This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5001-S11 Schedule NL(S11)

for the current year.

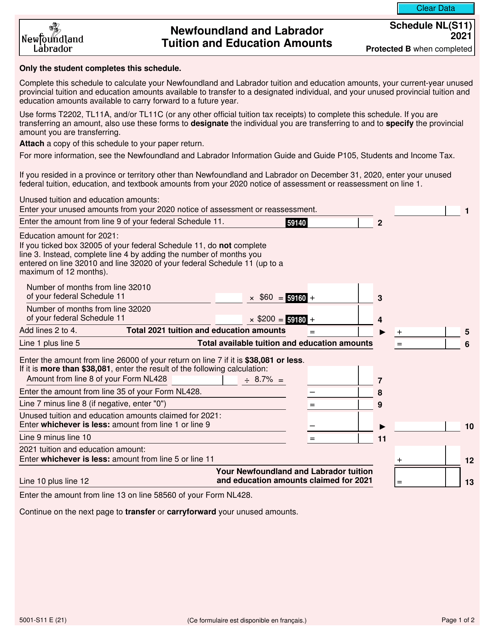

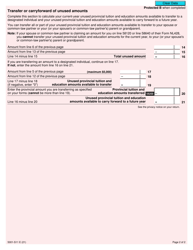

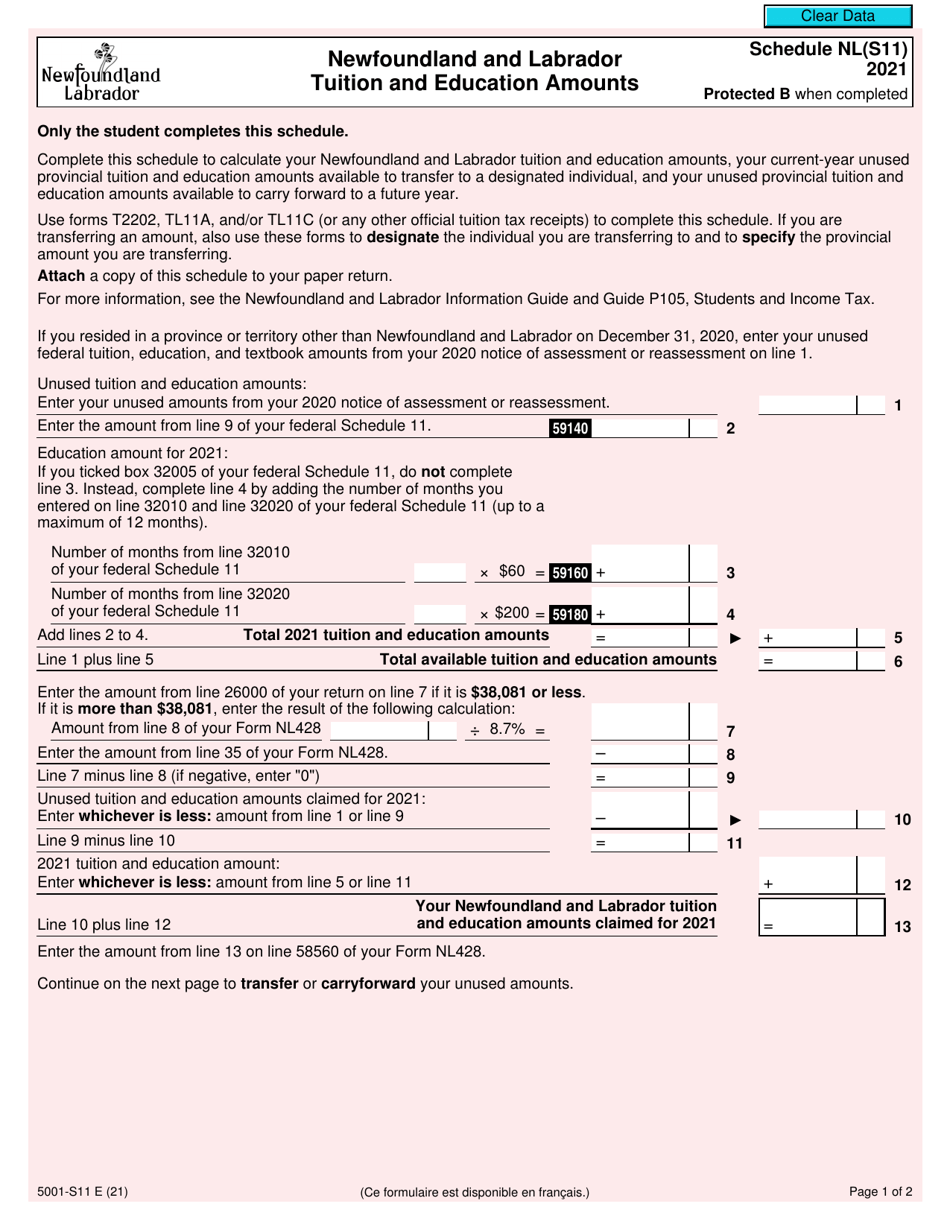

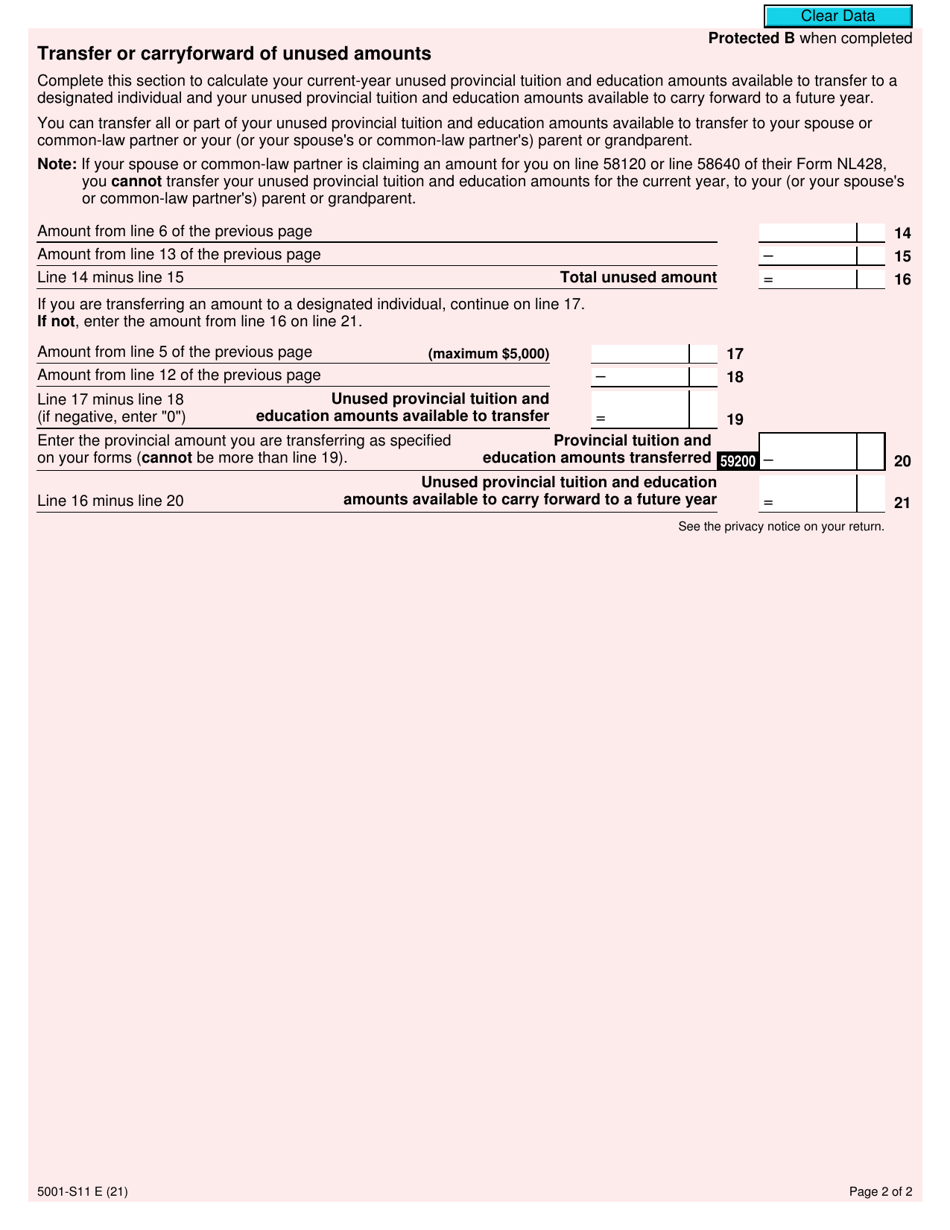

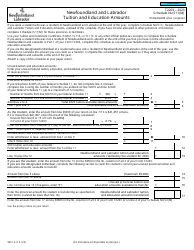

Form 5001-S11 Schedule NL(S11) Newfoundland and Labrador Tuition and Education Amounts - Canada

Form 5001-S11 Schedule NL(S11) is used in Canada for claiming tuition and education amounts for residents of Newfoundland and Labrador. It is a tax form that allows individuals to report and claim eligible education expenses for tax purposes.

The individual taxpayer who is a resident of Newfoundland and Labrador in Canada would file the Form 5001-S11 Schedule NL(S11) for tuition and education amounts.

FAQ

Q: What is Form 5001-S11?

