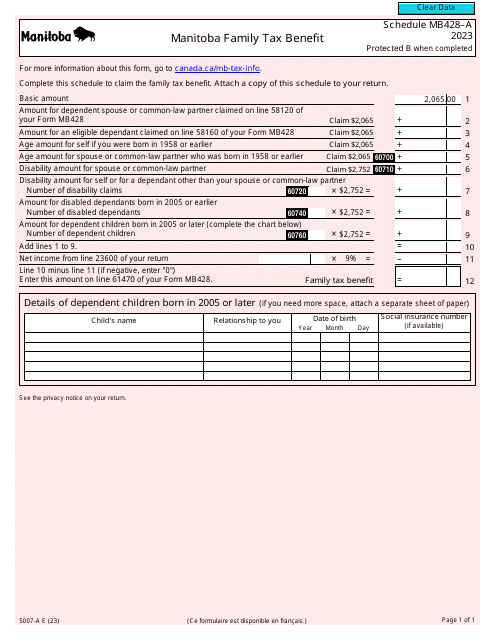

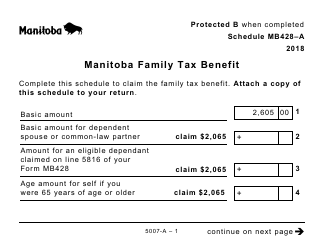

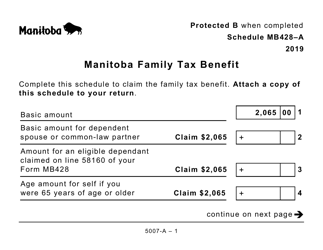

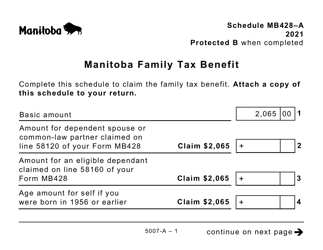

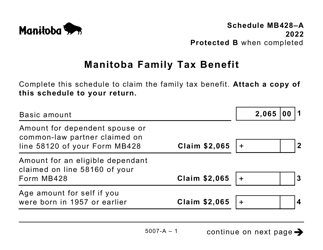

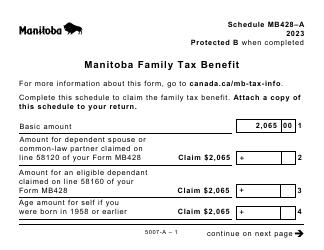

Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit - Canada

Form 5007-A Schedule MB428-A, Manitoba Family Tax Benefit, is used in Canada to apply for financial assistance provided to low-income families in the province of Manitoba. It helps eligible families receive additional support for their children.

The Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit is filed by residents of Manitoba, Canada who are eligible for the Manitoba Family Tax Benefit.

Form 5007-A Schedule MB428-A Manitoba Family Tax Benefit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5007-A?

A: Form 5007-A is a schedule used for the Manitoba Family Tax Benefit in Canada.

Q: What is Schedule MB428-A?

A: Schedule MB428-A is an attachment to the Manitoba Family Tax Benefit form.

Q: What is the Manitoba Family Tax Benefit?

A: The Manitoba Family Tax Benefit is a tax credit provided by the government of Manitoba to help low-income families.

Q: Who is eligible for the Manitoba Family Tax Benefit?

A: Low-income families residing in Manitoba are eligible for the Manitoba Family Tax Benefit.

Q: What is the purpose of Form 5007-A?

A: Form 5007-A is used to calculate the amount of the Manitoba Family Tax Benefit that a family is eligible for.

Q: Do I need to file Form 5007-A every year?

A: Yes, you need to file Form 5007-A every year to apply for the Manitoba Family Tax Benefit.

Q: Are there any deadlines for filing Form 5007-A?

A: Yes, the deadline for filing Form 5007-A is usually around April 30th of each year.

Q: What documents do I need to complete Form 5007-A?

A: You will need information about your income, family members, and expenses to complete Form 5007-A.