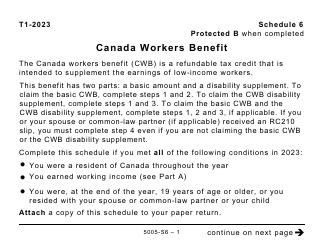

This version of the form is not currently in use and is provided for reference only. Download this version of

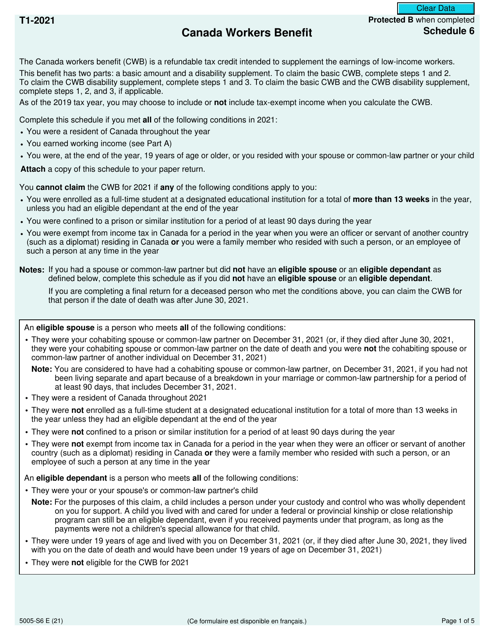

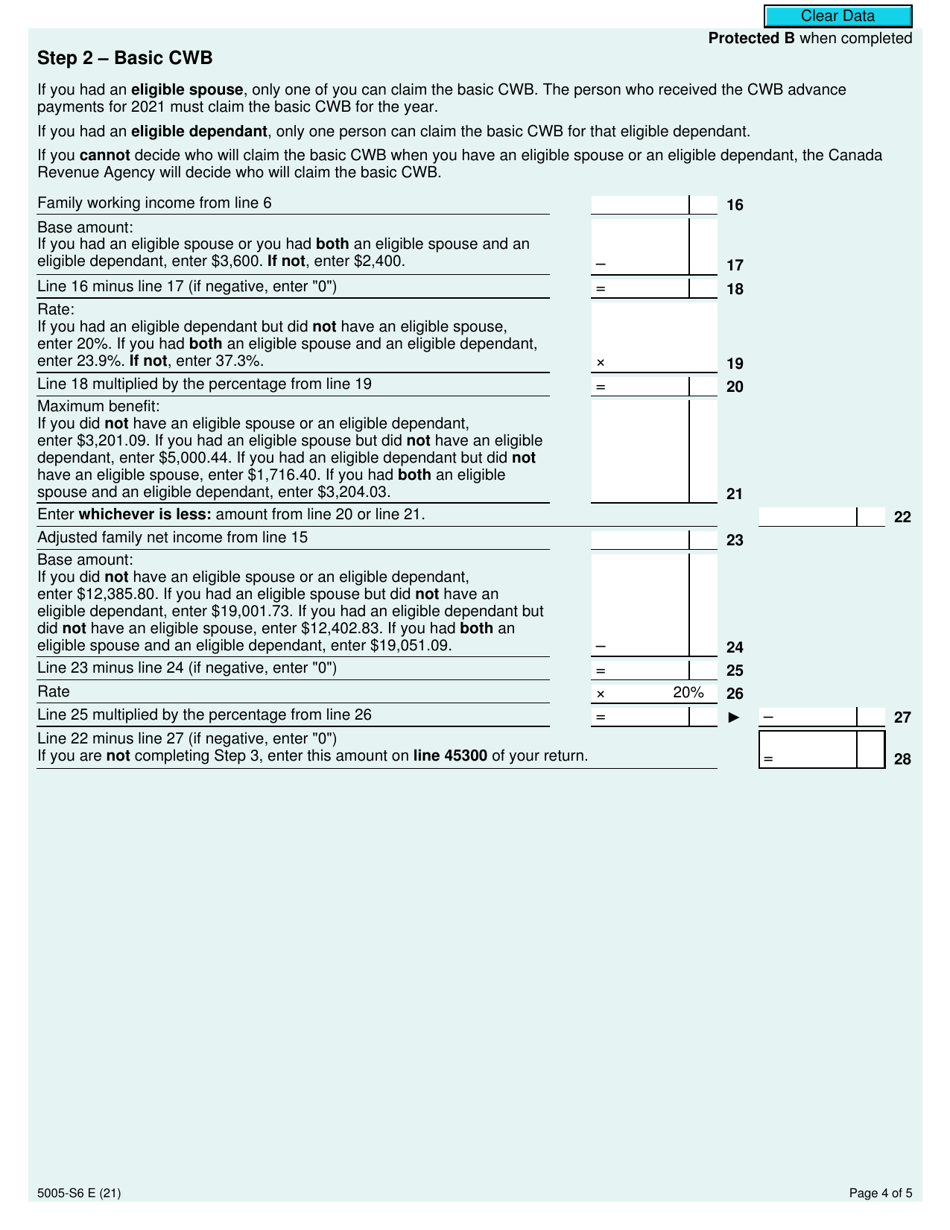

