This version of the form is not currently in use and is provided for reference only. Download this version of

Form PA-20

for the current year.

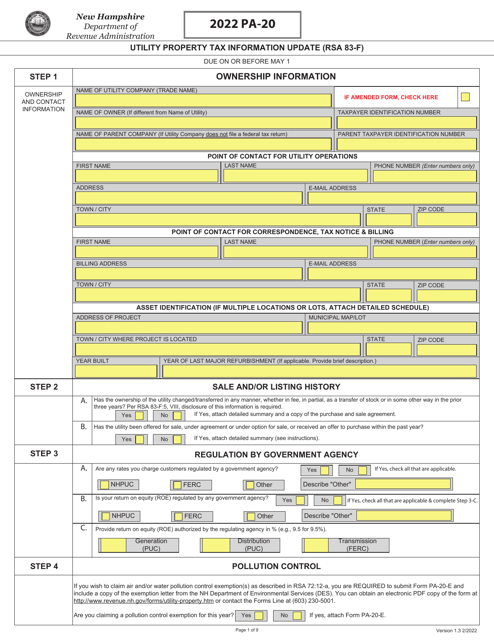

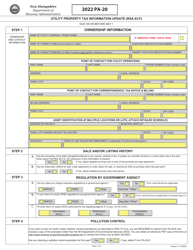

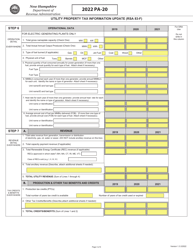

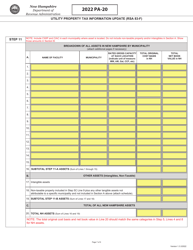

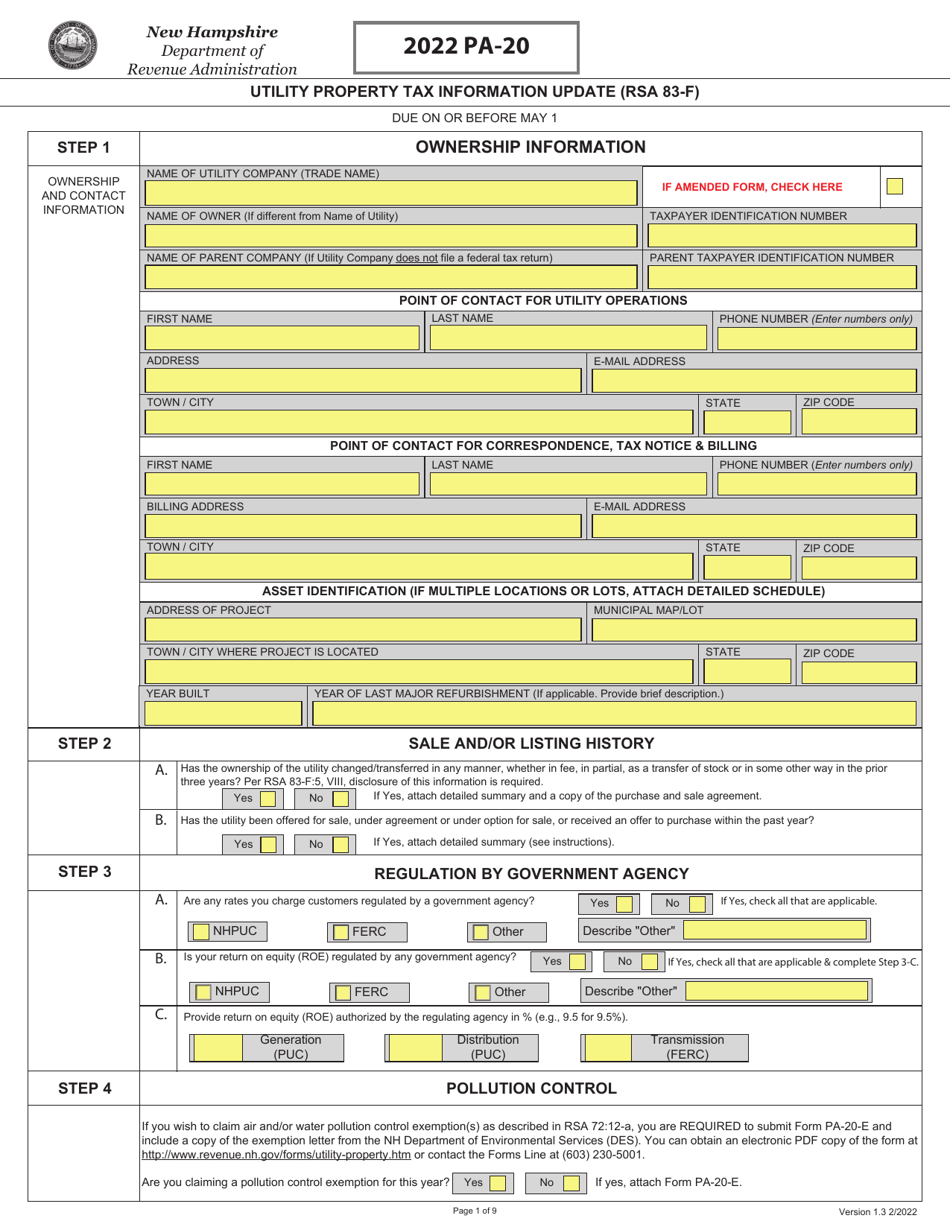

