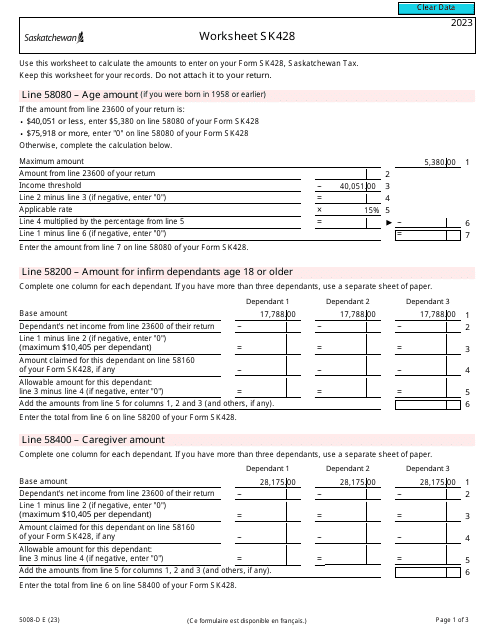

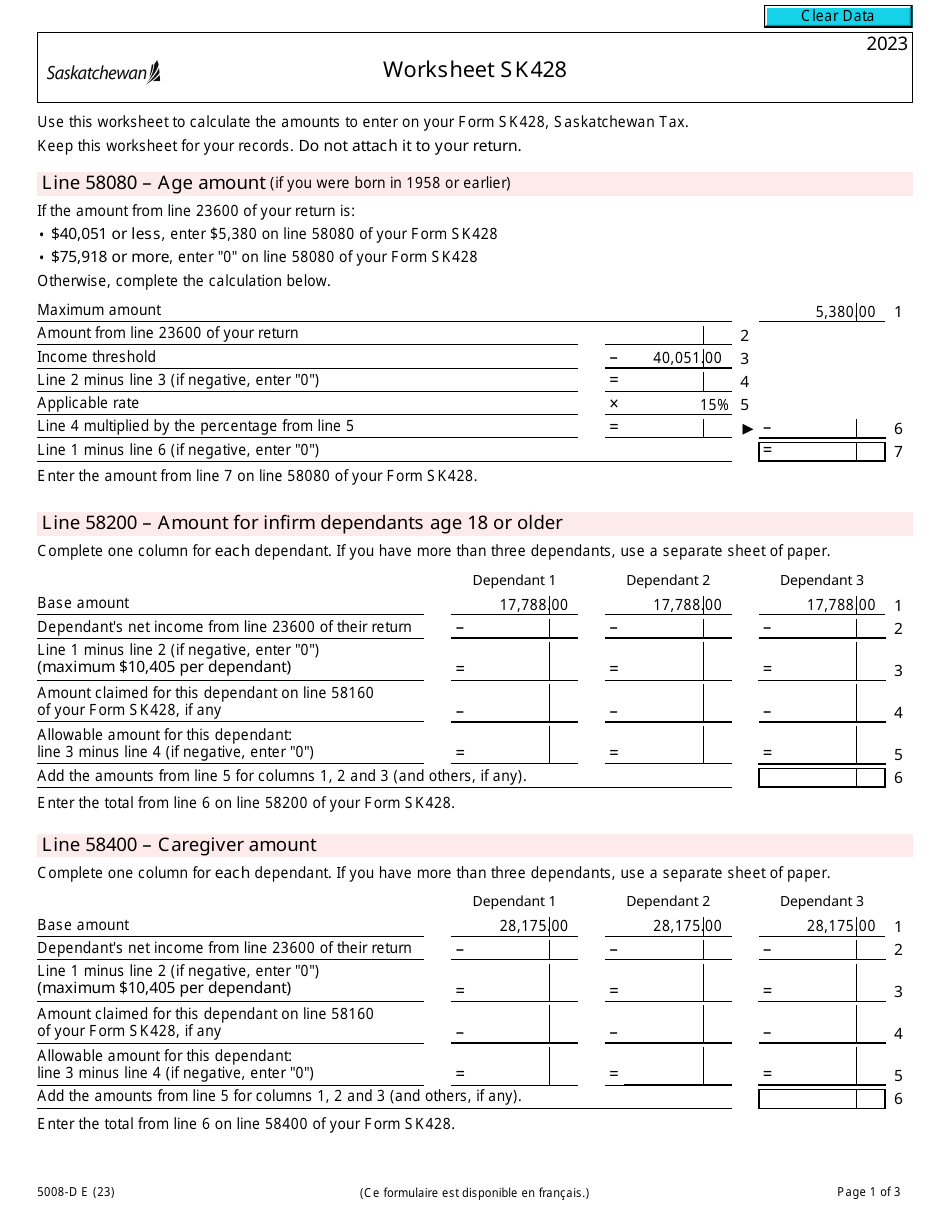

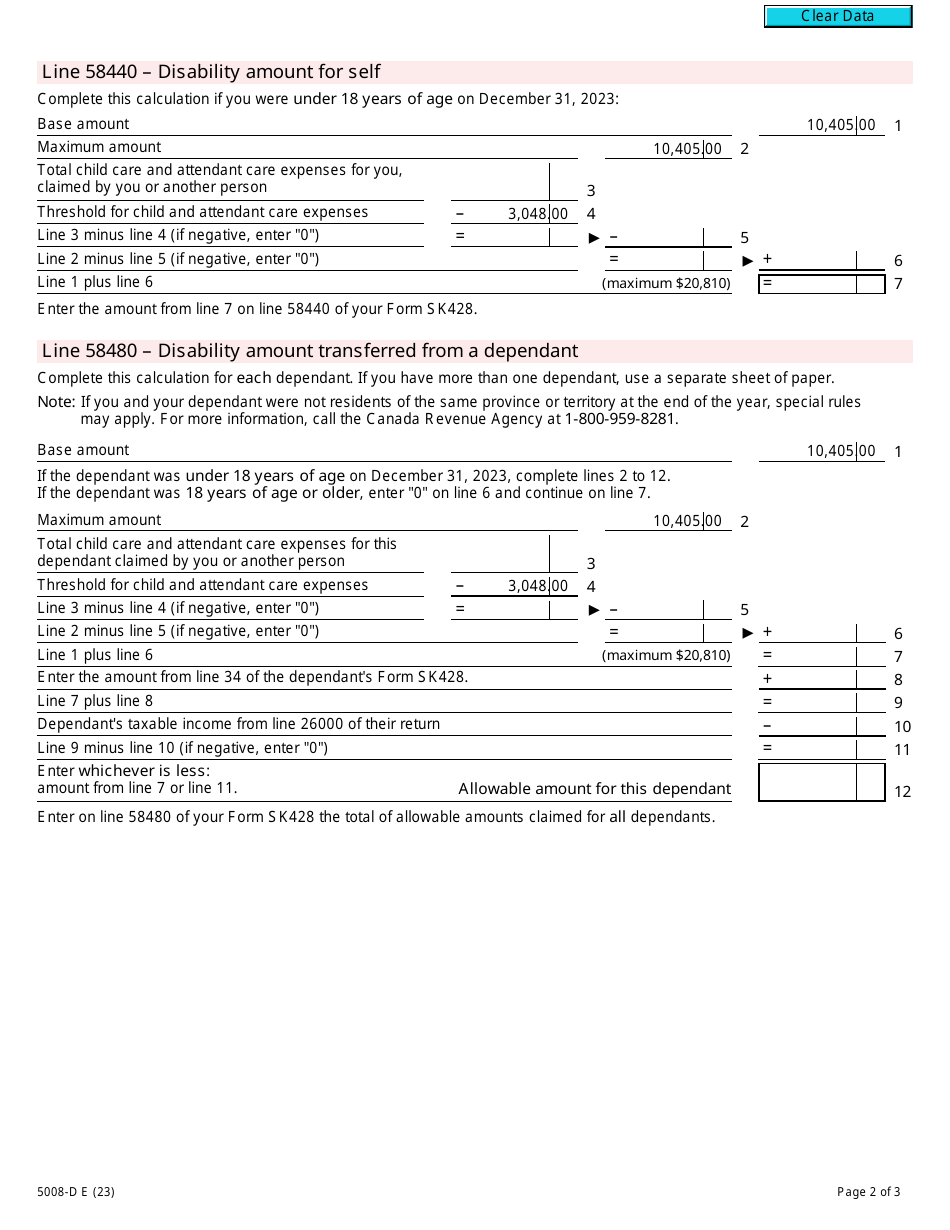

Form 5008-D Worksheet SK428 Saskatchewan - Canada

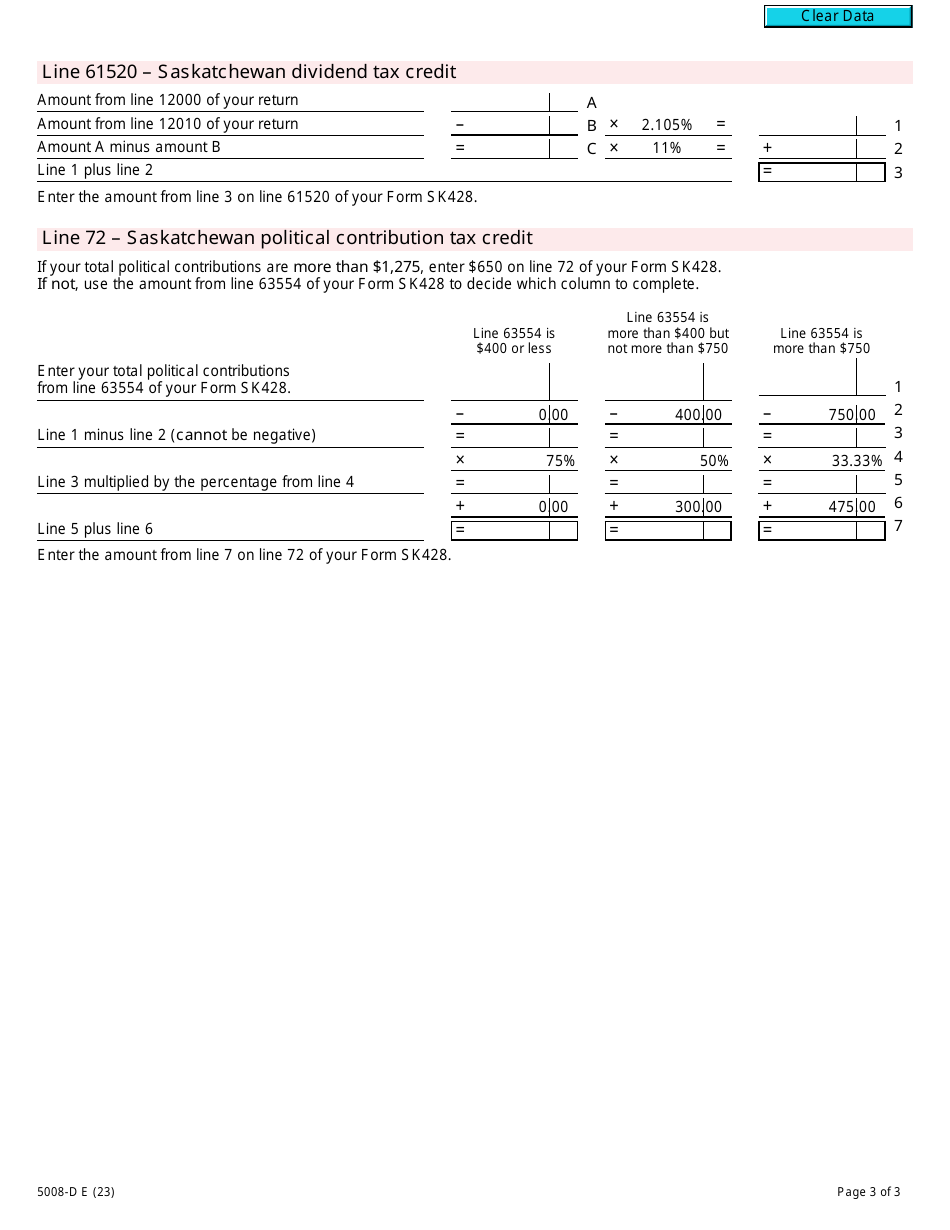

Form 5008-D Worksheet SK428 is used in Saskatchewan, Canada for calculating and reporting provincial taxes. It helps individuals determine their provincial tax liability and credits.

The Form 5008-D Worksheet SK428 in Saskatchewan, Canada is typically filed by individuals who are residents of Saskatchewan and need to calculate their provincial tax credits.

Form 5008-D Worksheet SK428 Saskatchewan - Canada - Frequently Asked Questions (FAQ)

Q: What is the Form 5008-D Worksheet SK428?

