This version of the form is not currently in use and is provided for reference only. Download this version of

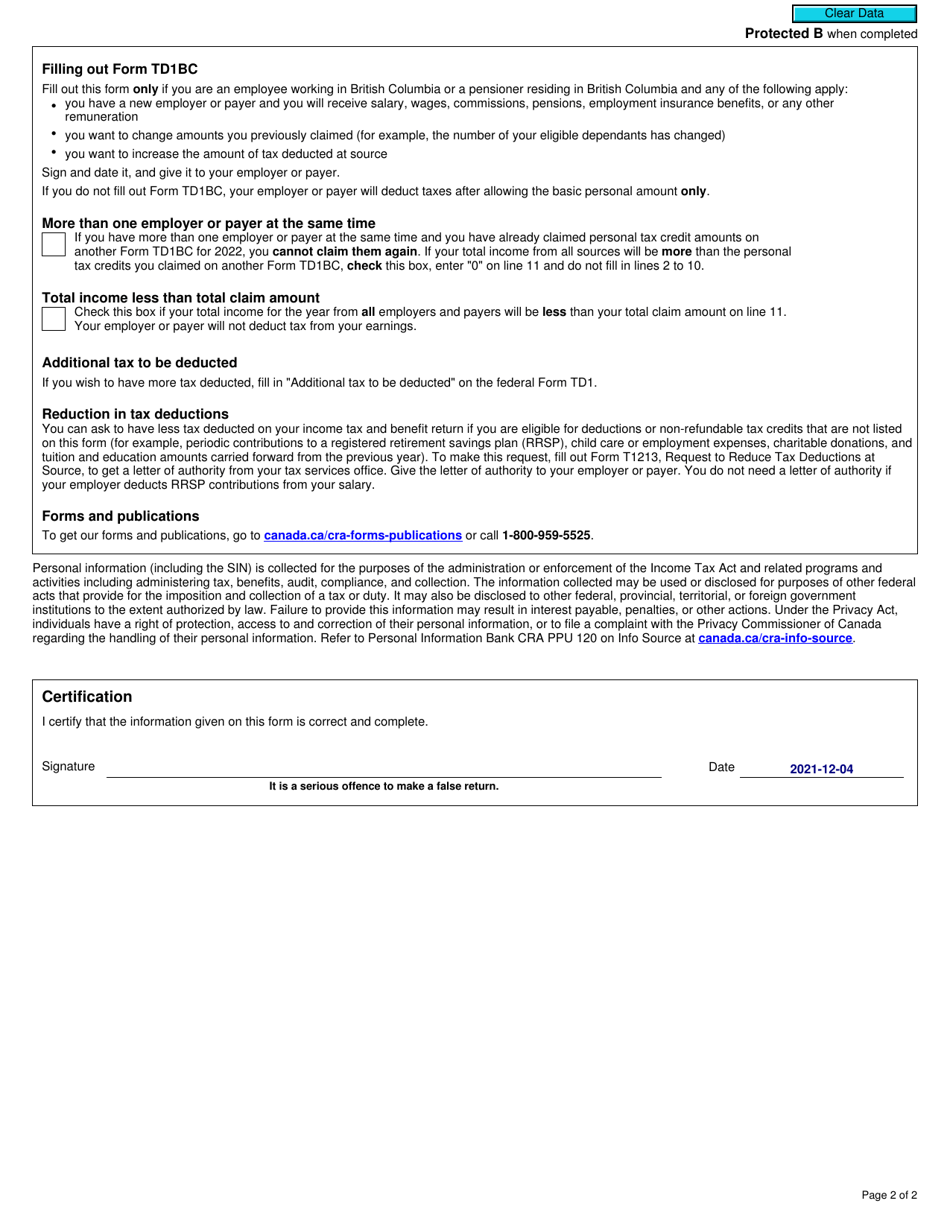

Form TD1BC

for the current year.