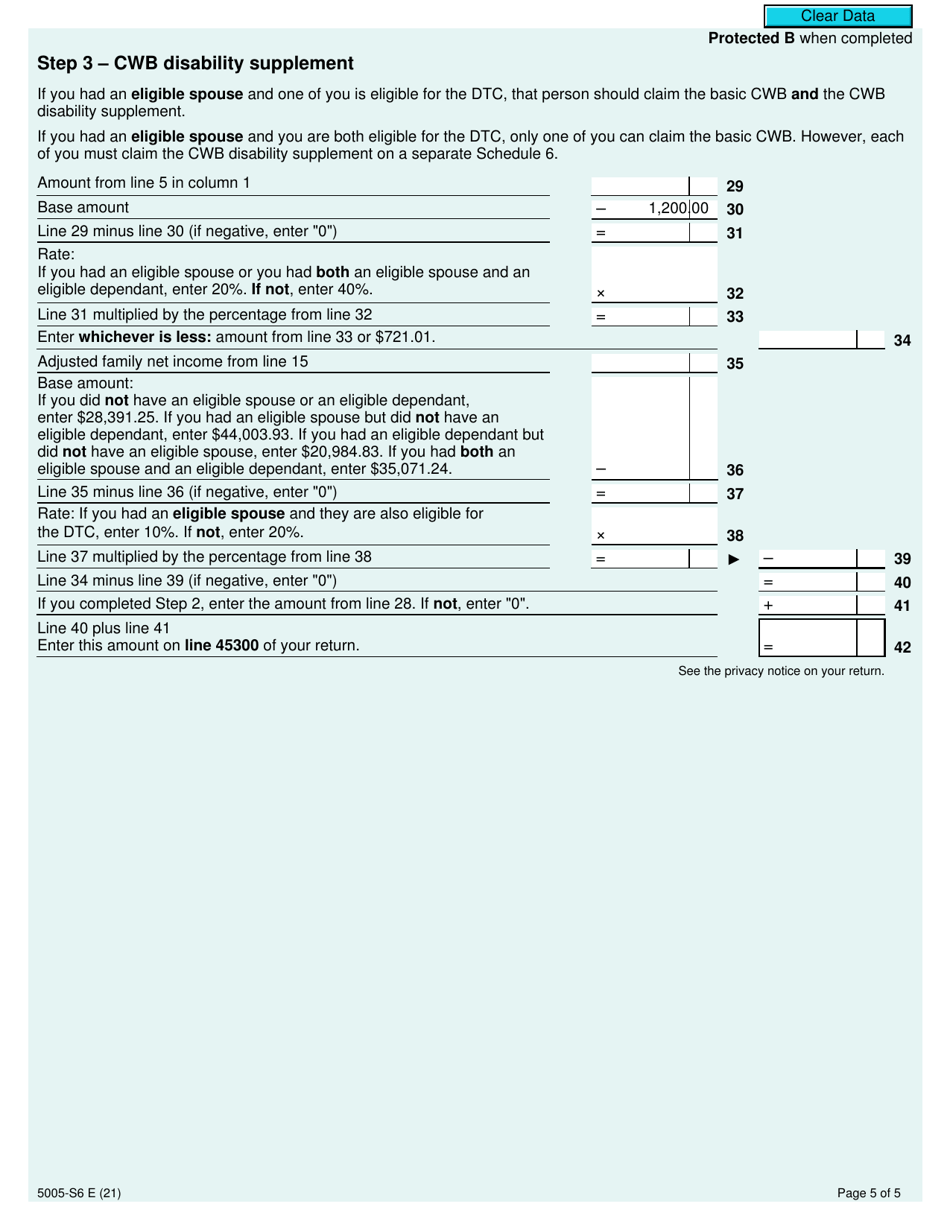

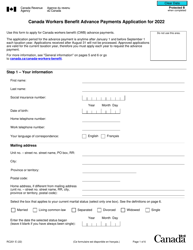

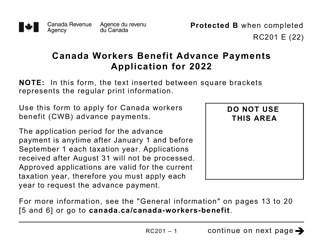

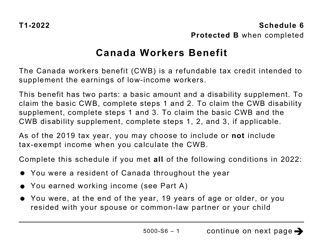

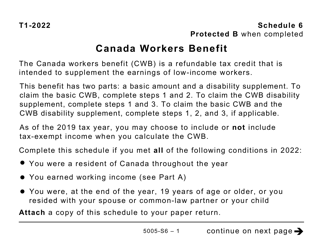

Form 5005-S6 Schedule 6

for the current year.

