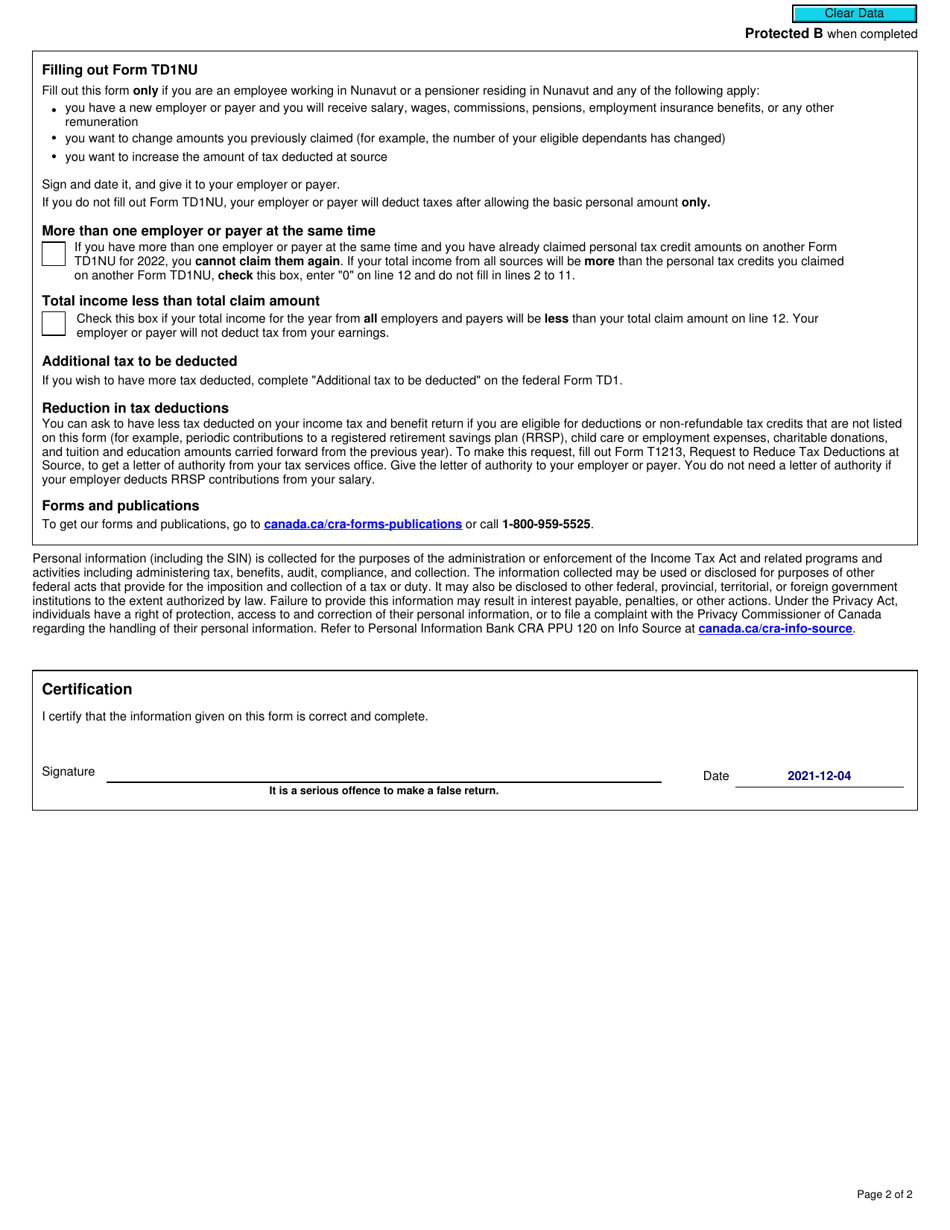

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1NU

for the current year.

