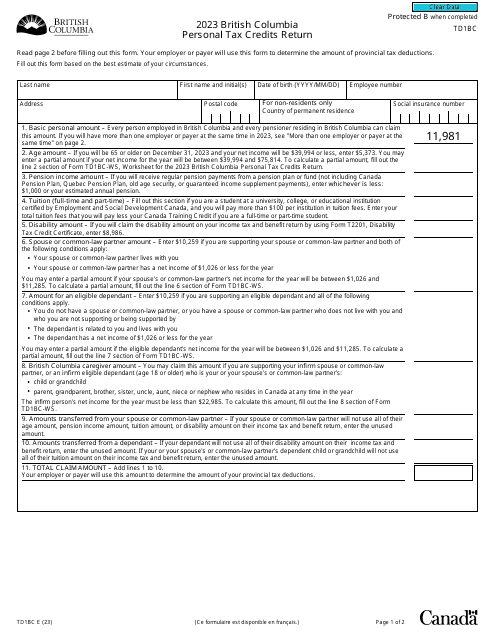

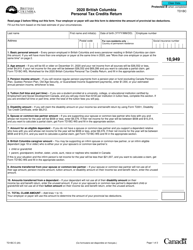

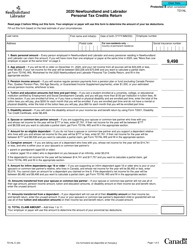

Form TD1BC British Columbia Personal Tax Credits Return - Canada

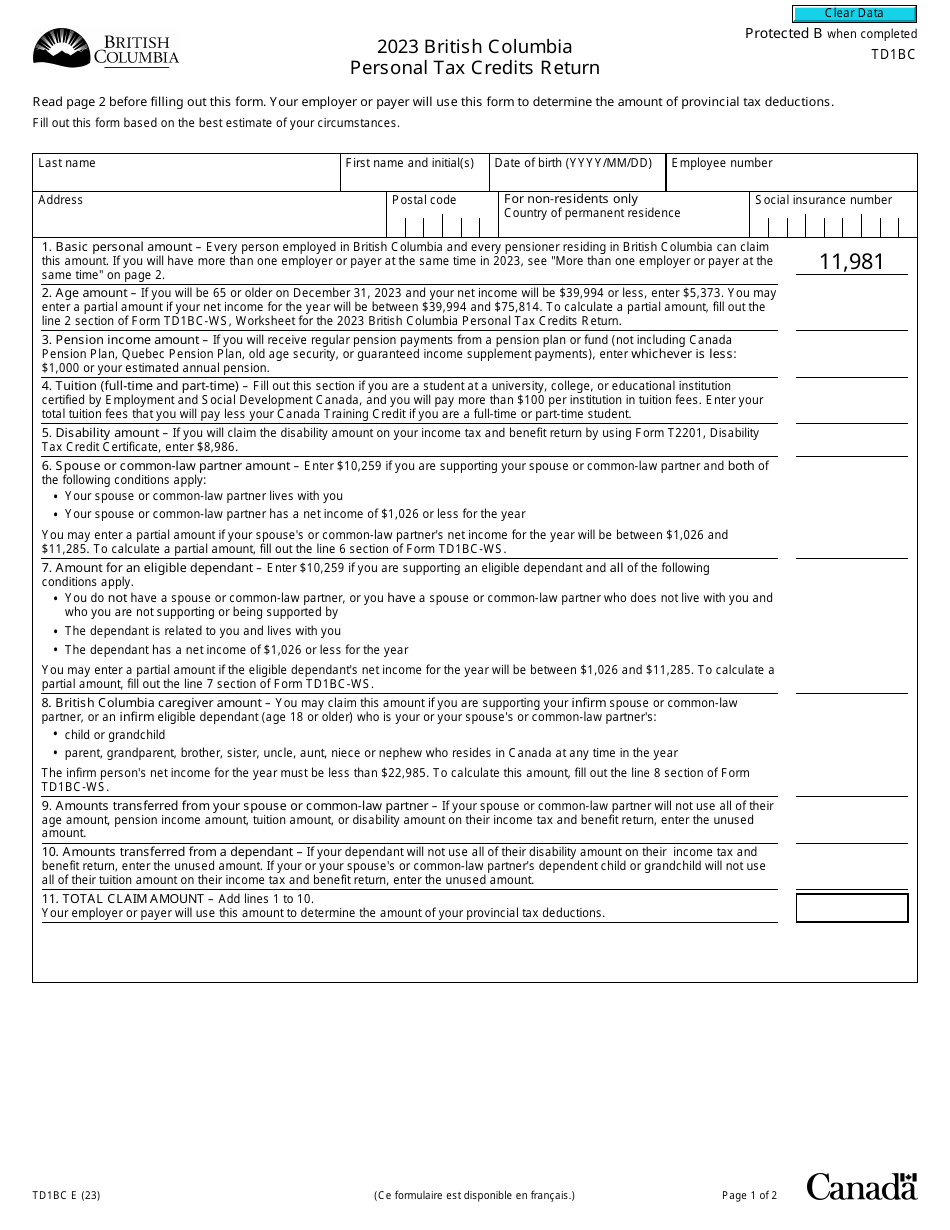

Form TD1BC, also known as the British Columbia Personal Tax Credits Return, is used by individuals who reside in British Columbia, Canada, to determine the amount of their personal tax credits. This form allows individuals to claim various non-refundable tax credits and reduce the amount of income tax they owe. It is used to ensure that the correct amount of tax is withheld from an individual's employment income throughout the year.