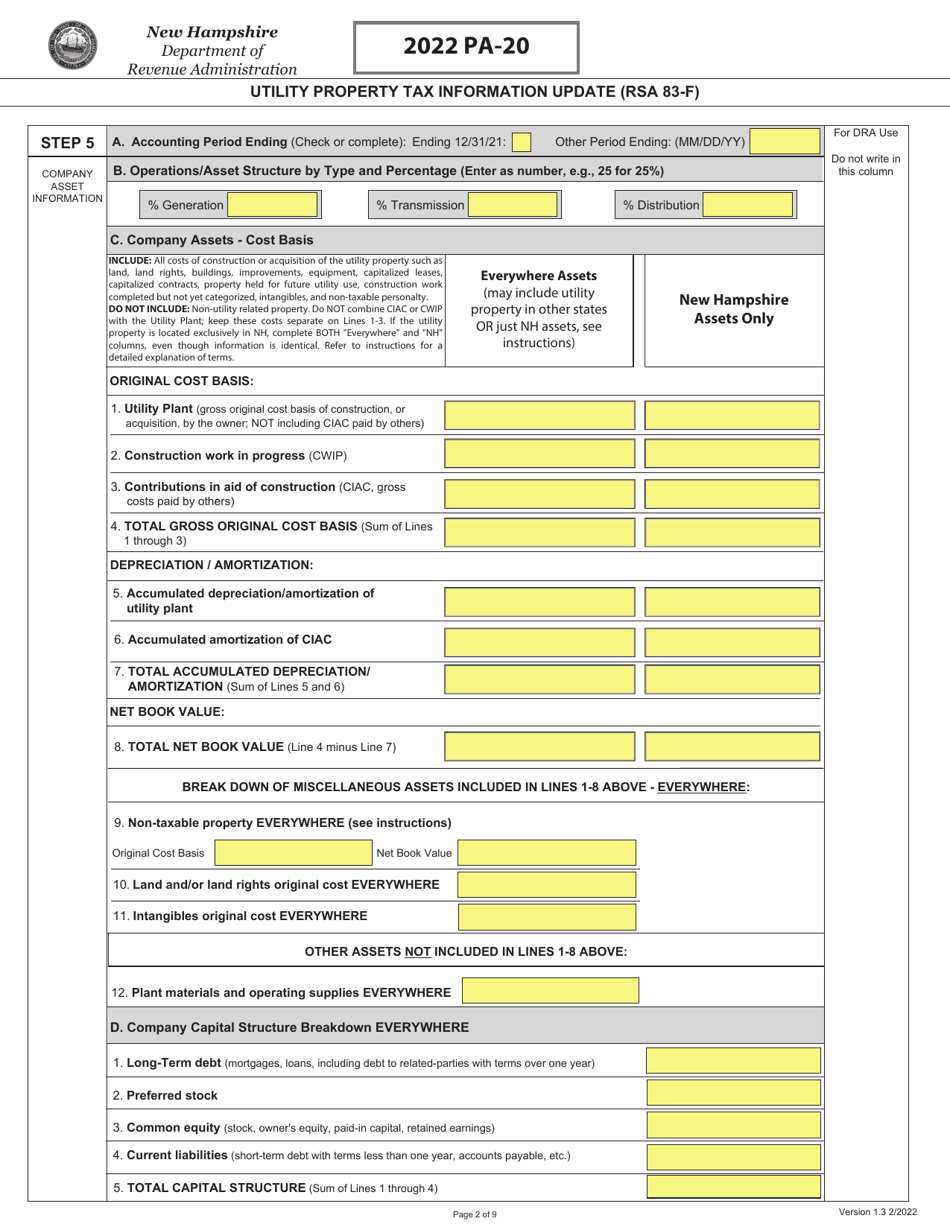

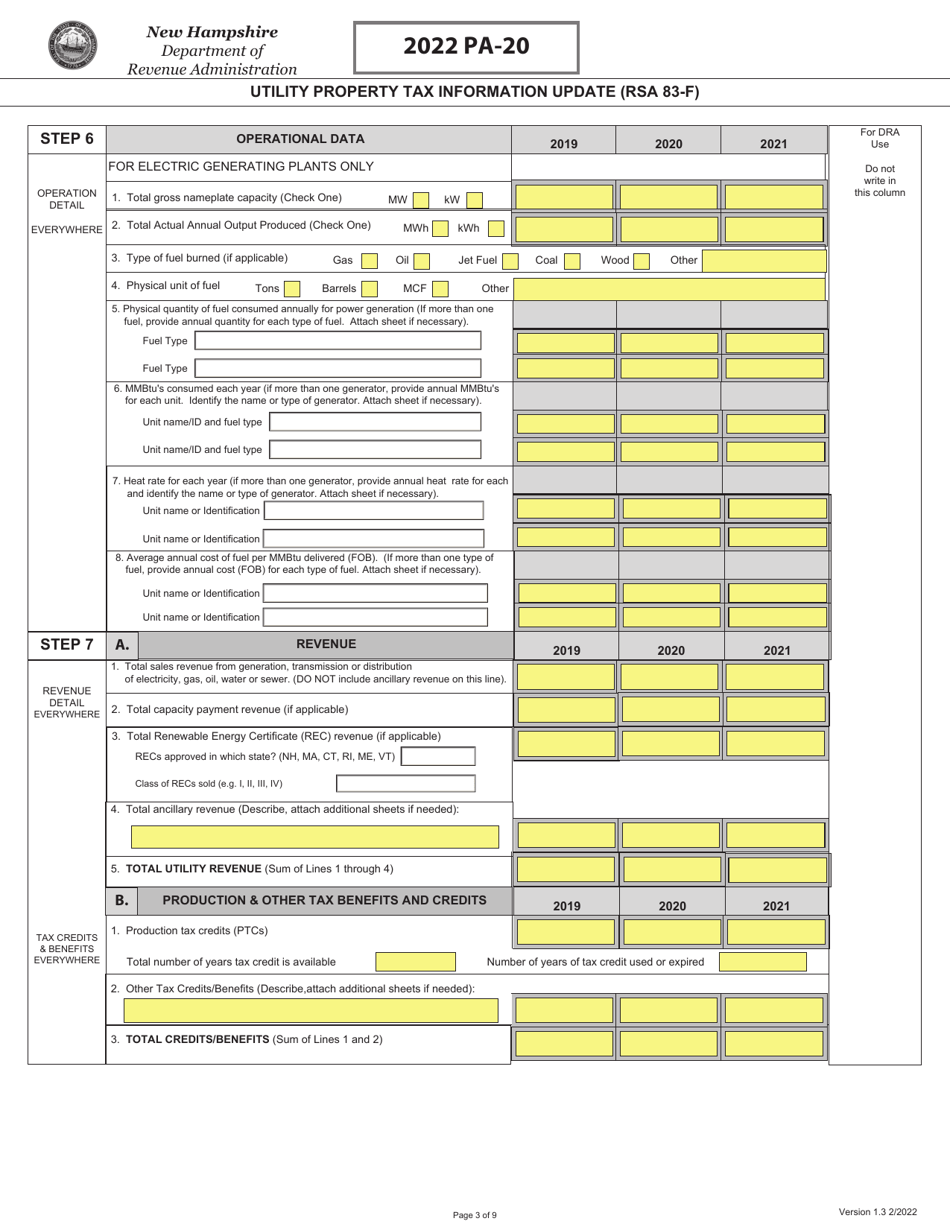

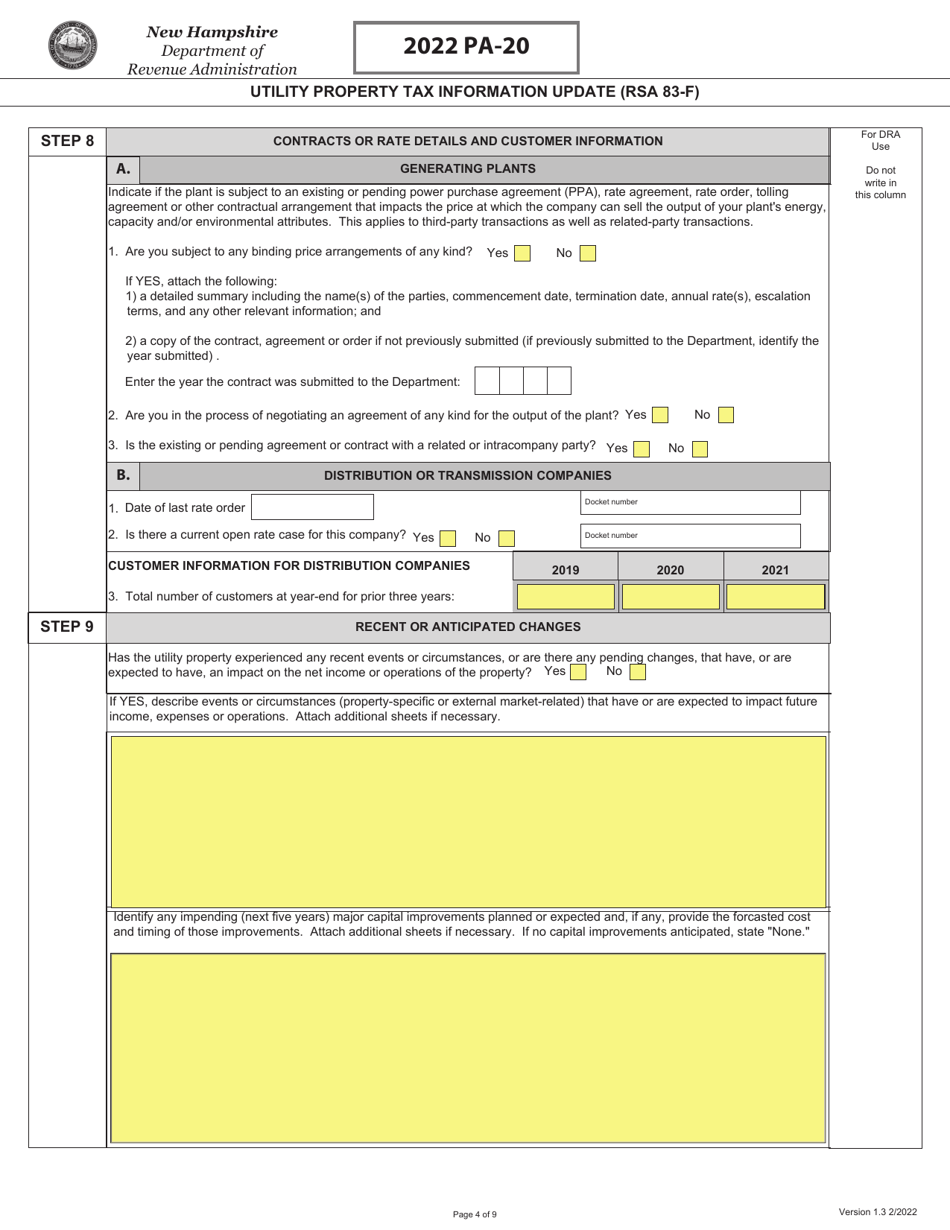

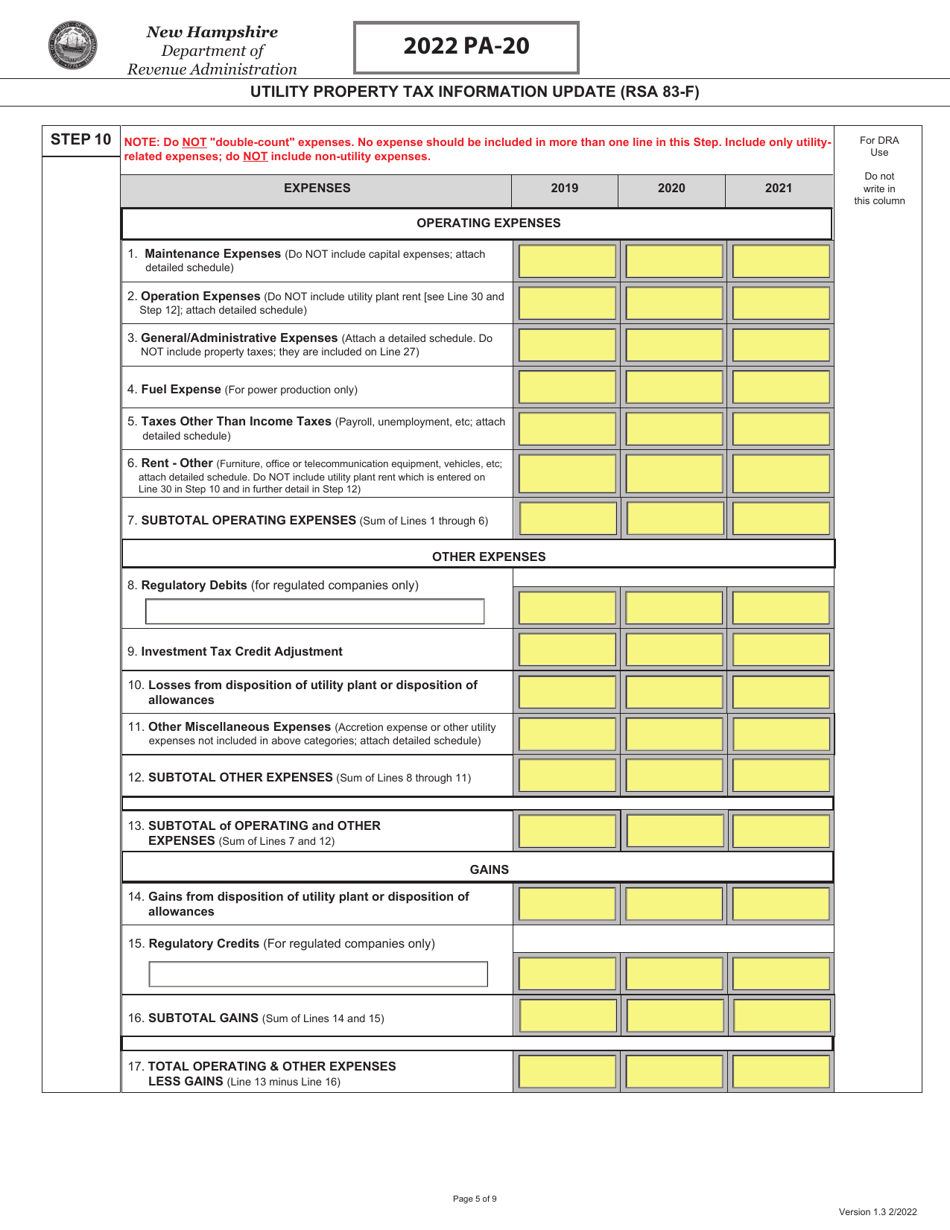

