This version of the form is not currently in use and is provided for reference only. Download this version of

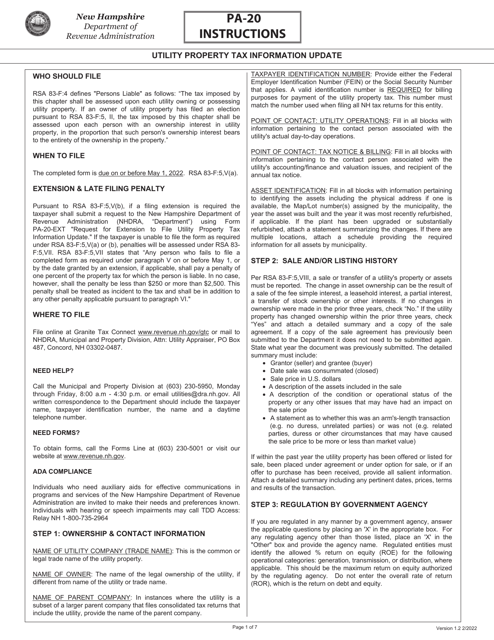

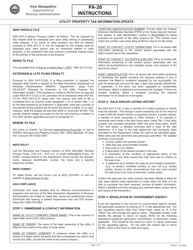

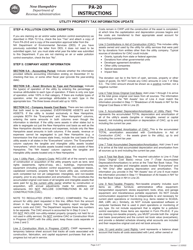

Instructions for Form PA-20

for the current year.

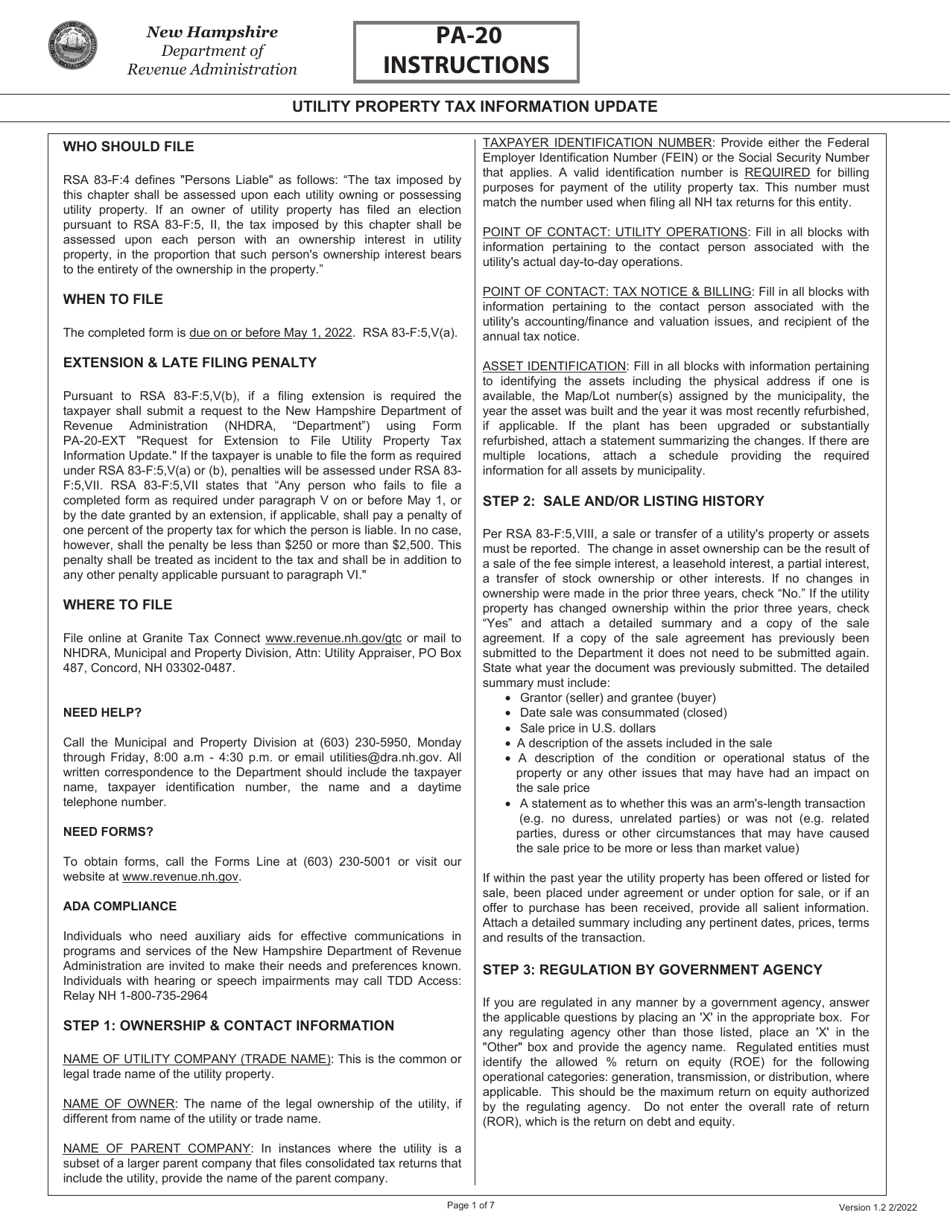

Instructions for Form PA-20 Utility Property Tax Information Update - New Hampshire

This document contains official instructions for Form PA-20 , Utility Property Tax Information Update - a form released and collected by the New Hampshire Department of Revenue Administration. An up-to-date fillable Form PA-20 is available for download through this link.

FAQ

Q: What is Form PA-20 Utility Property Tax Information Update?

A: Form PA-20 Utility Property Tax Information Update is a form used in New Hampshire to update information related to utility property taxes.

Q: Who needs to fill out Form PA-20?

A: Utility companies or their agents need to fill out Form PA-20.

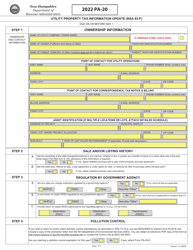

Q: What information does Form PA-20 require?

A: Form PA-20 requires information about utility property, such as locations, additions, deletions, retirements, and changes in value.

Q: When is the deadline for submitting Form PA-20?

A: Form PA-20 must be submitted by April 15th of each year.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Hampshire Department of Revenue Administration.