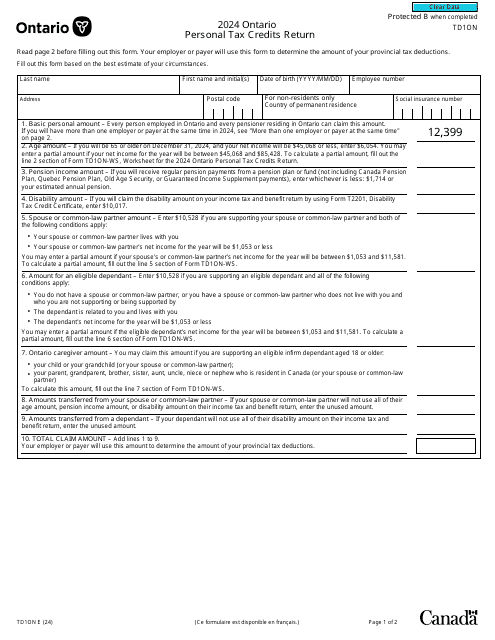

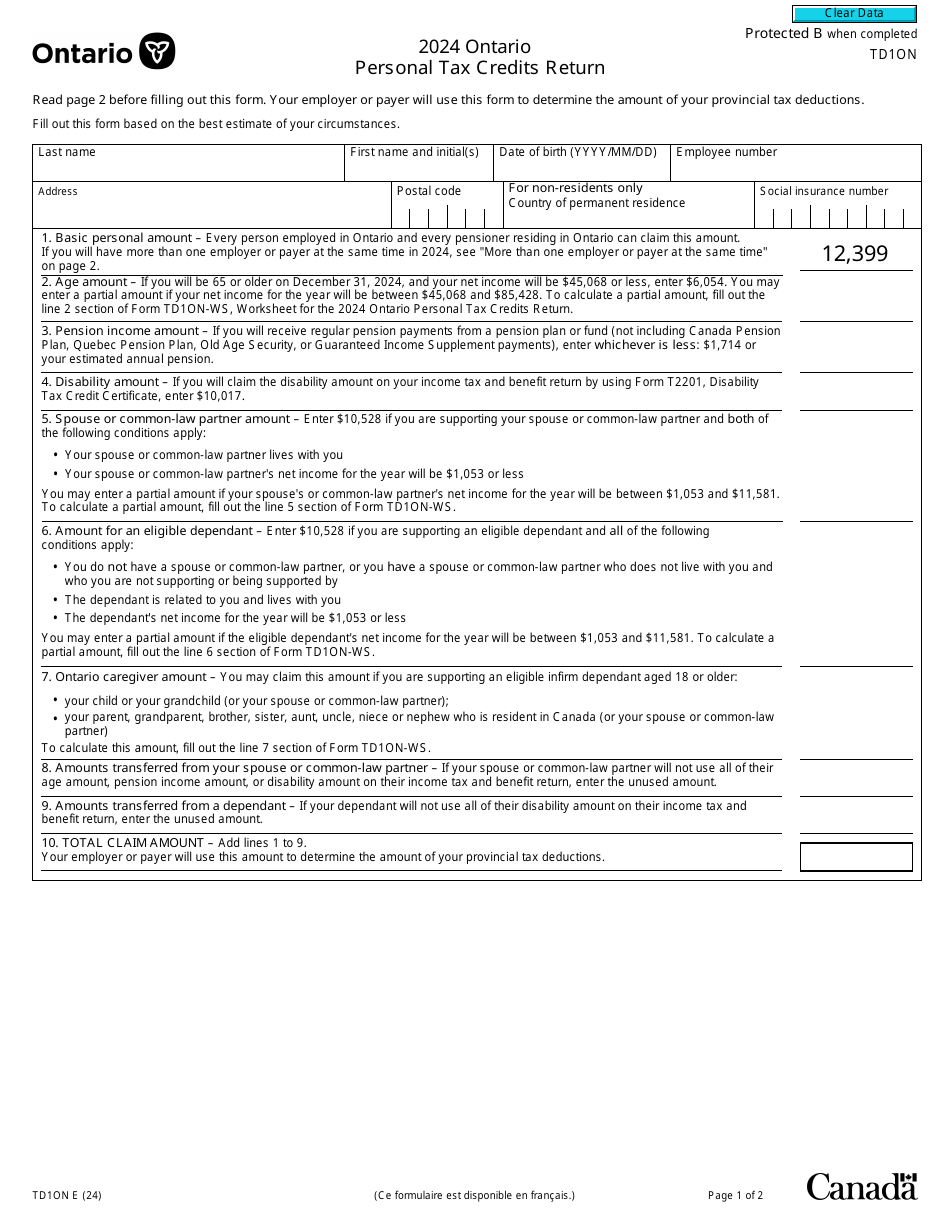

Form TD1ON Ontario Personal Tax Credits Return - Canada

Form TD1ON, the Ontario Personal Tax Credits Return, is used by residents of Ontario, Canada to determine the amount of provincial tax that should be deducted from their paychecks. It allows individuals to claim various tax credits and deductions that they are eligible for, such as the basic personal amount, tuition fees, and medical expenses. By completing this form, individuals can ensure that the correct amount of tax is withheld from their income throughout the year, helping them manage their tax obligations.