Form PA-20 Utility Property Tax Information Update (Rsa 83-f) - New Hampshire

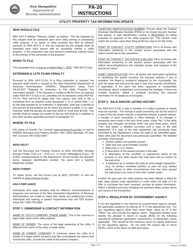

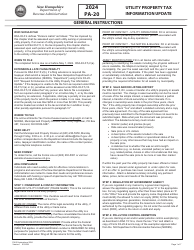

What Is Form PA-20?

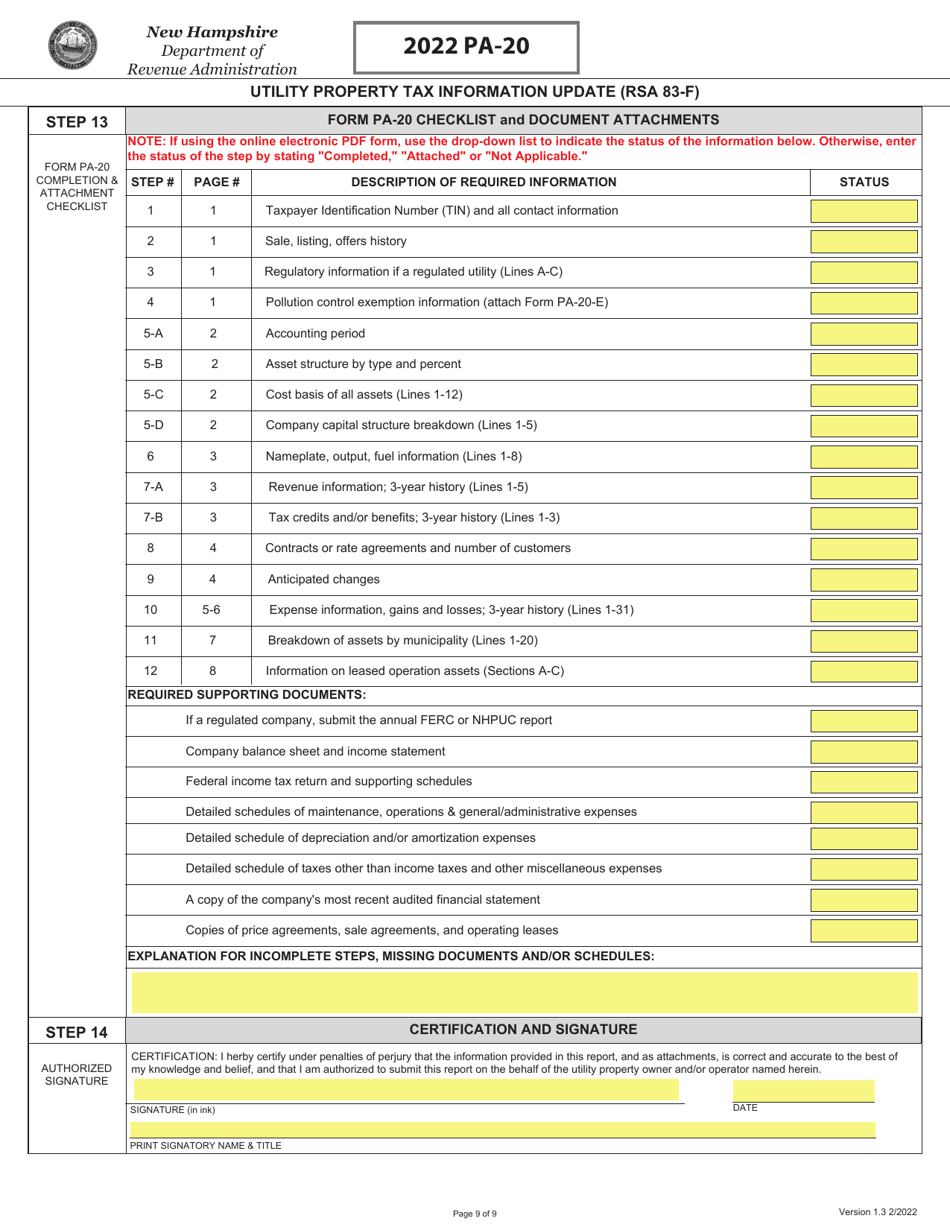

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. Check the official instructions before completing and submitting the form.

