This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5012-S11 Schedule NT(S11)

for the current year.

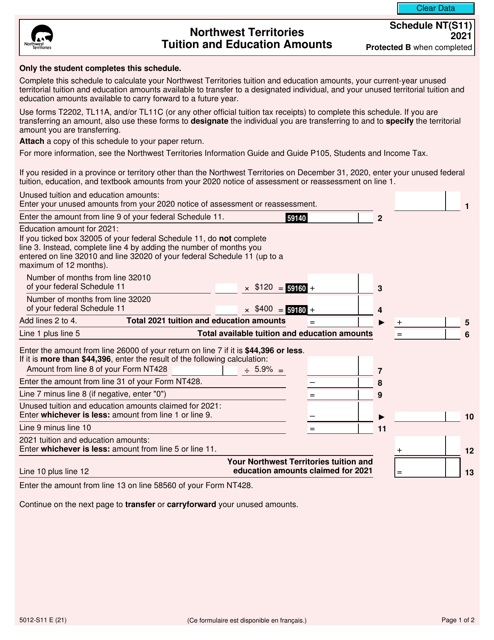

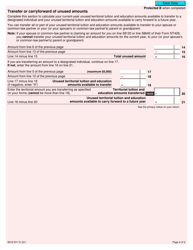

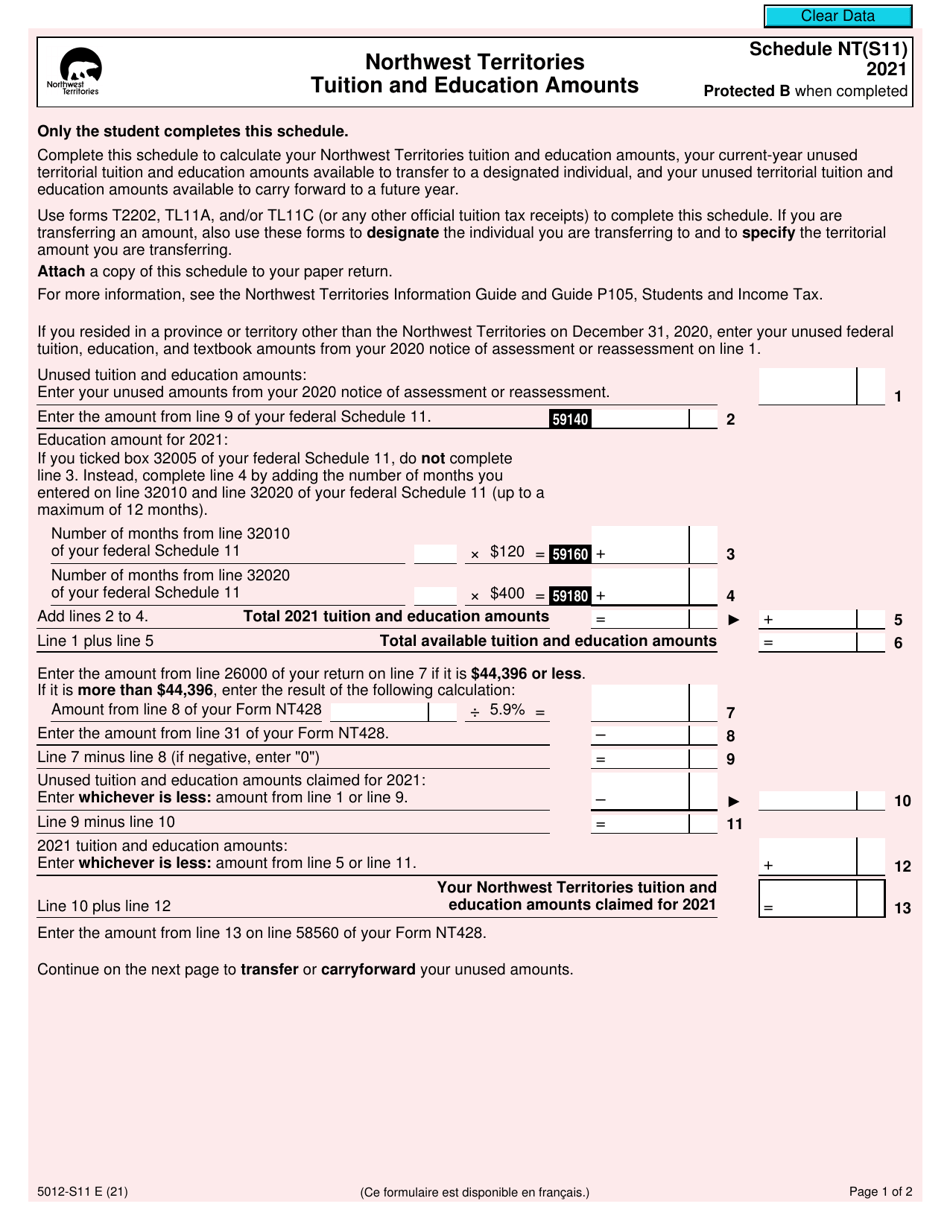

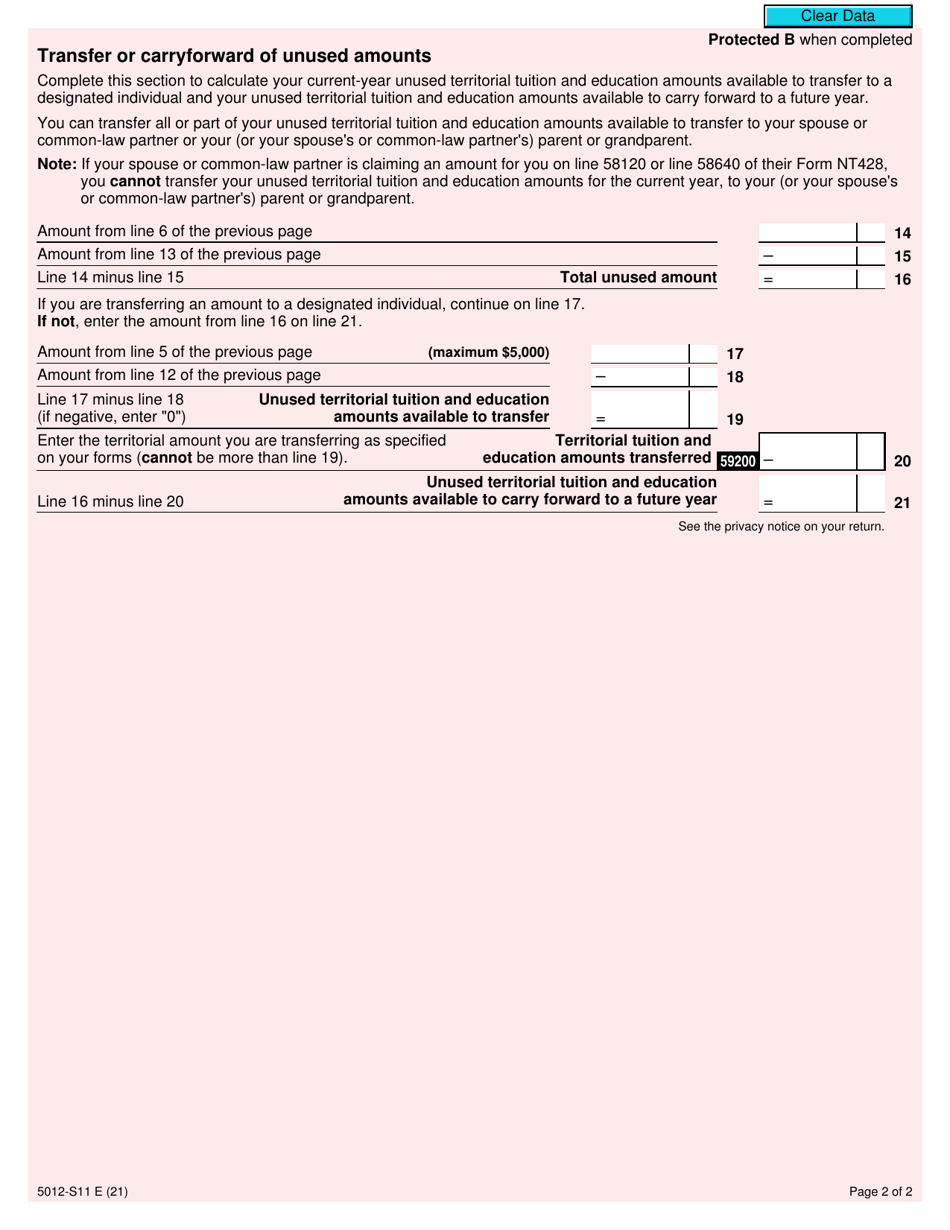

Form 5012-S11 Schedule NT(S11) Northwest Territories Tuition and Education Amounts - Canada

Form 5012-S11 Schedule NT(S11) Northwest Territories Tuition and Education Amounts is used in Canada to claim tuition and education amounts specific to the Northwest Territories. It allows residents of the Northwest Territories to claim tax credits for eligible education expenses.

The Form 5012-S11 Schedule NT(S11) is filed by residents of the Northwest Territories in Canada who are claiming tuition and education amounts.

FAQ

Q: What is Form 5012-S11 Schedule NT(S11)?

A: Form 5012-S11 Schedule NT(S11) is a tax form specific to residents of the Northwest Territories in Canada. It is used to claim tuition and education amounts for federal and Northwest Territories purposes.

Q: Who is eligible to use Form 5012-S11 Schedule NT(S11)?

A: Residents of the Northwest Territories in Canada who have paid tuition fees and educational expenses can use Form 5012-S11 Schedule NT(S11) to claim related tax credits.

Q: What can I claim on Form 5012-S11 Schedule NT(S11)?

A: On this form, you can claim eligible tuition fees, education amounts, and the Northwest Territories education tax credit.

Q: How do I fill out Form 5012-S11 Schedule NT(S11)?

A: You will need to enter your personal information, including your name, social insurance number, and address. You must also provide details about your educational institution, tuition fees paid, and any education amounts received.

Q: Is there a deadline for filing Form 5012-S11 Schedule NT(S11)?

A: Yes, the deadline for filing Form 5012-S11 Schedule NT(S11) is typically April 30th of the following tax year. However, deadlines may vary, so it is important to check with the CRA for the most up-to-date information.

Q: Can I claim tuition and education amounts for previous years on Form 5012-S11 Schedule NT(S11)?

A: No, Form 5012-S11 Schedule NT(S11) can only be used to claim tuition and education amounts for the current tax year.

Q: What supporting documents do I need to include with Form 5012-S11 Schedule NT(S11)?

A: You should keep any official receipts or documents that support your claims for tuition fees and education amounts, but you do not need to submit them with your tax return. However, the CRA may request these documents for verification purposes at a later date.

Q: Can I claim both federal and Northwest Territories tax credits on Form 5012-S11 Schedule NT(S11)?

A: Yes, Form 5012-S11 Schedule NT(S11) allows you to claim both federal and Northwest Territories tax credits for tuition and education amounts.