This version of the form is not currently in use and is provided for reference only. Download this version of

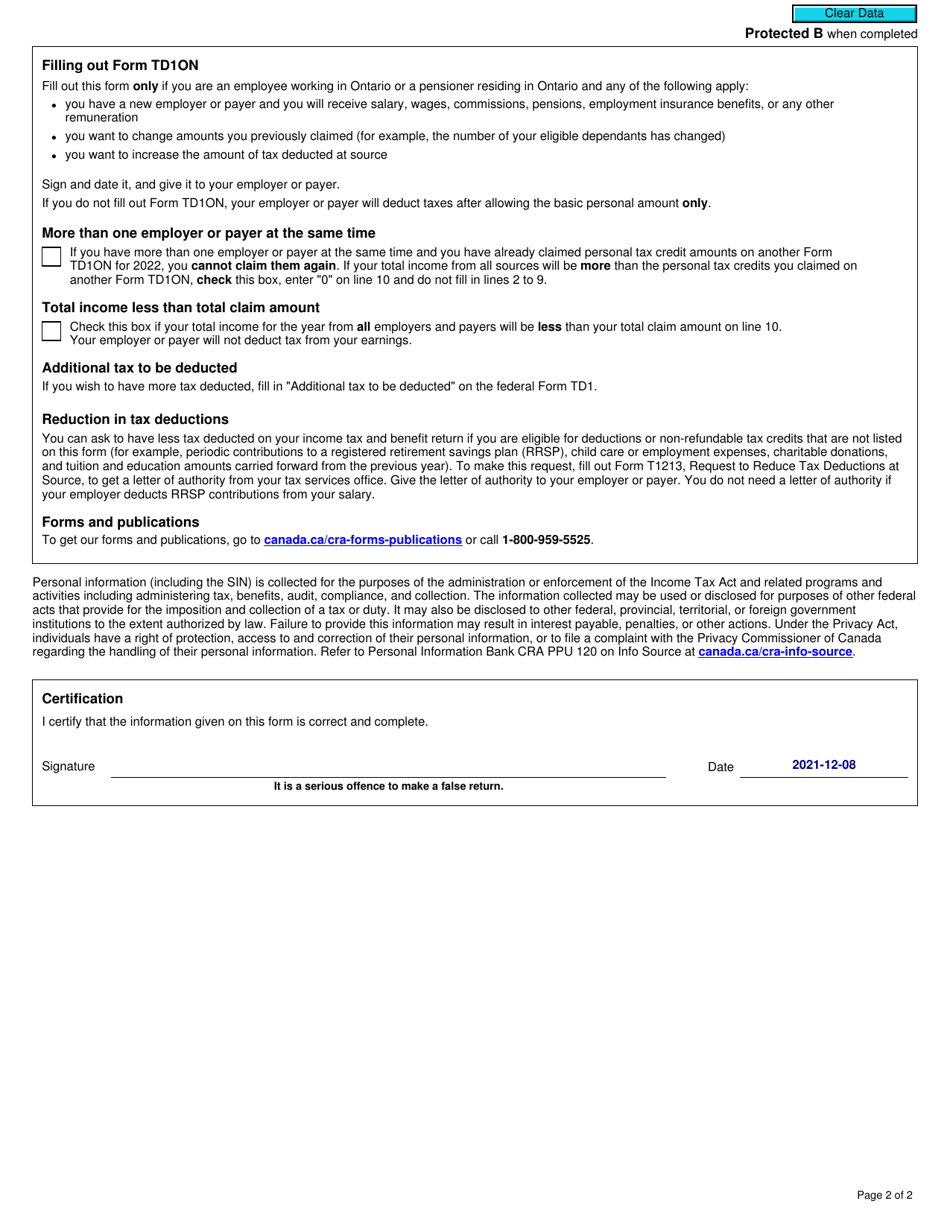

Form TD1ON

for the current year.

