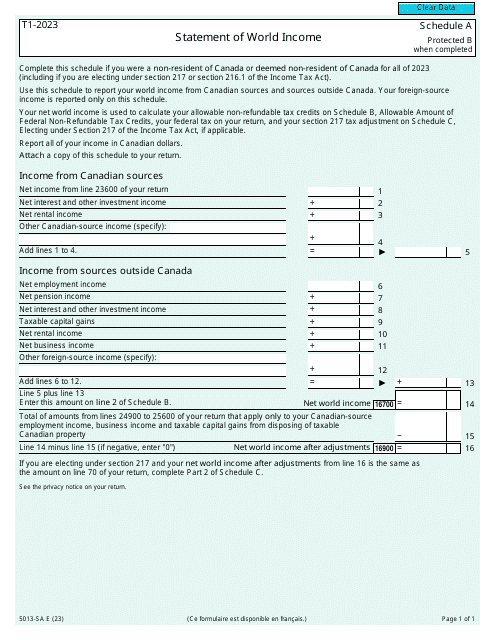

Form 5013-SA Schedule A Statement of World Income - Canada

Form 5013-SA Schedule A Statement of World Income - Canada is used to report income earned from worldwide sources by Canadian residents.

Form 5013-SA Schedule A Statement of World Income - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5013-SA?

A: Form 5013-SA is used by residents of Canada to report their worldwide income for tax purposes.

Q: Who needs to file Form 5013-SA?

A: Canadian residents who have income from sources outside of Canada.

Q: What is Schedule A?

A: Schedule A is a part of Form 5013-SA where the taxpayer lists their foreign income by country.

Q: What is considered as world income?

A: World income includes income from employment, self-employment, investments, rental properties, and any other sources outside of Canada.

Q: Do I need to report foreign income in Canada?

A: Yes, as a resident of Canada, you are required to report your worldwide income.

Q: What happens if I don't report my foreign income?

A: Failing to report your foreign income can result in penalties and consequences from the Canada Revenue Agency (CRA).

Q: Are there any exemptions or deductions for foreign income?

A: Yes, there may be exemptions or deductions available for certain types of foreign income. It is best to consult with a tax professional or refer to the CRA guidelines for specific details.

Q: What supporting documents do I need to attach with Form 5013-SA?

A: You may need to provide documents such as foreign tax statements, rental agreements, investment statements, and any other relevant documents to support your reported foreign income.

Q: Can I e-file Form 5013-SA?

A: No, Form 5013-SA and its Schedule A cannot be e-filed and must be submitted by mail to the CRA.

Q: When is the deadline for filing Form 5013-SA?

A: The deadline for filing Form 5013-SA is typically the same as the regular tax filing deadline in Canada, which is April 30th for most individuals.