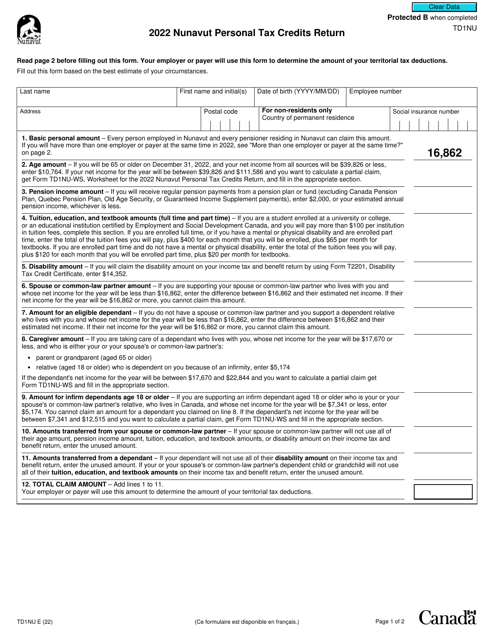

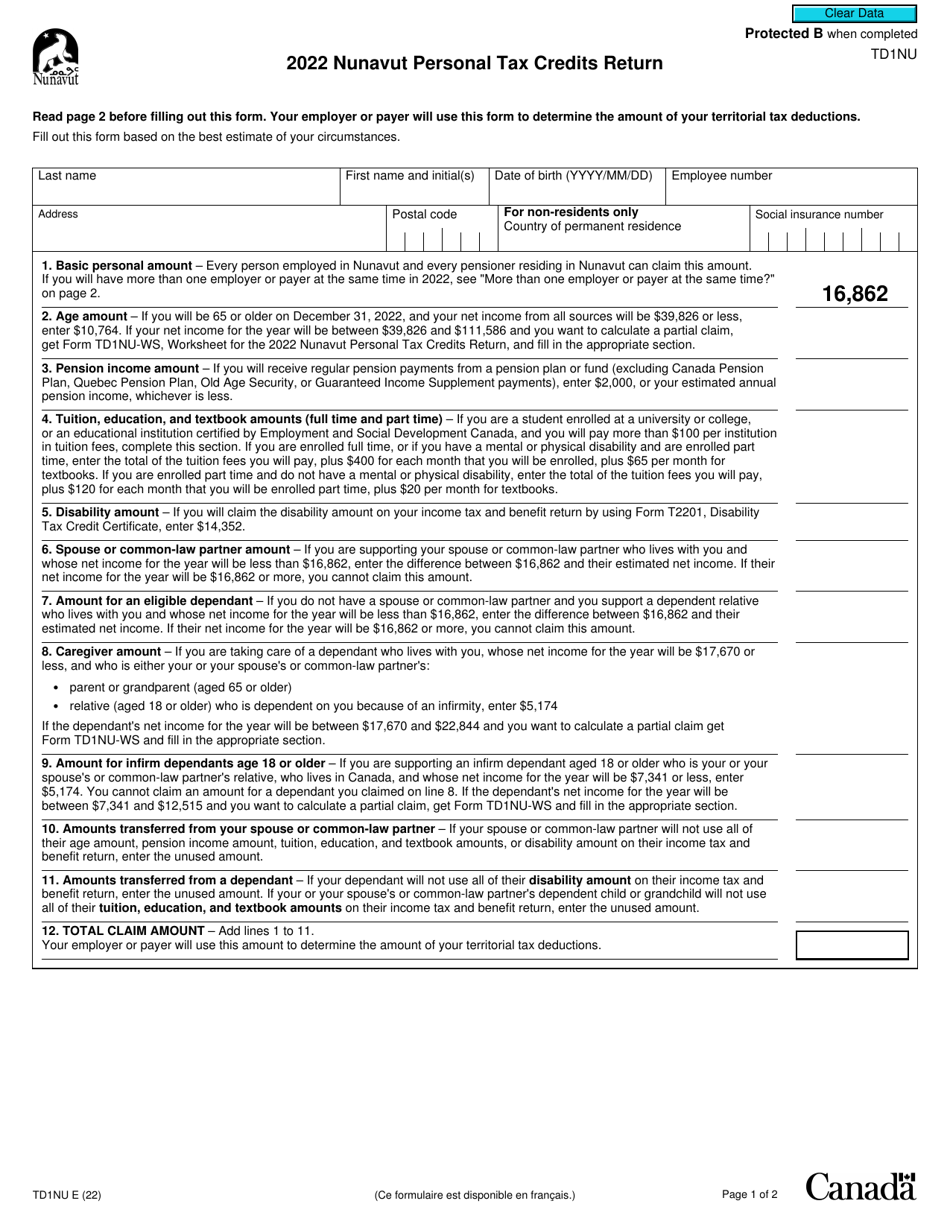

Form TD1NU Nunavut Personal Tax Credits Return - Canada

Form TD1NU Nunavut Personal Tax Credits Return is used by employees in Nunavut, Canada, to calculate the amount of tax to be deducted from their employment income. It allows individuals to claim various personal tax credits, such as the basic personal amount, tuition, education, and textbook amounts, and other tax deductions. By completing this form, individuals can ensure that the correct amount of tax is withheld from their paychecks throughout the year.

The Form TD1NU Nunavut Personal Tax Credits Return in Canada is typically filed by individuals who are residents of Nunavut and want to claim specific tax credits for that region.

FAQ

Q: What is Form TD1NU?

A: Form TD1NU is the Nunavut Personal Tax Credits Return in Canada.

Q: What is the purpose of Form TD1NU?

A: The purpose of Form TD1NU is to determine the amount of Nunavut tax to be deducted from an individual's income.

Q: Who should file Form TD1NU?

A: Nunavut residents who want to claim additional personal tax credits should file Form TD1NU.

Q: Do I need to submit Form TD1NU every year?

A: Yes, Form TD1NU should be submitted to your employer every year to ensure the correct amount of tax is deducted from your income.