This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5004-S12 Schedule NB(S12)

for the current year.

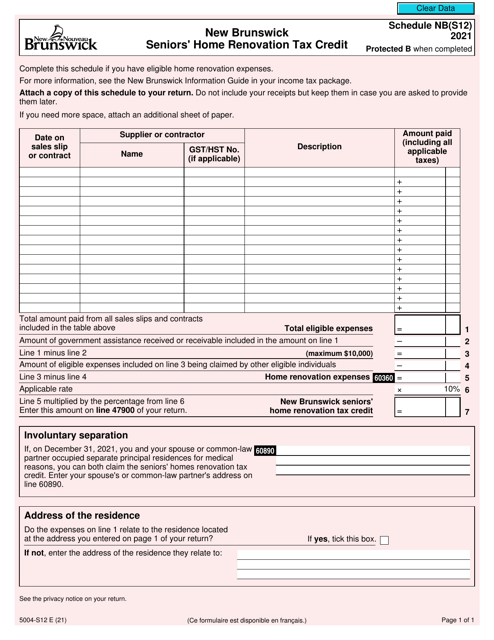

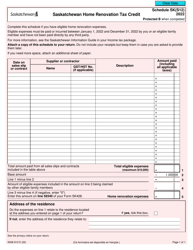

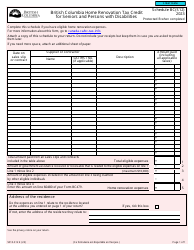

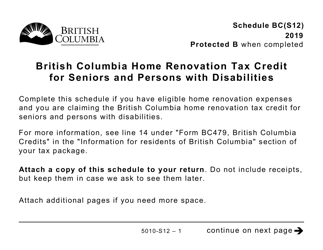

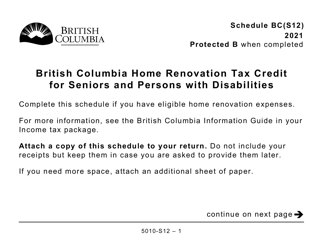

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Canada

Form 5004-S12 Schedule NB(S12) is used for claiming the New Brunswick Seniors' Home Renovation Tax Credit in Canada. This tax credit is designed to assist seniors with the cost of making their homes more accessible and safer.

The Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit in Canada is filed by eligible individuals who wish to claim the tax credit for seniors' home renovations in the province of New Brunswick.

FAQ

Q: What is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The New Brunswick Seniors' Home Renovation Tax Credit is a tax credit available to eligible seniors in New Brunswick, Canada.

Q: Who is eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Seniors who are 65 years of age or older and live in New Brunswick are eligible for the tax credit.

Q: What expenses qualify for the tax credit?

A: Expenses related to renovations that improve the safety and accessibility of a senior's primary residence may qualify for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 10% of eligible expenses, up to a maximum of $10,000.

Q: How do seniors claim the tax credit?

A: Seniors can claim the tax credit by completing Schedule NB(S12) and including it with their New Brunswick provincial tax return.

Q: Is the tax credit refundable?

A: No, the New Brunswick Seniors' Home Renovation Tax Credit is non-refundable. It can only be used to reduce the amount of taxes owing.