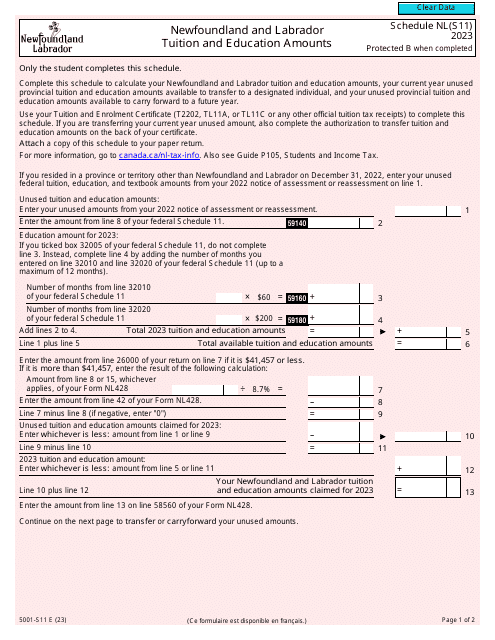

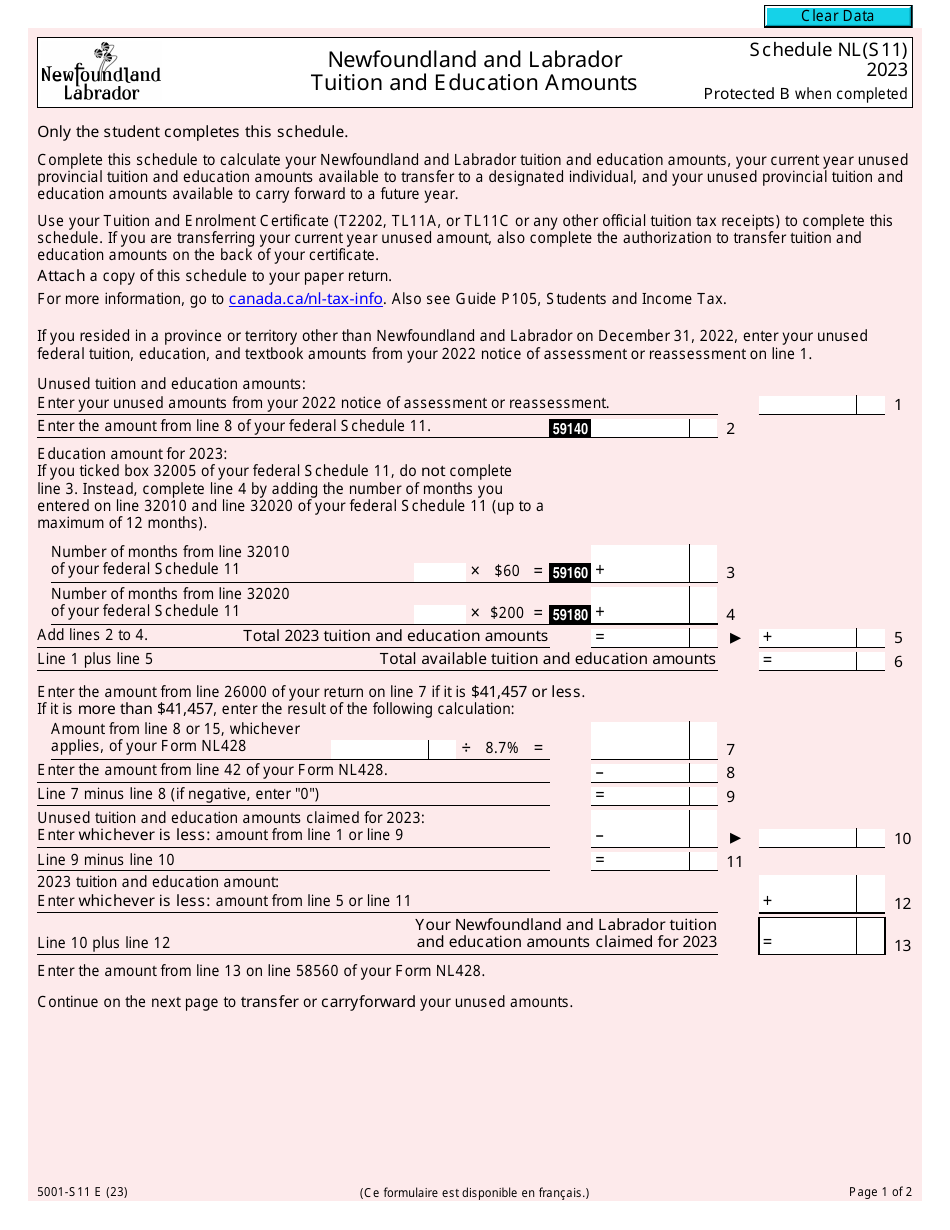

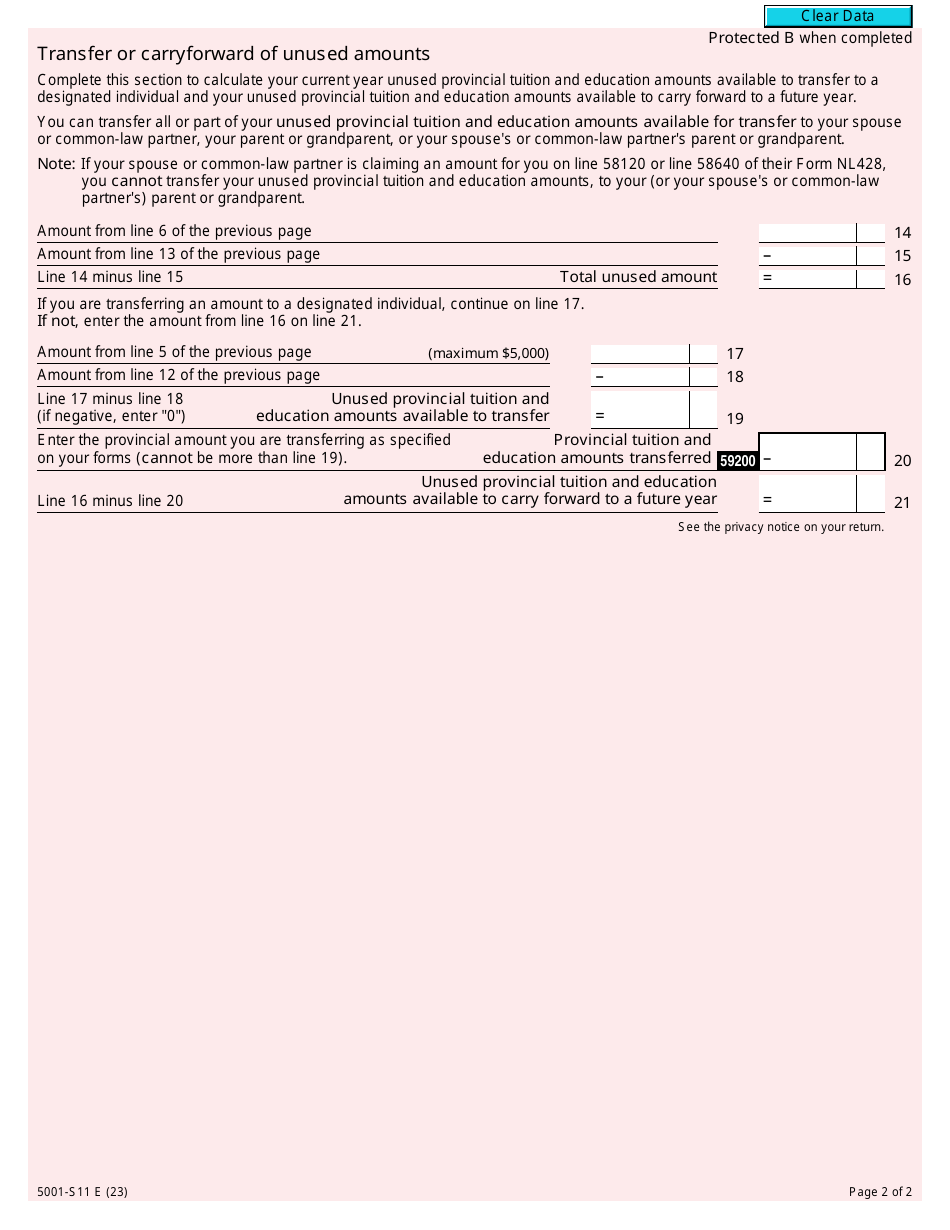

Form 5001-S11 Schedule NL(S11) Newfoundland and Labrador Tuition and Education Amounts - Canada

Form 5001-S11 Schedule NL(S11) is used in Canada specifically for the province of Newfoundland and Labrador to claim the Tuition and Education Amounts. It allows individuals to report and calculate the eligible expenses for education in order to claim deductions or credits on their tax returns.

The individual taxpayer or the student files the Form 5001-S11 Schedule NL(S11) for claiming tuition and education amounts in the province of Newfoundland and Labrador, Canada.

Form 5001-S11 Schedule NL(S11) Newfoundland and Labrador Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5001-S11 Schedule NL(S11)?

A: Form 5001-S11 Schedule NL(S11) is a tax form used in Canada to claim tuition and education amounts specifically for residents of Newfoundland and Labrador.

Q: What are tuition and education amounts?

A: Tuition and education amounts refer to the expenses incurred for post-secondary education, such as tuition fees, textbooks, and other eligible educational costs.

Q: Who can use Form 5001-S11 Schedule NL(S11)?

A: Residents of Newfoundland and Labrador who have eligible tuition and education expenses can use this form to claim the related tax benefits.

Q: What is the purpose of Form 5001-S11 Schedule NL(S11)?