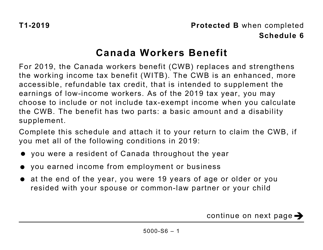

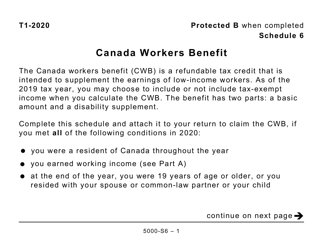

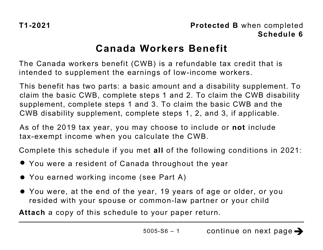

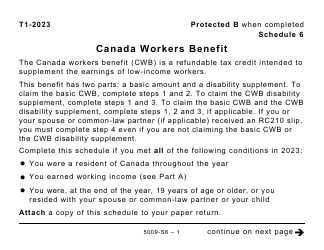

Form 5005-S6 Schedule 6 Canada Workers Benefit (For Qc Only) - Canada

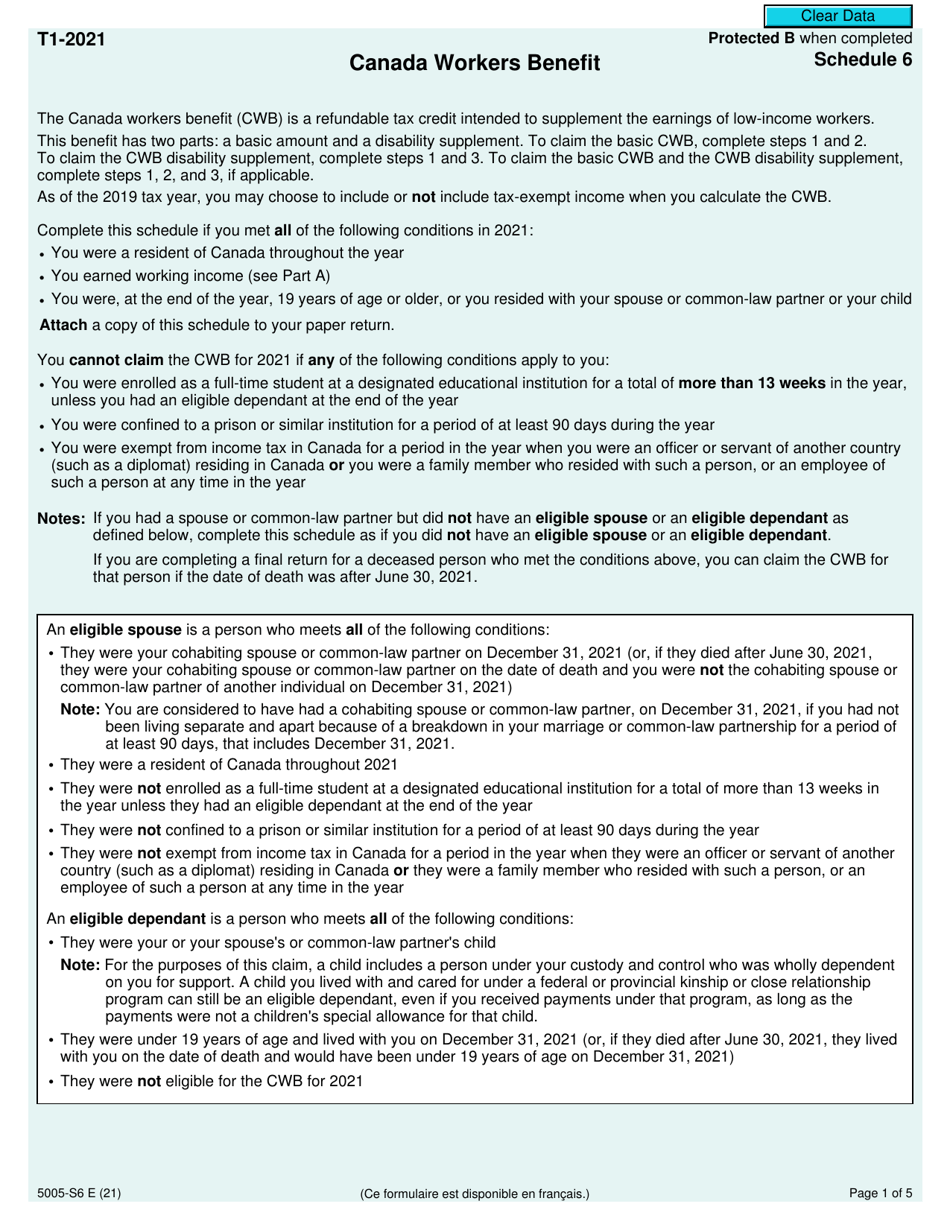

Form 5005-S6 Schedule 6 Canada Workers Benefit (For Qc Only) - Canada is used to claim the Canada Workers Benefit (CWB) for residents of Quebec. The CWB is a tax credit program designed to provide financial assistance to low-income workers in Canada.

The form 5005-S6 Schedule 6 Canada Workers Benefit (For Qc Only) is filed by individuals residing in Quebec, Canada.

FAQ

Q: What is Form 5005-S6?

A: Form 5005-S6 is a schedule used for claiming the Canada Workers Benefit specifically for residents of Quebec.

Q: What is the Canada Workers Benefit?

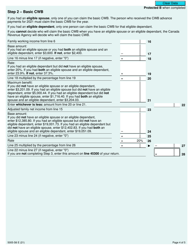

A: The Canada Workers Benefit is a refundable tax credit provided by the Canadian government to low-income individuals and families who are working.

Q: Who can use Form 5005-S6?

A: Residents of Quebec who are eligible for the Canada Workers Benefit can use this form.

Q: What is Schedule 6?

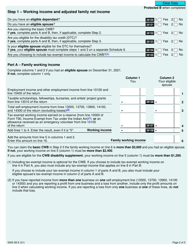

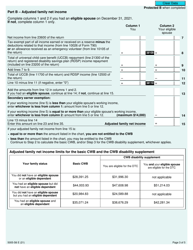

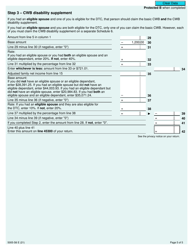

A: Schedule 6 is a form used to calculate the amount of the Canada Workers Benefit that an individual or family is eligible for.

Q: Is Form 5005-S6 only for residents of Quebec?

A: Yes, Form 5005-S6 is specifically for residents of Quebec.