The Form TD1BC is filed by individuals who are residents of British Columbia, Canada.

Form TD1BC British Columbia Personal Tax Credits Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form TD1BC?

A: Form TD1BC is the British Columbia Personal Tax Credits Return form used in Canada.

Q: Who needs to fill out Form TD1BC?

A: Form TD1BC needs to be filled out by individuals who are employed or receiving a pension in British Columbia and want to claim tax credits.

Q: What does Form TD1BC determine?

A: Form TD1BC determines the amount of provincial tax credits that an individual can claim.

Q: What information is required to fill out Form TD1BC?

A: To fill out Form TD1BC, you will need your personal information, such as your name, social insurance number, and employment information.

Q: When should I fill out Form TD1BC?

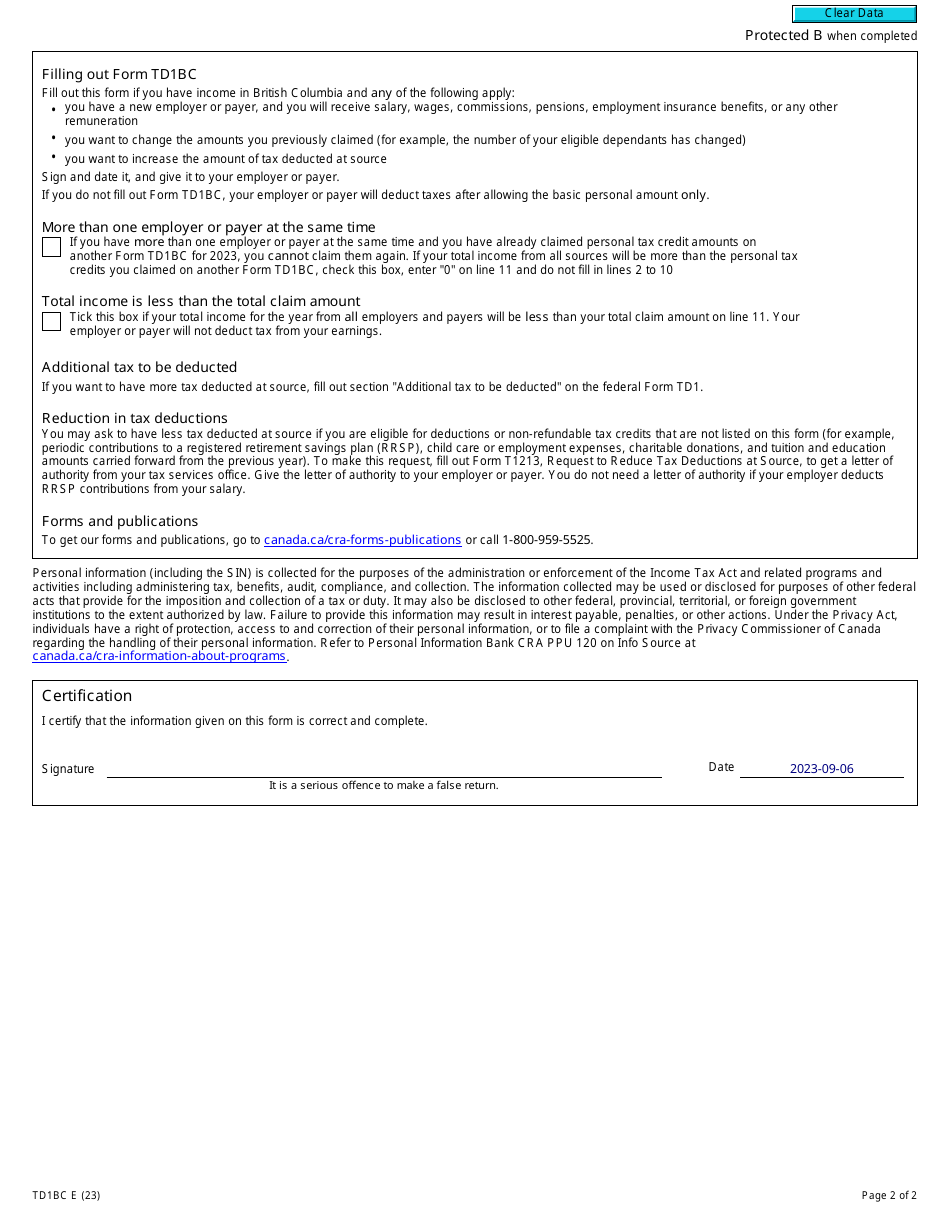

A: Form TD1BC should be filled out when you start a new job or when your personal tax situation changes.

Q: Do I need to submit Form TD1BC every year?

A: No, you only need to submit Form TD1BC when there are changes to your personal tax situation.

Q: Can I make changes to Form TD1BC during the year?

A: Yes, you can make changes to Form TD1BC during the year if your personal tax situation changes.

Q: What happens if I don't fill out Form TD1BC?

A: If you do not fill out Form TD1BC, your employer will deduct taxes based on the default tax rates, resulting in potentially higher tax withholdings.

Q: Can I claim both federal and provincial tax credits?

A: Yes, you can claim both federal and provincial tax credits by filling out the relevant forms, such as Form TD1BC for provincial tax credits and federal Form TD1 for federal tax credits.