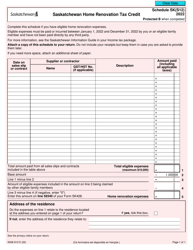

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5008-S12 Schedule SK(S12)

for the current year.

Form 5008-S12 Schedule SK(S12) Saskatchewan Home Renovation Tax Credit (Large Print) - Canada

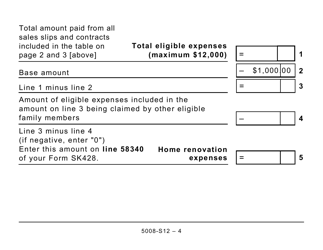

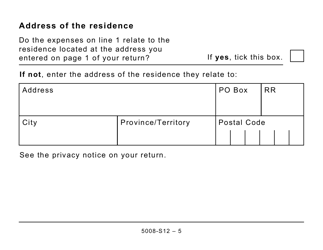

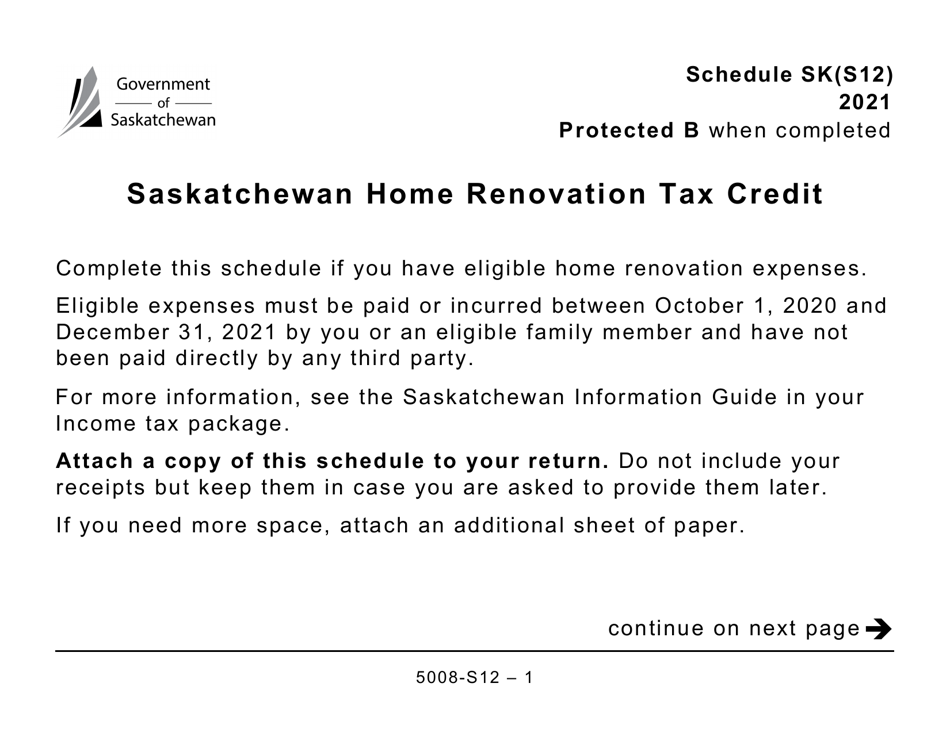

Form 5008-S12 Schedule SK(S12) Saskatchewan Home Renovation Tax Credit (Large Print) is a tax form in Canada that is specifically designed for residents of Saskatchewan. It is used for claiming the Saskatchewan Home Renovation Tax Credit. This tax credit provides financial assistance to homeowners who have made eligible renovations to their homes. The large print version of the form is available to individuals who have visual impairments and need a larger font size to read and fill out the form.

The Form 5008-S12 Schedule SK(S12) Saskatchewan Home Renovation Tax Credit (Large Print) in Canada is filed by individuals who are residents of Saskatchewan and have incurred eligible home renovation expenses.

FAQ

Q: What is Form 5008-S12 Schedule SK?

A: Form 5008-S12 Schedule SK is a tax form specific to the province of Saskatchewan in Canada. It is used to claim the Saskatchewan Home Renovation Tax Credit.

Q: What is the Saskatchewan Home Renovation Tax Credit?

A: The Saskatchewan Home Renovation Tax Credit is a non-refundable tax credit designed to encourage residents of Saskatchewan to make energy-efficient home renovations. It allows eligible individuals to claim a tax credit for eligible renovation expenses.

Q: Who is eligible to claim the Saskatchewan Home Renovation Tax Credit?

