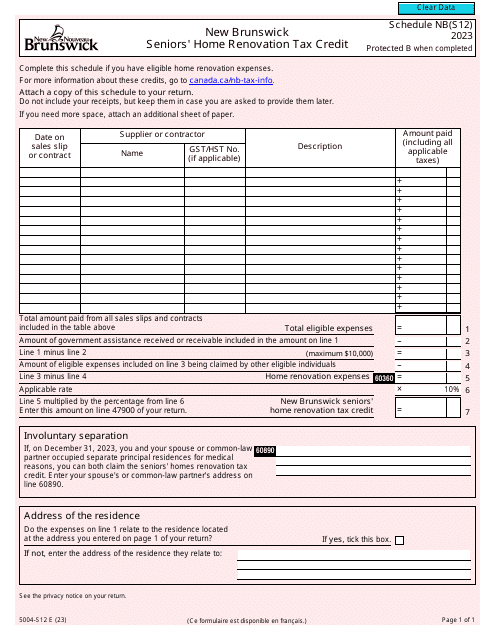

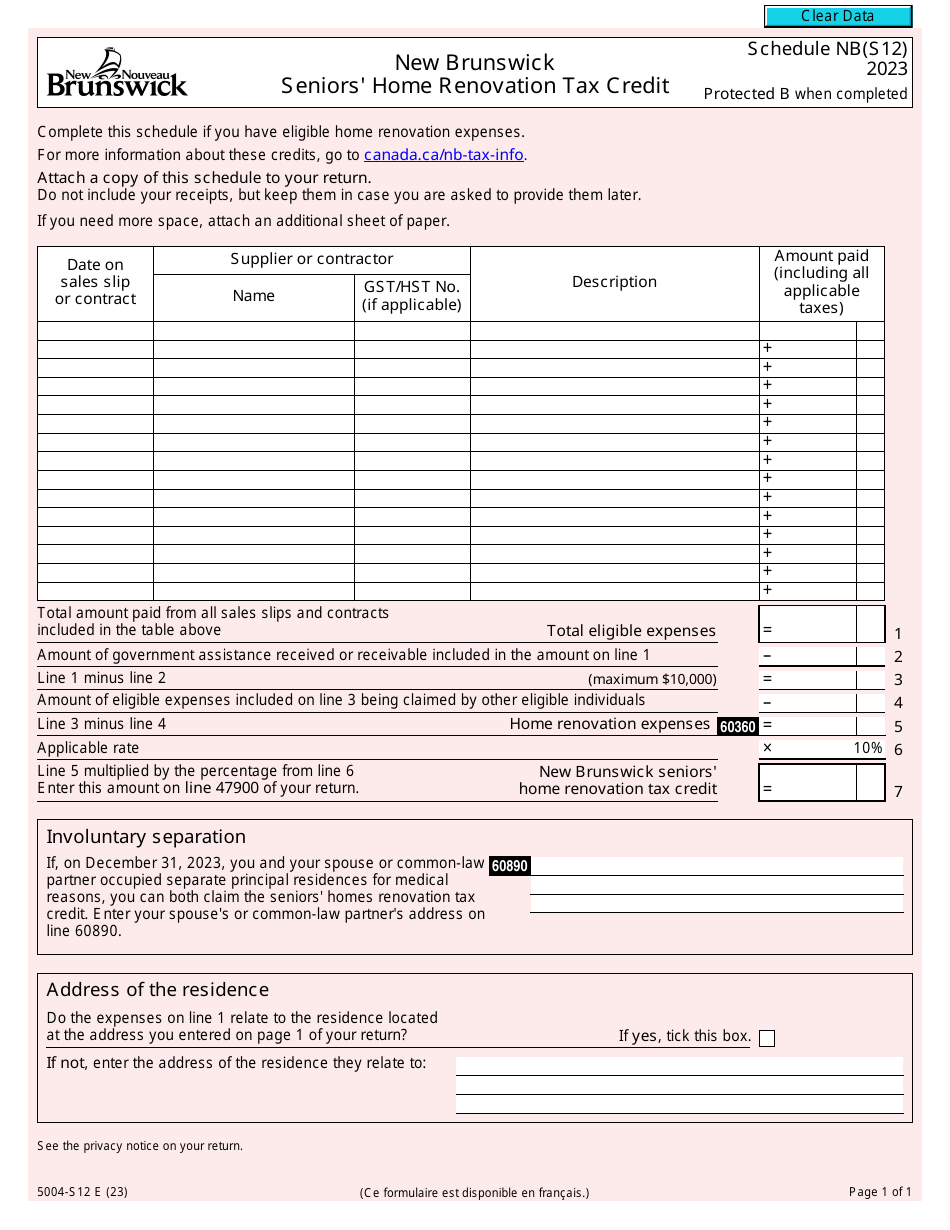

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Canada

Form 5004-S12 Schedule NB(S12) is used in Canada for claiming the New Brunswick Seniors' Home Renovation Tax Credit. This credit is aimed at seniors in New Brunswick who make eligible renovations to their homes to make them more accessible and safe.

The Form 5004-S12 Schedule NB(S12) for the New Brunswick Seniors' Home RenovationTax Credit in Canada is filed by eligible residents of New Brunswick who meet the required criteria for this tax credit.

Form 5004-S12 Schedule NB(S12) New Brunswick Seniors' Home Renovation Tax Credit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5004-S12 Schedule NB(S12)?

A: Form 5004-S12 Schedule NB(S12) is a tax form used in Canada for claiming the New Brunswick Seniors' Home Renovation Tax Credit.

Q: What is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The New Brunswick Seniors' Home Renovation Tax Credit is a tax credit provided by the government of New Brunswick, Canada. It allows seniors to claim a non-refundable tax credit for eligible home renovation expenses.

Q: Who is eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Seniors who are 65 years of age or older and who have incurred eligible home renovation expenses in relation to their principal residence in New Brunswick are eligible for the tax credit.

Q: What expenses are eligible for the New Brunswick Seniors' Home Renovation Tax Credit?

A: Eligible expenses include costs incurred for renovations and alterations that improve accessibility, mobility, or safety of the senior's principal residence in New Brunswick.

Q: How much is the New Brunswick Seniors' Home Renovation Tax Credit?

A: The tax credit is calculated as 10% of eligible expenses, up to a maximum credit amount of $10,000 per year.

Q: How do I claim the New Brunswick Seniors' Home Renovation Tax Credit?

A: To claim the tax credit, you need to complete Form 5004-S12 Schedule NB(S12) and include it with your Canadian income tax return.