The Form TD1ON Ontario Personal Tax Credits Return in Canada is filed by individuals who are residents of Ontario and want to claim additional tax credits.

Form TD1ON Ontario Personal Tax Credits Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form TD1ON?

A: Form TD1ON is the Ontario Personal Tax Credits Return.

Q: What is the purpose of Form TD1ON?

A: The purpose of Form TD1ON is to determine the amount of your Ontario personal tax credits.

Q: Who needs to fill out Form TD1ON?

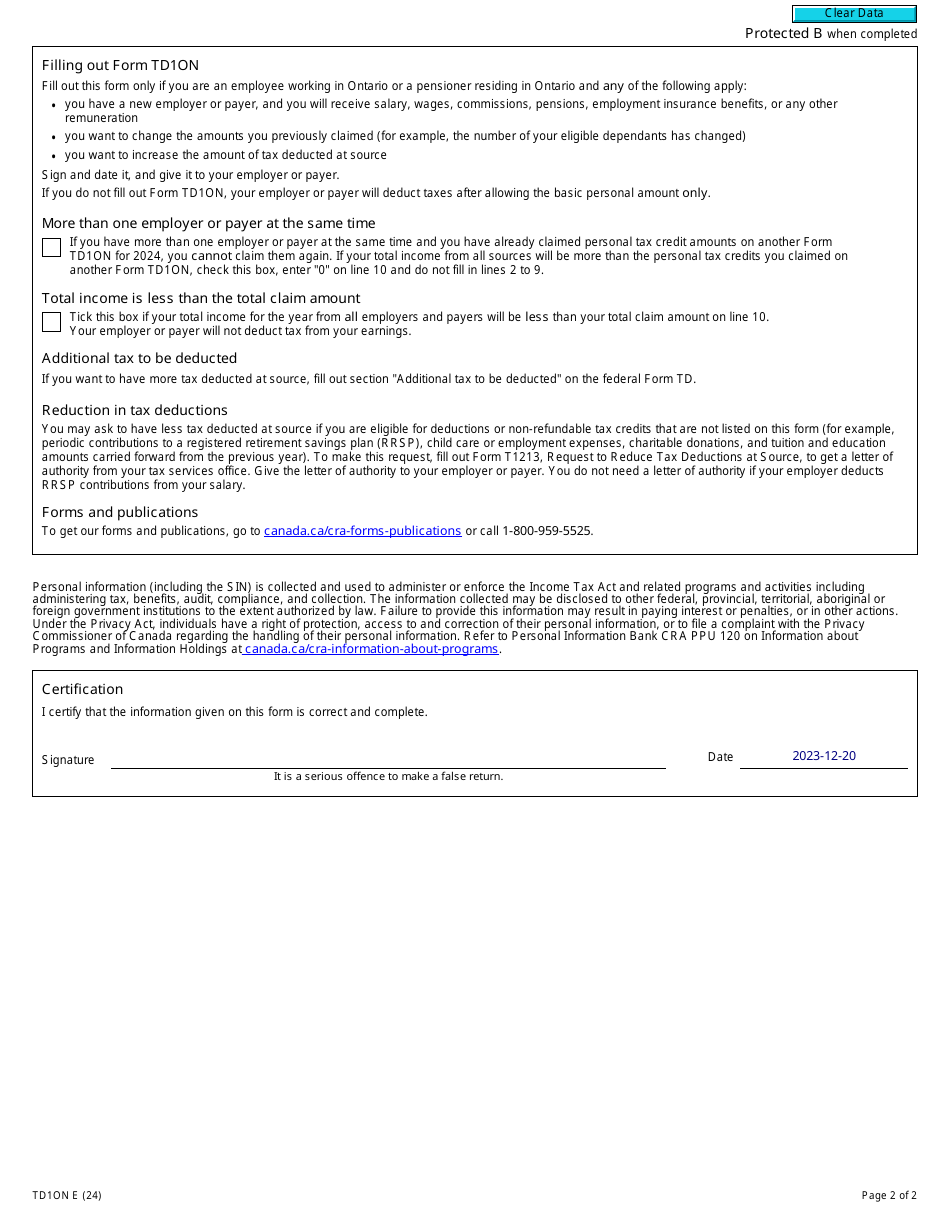

A: If you are an employee working in Ontario, you need to fill out Form TD1ON.

Q: When should I fill out Form TD1ON?

A: You should fill out Form TD1ON when you start a new job or your personal tax situation changes.