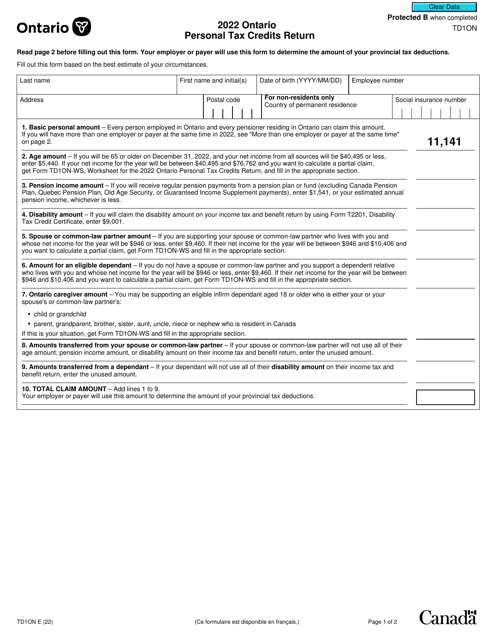

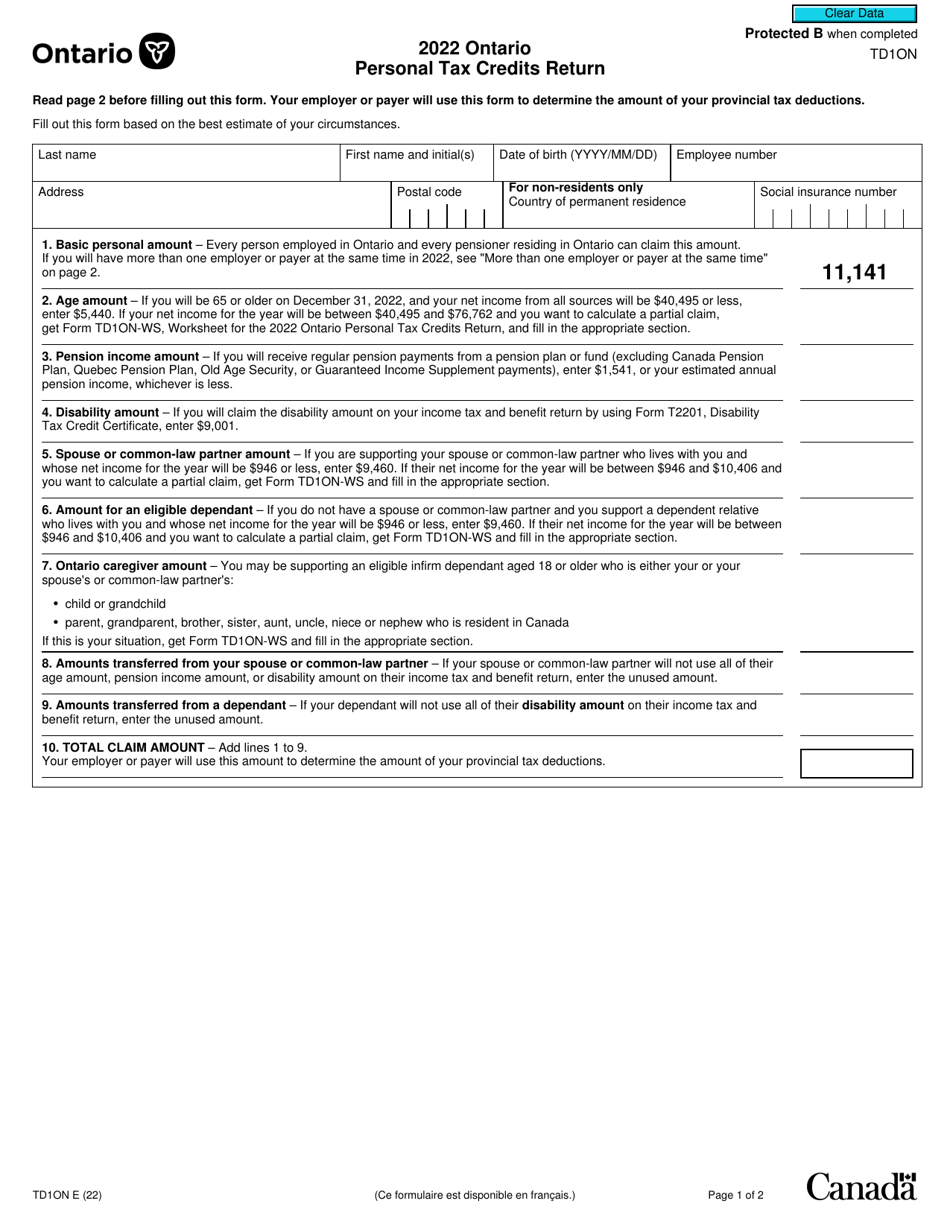

Form TD1ON Ontario Personal Tax Credits Return - Canada

Form TD1ON Ontario Personal Tax Credits Return is used by individuals who reside in the province of Ontario, Canada, to calculate the amount of provincial tax credits they are eligible to claim. This form helps employers determine the correct amount of income tax to deduct from an individual's employment income and ensure that they are not over or underpaying their taxes.

The Form TD1ON Ontario Personal Tax Credits Return in Canada is filed by individuals who reside in Ontario.

FAQ

Q: What is Form TD1ON?

A: Form TD1ON is the Ontario Personal Tax Credits Return form used in Canada.

Q: What is the purpose of Form TD1ON?

A: Form TD1ON is used to determine the amount of personal tax credits that can be claimed by an individual resident of Ontario.

Q: Can I claim personal tax credits if I live in Ontario?

A: Yes, if you are a resident of Ontario, you can claim personal tax credits by completing Form TD1ON.

Q: What information is required on Form TD1ON?

A: Form TD1ON requires information such as your name, Social Insurance Number, and various tax credit amounts.

Q: Do I need to submit Form TD1ON every year?

A: You may need to submit Form TD1ON every year if there are changes to your personal tax credits or if your employer requests it.

Q: Can I claim personal tax credits if I work in Ontario but do not live there?

A: No, Form TD1ON is specifically for residents of Ontario. If you work in Ontario but live in another province or territory, you would use the TD1 form for your province or territory of residence.