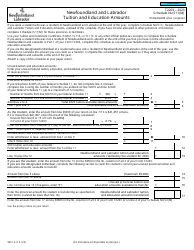

A: The purpose of this form is to calculate and report the amount of tuition and education expenses that can be claimed for tax benefits in Newfoundland and Labrador.

Q: How do I fill out Form 5001-S11 Schedule NL(S11)?

A: To fill out the form, you need to provide details about your eligible tuition and education expenses, as well as any applicable carry-forward amounts from previous years.

Q: When is the deadline to submit Form 5001-S11 Schedule NL(S11)?

A: The deadline to submit this form is usually April 30th of the following year, along with your personal income tax return for that year.

Q: What documents do I need to support my claim on Form 5001-S11 Schedule NL(S11)?

A: You should keep supporting documents, such as receipts and a copy of your tuition tax certificate, to substantiate your claim. However, you do not need to submit these documents with your tax return unless requested by the CRA.

Q: Can I still claim tuition and education amounts if I don't complete Form 5001-S11 Schedule NL(S11)?

A: No, you must complete this form in order to claim tuition and education amounts specifically for residents of Newfoundland and Labrador.

Q: What other tax forms may I need related to tuition and education amounts?

A: In addition to Form 5001-S11 Schedule NL(S11), you may also need to fill out Form T2202A, Tuition and Enrolment Certificate, provided by your educational institution.