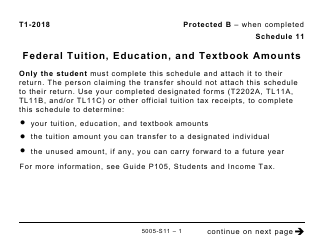

A: Form 5001-S11 is a tax form used in Canada specifically for Newfoundland and Labrador residents to claim tuition and education amounts.

Q: What is Schedule NL(S11)?

A: Schedule NL(S11) is a specific schedule within Form 5001-S11 that is used to calculate and claim tuition and education amounts for Newfoundland and Labrador residents.

Q: Who can use Form 5001-S11 Schedule NL(S11)?

A: Form 5001-S11 Schedule NL(S11) can be used by residents of Newfoundland and Labrador who are eligible to claim tuition and education amounts for tax purposes.

Q: What are tuition and education amounts?

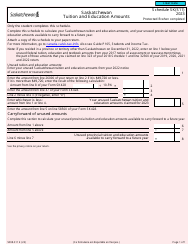

A: Tuition and education amounts are deductions that can be claimed on your taxes to reduce your taxable income. They are based on eligible education expenses incurred during the year.

Q: How do I use Form 5001-S11 Schedule NL(S11)?

A: You can use Form 5001-S11 Schedule NL(S11) by completing the necessary sections and entering the relevant information regarding your tuition and education expenses. The form provides instructions on how to calculate the amounts to claim.

Q: When is the deadline to submit Form 5001-S11 Schedule NL(S11)?

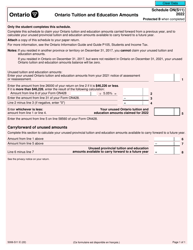

A: The deadline to submit Form 5001-S11 Schedule NL(S11) is the same as the deadline for filing your income tax return, which is typically April 30th of the following year for most individuals.

Q: Can I claim tuition and education amounts if I live outside of Newfoundland and Labrador?

A: No, Form 5001-S11 Schedule NL(S11) is specifically for Newfoundland and Labrador residents. Other provinces and territories in Canada have their own forms for claiming tuition and education amounts.