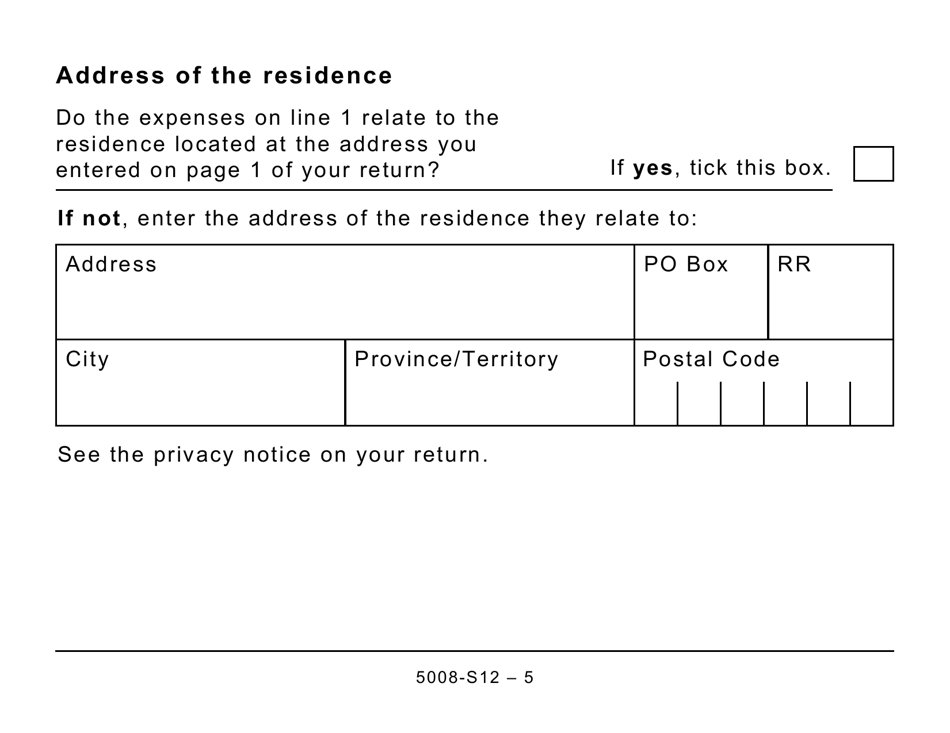

A: To be eligible for the Saskatchewan Home Renovation Tax Credit, you must be a resident of Saskatchewan and have incurred eligible renovation expenses for your principal residence.

Q: What expenses are eligible for the Saskatchewan Home Renovation Tax Credit?

A: Eligible expenses for the Saskatchewan Home Renovation Tax Credit include the cost of eligible renovations and permanent improvements that improve the energy efficiency of your principal residence.

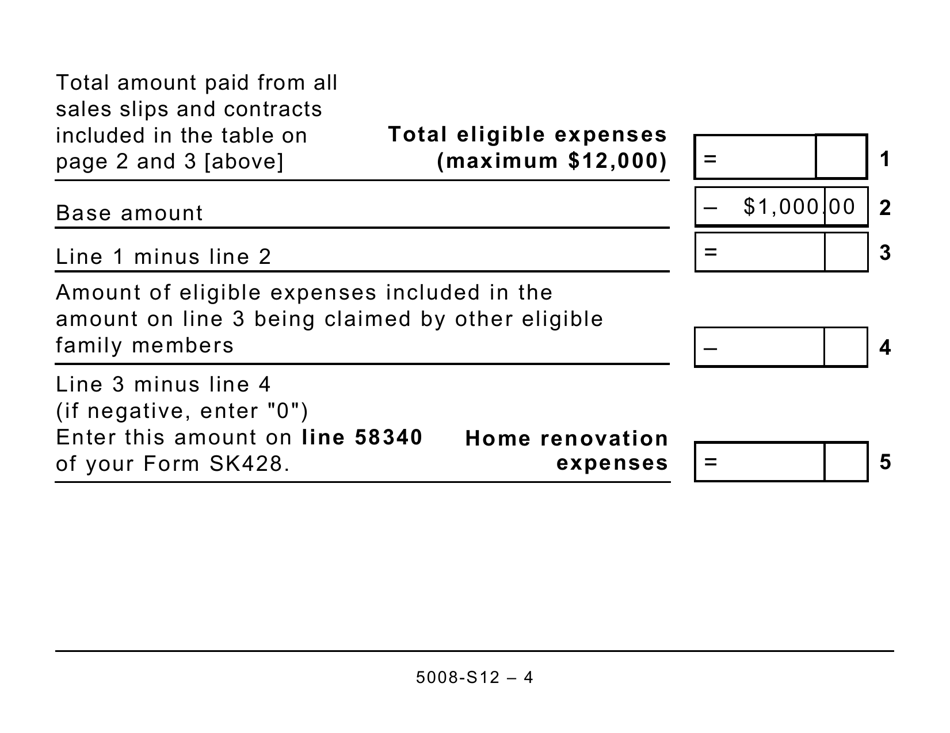

Q: How much tax credit can I claim through the Saskatchewan Home Renovation Tax Credit?

A: The Saskatchewan Home Renovation Tax Credit allows you to claim 10% of eligible renovation expenses, up to a maximum of $20,000. This means the maximum tax credit you can receive is $2,000.

