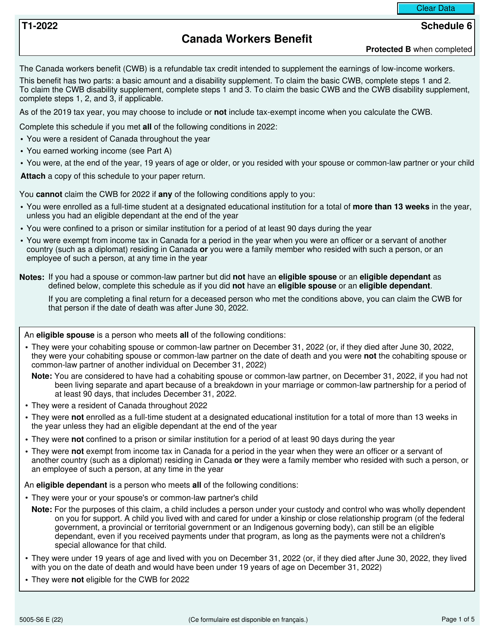

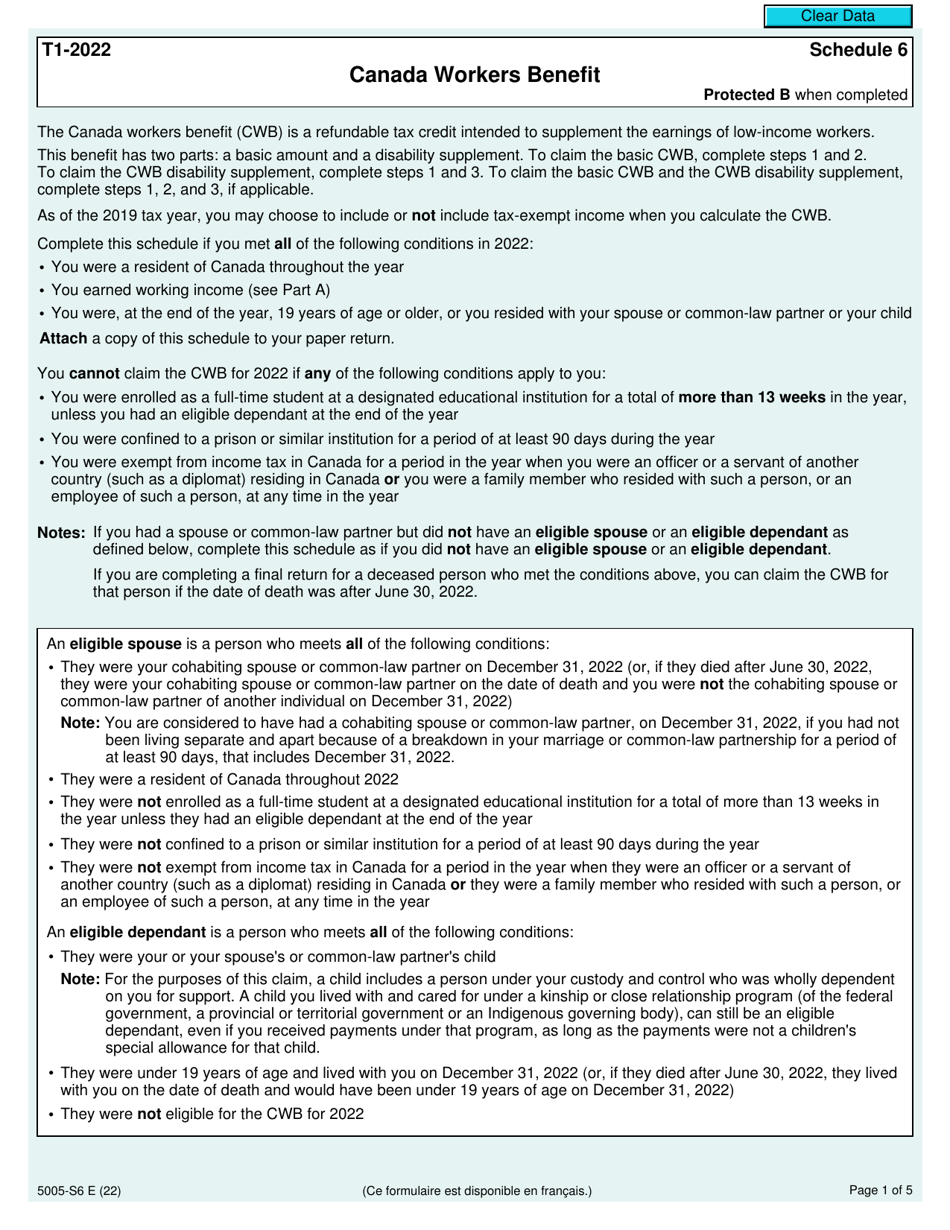

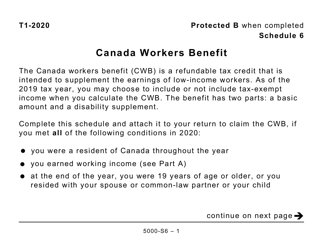

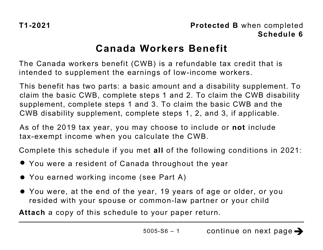

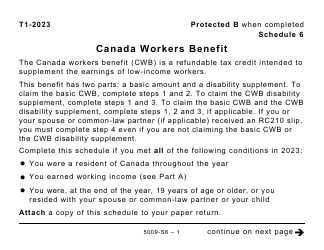

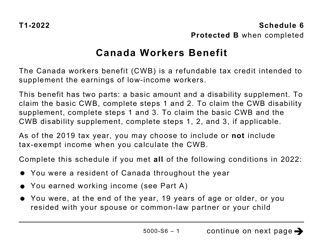

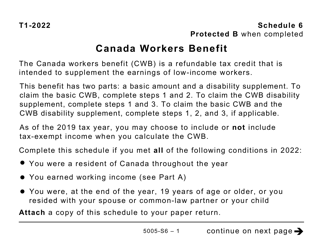

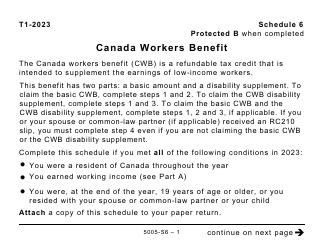

Form 5005-S6 Schedule 6 Canada Workers Benefit - Canada

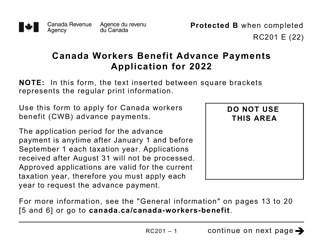

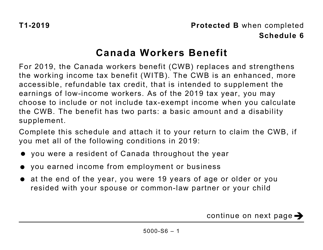

Form 5005-S6 Schedule 6 - Canada Workers Benefit is used to determine if individuals are eligible for the Canada Workers Benefit tax credit. This credit provides financial assistance to low-income individuals and families who are working but earning a low income. It helps to reduce the amount of income tax owed and may also result in a refund.

Individuals who qualify for the Canada Workers Benefit in Canada will need to file the Form 5005-S6 Schedule 6.

Form 5005-S6 Schedule 6 Canada Workers Benefit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5005-S6?

A: Form 5005-S6 is the schedule used for the Canada Workers Benefit (CWB) in Canada.

Q: What is the Canada Workers Benefit?

A: The Canada Workers Benefit (CWB) is a refundable tax credit designed to help low-income individuals and families with employment earnings.

Q: Who is eligible for the Canada Workers Benefit?

A: To be eligible for the Canada Workers Benefit, you must be a resident of Canada, have employment income, and meet certain income thresholds.