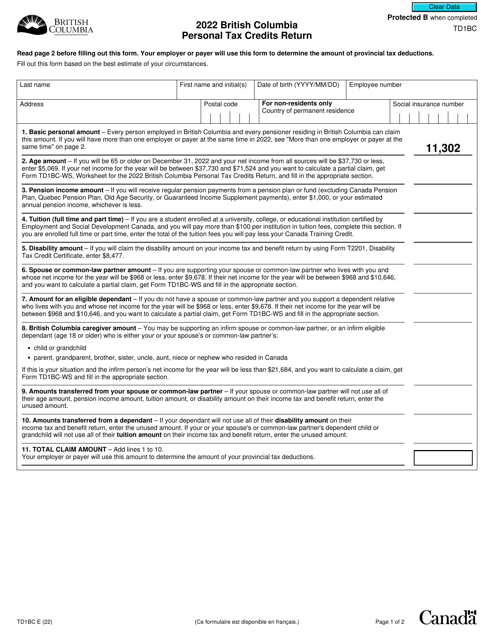

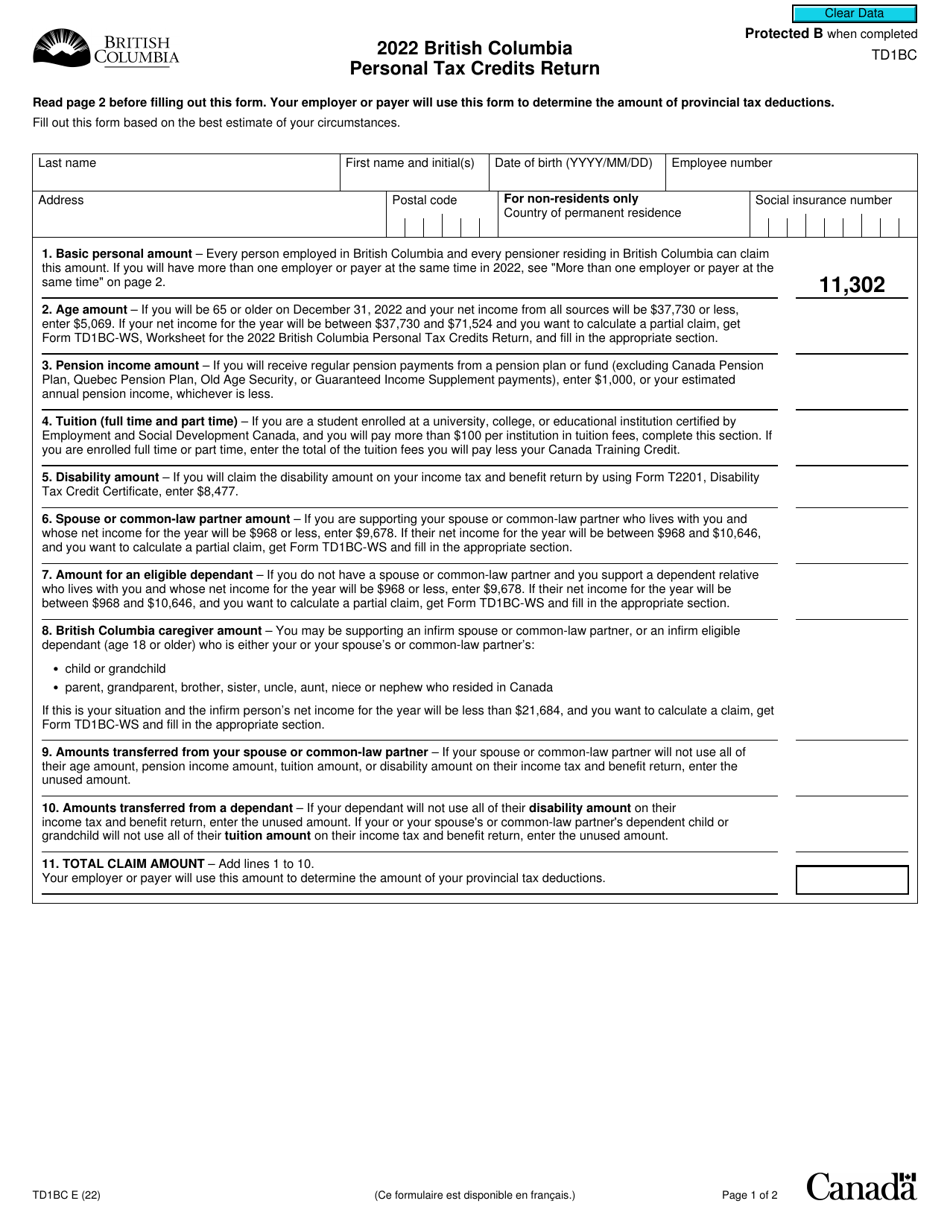

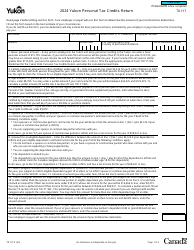

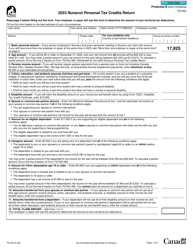

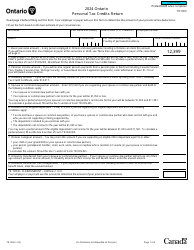

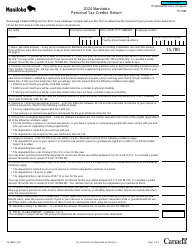

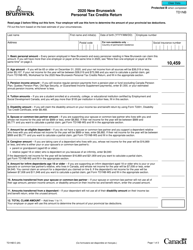

Form TD1BC British Columbia Personal Tax Credits Return - Canada

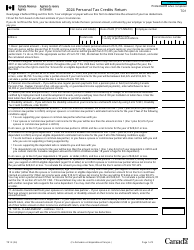

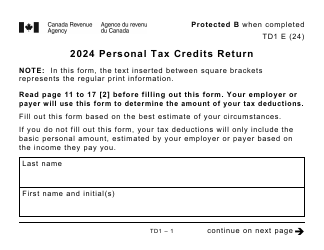

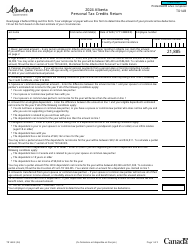

Form TD1BC, also known as the British Columbia Personal Tax Credits Return, is used by taxpayers in the province of British Columbia in Canada to declare their personal tax credits. It allows individuals to claim various tax credits and deductions that can reduce the amount of income tax they need to pay. The form helps ensure that the correct amount of tax is withheld from a taxpayer's income, taking into account their personal circumstances and eligible tax credits in British Columbia.

The Form TD1BC British Columbia Personal Tax Credits Return in Canada is typically filed by individuals who reside in the province of British Columbia and wish to claim specific tax credits and exemptions for that province.

FAQ

Q: What is Form TD1BC?

A: Form TD1BC is the British Columbia Personal Tax Credits Return.

Q: What is the purpose of Form TD1BC?

