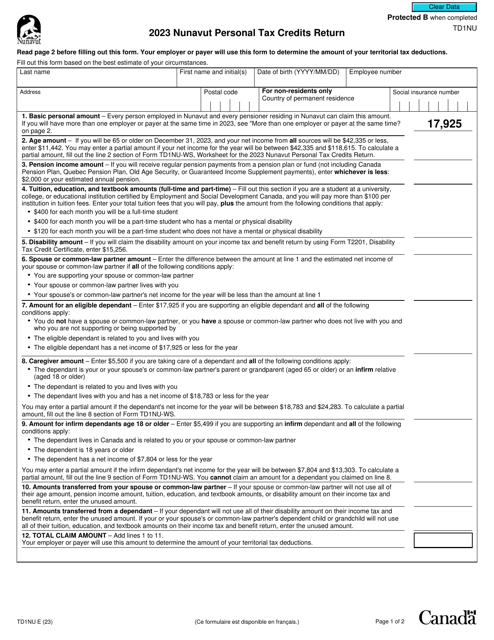

Form TD1NU Nunavut Personal Tax Credits Return - Canada

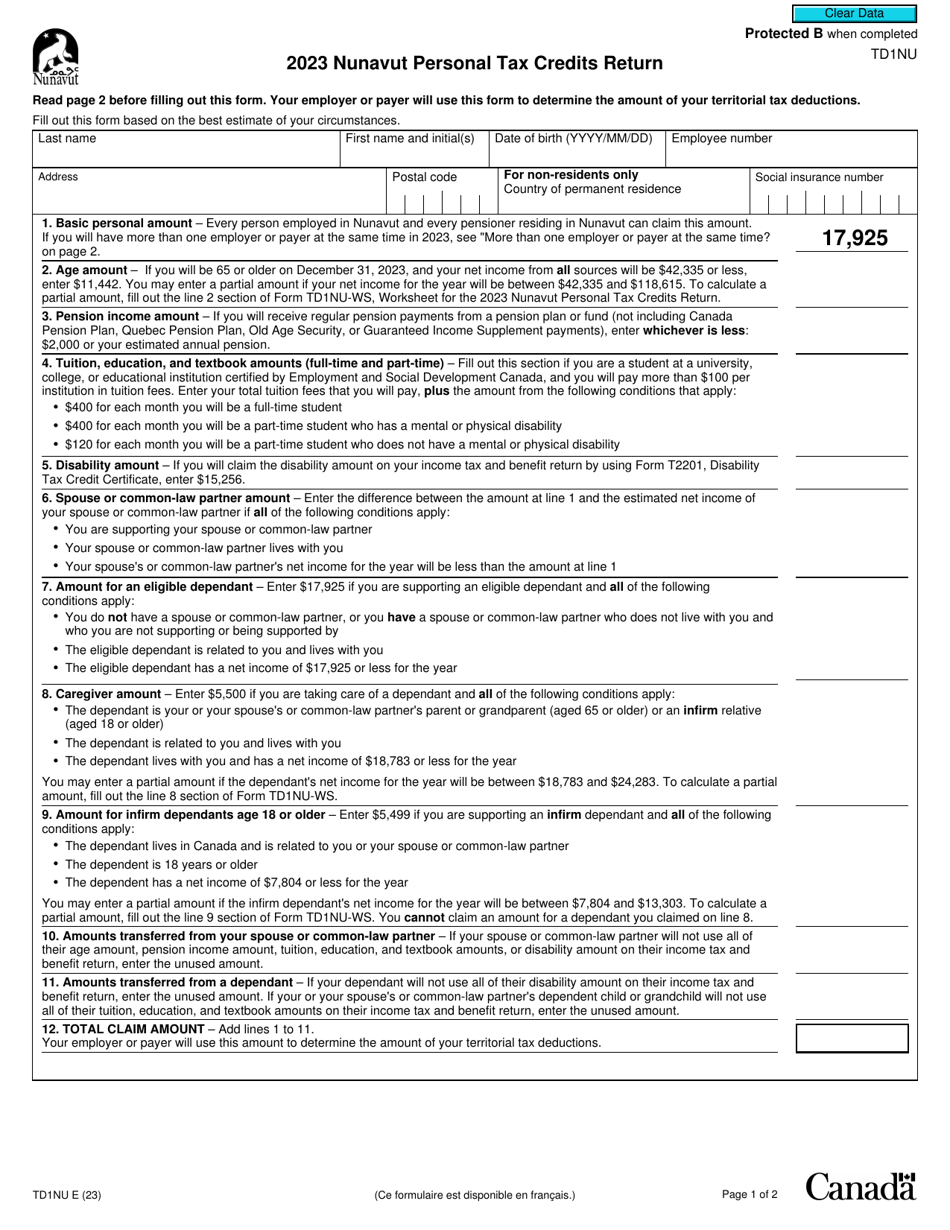

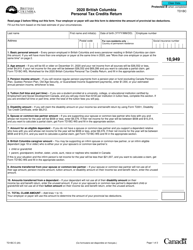

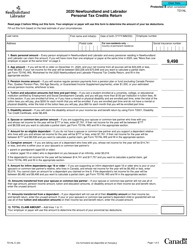

Form TD1NU - Nunavut Personal Tax Credits Return is a form used in Canada for residents of Nunavut to claim various tax credits and deductions on their personal income tax return. This form allows individuals to reduce the amount of tax withheld from their paychecks throughout the year, helping to ensure they are paying the correct amount of taxes based on their specific circumstances.

In Nunavut, individuals who are residents for tax purposes file the Form TD1NU Nunavut Personal Tax Credits Return. This form is used to calculate the amount of Nunavut tax deducted from an individual's employment income.

Form TD1NU Nunavut Personal Tax Credits Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form TD1NU?

A: Form TD1NU is the Nunavut Personal Tax Credits Return in Canada.

Q: Who needs to fill out Form TD1NU?

A: Nunavut residents who want to claim additional tax credits for their personal income tax return need to fill out Form TD1NU.

Q: What are personal tax credits?

A: Personal tax credits are deductions that can reduce the amount of tax you owe.

Q: Are the tax credits the same in every province?

A: No, the tax credits can vary from province to province. Each province has its own specific forms, such as Form TD1NU for Nunavut.

Q: When do I need to submit Form TD1NU?

A: You should submit Form TD1NU to your employer as soon as possible, preferably before you start receiving income.

Q: Can I make changes to my personal tax credits throughout the year?

A: Yes, if your circumstances change, you can submit a new Form TD1NU to your employer to update your tax credits.

Q: Do I need to submit Form TD1NU every year?

A: No, you only need to submit Form TD1NU if you want to claim additional tax credits or if there are changes to your personal tax situation.

Q: What happens if I don't submit Form TD1NU?

A: If you don't submit Form TD1NU, your employer will use the basic personal tax credits calculation, which may result in higher tax deductions.

Q: Can I claim personal tax credits for both Nunavut and another province?

A: No, you can only claim personal tax credits for one province or territory. If you live in Nunavut, you should claim the Nunavut tax credits using Form TD1NU.