Q: Do I need to file Form 5005-S6 every year?

A: Yes, if you are eligible for the Canada Workers Benefit and a resident of Quebec, you will need to file Form 5005-S6 each year to claim the credit.

Q: What information do I need to complete Form 5005-S6?

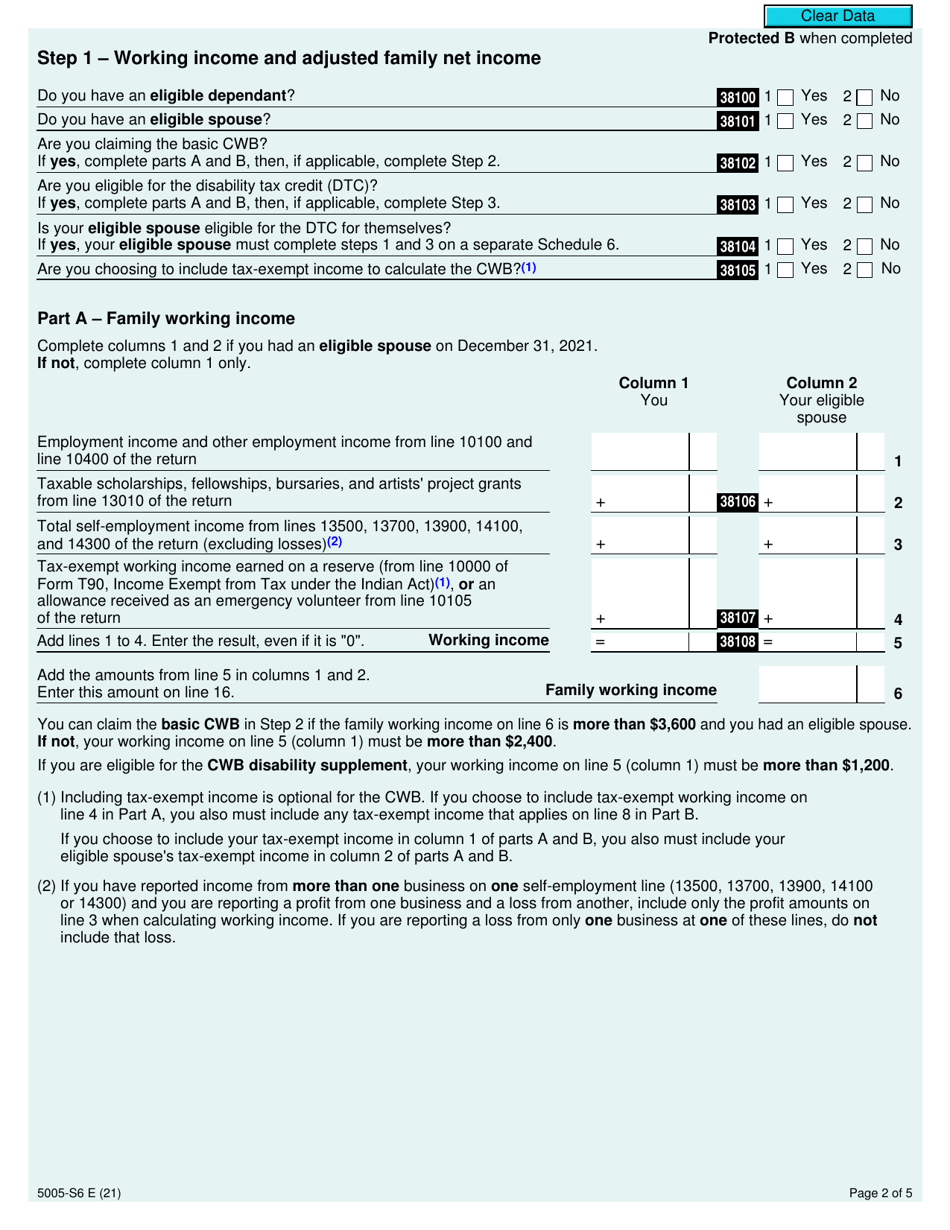

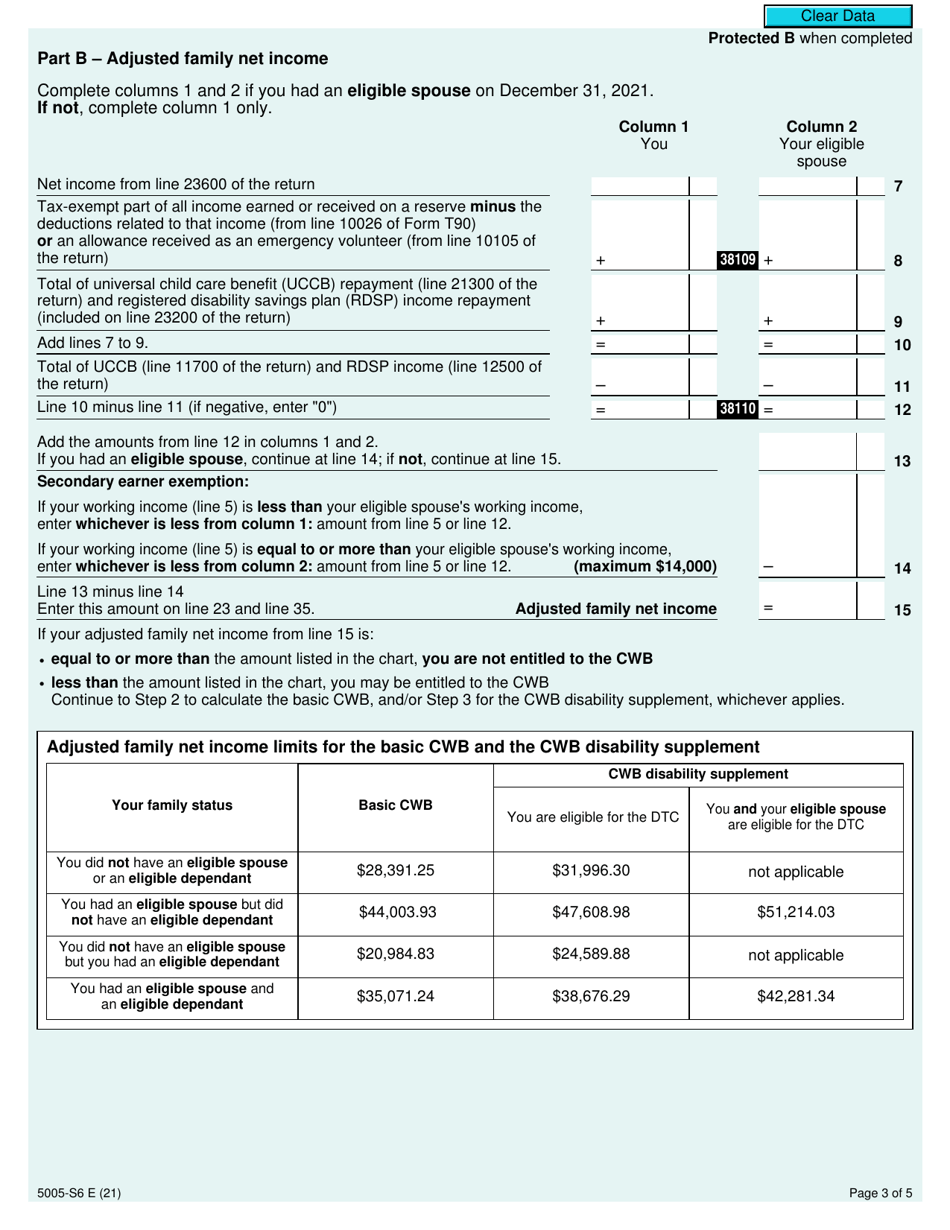

A: To complete Form 5005-S6, you will need information about your employment income, social benefits, and other relevant details. The form will guide you through the necessary steps.

Q: Can I claim the Canada Workers Benefit if I am not a resident of Quebec?

A: No, this schedule is only for residents of Quebec. Residents of other provinces or territories should refer to the appropriate schedule for their region.

Q: How much is the Canada Workers Benefit?

A: The amount of the Canada Workers Benefit varies depending on your income level, family size, and other factors. The CRA will calculate your eligibility based on the information provided on Form 5005-S6.