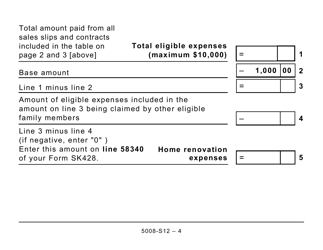

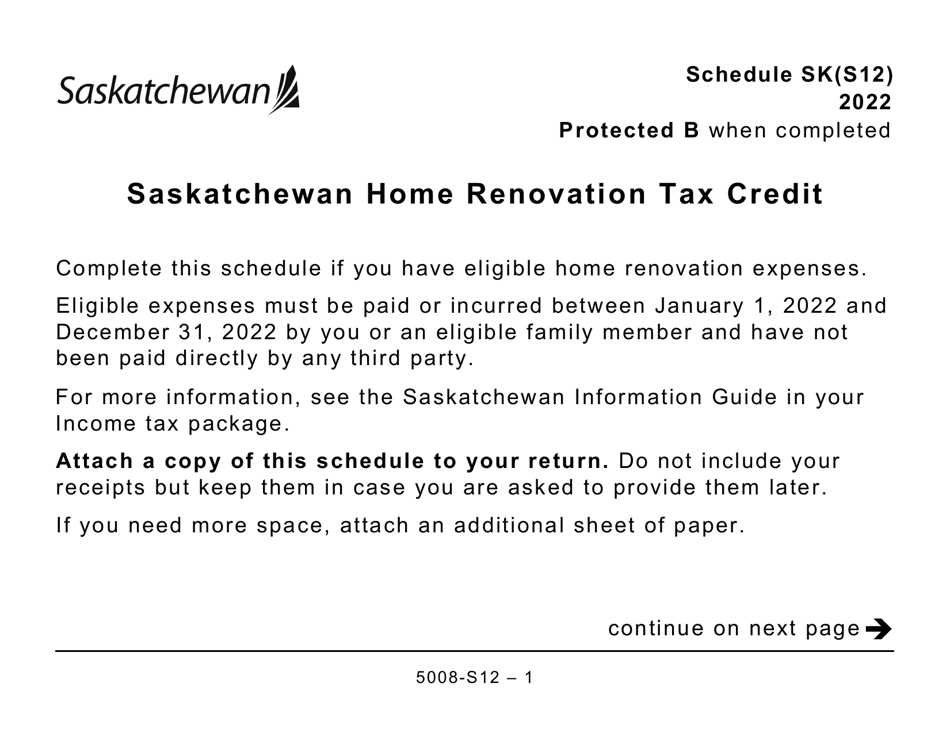

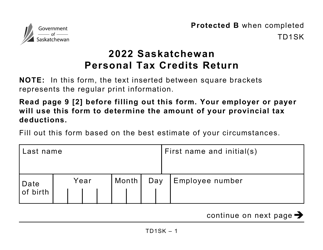

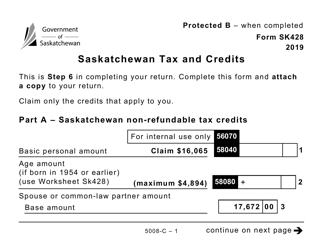

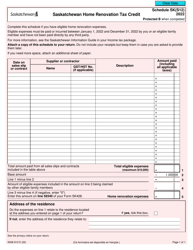

Form 5008-S12 Schedule SK(S12) Saskatchewan Home Renovation Tax Credit - Large Print - Canada

