This version of the form is not currently in use and is provided for reference only. Download this version of

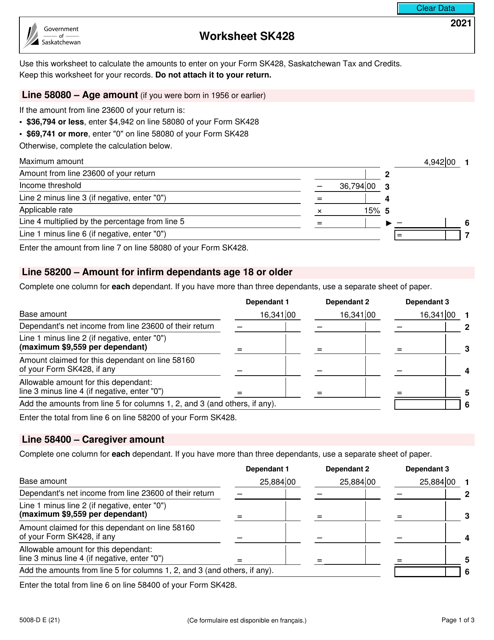

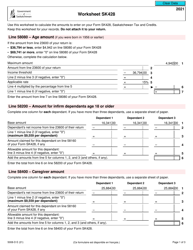

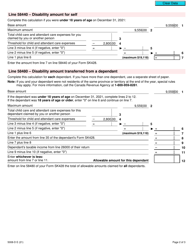

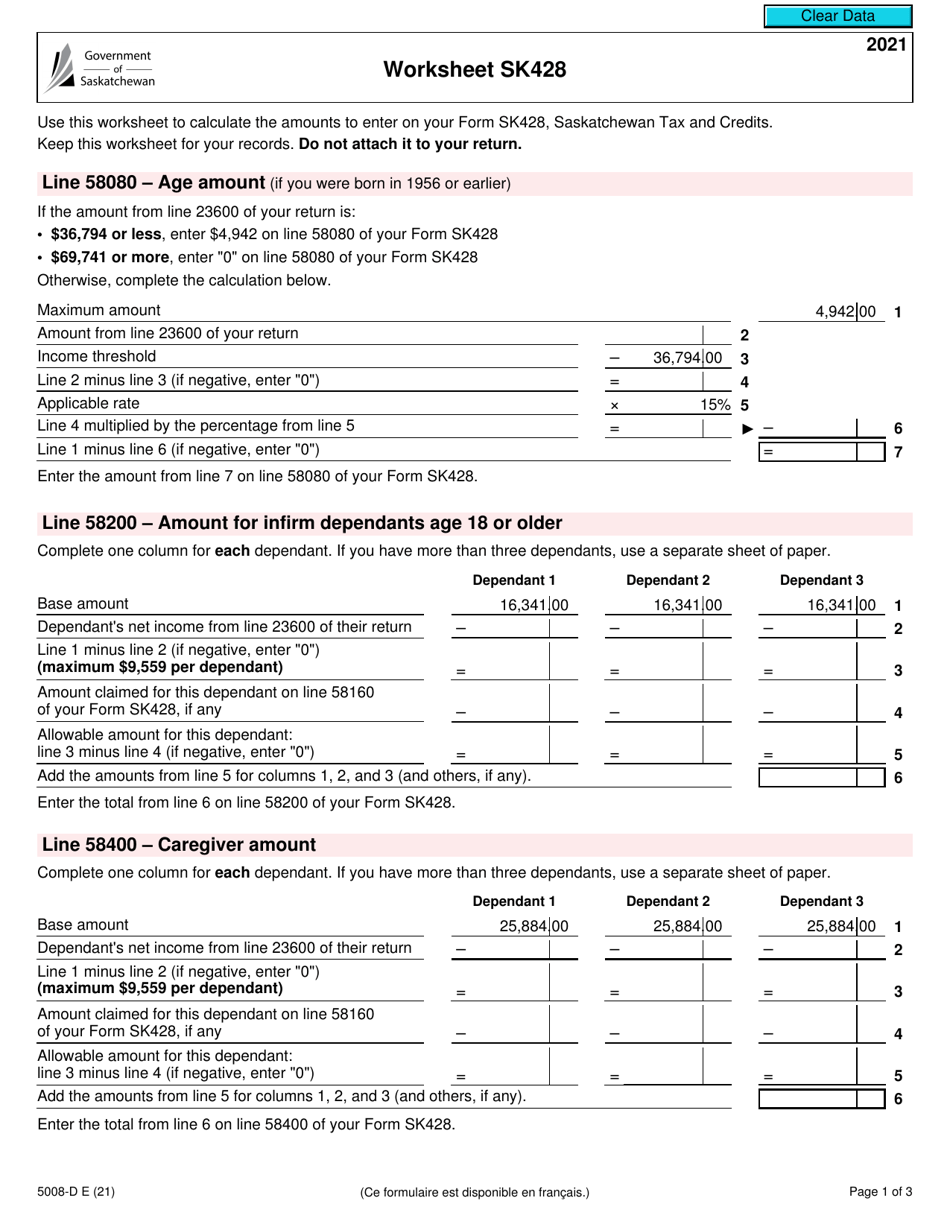

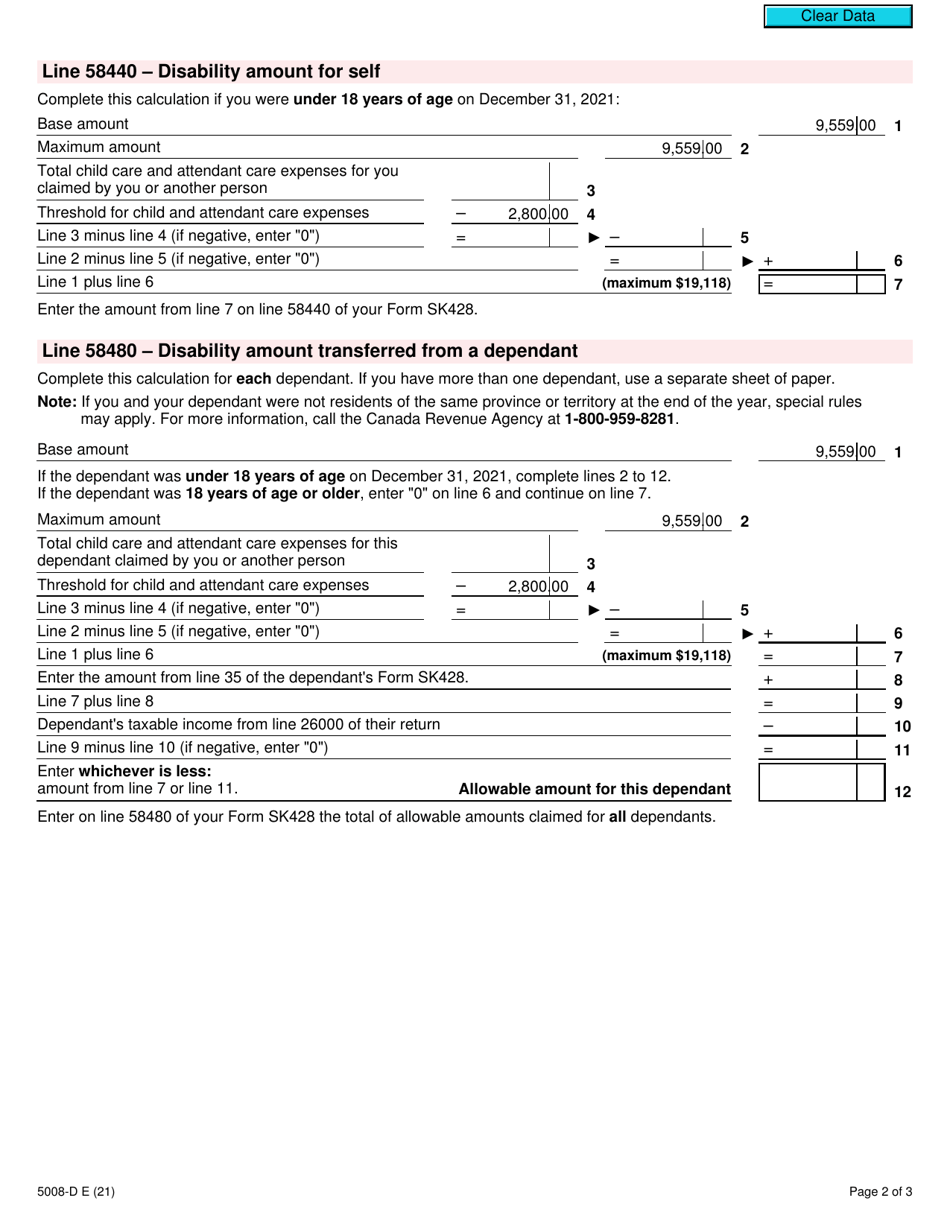

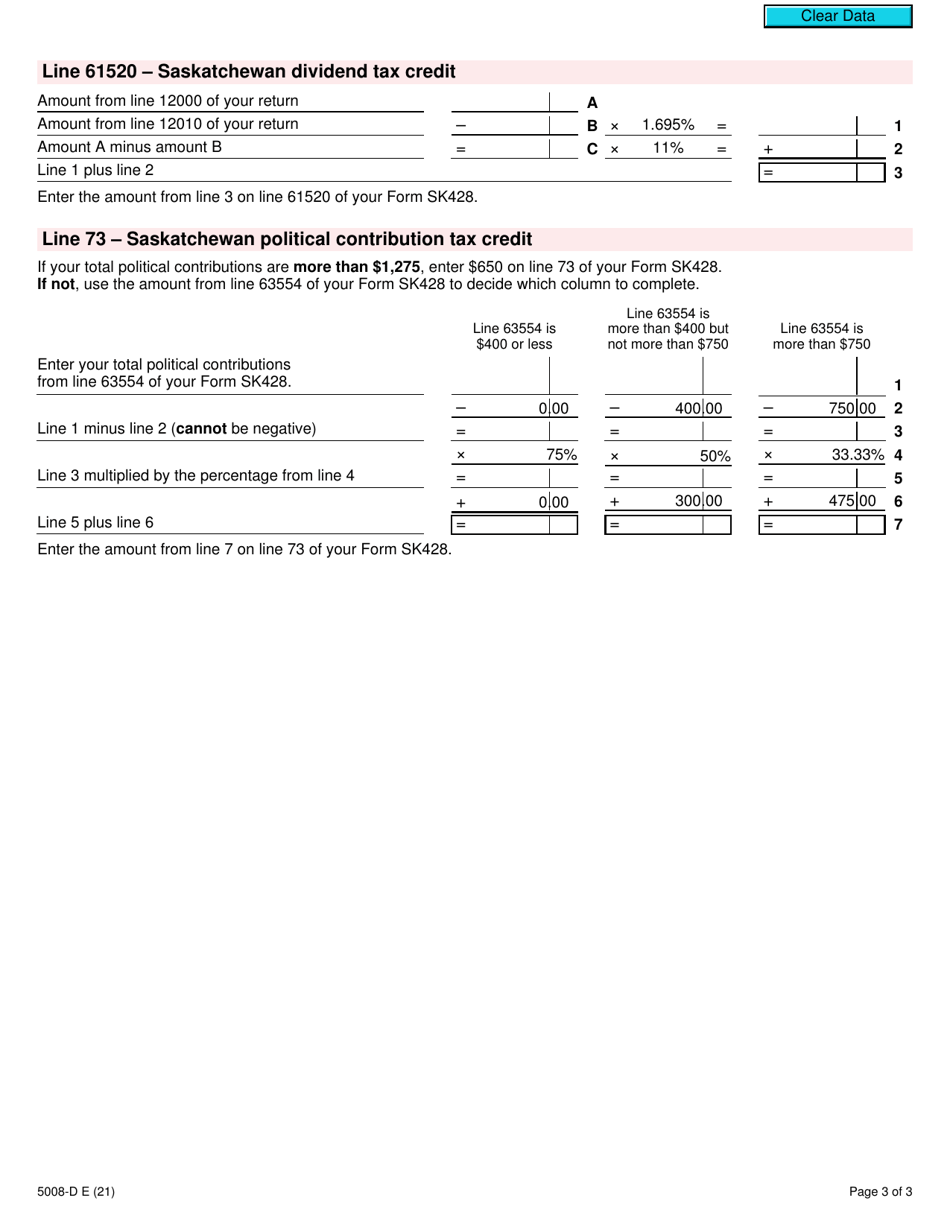

Form 5008-D Worksheet SK428

for the current year.

Form 5008-D Worksheet SK428 Saskatchewan - Canada

Form 5008-D Worksheet SK428 in Saskatchewan, Canada is used for calculating and reporting provincial tax credits and deductions. It helps individuals determine the amount of tax credits they may be eligible for and assists in accurately reporting tax information to the Saskatchewan provincial government.