A: The Form 5008-D Worksheet SK428 is a tax form used in the province of Saskatchewan, Canada.

Q: Who needs to fill out the Form 5008-D Worksheet SK428?

A: Residents of Saskatchewan who need to calculate their provincial tax credits and deductions need to fill out this form.

Q: What information do I need to fill out the Form 5008-D Worksheet SK428?

A: You will need information regarding your income, deductions, and tax credits for the tax year.

Q: When is the deadline to file the Form 5008-D Worksheet SK428?

A: The deadline to file the Form 5008-D Worksheet SK428 is usually April 30th of the following year.

Q: Are there any specific instructions for filling out the Form 5008-D Worksheet SK428?

A: Yes, you should carefully read the instructions provided with the form to ensure accurate completion.

Q: Can I electronically file the Form 5008-D Worksheet SK428?

A: No, the Form 5008-D Worksheet SK428 cannot be electronically filed. You must mail it to the CRA.

Q: Do I need to include supporting documents with the Form 5008-D Worksheet SK428?

A: You do not need to include supporting documents with the form when you file it, but you should keep them for your records.

Q: What should I do if I make a mistake on the Form 5008-D Worksheet SK428?

A: If you make a mistake on the form, you should contact the CRA for guidance on how to correct it.

Q: How long does it take to process the Form 5008-D Worksheet SK428?

A: The processing time for the Form 5008-D Worksheet SK428 can vary, but it usually takes a few weeks to a few months.