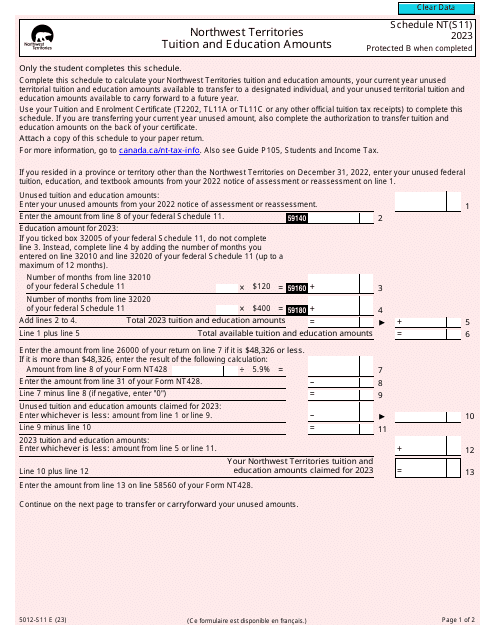

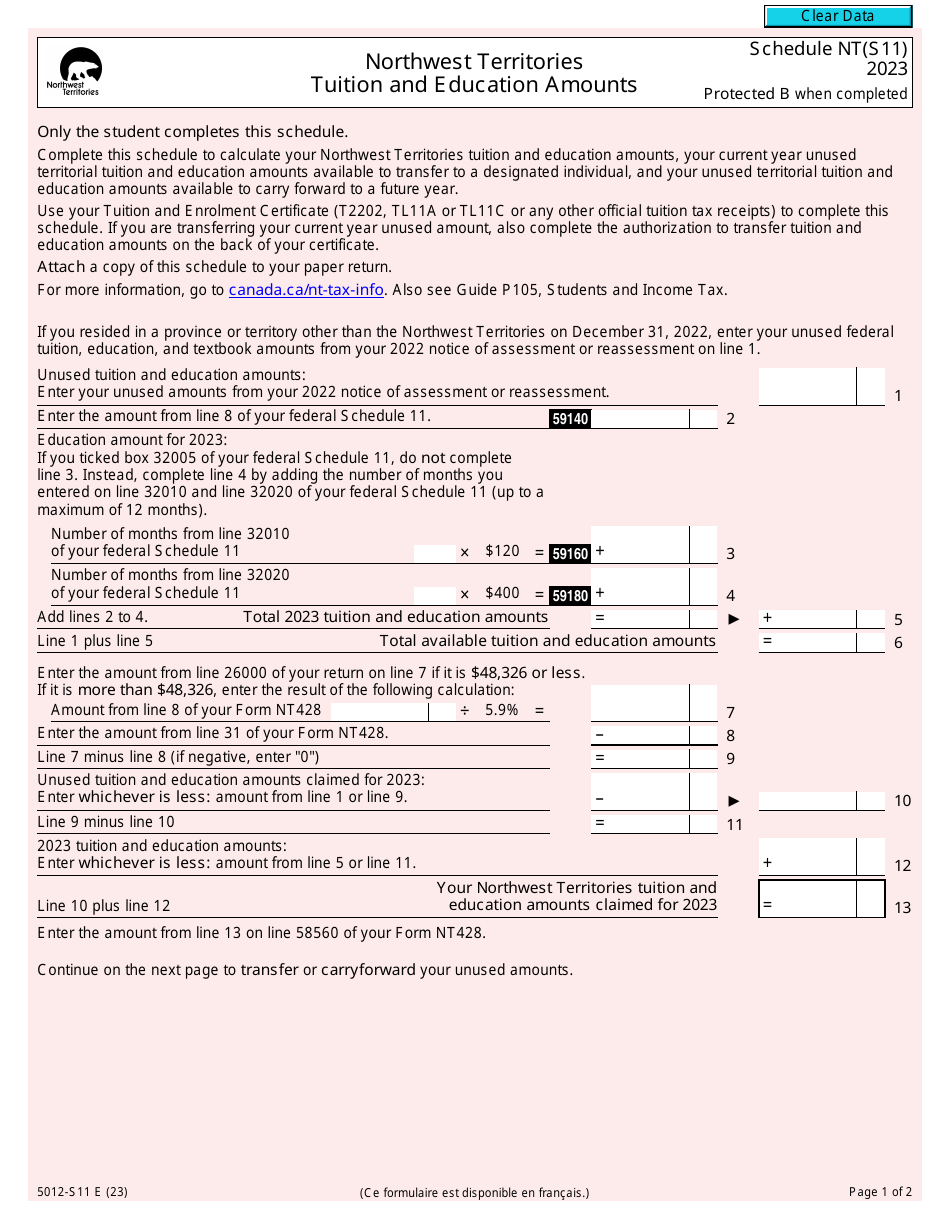

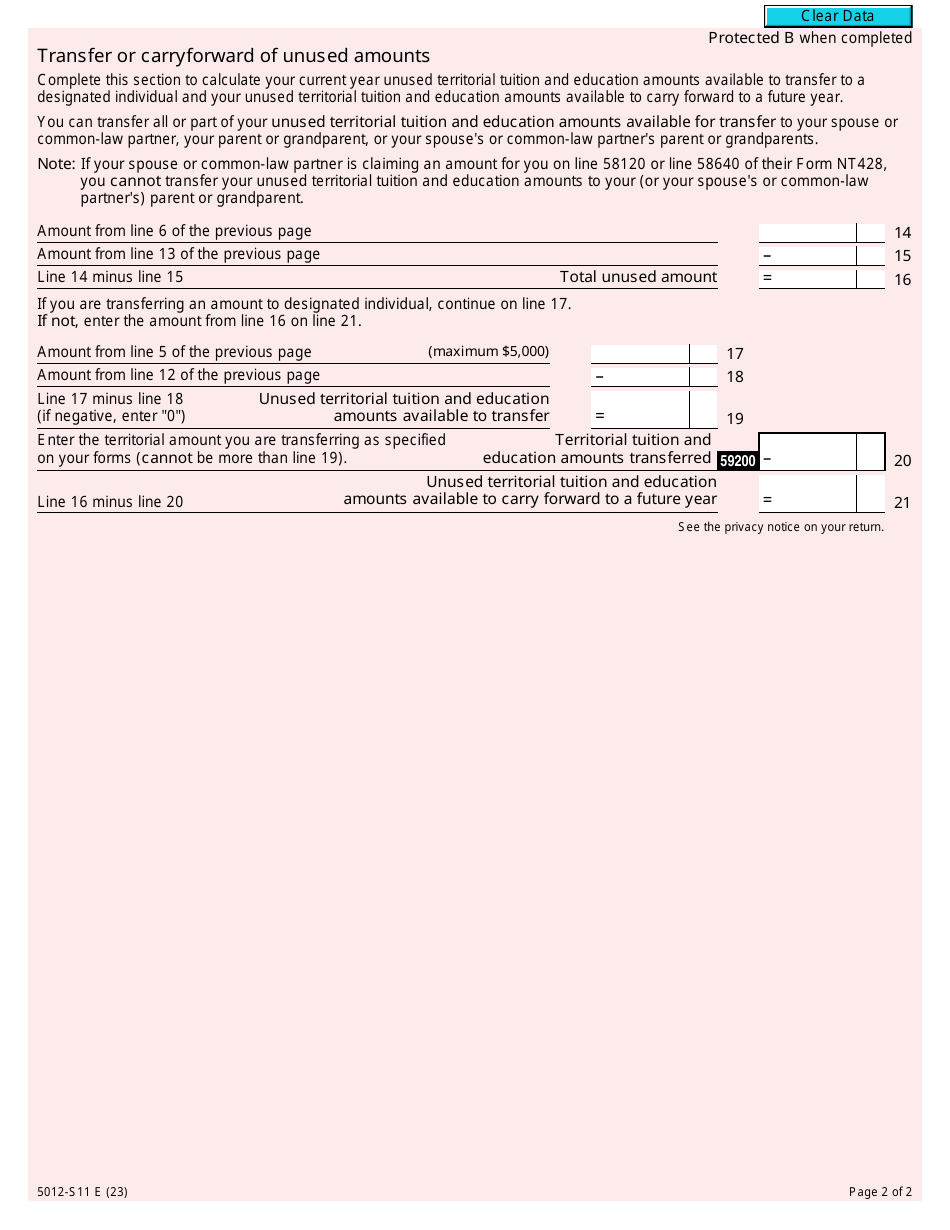

Form 5012-S11 Schedule NT(S11) Northwest Territories Tuition and Education Amounts - Canada

Form 5012-S11 Schedule NT(S11) in Canada is used to claim the tuition and education amounts for residents of Northwest Territories.

The student or their spouse/common-law partner files Form 5012-S11 Schedule NT(S11) for claiming tuition and education amounts in the Northwest Territories, Canada.

Form 5012-S11 Schedule NT(S11) Northwest Territories Tuition and Education Amounts - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5012-S11 Schedule NT(S11)?

A: Form 5012-S11 Schedule NT(S11) is a tax form used in Canada to claim tuition and education amounts in the Northwest Territories.

Q: Who is eligible to use Form 5012-S11 Schedule NT(S11)?

A: Residents of the Northwest Territories in Canada who are enrolled in a post-secondary educational program are eligible to use this form.

Q: What can I claim using Form 5012-S11 Schedule NT(S11)?

A: You can claim eligible tuition and education amounts that you have paid for yourself or for a dependant.

Q: How do I fill out Form 5012-S11 Schedule NT(S11)?

A: You need to provide your personal information, details of the educational institution, and the amounts paid. Refer to the instructions provided with the form for detailed guidance.

Q: When is the deadline to file Form 5012-S11 Schedule NT(S11)?

A: The deadline to file this form is the same as the deadline for filing your income tax return, which is generally April 30th of the following year.