This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5013-SA Schedule A

for the current year.

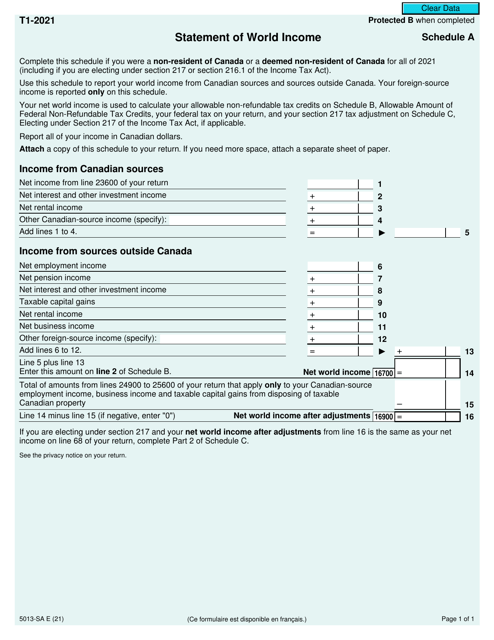

Form 5013-SA Schedule A Statement of World Income - Canada

Form 5013-SA, also known as Schedule A - Statement of World Income, is a document used by the Canada Revenue Agency (CRA) for individuals who are residents of Canada but have income from other countries. This form is used to report and declare the income earned outside of Canada, such as foreign employment income, foreign business income, foreign rental income, etc. It helps the CRA determine the taxpayer's global income and ensure proper taxation of both domestic and international earnings.

In Canada, the Form 5013-SA Schedule A Statement of World Income is not filed by individuals. This form is specifically used by Canadian corporations to report income earned outside of Canada. Individuals in Canada generally do not have to report their world income on this form.

FAQ

Q: What is Form 5013-SA Schedule A Statement of World Income?

A: Form 5013-SA Schedule A Statement of World Income is a Canadian tax form used to report income earned outside of Canada.

Q: Who needs to file Form 5013-SA Schedule A?

A: Individuals who are tax residents of Canada and have earned income outside of Canada need to file Form 5013-SA Schedule A.

Q: What types of income should be reported on Form 5013-SA Schedule A?

A: You should report income from employment, self-employment, investments, rental properties, and any other sources of income earned outside of Canada.

Q: Do I need to file Form 5013-SA Schedule A if I have already paid taxes on the foreign income?

A: Yes, even if you have already paid taxes on the foreign income, you still need to report it on Form 5013-SA Schedule A.

Q: Is there a deadline for filing Form 5013-SA Schedule A?

A: The deadline for filing Form 5013-SA Schedule A is the same as the deadline for filing your Canadian income tax return, which is generally April 30th of the following year.