FAQ

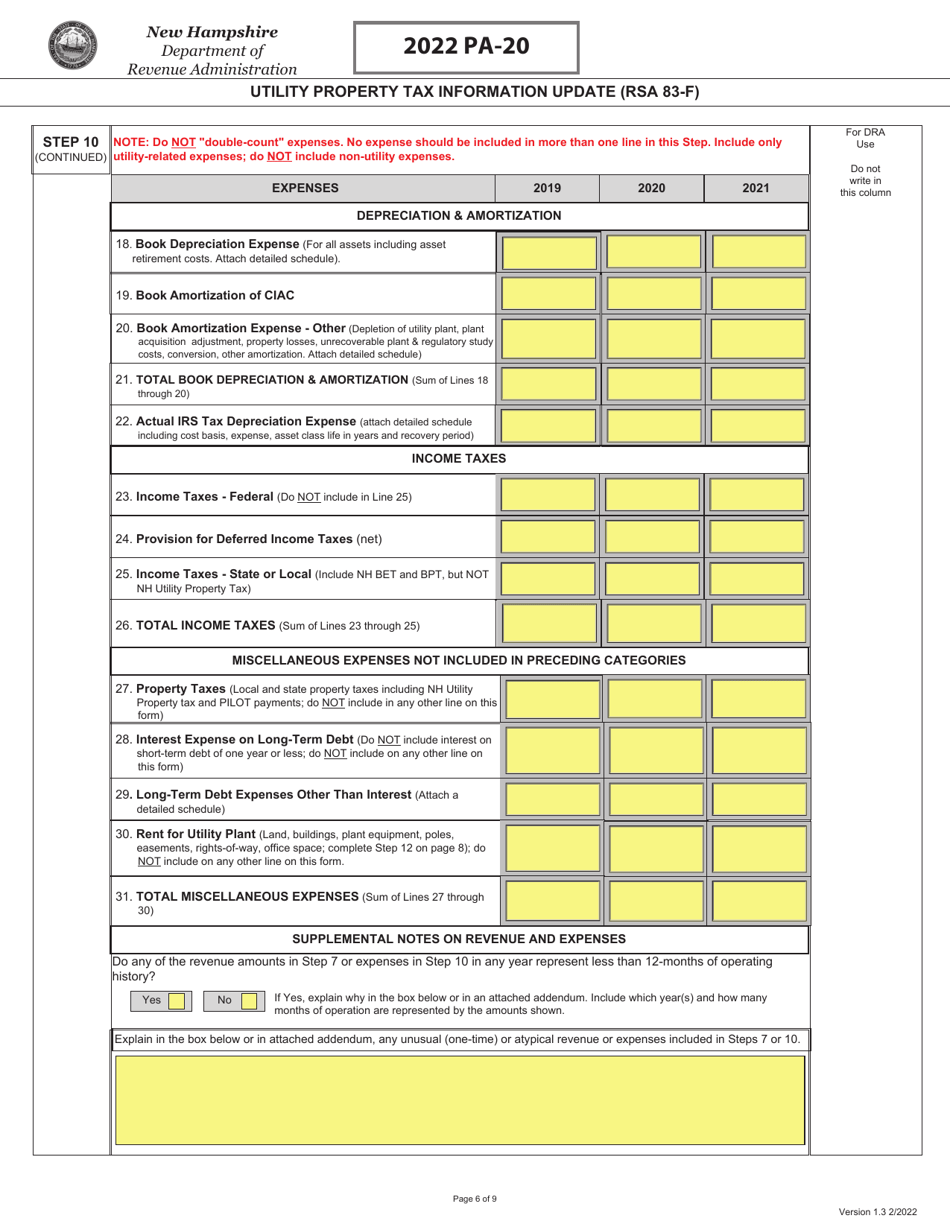

Q: What is PA-20 Utility Property Tax Information Update (Rsa 83-f)?

A: PA-20 is a form used in New Hampshire for updating utility property tax information.

Q: Who needs to complete the PA-20 form?

A: Utility property owners in New Hampshire need to complete the PA-20 form.

Q: What is the purpose of the PA-20 form?