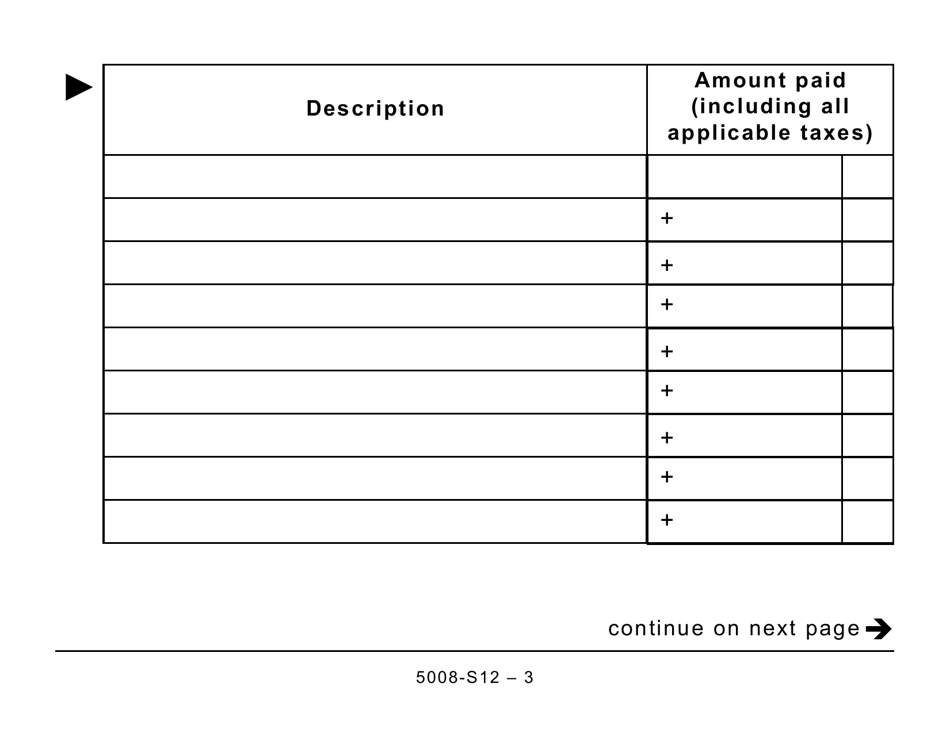

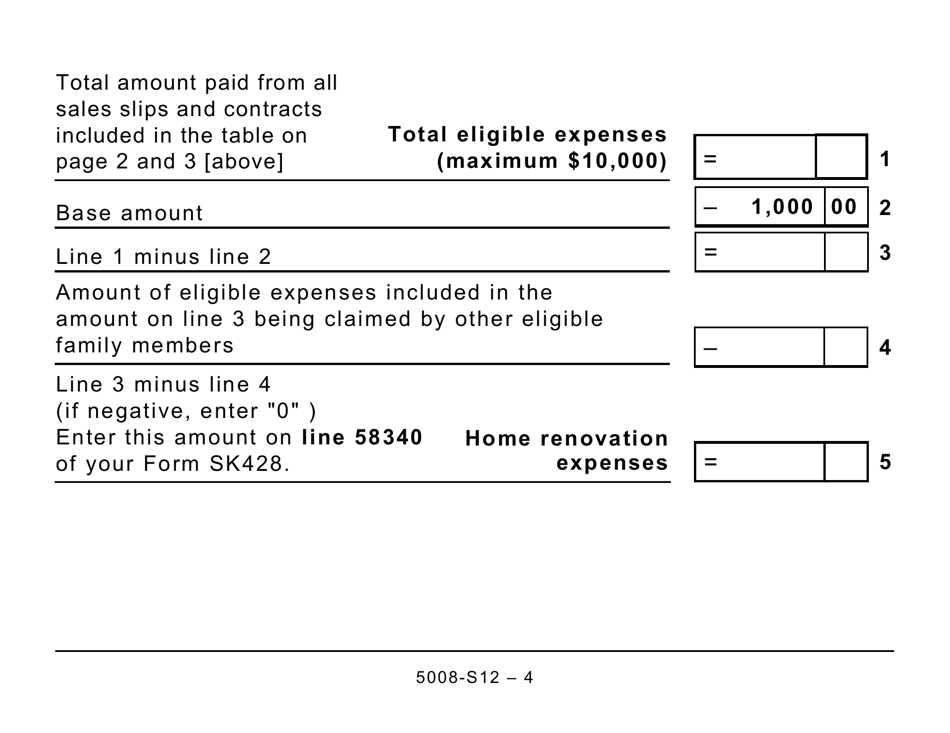

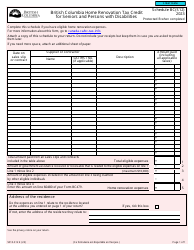

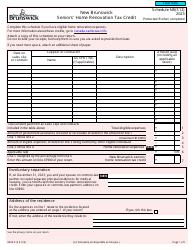

Form 5008-S12 Schedule SK (S12) is used in Canada specifically for claiming the Saskatchewan Home Renovation Tax Credit. This tax credit is aimed at supporting residents of Saskatchewan who have made eligible home renovation expenses.