Q: What is the purpose of Schedule 6?

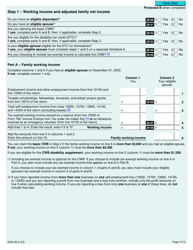

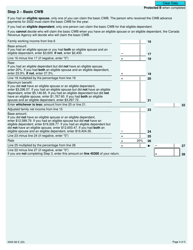

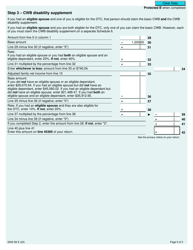

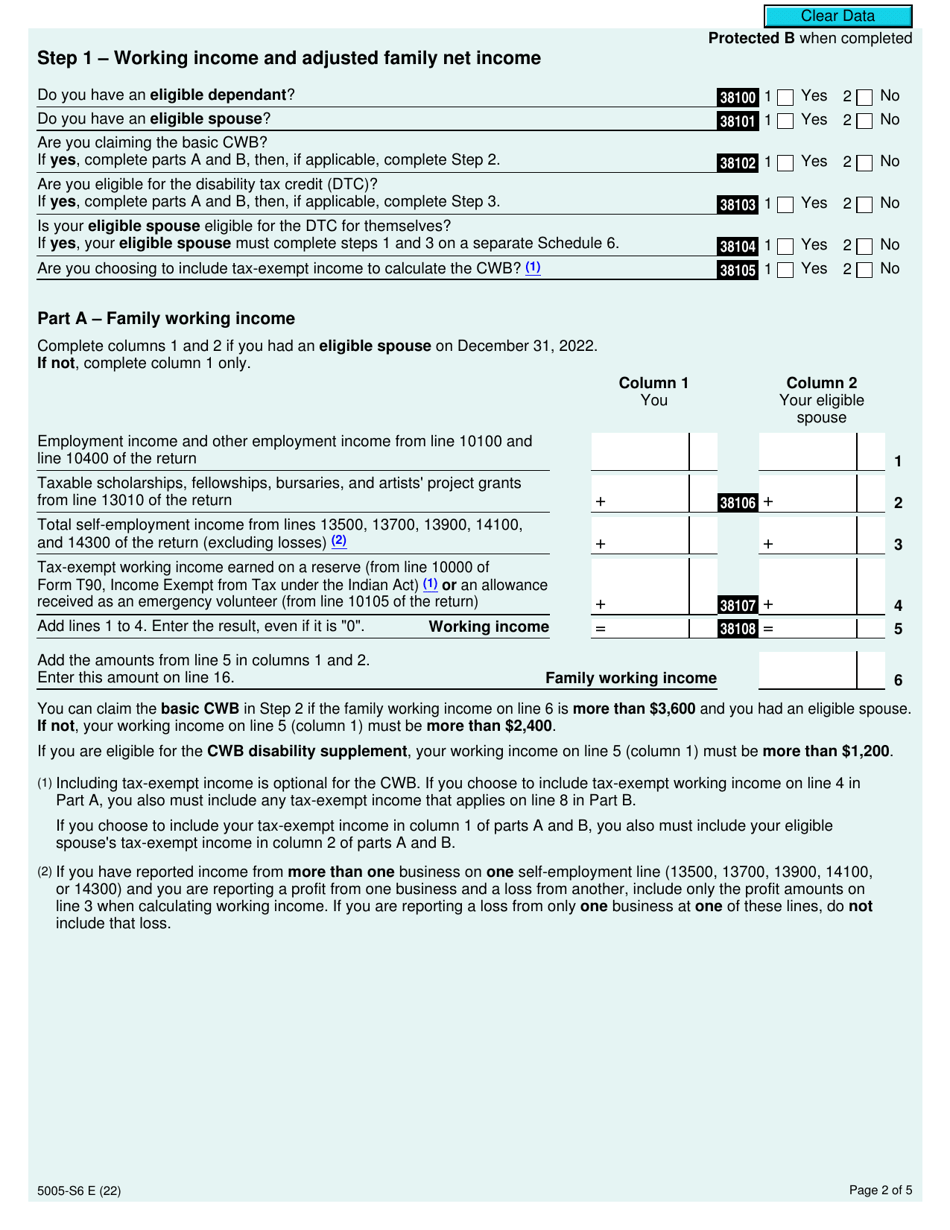

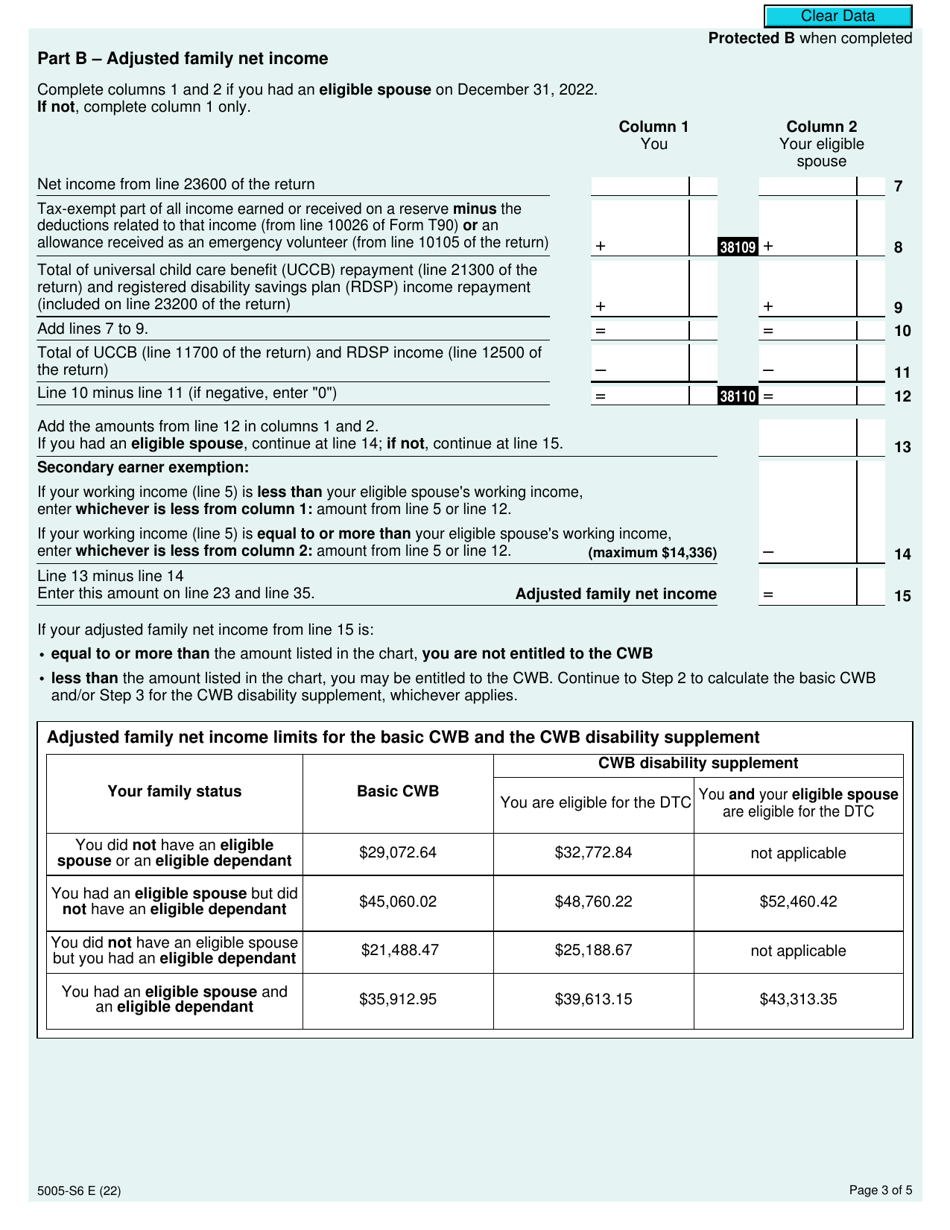

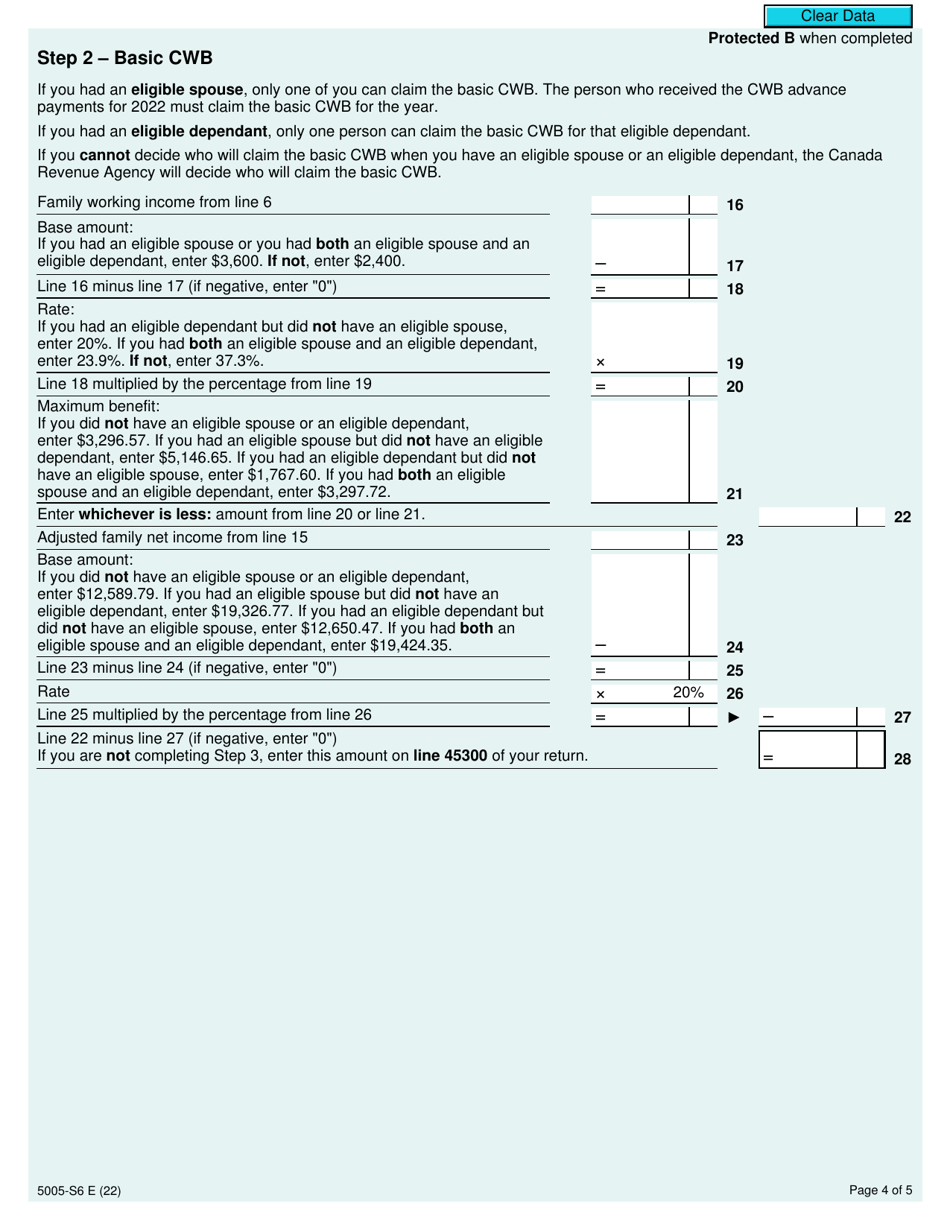

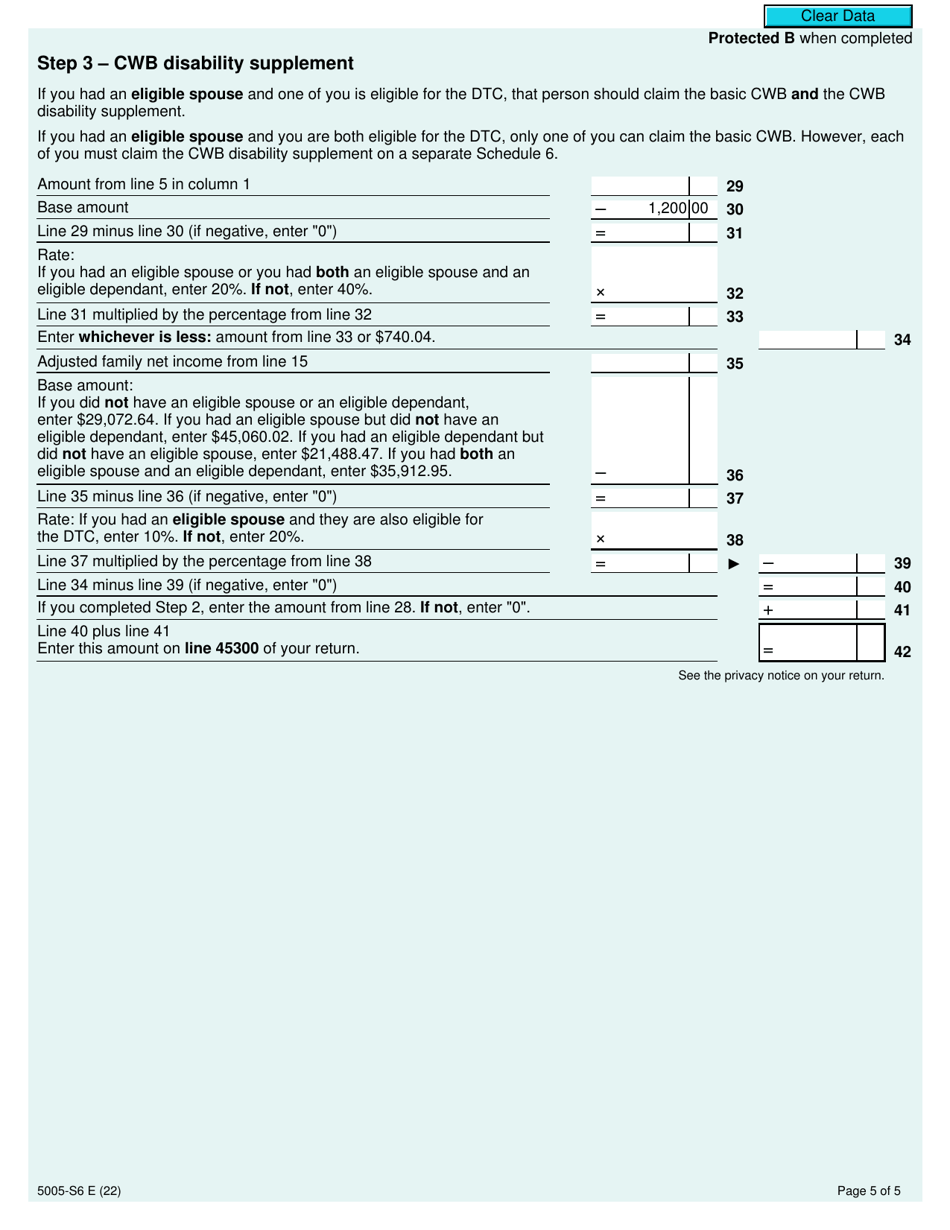

A: Schedule 6 is used to calculate the Canada Workers Benefit, including determining the amount of the benefit and any reduction based on income.

Q: How do I fill out Form 5005-S6?

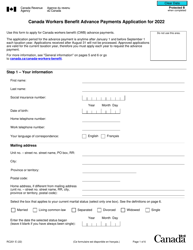

A: To fill out Form 5005-S6, you will need to enter your personal information, employment income details, and calculate various amounts based on the provided instructions.