A: The PA-20 form is used to provide updated information on utility properties for tax purposes.

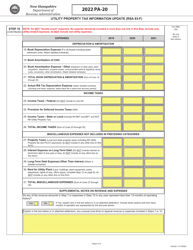

Q: What is Rsa 83-f?

A: Rsa 83-f refers to the New Hampshire Revised Statute Annotated Section 83-f, which relates to utility property taxation.

Q: When is the deadline for submitting the PA-20 form?

A: The deadline for submitting the PA-20 form varies each year and is determined by the New Hampshire Department of Revenue Administration.

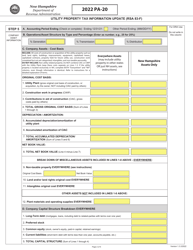

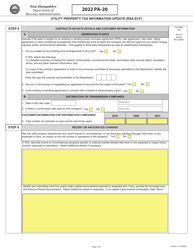

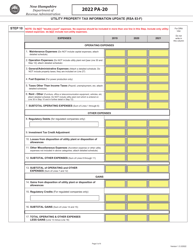

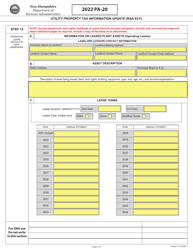

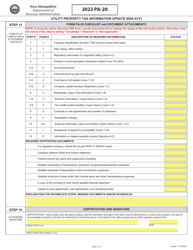