Form 5008-S12 Schedule SK(S12) Saskatchewan Home Renovation Tax Credit - Large Print - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5008-S12 Schedule SK(S12)? A: Form 5008-S12 Schedule SK(S12) is a tax form used in Canada for claiming the Saskatchewan Home Renovation Tax Credit.

Q: What is the Saskatchewan Home Renovation Tax Credit? A: The Saskatchewan Home Renovation Tax Credit is a tax credit available to homeowners in Saskatchewan for home renovation expenses.

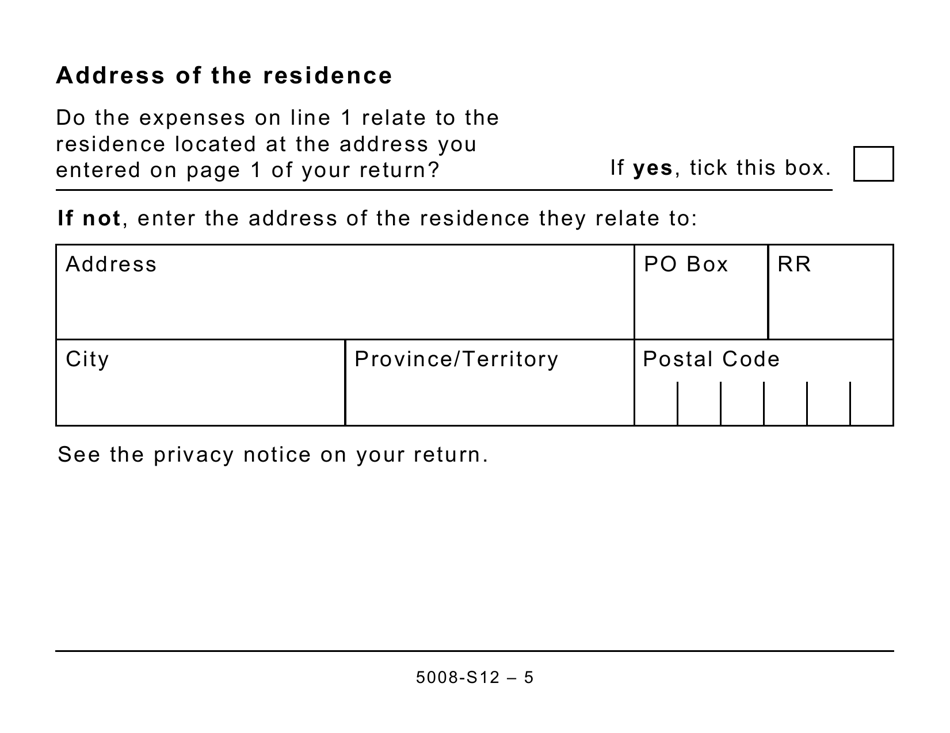

Q: Who can claim the Saskatchewan Home Renovation Tax Credit? A: Homeowners in Saskatchewan who have incurred eligible renovation expenses on their principal residence can claim the tax credit.

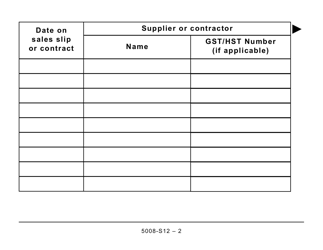

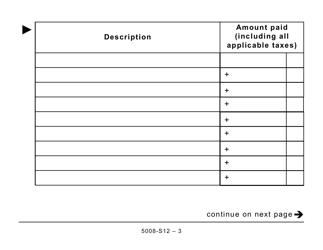

Q: What are eligible renovation expenses? A: Eligible renovation expenses include costs for renovation or improvement projects that are of enduring nature and enhance the property.

Q: Do I need to submit Form 5008-S12 Schedule SK(S12) with my tax return? A: Yes, if you are claiming the Saskatchewan Home Renovation Tax Credit, you need to submit Form 5008-S12 Schedule SK(S12) with your tax return.