The Form 5008-D Worksheet SK428 in Saskatchewan, Canada is filed by individuals who are claiming a provincial tax credit.

FAQ

Q: What is Form 5008-D?

A: Form 5008-D is a worksheet used for calculating taxes in the province of Saskatchewan, Canada.

Q: Who uses Form 5008-D?

A: Residents of Saskatchewan, Canada use Form 5008-D.

Q: What is the purpose of Form 5008-D?

A: The purpose of Form 5008-D is to calculate the provincial tax payable by residents of Saskatchewan.

Q: How do I fill out Form 5008-D?

A: To fill out Form 5008-D, you need to provide information about your income, deductions, and credits for the tax year.

Q: When is Form 5008-D due?

A: Form 5008-D is usually due on or before April 30th of the following year.

Q: What happens if I don't file Form 5008-D?

A: If you don't file Form 5008-D, you may be subject to penalties and interest charges.

Q: Can I file Form 5008-D electronically?

A: Yes, you can file Form 5008-D electronically through the Saskatchewan eTax Service (SETS).

Q: Is Form 5008-D only for residents of Saskatchewan?

A: Yes, Form 5008-D is specifically for residents of Saskatchewan, Canada.

Q: Are there any other forms I need to file along with Form 5008-D?

A: You may also need to file your federal tax return and other provincial tax forms, depending on your situation.