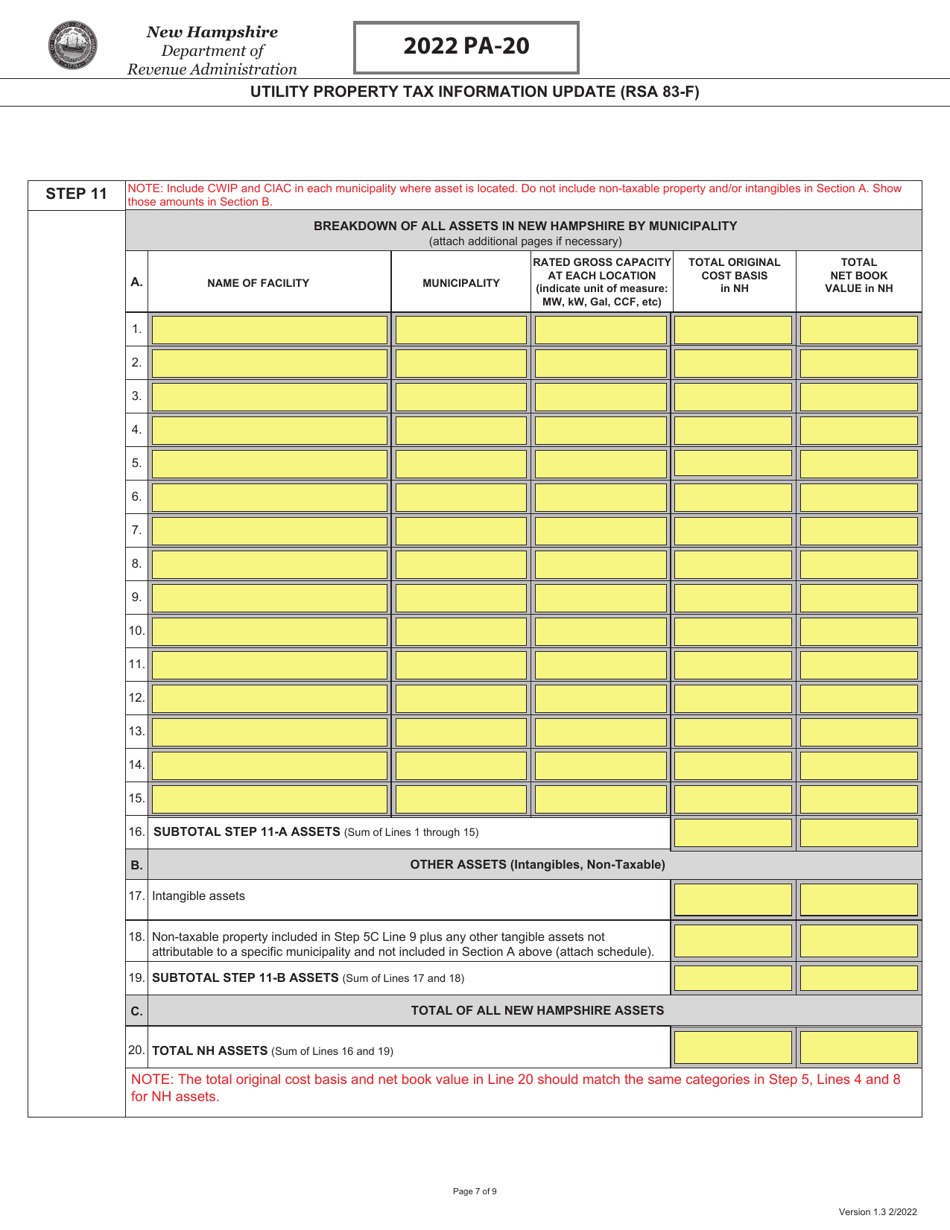

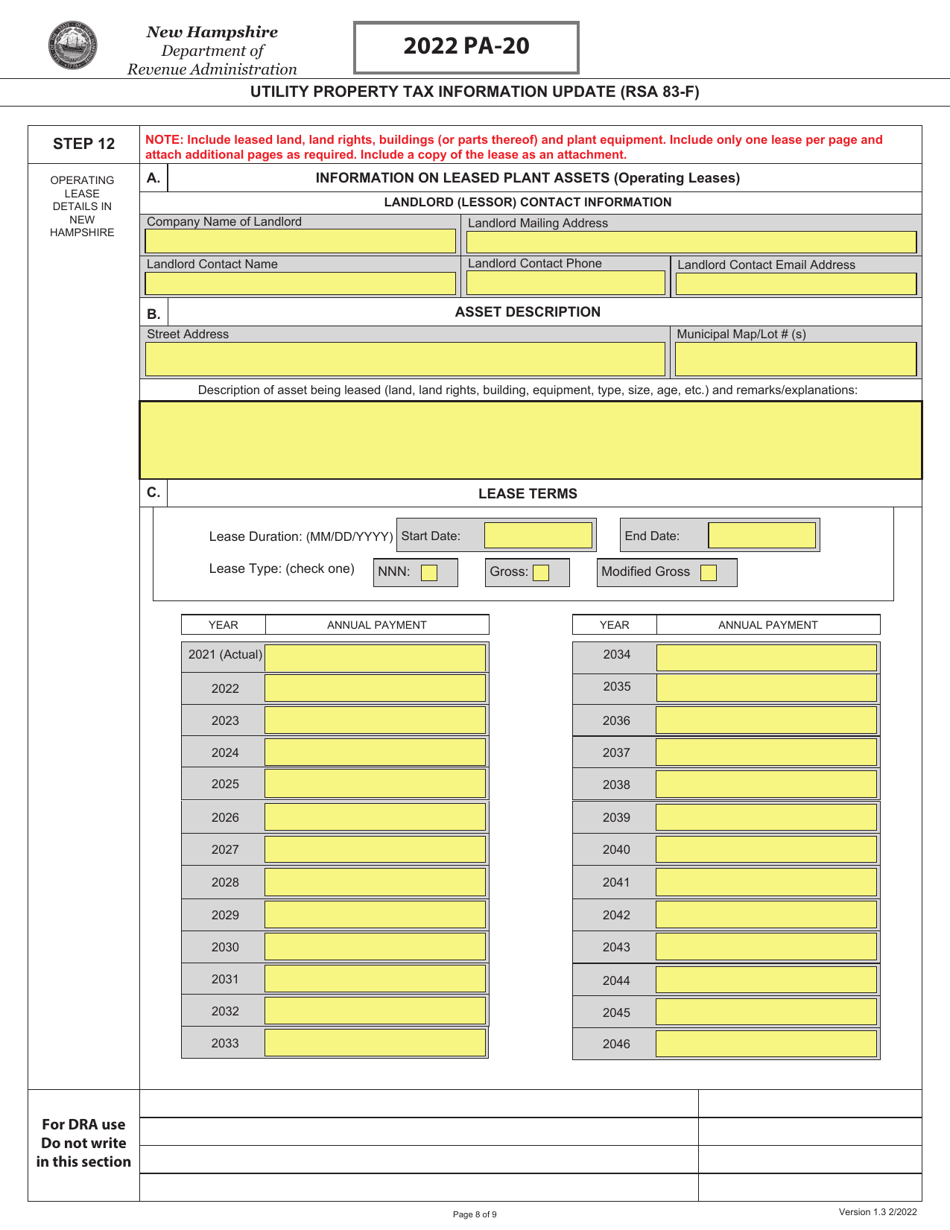

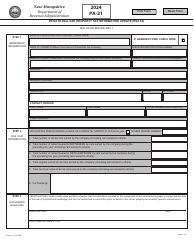

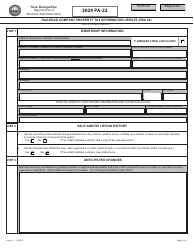

Q: What information is required to complete the PA-20 form?

A: The PA-20 form requires information about the utility property, including its location, ownership, assessed value, and other relevant details.

Q: Are there any penalties for not submitting the PA-20 form?

A: Yes, failing to submit the PA-20 form or submitting false information may result in penalties imposed by the New Hampshire Department of Revenue Administration.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.