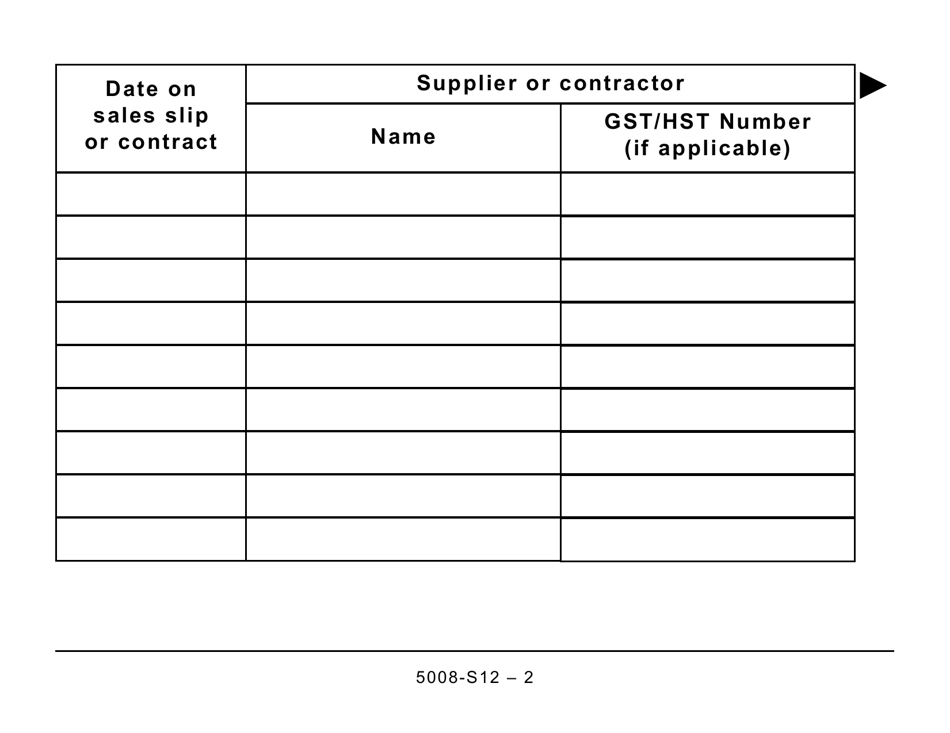

Q: How do I claim the Saskatchewan Home Renovation Tax Credit?

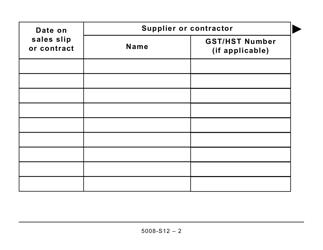

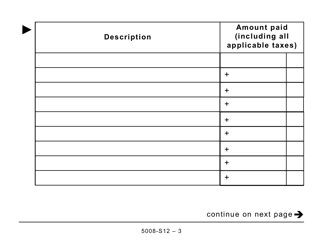

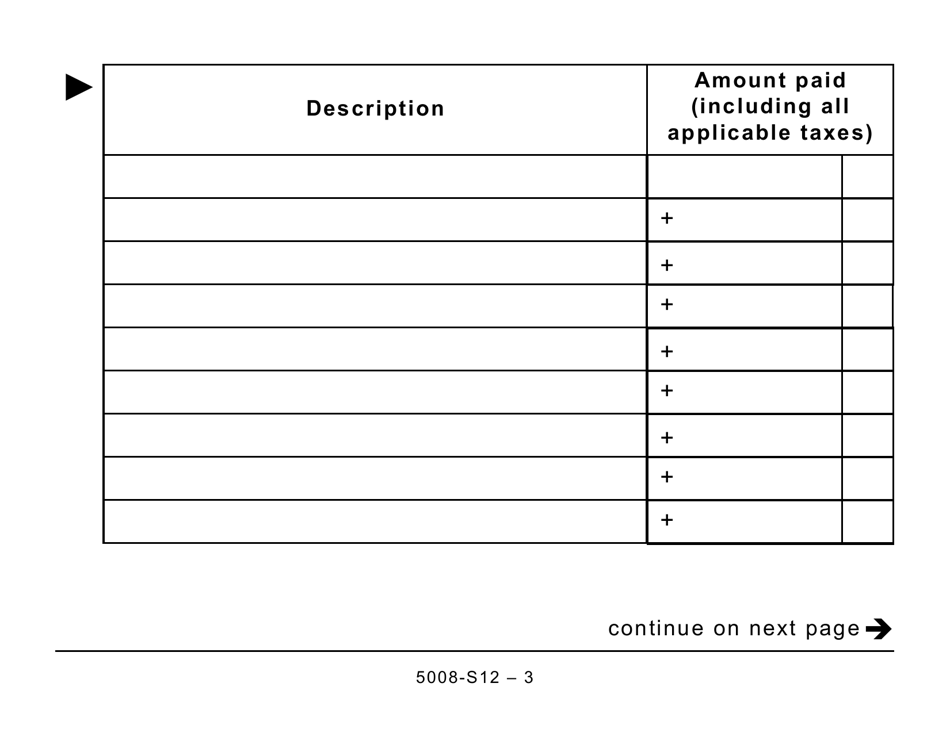

A: To claim the Saskatchewan Home Renovation Tax Credit, you need to complete and file Form 5008-S12 Schedule SK along with your provincial tax return. You will need to provide detailed information about your eligible renovation expenses.