A: The purpose of Form TD1BC is to calculate the amount of provincial income tax to be deducted from your salary or wages in British Columbia.

Q: Who should fill out Form TD1BC?

A: If you are a resident of British Columbia and want your employer to deduct less income tax from your salary or wages, you should fill out Form TD1BC.

Q: Is Form TD1BC for residents of other provinces?

A: No, Form TD1BC is specifically for residents of British Columbia.

Q: Do I need to fill out Form TD1BC every year?

A: No, you only need to fill out Form TD1BC when your personal circumstances change or when the CRA requests you to do so.

Q: Can I claim tax credits on Form TD1BC?

A: Yes, Form TD1BC allows you to claim tax credits for various situations, such as the disability amount, caregiver amount, and tuition fees.

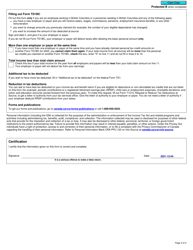

Q: Are there any specific instructions for filling out Form TD1BC?

A: Yes, the CRA provides instructions on how to fill out Form TD1BC. Make sure to read them carefully and follow the guidelines.

Q: When should I submit Form TD1BC to my employer?

A: You should submit Form TD1BC to your employer as soon as possible after any changes have occurred that would affect the amount of tax to be deducted from your salary or wages.

Q: Can I make changes to Form TD1BC during the year?

A: Yes, if your personal circumstances change during the year, you can make changes to Form TD1BC and submit the revised form to your employer.